Will NOVA be the next Pepe? Analysis from the perspective of trading techniques.

Analyzing trading techniques to determine if NOVA will be the next Pepe.“A decade of speculation in coins is all for nothing, playing Meme, living in the palace.”

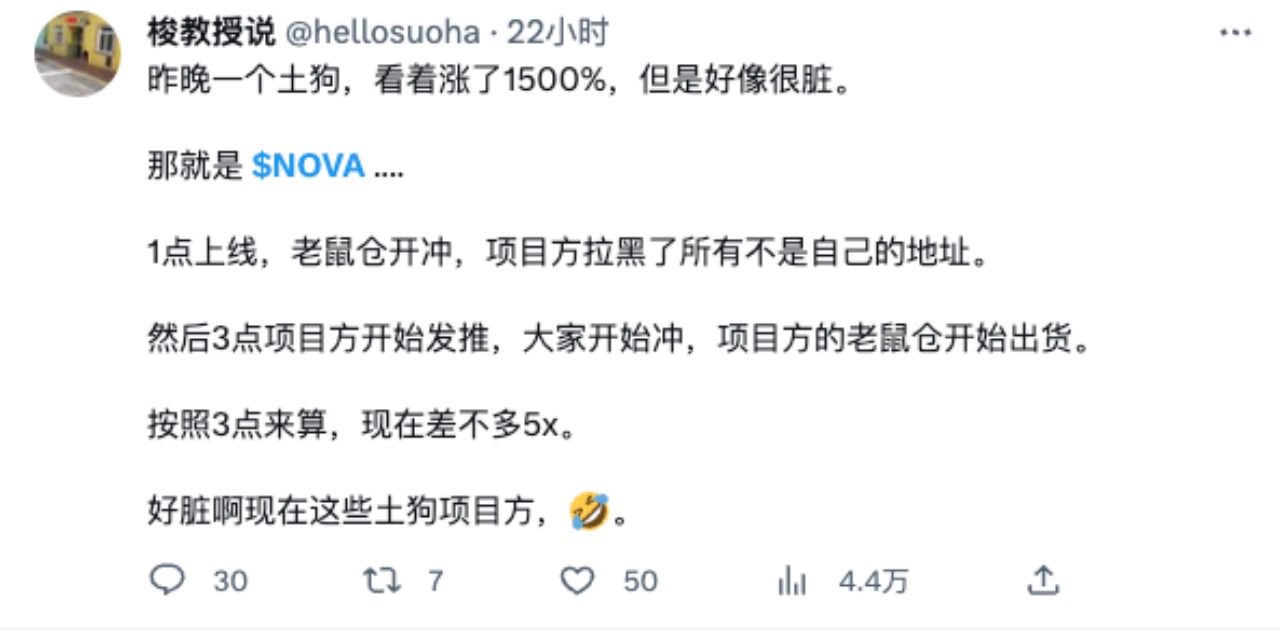

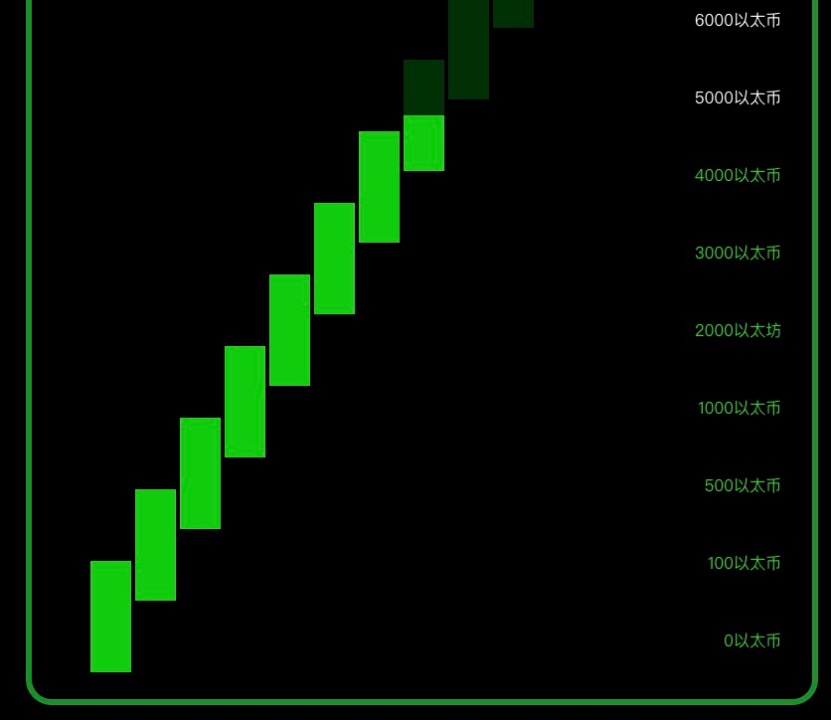

Yesterday, various dog groups in the coin circle were discussing a project-nova. On the first day of opening, it directly skyrocketed by 187,048%, with a maximum market value of 30 million US dollars. Word of mouth experienced two extremes in one day, and the topic degree was directly full.

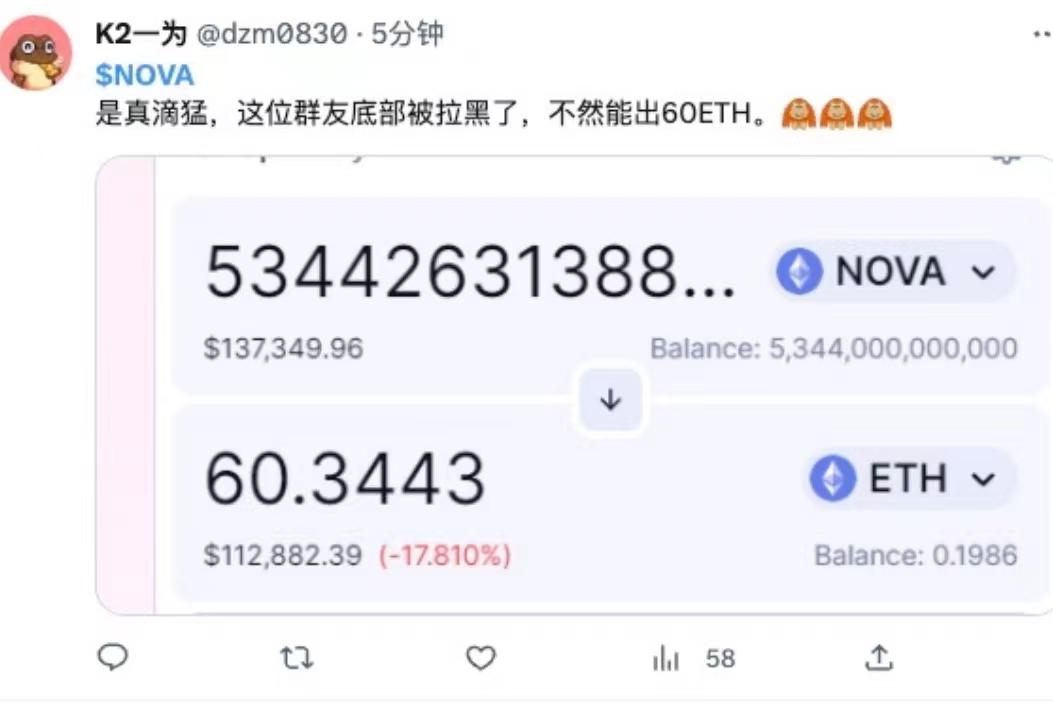

First, it was launched secretly at 1 am, and at 3 am, the official Twitter announced the contract address and blocked several scientific addresses before this.

- Analyzing the new token governance system: Utilizing Balancer weighted pools to achieve deep liquidity and reduce impermanent loss.

- How can Opside collaborate to build the ZK ecosystem as the era of multiple Rollups approaches?

- YugaLabs CEO: Our biggest risk is deviating from our mission, not regulation

Many people began to ridicule that the dog project had no pattern. However, after stabilizing during the day, it began to charge at night. Many players who bought in the afternoon received a return on investment of 5 to 10 times in the evening.

After reading this series of amazing reversals of nova. I feel that things are not simple.

This method of manipulating the market seems to be able to see the shadow of Pepe on nova, and it may even surpass Pepe and become the meme king of the next $1 billion club.

1. Strong village control, decisive action

The two paths that can truly rise by thousands or tens of thousands of times and become high-market-value meme coins usually are:

One is like pepe, ladys, and nova. The project is biased towards centralization, and the bottom is blacklisted for non-project addresses to achieve high control.

The other is like shib, cult dao, and other contracts are clean, decentralized, and fair launch, and all permissions are lost, but they will wash the disk for at least two or three months at the bottom until the strong village collects enough chips and completes high control with time exchange space.

As shown in the figure, Shib and Cult DAO both experienced a long period of horizontal washing for more than three months, and then exploded and pulled in just one or two weeks, like a bamboo shoot after a spring rain, becoming the meme king of a period.

Shib rose 100,000 times in more than a year, while Pepe only took about 20 days.

Whether to exchange time for space to raise funds or to sacrifice decentralization to achieve strong control of the market, there is no superiority or inferiority between the two paths. The core essence is high market control to achieve new heights. There are very few retail investors who can eat the entire market trend from beginning to end.

Only for players who like to play with memes, there is now an additional indicator for screening golden dogs. If the address that blackens the bottom scientist at the opening is used, it is also possible that it is a strong and high-controlling currency.

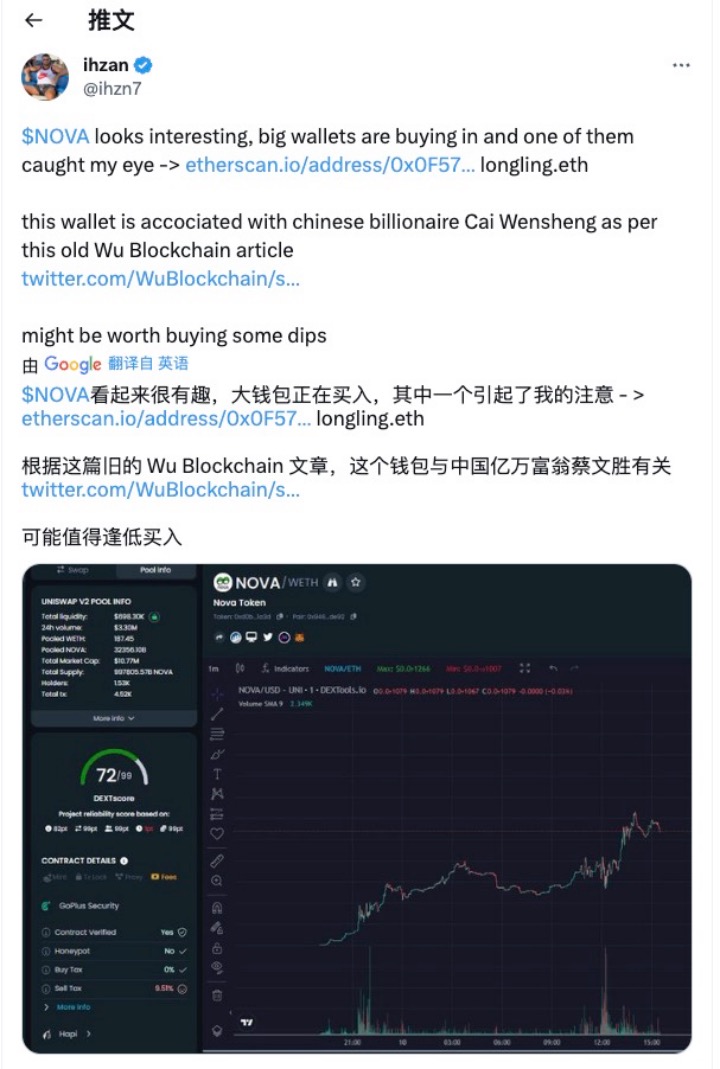

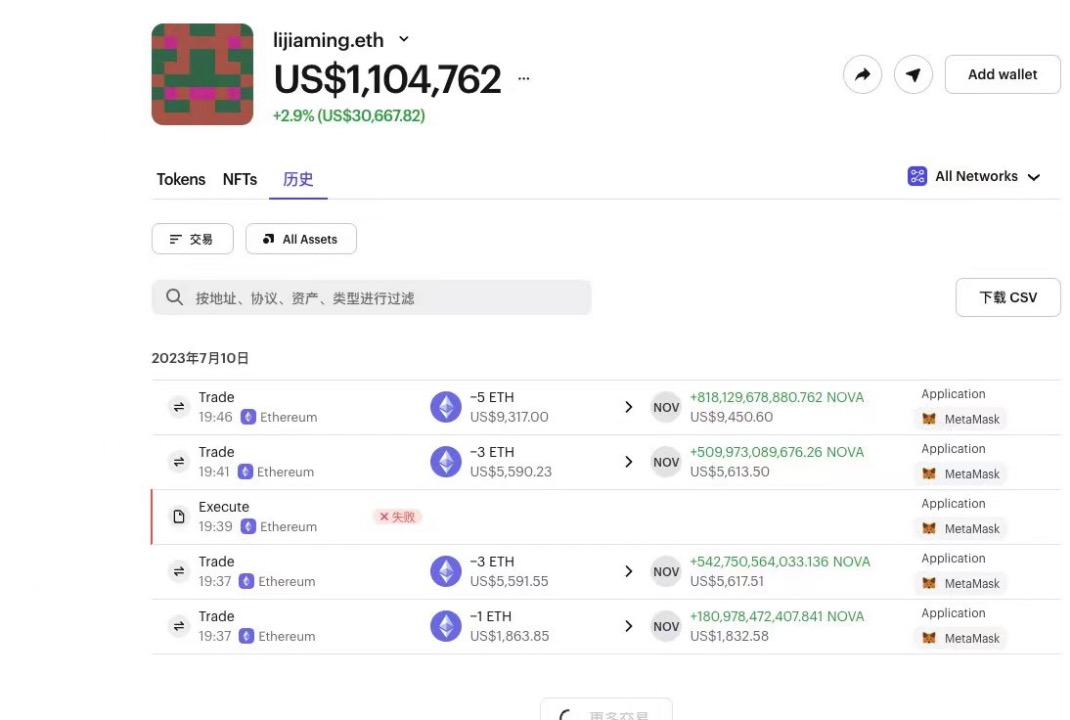

2. Smart money address continues to buy

It is important to follow smart money when looking for good memes, and monitoring the activities of whales is crucial as a basis for further research.

Last night, on-chain data monitoring found that whales such as Cai Wensheng, the boss of Meitu Xiuxiu, also began to buy Nova and have not yet sold it. And there are rumors that Cai Wensheng posted a circle of friends optimistic about UBI, which happens to be consistent with Nova’s UBI narrative. It inevitably leads to community speculation whether the team behind Nova has some connection with these bigwigs and whether the strength of the market makers is very strong.

3. The next big game, relief for NFT blue chip holders

In Nova’s economic model, the total amount is 10 million trillion, 95% is used for liquidity, and 5% is used for ecological development.

And in the smart contract, a tax rate of 9% is set for players who sell, of which 3% is for marketing, 3% is automatically added to the liquidity pool, and another 3% is exchanged for ETH into the relief pool, which is used to rescue NFT blue chip holders.

The Nova target is a total airdrop of 10,000 ETH, which starts to be received when the relief pool reaches 100 ETH. The stages are divided into 100 ETH, 500 ETH, 1000 ETH, etc., up to 10,000. Relief funds for each stage can be claimed once the stage is achieved.

The NFT market has entered a dark period recently driven by the Azuki incident. At its peak in 2022, the total market value was as high as 33.7 billion U.S. dollars, and a large number of players also flocked to and purchased NFTs during this period. Although the NFT market has been in a downward trend for the past year, there is still a market value of about 9.6 billion US dollars.

NFTScan data shows that the market value of 19 blue-chip contracts is 2128.268 ETH (about 4 billion US dollars), accounting for 41.68% of the total NFT market value.

In the crypto industry, airdrops are a common customer acquisition channel, and the user conversion rate is usually between 10% and 40%.

Nova airdropped to high-net-worth individuals holding NFTs. Even calculated based on the lowest conversion rate of 1%, this relief NFT method can convert buying orders worth at least 40 million U.S. dollars. If Nova can really distribute all 10,000 ETH, it is not impossible to convert several hundred million U.S. dollars in buying orders from the NFT blue-chip market to Nova.

Secondly, according to the Nova official website, there are about 150,000 holding addresses that are eligible to apply for ETH relief funds. This indirectly adds a large number of potential holding users to Nova, providing more possibilities for subsequent support by large exchanges.

There is a saying, “poor play with cars, rich play with watches.” A similar saying is circulating in the currency circle: “Poor speculate on coins, rich speculate on charts.”

NFT blue-chip players almost gathered the high-net-worth individuals and influential V of the entire crypto industry. Nova’s “robbing the poor to help the rich” operation of airdropping to high-net-worth users and converting buying orders can be rated 82 points, and the remaining 18 points can be praised in the form of 666.

Finally

“Question Nova, understand Nova, and finally believe in Nova.”

Nova has continued to hit new highs in the midst of questioning, combining AI’s grand narrative UBI, and using hot marketing to rescue blue-chip holders in the Azuki incident. This all shows that there is an ambitious and professional team behind it.

The project has only been launched for two days. You can pay attention to what other actions Nova will take next, and whether there is a chance to surpass Pepe in July and become the next 1 billion U.S. dollar meme coin and surge 100,000 times.

Embrace and be wary of bubbles, bubbles are the spark that ignites the market, which can bring benefits, but also be skeptical about bubbles.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- With the advent of the Rollup era, how can Opside collaborate to build the ZK ecosystem?

- Crash and Reshape: Drawing Lessons from the History of the Gaming Industry to Look Ahead at the Future of NFTs

- Pendle v2 Overview: Driving Pendle to Become a Key Part of DeFi Infrastructure

- ERC4337: Trigger Transactions Autonomously Without Relying on External EOA Accounts

- Encryption startup Arkham has been conducting months-long doxxing campaigns against its users

- Exploring the current development status of LSD stablecoins field

- Opportunities and Reflections on Ethereum Block Space in the Future