USDT, the invisible sword of Damocles

In recent months, Bitcoin has soared from 7000USDT, even to 14000USDT. Although Bitcoin has suffered a continuous correction in the near future, the logic of the overall rise of Bitcoin in the next period of time is due to the geopolitical crisis, the awakening of giants such as the US consortium and FACEBOOK, and the gradual approach of the halving cycle of Bitcoin technology. . It has to be noted that we pay attention to a phenomenon, every time the bitcoin surge will be accompanied by a large number of additional issuance of USDT. This has to trigger our deep thinking and vigilance. On July 29th, the New York Attorney General's Office (NYAG) will hold a hearing on Tether. The legendary "USDT Thunder" will come true. We will wait and see where Tether and Bitfinex will go.

As the bridge connecting the world of encrypted digital currency and French currency, USDT is one of the currencies that most holders will handle or hold. The USDT is a legal currency linked to legal tender issued by Tether and may be issued under the Omni Agreement, TRC-20 or ERC. The original intention was to provide deposit options for exchanges that are difficult to establish contact with banks for business cooperation and that require legal currency. Users can redeem/reduce Tethers into legal tender or other encrypted digital currency by virtue of Tether Limited's Terms of Service. So at the time of Tether's release, Tether itself was given the role of a "bank", each Tether anchored to the corresponding currency of 1:1 (such as USDT for the corresponding US dollar, cash equivalents and third-party loans) All data can theoretically be checked by Tether official website and blockchain browser. In addition, in a centralized operating model, in order to ensure transparency and user rights, Tether needs to periodically disclose information such as collateral reports, Tether account balances and coinage data behind its Tether tokens.

USDT, Bitcoin's Annunciation?

Although Tether has only been developed for four years, the USDT issued by Tether has taken the absolute advantage of the encrypted digital stable currency market. Despite the rise of various stable currency projects in 2018, the market share of 97.6% makes the USDT easy to stabilize in the first place.

- The SEC issued a second no-objection letter, and the company’s tokens do not need to be registered as securities.

- A large amount of capital has poured into the field of bitcoin mining, and the computing power has risen sharply.

- Reshaping the scalability of blockchains: separation of state and time

It is not difficult to see that the impact of USDT on the entire encryption market cannot be ignored. Every time the USDT is issued, it will bring huge fluctuations in the price of Bitcoin. Take the USDT issuance in April-July this year as an example. Each time the USDT is issued with the same booster fuel, the bitcoin price is pushed up and pushed:

1. In April, USDT issued 6 additional shares, totaling 640 million USDT. The price of bitcoin rose from 5,000 USD to 7851 USD, an increase of more than 50%.

2. From May to June, USDT issued 4 additional pens, totaling 500 million USDT. The price of bitcoin rose from 7851 USD to 11058 USD, an increase of more than 40%.

3. On July 2nd and 4th, Tether issued 200 million USDTs. The price of bitcoin jumped directly from below 10,000 USD to 12,000 USD, an increase of 23%.

4. On July 8th and 10th, Tether issued 200 million USDTs in Ethereum, boosting the price of Bitcoin to over US$13,000, up to US$13,147, and up to 15% in just two days.

In July, up to the 12th, 400 million USDTs have been issued. The increase in U SDT has brought a lot of purchasing power to the market and pushed the price of bitcoin further. Although it is difficult to conclude that the U SDT issue and the bitcoin price increase are inextricably linked from just a few months of data , the frequent issuance of U SDT also reflects a significant increase in the market demand for B TC purchases.

In addition, it can be seen from the figure that the impact of the increase in USDT on bitcoin prices seems to be lagging. This speculation is based on evidence, the USDT issuance process is first issued through the Tether Treasury address, and then to the various exchanges or other addresses. Because of the seemingly subtle connection between Bitcoin and USDT, some investors have inevitably produced "Tether conspiracy theory":

Some people think that Tether deliberately "super-issue" USDT is used for bitcoin pulls, and then through the short-selling short contract to achieve the purpose of absorbing BTC; or Tether to increase the price of USDT to reduce the price drop of the USDT to increase the USDT price .

Although Tether investors have taken the lead in explaining that USDT's additional claims to manipulate bitcoin prices are purely nonsense, but there are problems with Tether's own trading risks and transparency, or let the US Department of Justice and the Office of the Attorney General of New York resolve to investigate whether USDT is being investigated. Tether and its parent company's cryptocurrency exchange Bitfinex have become tools for manipulating the market.

U SDT 's sword of Damocles appeared?

Just recently, the New York Attorney General’s Office (NYAG) submitted a detailed memo stating that Tether and Bitfinex were suspected of illegally trading in New York State, accusing Bitfinex and Tether of issuing US dollars to investors without an unregistered securities operator. Loans, as well as the registration of overseas shell companies and nominal accounts for traders in the New York area, also mentioned that Bitfinex made up for its exchange losses by borrowing USDT user reserves.

Source: Attorney General of the State of New York

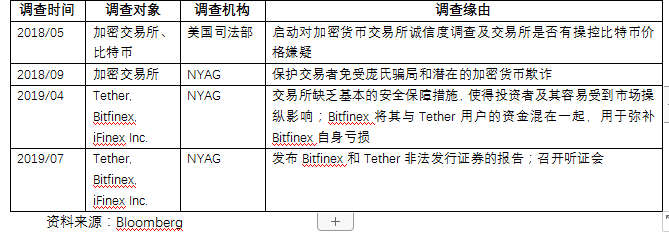

In fact, this is not the first time a US prosecutor has conducted a survey on this stable currency supplier. Since the US Department of Justice began investigating Bitcoin in May 2018, Tether's every move has attracted regulatory attention:

In more than a year of forensics and investigations, NYAG disclosed in its report the miscellaneous relationship between Tether and Bitfinex. In the final analysis, it investigated and charged all the common problems surrounding the existing stable currency:

Transparency problem

In the legal memo published on July 8 this year, NYAG listed a number of undisclosed items in Bitfinex. For example, in November 2018, Bitfinex transferred $625 million in assets from the Tether corporate account to make up for Bitfinex 850 million. The dollar’s loss, which is clearly inconsistent with the “full anchor” US dollar commitment promised in the Tether white paper and exceeds Tether’s credit limit for Bitfinex, but still shows 100% of all Tether value on Tether’s disclosed balance sheet. The fiat currency was anchored and there was no explanation for this special transfer. After four months, Tether raised its credit limit on Bitfinex from $600 million to $900 million, making the loan appear to meet Tether's internal rules, but still did not disclose the early adoption of such credit limits between the two companies. Where does the transaction transfer flow, and whether there are similar borrowing behaviors. In addition, Tether has hired the US accounting firm Friedman for auditing, but the audit report only confirms that Tether has the equivalent of the USDT reserve amount issued during the audit period. However, the assets specifically covered in the reserve, where they are stored, whether the reserves have been under the account of Tether, have been used for other commercial activities, the accounting firm did not give a detailed reply, January 2018, Friedman LLP stopped auditing services for Tether and Bitfinex.

Source: Coin Market Cap, Tether.to

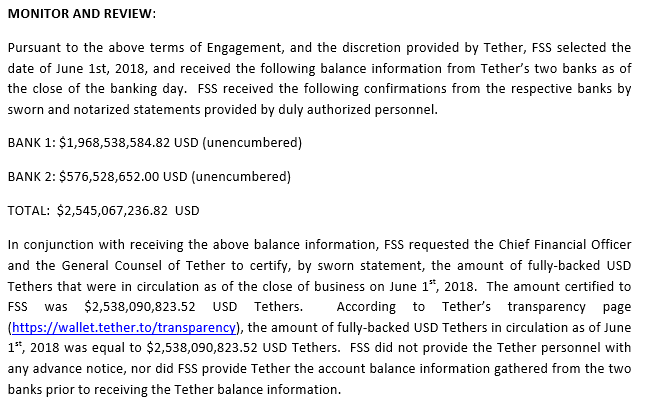

In June 2018, the law firm Freeh, Sporkin & Sullivan LLP (FSS) was commissioned by Tether to issue a report on its USD account balance, but the report was not issued by the auditing agency. Since then, we have not seen other third-party agency investigation reports disclosed by Tether.

Source: Tether.to

As the world's largest stable currency in encryption, Tether is responsible for the circulation of most encrypted digital currencies and is one of the currencies commonly held by investors. You have a “stable” credit responsibility for the industry giants, but Tether has not given timely convincing details of the reserves, additional sources and other financial data, and the information published on the official website is not sufficient. In the world of encrypted digital currencies that emphasize decentralization and transparency, Tether's lagging practices are clearly not conducive to its positive image in the market.

Credit risk problem

According to the Tether White Paper's commitment, Tether uses a full reserve system, that is, each USDT is 1:1 exchanged by the equivalent legal currency as a reserve. In March of this year, Tether changed its wording on the reserve to change the anchor USDT from a single legal currency to a cash equivalent. Tether's general counsel advised in a dictation in April this year that Tether currently holds $2.1 billion in cash and short-term securities. Comparing the total amount of USDT circulating in the market, it is not difficult to find that only about 74% of USDTs are anchored by cash or cash equivalents.

In addition, because Bitfinex's approximately $850 million in deposits from deposit service provider Crypto Capital was frozen by governments such as Portugal and the United States, the rate of user withdrawals on the exchange was largely delayed, and Bitfinex made up for some losses by transferring Tether reserves. But this behavior has directly accounted for losses in Tether's financial statements, making the public doubt whether Tether can really guarantee that each USDT is 1:1 anchored. In January 2018, the US Commodity Futures Trading Commission (CFTC) summoned Tether and Bitfinex to investigate whether it really had an equivalent reserve.

Market manipulation problem

As early as September 2017, Professor Texas of the United States published a paper stating that when the price of Bitcoin fell, the purchase of USDT usually increased sharply, and finally the price of Bitcoin continued to fall. In the case of bitcoin prices, the opposite situation did not appear, indicating that USDT may be used to maintain bitcoin prices, and Tether issuing USDT may be the real manipulation behind the scenes. According to the research of The Tether Report, the price fluctuation of Bitcoin is highly positively correlated with the issuance of USDT. In the past nine months of Tether's issuance, more than 45% of the bitcoin price has risen sharply two hours after the USDT issuance.

In addition, the July 8 report showed that Bitfinex also assisted traders in New York to establish overseas shell companies and hold them as nominal account holders. The trading activities of these companies all point to Bitfinex, which apparently contradicts the Bitfinex platform. The promise of not providing services to US users is contrary. In this 24-page legal memo, NYAG also cited a number of evidence that Bitfinex and Tether used their position in the market to conceal transactions from investors. If the investigation is true, Bitfinex and Tether will be sentenced to stop operating while facing high fines, and investors will suffer huge losses.

What else can I use besides U SDT ?

The stable currency bears the function of the monetary value scale and exchange because it anchors the legal currency of the real world and its market price fluctuates less than other virtual currencies. If it happens that day, how should we deal with it? According to the current development of the cryptocurrency market, Pentax Capital will simply share the following four methods:

1. The usage currency replaces the U SDT deposit, for example, the cryptocurrency such as Bitcoin is purchased directly through the US dollar. It can be purchased through over-the-counter trading or exchanges holding virtual currency exchange licenses, such as Coinbase.

2. Reduce U SDT holdings and diversify to hold other stable currencies. In 2018, the New York Financial Services Agency (NYDFS) approved applications for the issuance of stable coins by Gemini and Paxos. Both stable currencies are pegged to the US dollar and are issued based on Ethereum.

3. Watch out for Facebok's stable currency project “Libra”, waiting for a stable currency from a traditional Internet or financial institution. Considering that Libra's development has been hampered by US authorities, even President Trump has emphasized on Twitter that Libra should be regulated by the United States. In the short term, it is unlikely that the hope of stabilizing the currency will be pinned on Libra.

4. Reduce U SDT holdings and instead hold bitcoin or mainstream cottage currency. Bitcoin has risen more than $5,000 since the beginning of this year, surpassing the holding rate of gold and most stocks. In addition, Bitcoin's hedging and payment attributes are gradually being accepted by traditional financial institutions.

At present, it seems that the completely decentralized mode of operation still does not allow the stable currency to operate effectively. There are many issues such as compliance, liquidity, volatility, stable currency availability, and information disclosure systems that need to be resolved. This requires not only the issuer of stable currency to accept supervision and compliance, but also to improve the transparency of information disclosure. It also requires the issuing company to have a clear understanding of risk and ethics. As an important tool for global payment, stable currency has a profound impact on changing the global payment structure and even the national interest.

We are happy to see that government agencies have actively participated in the layout of digital stability coins and regulate the opacity and fraud in the industry. But at the same time, we also need to think about and be wary of why the US government is so active in investigating Tether? If there are problems with Tether and USDT and Black Swan events, the impact on crypto assets such as Bitcoin will be enormous. In the long run, will the Bretton Woods system be replayed based on blockchain?

Author: Chu Campanian In surplus

Produced by the Perrin Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum is becoming more vulnerable, and its power has fallen more than 42% from its highest point in history.

- The Digital Dimension of RMB Internationalization: What is the anchor of sovereign currency internationalization?

- Bitcoin will reach $100,000 in 2019? Claiming to be a "time traverser" from 2025

- Introduction | Carl: Punishment in Eth 2.0

- The latest development of the Ethereum Layer-2 protocol: Plasma and state channels go hand in hand

- The Galaxy Consensus Node plans to add Southeast Asian members – RiveX!

- Centralized Exchange VS Decentralized Exchange Who is the future of cryptocurrency?