The Digital Dimension of RMB Internationalization: What is the anchor of sovereign currency internationalization?

The breadth, depth and degree of RMB internationalization must be further strengthened, and digital thinking must be integrated. The internationalization of sovereign currency must be multi-objectively iteratively advanced, and the two strategies of sovereign currency and digital currency should be exerted while dynamically adjusting the internationalization strategy.

Even if there is a blindness or deafness to new things like bitcoin, virtual currency, tokenization, blockchain, etc., there is no doubt that technology is profoundly changing human life, and the digital age is coming. For the Chinese economy, structural adjustment and transformation and upgrading are parallel, and the ideal economic model is a new paradigm that almost all economies face together, and even a new future after another “industrial revolution”. The known part is very Small and limited reference value, the unknown part is huge and subverted or constructed. Therefore, any strategic choices at this transition node are extremely risky, retrospective and reflective, “exchange, comparison, iteration”, prediction and outlook, “ No one can be less, and science and reason must always run through it. The issue of RMB internationalization must also be the same. The following questions must be answered one by one.

First, what is the anchor of sovereign currency internationalization? In fact, it is a question of two related issues, the fundamental nature of money and the determinants of the degree of internationalization of sovereign currency and the speed of progress. The textbook defines the currency attribute as a general equivalent. There are three basic functions: the Medium of Exchange, the Store of Value, and the Unit of Price. If the use and flow of money is only within the boundaries of a country, the above conclusions are generally established. However, the reason why the currency can fully play its role, the corresponding trust and credit mechanism are indispensable. In the final analysis, the national credit endorsement of sovereign currency is the key to the currency becoming the core medium of economic activity.

Further, if sovereign currency crosses national borders and becomes a carrier of international economic and trade exchanges, then it is only the national interest to support the currency. The establishment of the Bretton Woods system in 1944 was a milestone in the international monetary system, but the often overlooked details were the main linked currency, the anchor currency. On behalf of the United Kingdom is Keynes, whose proposal is the super-sovereign currency BANCOR; on behalf of the United States is White, whose proposal is the US dollar. The result of wrestling is self-evident, and the US dollar backed by US interests has become the only choice for the anchor currency of the international monetary system, and the more reasonable super-sovereign currency option has returned even if it has the protection of Keynes.

Therefore, the fundamental attribute of money is national interest, and currency is the value symbol of national interest. Once the currency initiates the internationalization process, the status of the sovereign currency depends on the overall national strength. Regardless of how the international currency landscape is designed, the voice of the main anchor currency depends on the core competitiveness of the sovereign state. The US dollar has become the mainstay of the global reserve currency, and the basic role of the US comprehensive national strength is an indispensable element. The "Nixon Shock" on August 15, 1971 was a sign of the transition of the gold standard to the credit currency standard. The reason why the United States dared to unilaterally abandon the dollar and gold was linked to its irresistible superpower strength, although the question of the status of the dollar was later Unsettled, coupled with the emergence of the euro as a challenger in 1999, has not shaken the role of the dollar as the main currency of the international reserve, not only has the share not reduced, but has a tendency to strengthen. It can be seen that the anchoring of sovereign power by the comprehensive national strength is still the main thread of international currency competition.

- Bitcoin will reach $100,000 in 2019? Claiming to be a "time traverser" from 2025

- Introduction | Carl: Punishment in Eth 2.0

- The latest development of the Ethereum Layer-2 protocol: Plasma and state channels go hand in hand

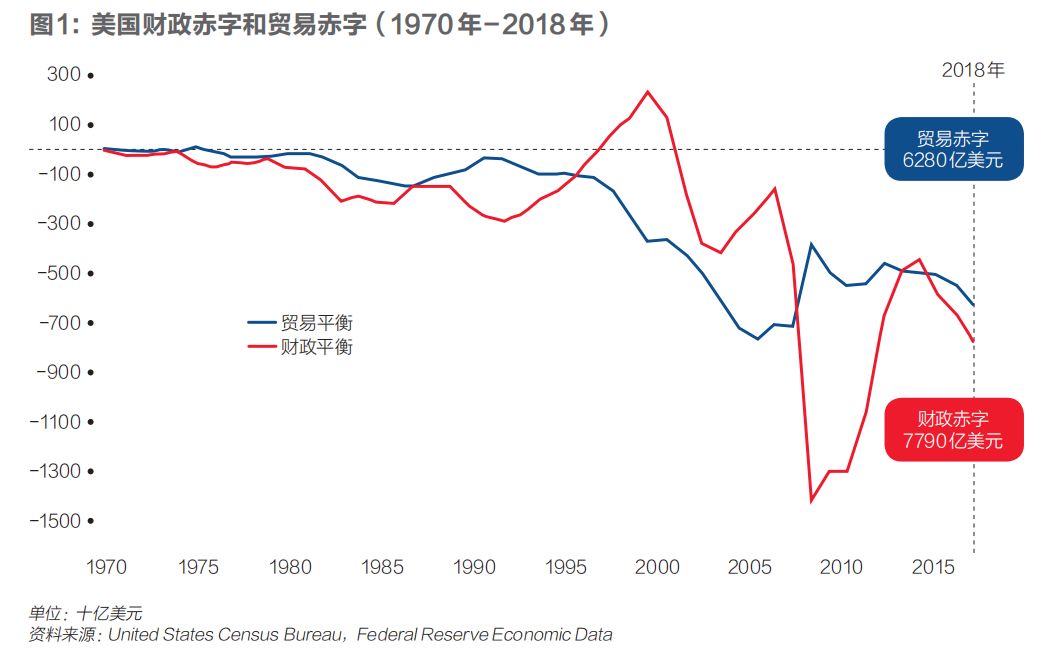

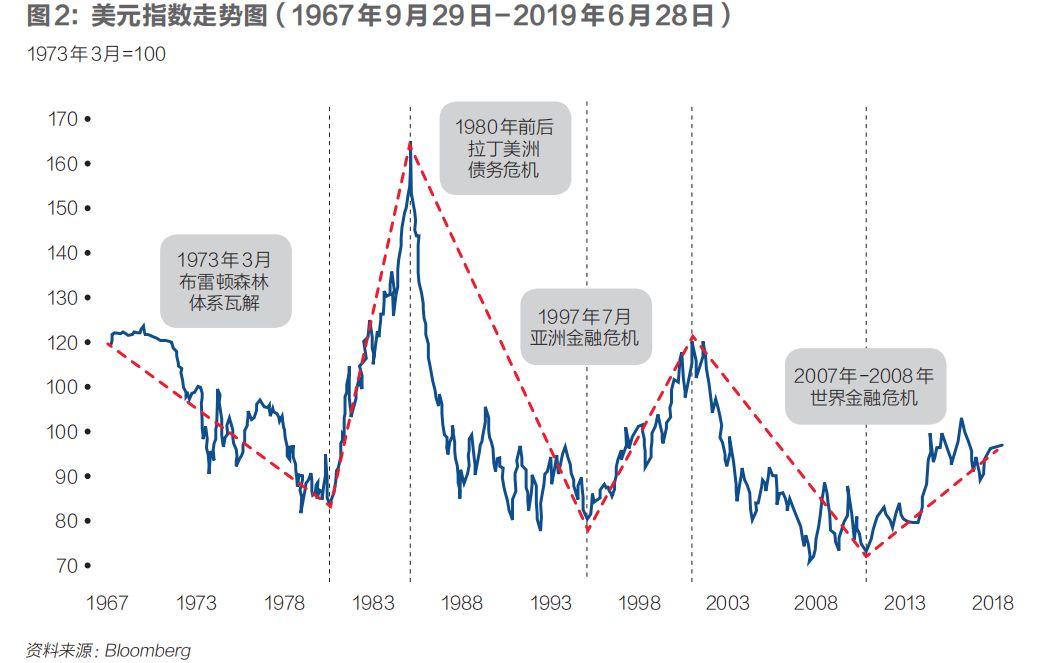

Second, is the classic theory of currency internationalization always inexplicable truth? One of the theories is the Triffin Dilemma. The main point is that if the US dollar becomes the world currency, it must maintain a certain degree of current account deficit, so that other countries can use the dollar flowing out of the border, while the dollar flows out and continues. The growing deficit will in turn affect the confidence of dollar-holding countries in the dollar. Once the market has a crisis-characteristic shift, panic selling dollars may be a high probability event. Any dilemma is a trade-off. The performance of the United States and the US dollar is not only controlled in the trade-offs, but also weighed in control. After the US dollar gained the global coin-making power advantage, the US fiscal deficit and trade deficit have always been “double peaks” (see Figure 1). If based on theory, a strong dollar may not be realized. However, the real dollar's strong monetary status has remained intact, and the US dollar index has remained firm (see Figure 2). It can be seen that the reality of the US unipolar superpower makes the theory pale.

The second theory is the Impossible Trinity. The main idea is based on the Mundell-Fleming model. The Krugman revision is expressed as a fixed exchange rate, independent monetary policy and capital flows. achieve. First of all, the “independence” of independent monetary policy cannot be precisely defined. Even if the Fed is only “independence within the government”, the absolute independent central bank may only exist in the “ideal country”, the Quantitative Easing policy of the central bank of major economies. It has been proved that complete independence is not available. Secondly, the fixed and floating exchange rate mechanism is strictly a relative concept. There is no purely free floating, and there is no pure absolute fixation. The exchange rate mechanism of the major economies is between the two; The free flow of capital is not unconstrained. The necessary regulation is a necessary option for monetary supervision in sovereign countries. The US policy of promoting the return of foreign dollars through taxation policies is also a non-free regulation, but it is more indirect and more subtle. If it is a concept, it is impossible to be a triangle and it is not necessarily impossible. The motivation for making it possible is the practical demand and market conditions.

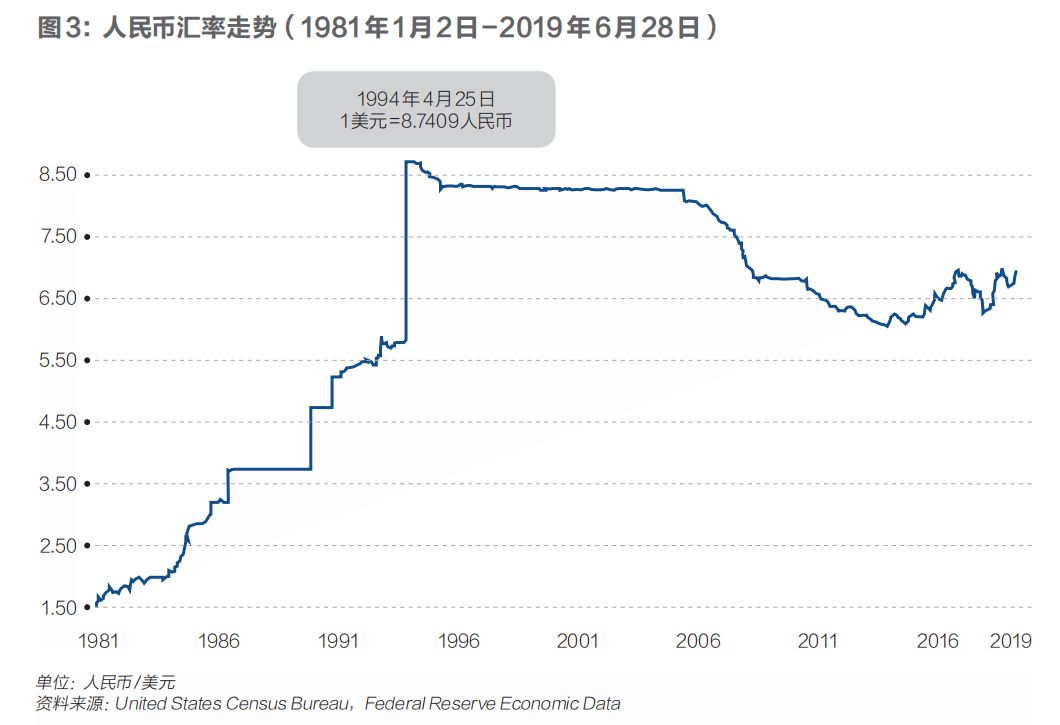

The answers to the above two questions may be necessary for the internationalization of the RMB. At least the following conclusions can be established and available for reference. First, the internationalization of the renminbi has become a reality. Even though the renminbi internationalization index has fluctuated or even declined since 2016, the reality of the renminbi as an integral part of the international monetary system cannot be denied. Second, the true internationalization of the renminbi is only a matter of time, as long as China’s economic situation has not changed. As long as China’s participation in international economic and trade activities has not diminished, as long as China’s open door is growing, as long as China’s contribution to world economic growth does not slow down, the renminbi becomes the main trading currency, investment currency and The prospects for reserve currency can be expected; thirdly, the necessary policy instruments in the process of RMB internationalization must be firmly applied. Exchange rates, capital account controls and reserves should be used at least in accordance with market changes, and should not be blamed by critics. The results of the regulation can be verified in the opposite direction. Fourthly, it is not necessary to be too attached to the clean floating of the RMB exchange rate. It is difficult to accurately quantify the cleanliness itself. Moreover, the 100% clean exchange rate mechanism does not exist at all. The US Trump administration’s exchange rate against the US dollar Twitter intervention also proves the exchange rate In the formation mechanism, the “invisible hand” and the “visible hand” play a role at the same time. The marketization trajectory of the RMB exchange rate is evidence (see Figure 3). Moreover, the value of the sovereign currency has been determined from the original absolute value standard. Gold or strong currency has evolved into a relative value standard, that is, the relative comparison between the strengths of the economy. The relative value of the renminbi and the Chinese economy is not a basic fact. Fifth, the opening of the capital account needs to be used with urgency and no need to care too much. The pressure, after all, the development of China's own capital market is not perfect, and the domestic and international linkage effect of financial markets is significant. Therefore, the independent, gradual and controllable opening of the capital account is the wisdom of the water, and must not go against the trend.

The background of the internationalization of the renminbi is a new digital economy. In addition to the traditional inheritance, it will inevitably face new challenges. The following issues will focus on the subversion and construction factors of the internationalization of the renminbi in the new economic environment.

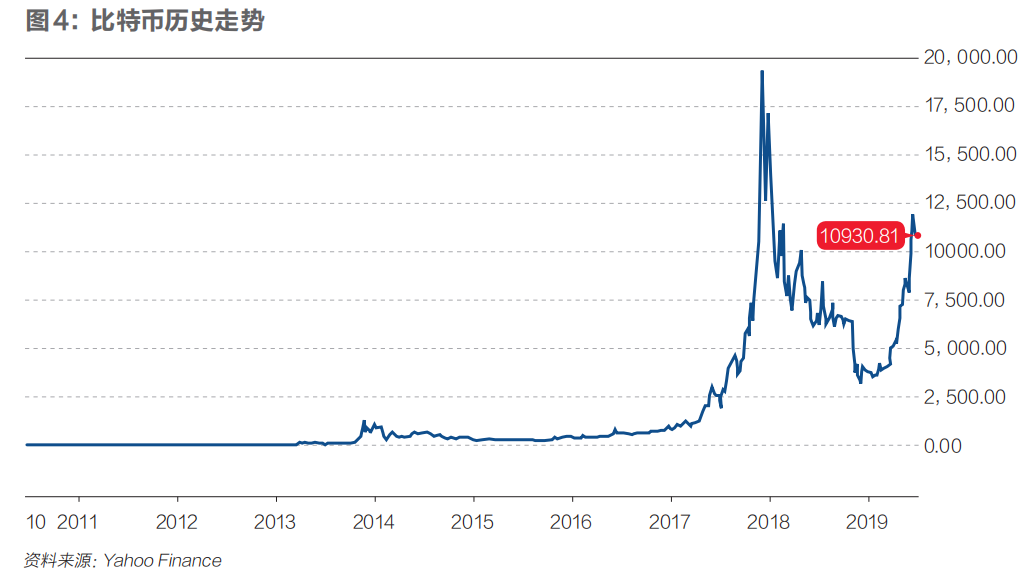

Third, is the RMB 2.0 internationalization competition in the original system or the competition of new elements? The context of the internationalization of sovereign currency is the physical form of banknotes and legal currency. The competition between currencies is essentially the struggle for the status of sovereign currency. In short, it is the competition between the US dollar, the euro, the Japanese yen, the British pound, and the renminbi. However, this is the past tense. A "Pandora Box" that opened the digital currency with Bitcoin, which is still unidentifiable, has become a subversive person in the digital age with virtual currency, electronic money, and cryptocurrency. As a representative of Bitcoin, its currency value has also become a new vane for investment or investment in the international market, although there is no shortage of curves that are soaring and falling (see Figure 4).

The emergence of virtual currency maps the shortcomings of traditional finance, namely currency over-issue, financial repression, etc. The goal is obviously not only “disintermediation” but the establishment of a new currency of “decentralization” and “de-media”. The underlying blockchain technology and distributed accounting also enable the establishment of a virtual currency trust mechanism, and fraud or fraud is nowhere under the smart account system. More importantly, in the context of “everything is interconnected”, virtual currency is the international currency at the time of its birth, and it is positioned in the grand narrative of global currency flow. Therefore, the internationalization of sovereign currency is not only the existing international currency. The challenge, but also the systematic impact of the new currency.

Fourth, is the virtual currency necessarily a unique existence of “decentralization”, “going to sovereignty” and “going to the central bank”? There are differences in the answer. One party thinks that even Bitcoin's Fork and Sharding cannot deny the original intention of “decentralization”; while the other side believes that virtual currency is only in the name of “decentralization”. The principle of “multi-centeredness” and “breaking” is the different platforming centers that are supported by different algorithms and technologies. Actually, social media is the center to shape one ecosystem after another. The currency is in the real world. The center of sovereignty in the virtual world rearranges and combines new non-physical centers. This conclusion was reaffirmed by Facebook's recently launched Libra, and it further illustrates that sovereign interests are equally important to virtual currency. In-depth study of Libra and its wallet (Calibra) and the corresponding organization Libra Association, it is not difficult to find that Libra is still pegged to a basket of physical currency and sovereign assets, essentially a value-linked credit currency system, but credit The source of more is the trust in Facebook technology. The anchor of the stability of monetary value is the comprehensive national strength of the sovereign state. The trust of the corresponding currency comes from this. In the digital age, the national trust or national power trust has joined the technical trust and even the technology worship (Techno-worship). The simultaneous existence of currency and legal currency also reflects the evolution of the currency trust mechanism.

Fifth, is the internationalization of the renminbi an independent narrative from the digital currency? Obviously not. The process of internationalization of the renminbi has already started. Although there are many twists and turns, the trend is good and the momentum is huge. However, while fully considering the interaction with international mainstream currencies such as the US dollar, it is necessary to take into account the development and changes of digital currencies. Corresponding to the RMB, the generation, development and supervision of China's digital currency must also be put on the agenda as soon as possible. In the overall planning of the internationalization of the RMB, the application and management of digital currency will be planned simultaneously, because the future international monetary system is not only a combination of sovereign currencies, but also a new pattern of symbiosis and intertwined between digital and sovereign currencies.

Then, the answers to the above three questions naturally lead to the following recommendations.

First, in view of the development of digital technology, the breadth, depth and extent of RMB internationalization must be further strengthened, and digital thinking must be integrated. Second, technology, especially financial technology (Fintech), has a certain disturbance to the internationalization of the RMB, among which The subversive component also has the construction component; thirdly, the internationalization of sovereign currency must be multi-objective iterative advancement, and dynamically adjust the internationalization strategy while exerting two dimensions: sovereign currency and digital currency; fourth, the participants of multi-market participants Nurturing and introduction and the construction of multi-level capital markets are guarantees for the internationalization of the RMB. The use of RMB in the domestic market is highly correlated with the status of the international market. There are no differentiated market participants, no capital market system with different functions, and currency. The role cannot be fully exerted, and the possibility of playing a role in the international market is even more rampant. Fifth, the international monetary system requires an international coordination mechanism for monetary regulation. At the same time, Regtech's advancing with the times is indispensable. Even if regulation cannot lead the market in reality, it does not hinder supervision. Forward-looking and targeted capacity building, supervision half-step is the difference between the market place without appropriate supervision offside.

The uncertainty in the digital age is true. It is necessary to deal with the uncertainty of the renminbi internationalization path. Therefore, it is inevitable that the renminbi and its corresponding digital currency will become international currencies.

(Author: Liu Jun, deputy general manager of China Investment Corporation, CF40 members of the academic committee of the International Monetary Institute, Renmin University of China; Editor: YUAN Man)

(The first issue of this article was published in the Caijing magazine on July 22, 2019)

Editor: Original titled "Digital Dimensions of RMB Internationalization"

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Galaxy Consensus Node plans to add Southeast Asian members – RiveX!

- Centralized Exchange VS Decentralized Exchange Who is the future of cryptocurrency?

- US Presidential Candidate Andrew Yang will accept bitcoin donations from Lightning Network

- Morning market analysis: BTC shock adjustment is still continuing, mainstream currencies are still under strong pressure

- EU: At present, the digital currency market is “anti-competitive”, and the European Central Bank’s digital currency will reshape the competition.

- The market continued to oscillate and shuffle, and prudently waited patiently

- Looking at the DeFi asset management platform from the point of view of the traditional fund: What is the future cap of the DeFi world?