Viewpoint | Is Bitcoin a macro hedging tool?

Bitcoin is often considered a value store and acts as a hedging tool for traditional asset classes during the downturn of the market. I think it would be interesting to study the performance of Bitcoin under this premise. Let's briefly discuss Bitcoin's dominance in the field of encryption, and then delve into its performance in the market's sharp downtrend.

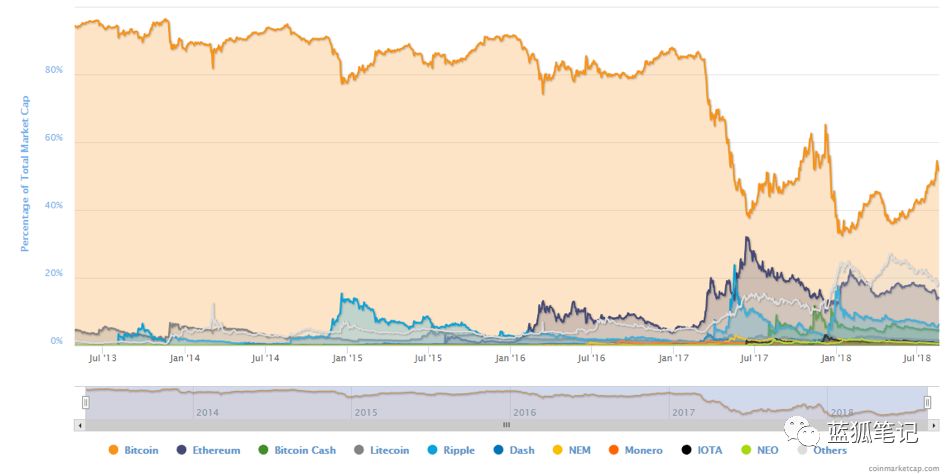

In the long crypto bear market in the past few months, traders have pulled out from the more speculative alternative altcoins and returned to the relatively safe position of Bitcoin. Bitcoin's dominant position has been receiving attention from all walks of life.

However, looking at historical data on bitcoin dominance, you will find that the recent highs are only 50% of the 18-year high. In fact, in the price market promoted by retail investors in December 2017, the bitcoin accounted for 65% of the BTC price on the day when the BTC price reached $16,800. Perhaps the bitcoin's dominant position in the market value is a characteristic of the bear market. Is this statement itself wrong?

In contrast, in the long-term bear market, Bitcoin's dominance is justified because many other cryptocurrencies that were overbought during market ups are being abandoned, and on the other hand, in the bull market cycle. In the middle, new technologies were speculated, and funds flowed into these cryptocurrencies, which also led to the weakening of the dominance of Bitcoin.

- The "public opinion war" of the dealer? BTC's Google search volume is 7 times that of Bitcoin

- Indicted by the SEC, Kik CEO suspected of collapse and drunk: "I don't want to go to jail"

- MakerDAO multi-asset mortgage road was questioned by the community, the founder responded: the nature of the trust agreement will not change

Looking further at the above figure, it is normal for Bitcoin to be above 80% of the total market capitalization ratio 17 years ago. So what does the high or low of this indicator mean? I don't think the answer can be generalized. Although I think Bitcoin's dominance is not a macro indicator of the health of the cryptocurrency market. Although Bitcoin's current monetary attributes are more prominent, it is more likely to reflect the investment community's other encryption. A measure of whether the project is viable.

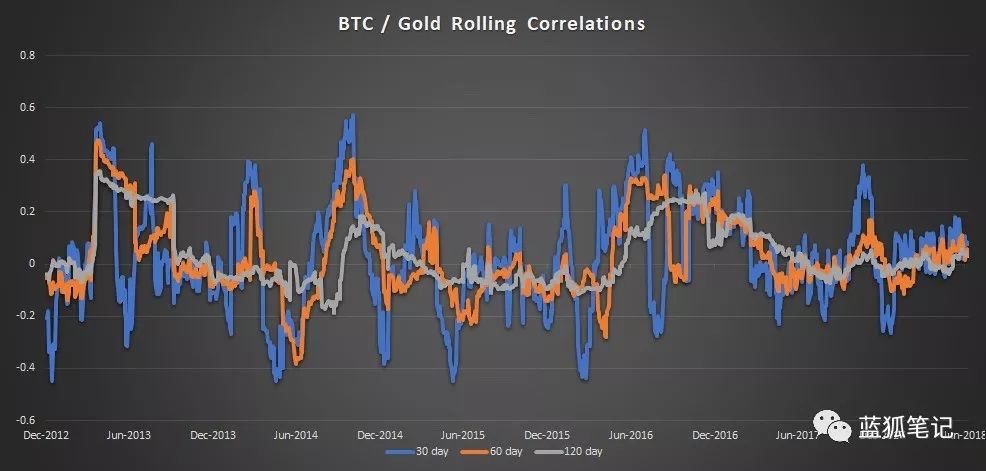

In any case, although the market share is an interesting indicator, the encryption market has different interpretations, and I don't think it is a hard science indicator. So, what is a good macro indicator for Bitcoin? As I mentioned, one of the characteristics of Bitcoin is that it can be stored primarily as value. I can immediately think of gold that can be used for comparison, or it can be silver.

Historically, both metals have performed well when financial markets have been turbulent, but when the market is in a bullish mood, they are being sold. Therefore, if Bitcoin exists as a true value store, then ideally it should be highly correlated with the two precious metals.

The above graph shows the historical correlation between gold and bitcoin, and the 120-day rolling correlation is maintained within a fairly small range of fluctuations. Since this correlation will not be lower than -0.2 for any significant period of time, it may take a while (if any) for Bitcoin to completely replace gold as a hedge asset in the market. (Blue Fox notes: From the current point of view, the correlation is not high. Of course, now does not equal the future.)

Should gold and silver be related to Bitcoin? If a larger percentage of smart money starts using Bitcoin as a macro hedging tool, will there be less money flowing into gold and silver?

According to this logic, there should be no high positive correlation between Bitcoin and metals, because it is important to consider the “value storage” asset class as a whole, and the overall allocation of funds is a zero-sum relationship. Any additional funds injected into Bitcoin to hedge against major currency sell-offs will erode funds flowing into gold or silver for the same purpose.

Gold has been used as a “currency” since ancient times, the most common of which was from around 700 BC, when it was located in the Lydian Empire in western Turkey. In contrast, Bitcoin is still in its infancy, and to replace the functions offered by gold in the financial market, Bitcoin may take a lot of time.

But a unique and interesting phenomenon of Bitcoin is how citizens in hyperinflation countries can transfer their wealth to Bitcoin. Bitcoin can resist the erosion of local currency purchasing power. More importantly, Bitcoin does not. Give the local government an easy way to prevent its citizens from transferring wealth in this way. The most obvious examples are Venezuela and Zimbabwe.

Having said that, let's take a closer look at some of the events in the down cycle that the market is experiencing and whether Bitcoin has any major reaction. Let us first look at the market adjustments in the first quarter of 2016. In December 2015, the Federal Reserve raised interest rates by 25 basis points for the first time since the interest rate fell to zero during the 2008 financial crisis. The Fed subsequently issued guidance and expects to raise interest rates three more times by 25 basis points in 2016. This view is recognized by most seller researchers and asset management companies.

From December 22, 2015 to the end of January 2016, the Shanghai Composite Index (SSE) has fallen by about 27%, triggering global market volatility. The most obvious is that the Fed is forced to adjust its monetary policy tightening frequency. The three interest rate cuts in 2016 were only carried out once, and it was only carried out in December 2016, and it has been a full year since the first interest rate cut.

Let us pay attention to the decline of the Shanghai Composite Index (SSE). During this period, gold prices rose by about 4.1% and bitcoin fell by 14.6%. It can be said that since the Shanghai Composite Index has experienced a particularly large decline and occurred within a month, for such a broad-based index, the time of one month is very short, so gold or bitcoin Appreciation will be a lagging indicator.

In this case, gold performed as expected. If we look at the six-year price history of gold from July 2012 to July 2018, the biggest 120-day price increase is 278 points from January 13, 2016 to July 6. Most of the time in 2016, prices continued to rise. However, due to the withdrawal of the British referendum from the EU, the global market began to slump later in 2018, and it was not until the end of the US presidential election that the heat began to recover. However, the Bitcoin market is another way. In the first half of 2016, the price trend was sideways, rising by 68% in June and ending at the end of the year, which was 30% higher than the peak in June.

The Shanghai Composite Index has fallen again in the past few months, and has fallen by 17% since the US announced in May that it began to impose tariffs on Chinese goods. Bitcoin price performance once again showed no significant negative correlation with the Shanghai Composite Index, as bitcoin prices fell from about $8,000 to the current $7,200 level during the same period. (Blue Fox notes: Bitcoin prices are currently fluctuating around $10,000)

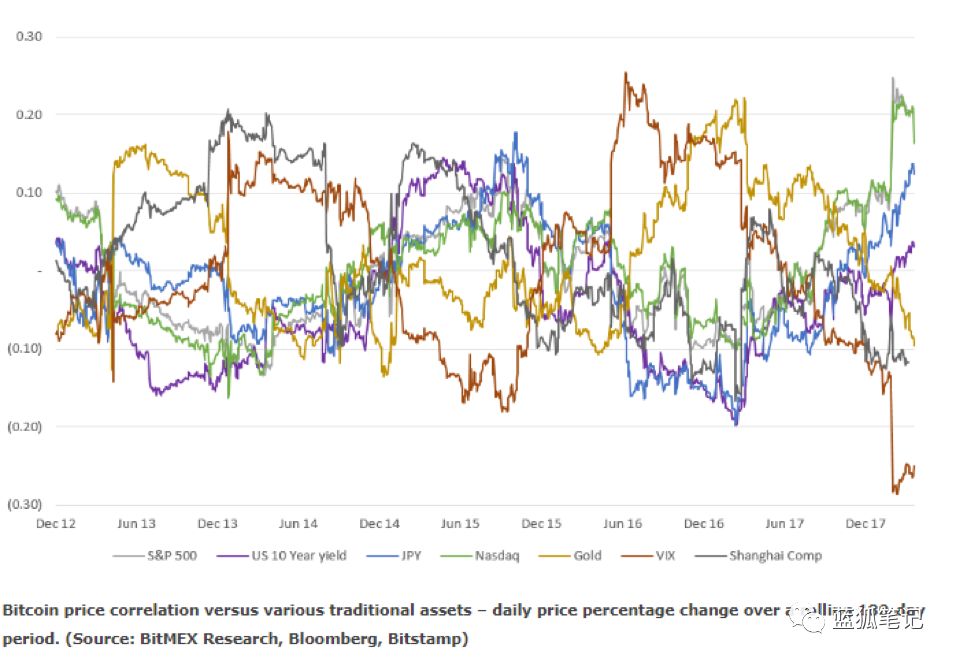

The conclusion here is that Bitcoin has not played a role in hedging the geopolitical events that caused macro market volatility like gold. Although bitcoin is not highly correlated with most legal tenders, commodities and other macro indices, as shown in the chart below by BitMEX research, in the current environment, bitcoin prices are mainly driven by factors outside the global macro.

However, Bitcoin's response to currency volatility is more pronounced than the stock index volatility. For example, the impact of the Greek debt crisis, which is depreciating against the euro and approaching the dollar parity, on bitcoin prices is more influential to bitcoin prices than the examples of the Shanghai Composite Index used in this analysis and other indices such as the Standard & Poor's 500 Index. For clarity. In fact, the stronger the currency, the greater its impact on Bitcoin.

I originally thought that the situation in Turkey in 2018 and the pressure on the lira may provide an interesting perspective on the analysis of bitcoin prices. But Turkey, the world's 18th largest economy, is not big enough on a global scale, and its volatility can't make a meaningful impact, especially when it comes to bitcoin and the SSE, the second largest economy. There is no direct relationship between them (Turkey's estimated GDP in 2018 is only 6.45% of China).

Finally, I believe that before we can really judge whether Bitcoin can be used as a value store and a downside hedging tool in the market, some more important events are needed as a trigger. For example, Italy withdraws from the EU and the US further cuts its balance sheet. Or other major events that have led to further downward pressure on emerging markets. Bitcoin has a number of special effects on the technological advancement of the encryption market. These effects are far more important than the factors that cause bitcoin price volatility in the global macro environment. This means that if you want to influence the price of bitcoin, it must be a very significant macro. event.

——

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain needs academic spirit | 2019CCF Blockchain Technology Conference

- "Learning Times" article: Libra coins pose challenges to cryptocurrency regulation

- Bakkt low volume is in line with expectations? We chatted with the investor who opened the account.

- Tencent's largest shareholder, Naspers, Coinbase, and other companies, Immutable received another $15 million in financing

- BTC short-term risk of breaking, but should not be blindly bearish

- A picture to understand the difference between Bakkt's bitcoin futures and "traditional" futures

- Swiss Stock Exchange SIX launches digital asset trading test platform to build a trusted digital infrastructure based on DLT