Bakkt low volume is in line with expectations? We chatted with the investor who opened the account.

Bakkt is on the line, but the volume is completely different from what you think, saying that good traditional investors come into the market? Say good big bull market?

With some questions, we found Mr. King of Qitao Capital, a compliant encrypted digital fund that had a history of bitcoin futures trading in CME for a year, and Bakkt's account is awaiting approval.

1. Why do you need an exchange like Bakkt?

- Tencent's largest shareholder, Naspers, Coinbase, and other companies, Immutable received another $15 million in financing

- BTC short-term risk of breaking, but should not be blindly bearish

- A picture to understand the difference between Bakkt's bitcoin futures and "traditional" futures

King: We are a compliant fund. From the perspective of being responsible for LP money, if we want to do bitcoin futures, Bitmex, OKex, etc. will not be our choice. Spot trading We also selected compliance exchanges such as Coinbase and Bitstamp. The emergence of Bakkt and CME complemented the gap in the compliance futures platform.

The emergence of a compliance exchange, from the perspective of fundraising, allows you to better convince the traditional LP and safely hand over the money to the fund.

2. What is the risk appetite and return expectation of LP for the compliant Crypto Fund?

King: Generally speaking, it is not a very aggressive investor. There are many high-net-worth individuals. Generally, when you want to configure some digital currencies when you configure assets in multiple directions, you will invest in our funds.

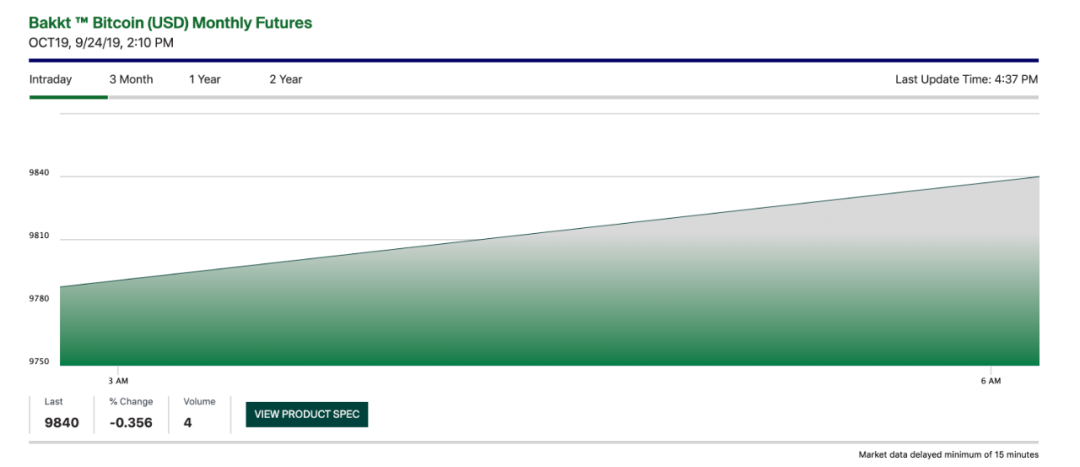

3. Is the trading volume of Bakkt on the first day in line with expectations?

King: It is in line with expectations.

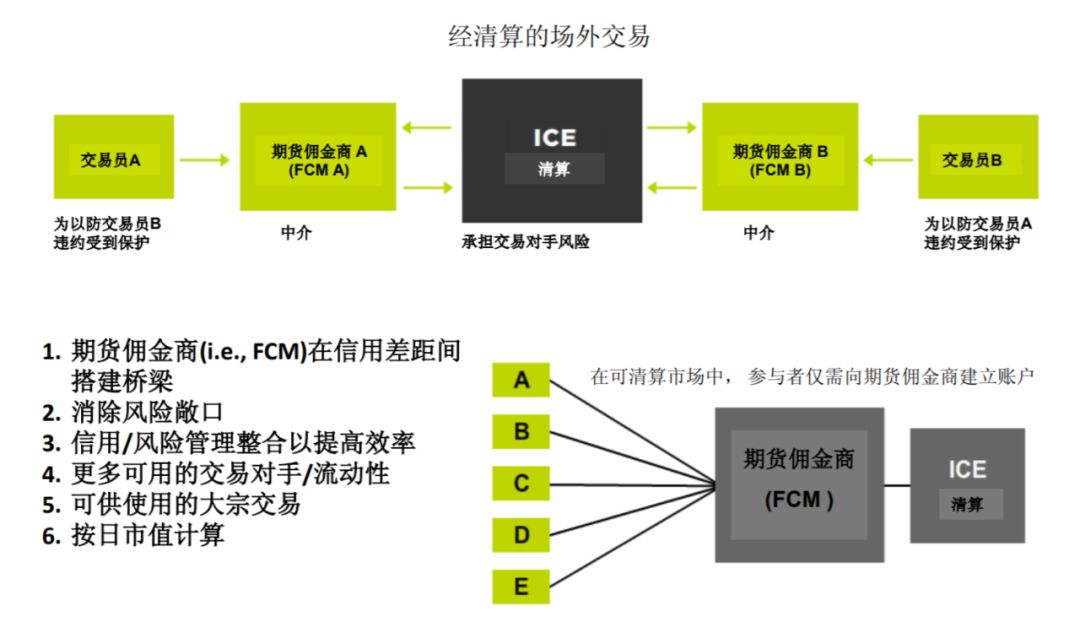

First of all, the essence of Bakkt is a product of the US futures market. Investors should participate, and the role of FCM (futures commission merchants) is very important.

The role of FCM in the traditional futures trading market

Our fund has been involved in Bitcoin futures for about one year (CME Bitcoin futures), the performance is very good and the middle agents also have a good credit value.

However, at present, we have consulted the mainstream FCMs in the United States and the Asia-Pacific region. They are basically in a wait-and-see state, and only two of them support it in the first place.

In addition, according to the Wall Street Journal report, some large liquidators such as Goldman Sachs did not enter the market for the first time. This may also be one of the reasons for the small volume.

Of course, this may also be related to Bakkt's marketing strategy. There are not many accounts for high-net-worth individuals and small institutions, and they may be mainly for large organizations.

This has led to many general investors who want to enter the market, such as high net worth miners, either unable to find a good FCM or still on the way to get an account.

Another reason is that all futures products take a certain amount of time to become a climate. CME has also experienced a period of time before, so Bakkt needs some time to develop.

Therefore, today's low trading volume is not his "high opening and low walking", but it is a normal phenomenon, mainly because of the gradual trust, and the traditional fund industry of BTC physical delivery also needs a training process.

4. How to open an account at Bakkt? Is the threshold high?

King: I mentioned the last question. Bakkt is essentially a product of the US futures market. In the past, what was your account opening process in the US futures market? What is the process now, KYC, qualification verification, 1v1 inquiry and so on.

The biggest difference with the current mainstream digital currency exchanges is that you need to find an intermediary. The big exchanges in the United States generally do not deal directly with small institutions and individuals, but there will be special FCM contacts.

And FCM a license usually costs tens of millions of dollars to get down, small institutions and individuals can find FCM to open an account, but FCM is relatively cold, more difficult to dock, so there will be a group of brokers underneath, each broker may be a few The FCM relationship is relatively good, so an intermediary intermediary account opening process is formed.

In the futures account opening, IB and FCM are more concerned about whether they will run. Because in a market that is violently fluctuating, if there is a burst of positions, customers have no money to make up for them to take risks.

Therefore, when they open an account, their own risk control is very strict, which will result in low capital utilization rate (that is, low leverage). It takes a long time for cooperation and they dare to let go of more trading rights. This professional threshold is very high.

We also made a high profit from the account after a year of hard work, and now we can fully use our own funds.

5. What is the difference between playing futures on Bakkt or CME and playing futures on Bitmex?

King: Investors are more professional, because both FCM and the platform will review you.

In addition, there is no common 100x leverage, CME is also up to 2.7 times leverage, it is estimated that Bakkt will be similar.

————————————————– —

After chatting with Mr. King, my feeling is that everyone’s expectation of bitcoin price increase is really too high. Whether it is Bakkt or an ETF that has not yet been launched, it is probably a surge in online trading volume, and then the currency. The price has skyrocketed.

But whether it is the traditional financial institution that operates and uses it, stability is the first factor. Even with the platform of Bakkt, there is no way to easily enter the market with hundreds of millions of dollars as easily as the currency exchange. After all, it is only for the platform. The steps of the audit and review will not be less.

If the style of the currency circle is that rowing does not rely on paddles, all rely on the waves, then the traditional financial ship, when using the pulp, probably have to consider the matter of too much force to destroy the ship, how much money to lose.

(Finish)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Swiss Stock Exchange SIX launches digital asset trading test platform to build a trusted digital infrastructure based on DLT

- Play Compound from 0 to 1, 5 minutes and get passive income from DeFi

- What does Google's quantum breakthrough mean for blockchain cryptography?

- Central Bank Governor Yi Gang: There is no timetable for the launch of digital currency (with full text of the speech)

- Wall Street Journal: Central bank digital currency may end US dollar hegemony

- Market analysis: the mid-term adjustment is officially opened, alert to the long yin to

- One week observation: digital economy and digital currency become the new battlefield of big country game