Warren Buffett hit a ring and erased half of the cryptocurrency investors?

On the first Saturday of May each year, it is a “pilgrimage to the global investor” – the Berkshire Hathaway shareholder meeting of Warren Buffett is held in Omaha, USA. As usual, Buffett sat down in the "singing sing group" group status and high-profile bitcoin, it is like a collection of six gems of the tyrant, hit a ring finger…

On the first Saturday of May each year, it is a “pilgrimage to the global investor” – the Berkshire Hathaway shareholder meeting of Warren Buffett is held in Omaha, USA, where its headquarters are located, and tens of thousands of people around the world travel here. I hope to know the wind vane of investment. At this year's shareholders meeting, the 88-year-old Buffett once again chatted with a group of reporters about Bitcoin. "This is a gambling thing… a lot of fraud is related to it. Bitcoin has no value, it can't do anything." It is there, it's like a shell, it's not an investment for me."

This year, Buffett’s evaluation has been more polite. In 2018, Omaha, the old man launched a fierce attack on cryptocurrencies such as Bitcoin. He said that the ending of cryptocurrency will be very miserable, and he said unceremoniously, “Bitcoin is the second of the rat poison. Second power."

- What does the bitcoin power surge mean?

- The court asked CSW to disclose the early bitcoin holdings. Can "Zhong Ben Cong's mystery" be solved?

- The joint-stock company has created the world's major wealth, will the encryption network be the next one?

The legendary "stock god" Warren Buffett's influence is super strong, and the stable "singing sing" group status is high-profile and bitcoin. It is like a jewel of six gems, hitting a ring finger. It is estimated that the incremental funds in the mainstream market have heard this, and half have decided not to touch Bitcoin. Why is Buffett's father not optimistic about cryptocurrencies such as bitcoin?

The "ball" of Bitcoin is not worthy of Buffett's "swinging"

Buffett's investment philosophy has a very important concept – the "capacity circle principle", in short, only invest in projects that you can understand. In the interview, Buffett often used baseball as an example. The ability circle is equivalent to the hitting range of the baseball batter. If the ball is closer to the hitting point that the baseball player is best at, the farther the ball can be played. "For most people who are investing, what matters is not how much they know, but how to truthfully determine what they don't know. An investor doesn't have to do too much, as long as he or she avoids making big mistakes. Charlie Munger also added this point of view, saying that they have three options for investing: they can invest, they can't invest, and it's too hard to understand.

Buffett believes that he does not understand the Internet, so he never invests in any Internet company until the later IBM and Apple are not really Internet companies. (I heard that Berkshire finally invested in Amazon's stock, the ratio is limited, still can see the principle of Buffett's investment.) Buffett and Gates are long-time friends, the two often play table tennis and bridge together, Buffett has been The Gates Foundation donated $2.1 billion and even said it would be naked after death. However, he actually did not buy a share of Microsoft stocks! Because Buffett said that technology stocks are beyond his ability circle. His inability to understand is not to confuse the company's specific business, but to make an accurate estimate of the company's future (5-10 years) free cash flow.

For Buffett, who is good at avoiding uncertainty, Bitcoin has already exceeded his ability circle, and it is normal to be uninterested in Bitcoin and other cryptocurrencies.

Gold can't be seen, how can you look at Bitcoin?

Buffett has always had little interest in gold and is well known. In a letter to Berkshire Hathaway shareholders in 2011, Buffett pointed out that gold is a big love for investors who are afraid of almost all other assets, especially paper money. To be fair, Buffett admits that investors are afraid to use banknotes as a stored value tool, especially for inflation reasons.

Regarding gold, Buffett talked about two main weaknesses: like all assets without production capacity, gold does not have production capacity. In other words, gold will never produce more gold, or any other value. Instead, every well bought by Berkshire Hathaway will produce valuable oil; a garment factory can produce clothes as long as it is in operation; stock investments can receive dividends, and then you can buy more with dividends. More stocks. But the one ounce of gold you buy now is still an ounce of gold in the next 400 years.

The second weakness that Buffett talked about is that the actual use of gold is insufficient. Of course, it is used to make jewelry, and there are other applications, but the widespread demand for gold does not come from this. Buffett's focus is on unproductive assets that can be widely used in industrial production, such as copper and steel, and at least can rely on this demand to increase prices.

Bitcoin is known as digital gold. Nakamoto has repeatedly compared bitcoin with gold and gold mining in the mail and forum posts. The industry also believes that "crypto assets like Bitcoin have the potential to develop into investment and diversification tools that will play over time. A role similar to gold."

In short, in the face of this digital currency that does not seem to have the capacity and practical application value, how can a gold useless advocate be optimistic about digital gold bitcoin?

Deviation from the underlying logic

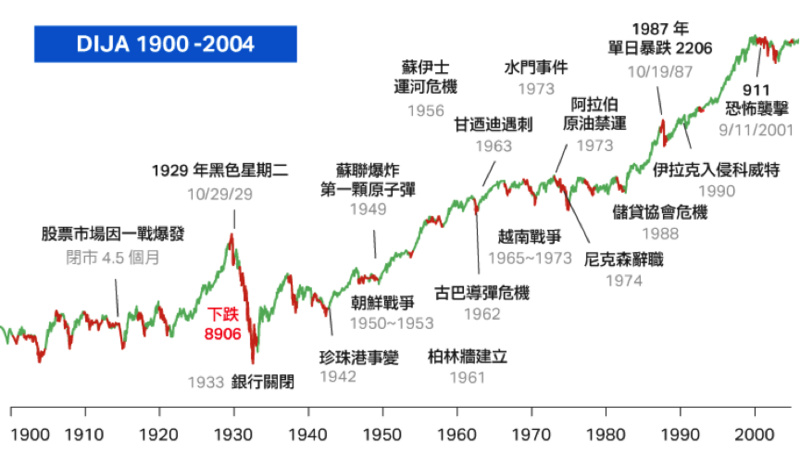

The success of Berkshire Hathaway is positively related to the success of the US economy. The optimistic view of the US economy is the foundation of Buffett’s investment philosophy. Throughout the 100-year trend of the US stock market, it has created a century-old bull market in the history of mankind. Buffett's portfolio and investment ideas fit perfectly into the path of a growing economy, creating a miracle from $7 in 1964 to $327,700 today. Buffett’s success is based on the long-term strength of the long-term US dollar boom. The rise of Bitcoin confirms the weakness of the US economy from the side, which is contrary to the investment philosophy that the stock god has always emphasized. Imagine if the US economy is not like this. If the US national economy is not the world's number one economy, what is the stock of Berkshire Hathaway? Is the myth of the stock gods a survivor bias? History has no assumptions, but history is hard to repeat.

The above three reasons are the underlying reasons for Buffett to look at Bitcoin. There is a saying that Buffett is a shareholder of Wells Fargo and JP Morgan, because the interests prompted him to come out and stand diss bitcoin. In fact, this is a misunderstanding of Buffett. Without understanding Buffett’s value investment and underlying investment logic, it is difficult to understand why he rejects Bitcoin so much.

Have something to say about "half erased"

From the perspective of first principles, whether bitcoin is valuable or not can be found in Hera's A Brief History of Humanity. The book "A Brief History of Humanity" has two sentences, one of which is 'The most important things only exists in our imagination'. "Those things that really change the world are often things that we didn't seem to use at the beginning of our imagination." . It is through these illusory things that the model of cooperation between people gradually evolves until today's human beings.

Turning over the early history of any nation, you will see a mythological map made up of various river gods, tree spirits and sun gods. If you think that these are just entertainment, then it is a big mistake. Without these ancient gods, the tribes will not work together to wage war, and larger organizations like tribal alliances and city-states will not stand out. Myths usually belong to the collective imagination of a tribe. Different people share this imagination and produce a collective identity.

The scope of mythology is not limited to myths or religions, but includes many things that we take for granted in modern life. For example, companies, countries, currencies, stocks, and so on, all exist in our brains, but they can Play a pivotal role in life. The change of concept promotes the development of productivity and promotes the change of production relations.

The banknotes printed by the Federal Reserve are not bound to any assets. Due to our common imagination of the United States, we believe that this banknote has value, although the cost of producing this banknote is only a few cents, although this banknote does not create any value. . Diamond is another classic case imagined by human beings. A carbon-element allotrope, a mineral with the same composition as a pencil refill, has a value of tens of thousands of dollars or even hundreds of thousands per gram of gram (1 carat). The US dollar, but also derived a set of industry chain of rating, identification, processing, sales. When human women imagine that diamonds represent eternal love, once it breaks through the threshold, it is also an irreversible process.

"Common imagination" is "consensus"

Like money, diamonds, companies and stocks, bitcoin is like human imaginary imagination. As more and more people believe in the value of Bitcoin, once the threshold is broken, it will be an irreversible process. In fact, "common imagination" is not mysterious. The "common imagination" of anthropological perspective is the "consensus" in the field of blockchain.

According to the British "Financial Times" article, Bitcoin is more sought after by millennials, and this common imagination has quietly formed among young people. If gold is valuable, if the diamond is valuable, then bitcoin can be valuable? Because bitcoin is the same as human beings, like gold, diamonds and currency.

Conclusion

Of course, Bitcoin also has its own problems to solve. The problem with Bitcoin is not that it "can't create any value." The biggest problem is that bitcoin's computing power is concentrated in a few mines, maintaining consensus on resource waste, price volatility, distribution concentration, and so on.

It is also the “common imagination” of human beings. At present, the total market value of the cryptocurrency market is 200 billion US dollars, and the market value of Berkshire Hathaway is 530 billion US dollars. More people are now willing to agree with the core of Buffett’s 55-year creation. Values, and Berkshire Hathaway's "common imagination."

However, when the millennial generation enters the prime year, will there be any change when the "after 00" and "after 10" adults grow up? The stories that people imagine and fiction together at different times are different. We not only have a stronger joint imagination, but also use this fictional meaning to transform the world and even transform ourselves. Fiction is much more important than reality.

Original article, author: ROY

Source: Planet Daily

Violation of the law will be investigated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Spain's largest stock exchange will launch a blockchain-based certification system to eliminate the creation and trading of physical certificates

- Buffett once again attacked Bitcoin at the shareholders' meeting, but isn't it a good thing?

- Tether admits that it is not 100% reserve, but the USDT price has not fallen. Why?

- BCH will implement Schnorr signature this month, V God: very good

- Buying "Apple" is worse than buying BTC: This year's BTC market performance surpassed Apple stock

- Bitfinex currency, has nothing to do with ordinary players?

- GitHub was attacked, hackers deleted hundreds of source libraries and asked for bitcoin