Watch | Policies continue to assist, Bitcoin options go public, this week is a lot better

The State Council issued a document to guide the exploration of the "blockchain +" model. The CSRC and the Ministry of Commerce also issued favorable policies. On January 17, the General Office of the State Council issued the “Guiding Opinions on Supporting Deepening Reform and Innovation in National-level New Areas and Accelerating the Promotion of High-Quality Development”. Model: Support the new area to accelerate the development of strategic emerging industries, cultivate and develop a number of characteristic industrial clusters, improve the level of specialization and innovation, and cultivate a group of globally competitive "gazelle" enterprises, new leader enterprises, special specialties "Little Giant" companies and "Single Champion" companies in the segmented field. Accelerate the development of blockchain technology and industrial innovation, explore the "Blockchain +" model, and promote the deep integration of blockchain and the real economy. "CSRC, Business Ministries and other ministries have also recently proposed to support the development of blockchain. Blockchain is expected to help the industries supervised by various ministries and commissions.

The Business Management Department of the Central Bank announced the first batch of shortlisted projects for the fintech "supervisory sandbox" in Beijing, and ICBC's blockchain traceability application was shortlisted. On January 14, the six projects announced by the central bank involved innovations such as the Internet of Things, micro-credit, smart banking, and mobile POS. ICBC's "Internet of Things-Based Authentication Management and Supply Chain Finance" was shortlisted. The application will collect data such as manufacturing, quality inspection, inventory, logistics, and sales of products based on the Internet of Things, which cannot be tampered with and recorded on the blockchain.

CME Group officially launched an option product based on bitcoin futures on January 13, and the capital market continued to expand investment channels in the digital asset market. The value of this option is based on the regulated CME CF Bitcoin Reference Rate (BRR) and is settled in the actual Bitcoin futures traded. The launch of CME Bitcoin options products reflects the smooth development of CME Bitcoin futures, reflecting the growing interest of traders in cryptocurrencies, and the increasing demand from customers for tools to manage Bitcoin risk.

- DeFi weekly selection 丨 the total value of the lock position exceeds 1.1 billion US dollars, the DeFi era of sailing is beginning

- Observation | Blockchain accelerates the digital transformation of commercial banks

- Xiao Yan: What is the legal boundary of blockchain technology and its application?

Uzbekistan will establish a "national mining pool". Recently, Uzbekistan has announced the establishment of a "national mining pool". The National Project Management Authority (NAPM), which oversees the crypto industry, announced that miners joining the pool will enjoy lower electricity prices. NAPM said the proposed mining pool will help ensure the economic efficiency of the country's cryptocurrency mining and increase transparency and security.

Last week's market review: Chainext CSI 100 rose 11.81%, and the AI performance in the segment was the best. From the perspective of subdivisions, the performance of entertainment and social networking, basic enhancement, basic chain and AI are all better than Chainext CSI 100 average levels, which are 12.39%, 17.59%, 16.25%, 37.22% respectively; payment transactions, Internet of Things & traceability, business The performance of finance, storage & calculation, and pure currency were all lower than the average level of Chainext CSI 100, which were 10.31%, 7.22%, 3.68%, 8.21%, 9.90%.

Risk Warning: Uncertainty in regulatory policies, and the development of blockchain infrastructure is not up to expectations.

1. The policy continued to assist and the listing of bitcoin options has benefited a lot this week.

The State Council issued a document to guide the exploration of the "blockchain +" model. The CSRC and the Ministry of Commerce also issued favorable policies. On January 17, the General Office of the State Council issued the “Guiding Opinions on Supporting Deepening Reform and Innovation in National-level New Areas and Accelerating the Promotion of High-Quality Development”. Model: Support the new area to accelerate the development of strategic emerging industries, cultivate and develop a number of characteristic industrial clusters, improve the level of specialization and innovation, and cultivate a group of globally competitive "gazelle" enterprises, new leader enterprises, special specialties "Little Giant" companies and "Single Champion" companies in the segmented field. Accelerate the development of blockchain technology and industrial innovation, explore the "Blockchain +" model, and promote the deep integration of blockchain and the real economy. "CSRC, Business Ministries and other ministries have also recently proposed to support the development of the blockchain, and the blockchain is expected to help the industries supervised by various ministries and commissions. From January 16th to 17th, the 2020 SFC System Working Meeting proposed that "support by science and technology supervision to further enhance the effectiveness of supervision. Promote the building of basic capabilities of supervision technology and accelerate the establishment of new supervision models. Strengthen the supervision of technology in the securities and futures industry To promote the promotion of the industry's scientific and technological development level. Actively explore the application of innovative financial technologies such as blockchain. "On January 14, eight departments including the Ministry of Commerce issued the" Guiding Opinions on Promoting Service Outsourcing to Accelerate Transformation and Upgrade ". One section puts forward "to support the development of information technology outsourcing, and include the development and application of information technology such as cloud computing, basic software, integrated circuit design, and blockchain in the support of national science and technology plans (special projects, funds, etc.). Foster a batch of information Technology outsourcing and manufacturing integrated development demonstration enterprises. "The market had previously worried that blockchain is a temporary hot spot, but the State Council, the Securities Regulatory Commission, the Ministry of Commerce and other departments continued to release favorable policies to promote industry development, serve the real economy, and respond to politics with practical actions. Bureau's collective learning spirit and continuously deepening the application of blockchain in various scenarios We expect that following the spirit of the "10.24" meeting, more ministries and commissions will issue similar documents, and more favorable policies are expected to continue to be introduced.

The Business Management Department of the Central Bank announced the first batch of shortlisted projects for the fintech "supervisory sandbox" in Beijing, and ICBC's blockchain traceability application was shortlisted. On January 14, the six projects announced by the central bank involved innovations such as the Internet of Things, micro-credit, smart banking, and mobile POS. ICBC's "Internet of Things-Based Authentication Management and Supply Chain Finance" was shortlisted. The application will collect data such as manufacturing, quality inspection, inventory, logistics, and sales of products based on the Internet of Things, which cannot be tampered with and recorded on the blockchain. ICBC said that after the application is fully promoted, it will involve more than 300,000 individual customers, more than 1 million transactions per year, and an annual transaction value of more than 50 million yuan. The "sandbox" is a pilot for innovation supervision. It insists on licensed operation, encourages the participation of multiple themes, sets flexible boundaries, and reserves space for innovation. Earlier, Hong Kong, China launched a fintech regulatory sandbox. We believe that the successive launch of regulatory sandboxes in Hong Kong and Beijing will drive the tide of blockchain applications. At the same time, the central bank's digital currency has basically completed the joint debugging test, and blockchain technology has been highly valued by the central bank's leadership. On January 10th, the People's Bank of China released a paper "Inventory of the Bank of China's 2019 Fintech", the article stated that the central bank basically completed the top-level design, standard formulation, and functions of legal digital currencies on the premise of adhering to two-tier operation, M0 substitution, and controlled anonymity. R & D, joint testing, etc .; We will carry out solid research on digital currencies and track and study the international cutting-edge information on digital currencies.

CME Group officially launched an option product based on bitcoin futures on January 13, and the capital market continued to expand investment channels in the digital asset market. The value of this option is based on the regulated CME CF Bitcoin Reference Rate (BRR) and is settled in the actual Bitcoin futures traded. The launch of the CME Bitcoin options product reflects the smooth development of CME Bitcoin futures, reflects the growing interest of traders in cryptocurrencies, and increased customer demand for tools to manage bitcoin risk, and its approval also reflects US regulators The recognition of bitcoin derivatives has a demonstration effect on the supervision of countries around the world, and China may follow up in the future.

Uzbekistan will establish a "national mining pool". Recently, Uzbekistan has announced the establishment of a "national mining pool". The National Project Management Authority (NAPM), which oversees the crypto industry, announced that miners joining the pool will enjoy lower electricity prices. NAPM said the proposed mining pool will help ensure the economic efficiency of the country's cryptocurrency mining and increase transparency and security. In addition, the country will launch Uznex, the first approved crypto asset exchange, next week. Uznex, a platform operated by the South Korean Kobea Group, is scheduled to officially open on January 20. The website is currently online testing and shows 7 BTC and USDT related trading pairs.

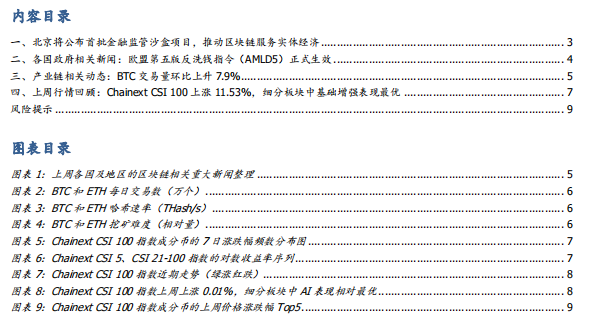

2. News from Governments: Japan ’s Financial Services Agency Announces “Financial Settlement Algorithm” Amendment

India: On January 16, according to Jp.cointelegraph, the Indian Supreme Court has postponed a public trial of the Bank of India (RBI) 's ban on cryptocurrencies in the banking industry. In April 2018, the Bank of India announced that it banned financial institutions from providing banking services to cryptocurrency companies. Banks then stopped providing services to the crypto business and closed their accounts. In response, industry stakeholders filed a petition to protest the ban. The IAMAI (Indian Internet and Mobile Communications Association) has sued the Indian central bank for arguing that the Constitution does not empower the central bank to enforce the ban.

Russia : On January 15, Mikhail Mishustin, who was appointed Prime Minister of Russia, pointed out some of the key priorities of his work and outlined the need for Russia's institutional reforms. Mishustin said the country should implement modern information technology, including the development of a national digital economy plan. It is reported that major Russian companies, including some companies in which the state holds significant shares, have begun testing and applying blockchain technology to all aspects of operations.

Japan : On January 14th, the Japan Financial Services Agency (FSA) announced a series of amendments to the "Fund Closing Algorithm". Among them, the adjustment of the system related to virtual currencies is the core of this amendment. According to reports, the bill changes a series of notifications before the registration of crypto asset exchanges, and lowers the transaction threshold that needs to be confirmed when trading. In addition, the bill adds relevant regulations on cryptocurrency derivative transactions and financing transactions. It stipulates that in order to conduct such financial instrument business, an application for registration must be made in advance, and relevant business content and methods must be reported in time.

3. Industry chain related dynamics: BTC transaction volume decreased by 0.9% MoM

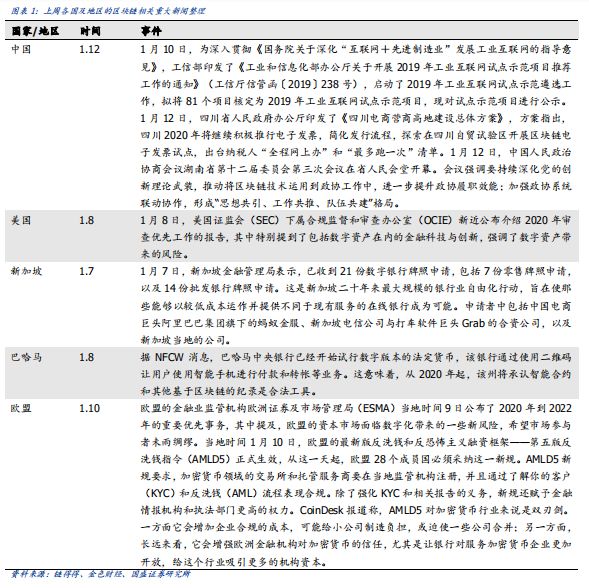

Last week, BTC added 2.19 million transactions, a drop of 0.9% from the previous month; ETH added 4.46 million transactions, an increase of 5.4% from the previous month.

Last week, the average daily computing power of BTC reached 107.1 EH / s, an increase of 0.7% from the previous month; the daily average computing power of ETH across the network reached 165.7 TH / s, an increase of 1.1% from the previous month.

Last week's BTC network-wide mining difficulty was 14.78T, an increase of 4.1% from the previous month; last week's ETH network-wide average mining difficulty was 2.08T, an increase of 1.1% from the previous month.

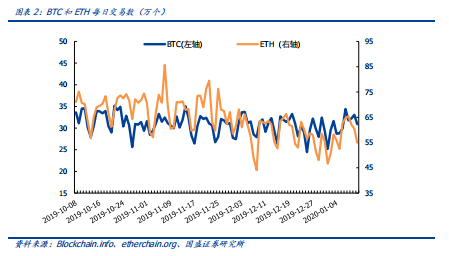

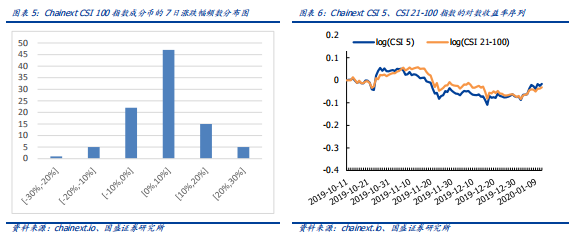

4. Last week's market review: Chainext CSI 100 rose 11.81%, the AI performance in the segment is the best

From the perspective of subdivisions, the performance of entertainment and social networking, basic enhancement, basic chain and AI are all better than Chainext CSI 100 average levels, which are 12.39%, 17.59%, 16.25%, 37.22% respectively; payment transactions, Internet of Things & traceability, business The performance of finance, storage & calculation, and pure currency were all lower than the average level of Chainext CSI 100, which were 10.31%, 7.22%, 3.68%, 8.21%, 9.90%.

2. The development of blockchain infrastructure did not meet expectations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Featured | Examining various centralized and decentralized crypto lending platforms

- Money laundering, stolen money, murder, Malta's bad crypto dream

- Can the central bank digital currency replace the US dollar in the future?

- Promote the progress of digital currencies in various countries. Will stable currencies such as Libra still have huge development potential in the future?

- Counting mining 2019: the seven major mining pools have annual revenues of more than 10 million and a variety of cloud computing power contract losses

- 27 blockchain companies' performance forecast last year

- Blockchain asset tokenization helps local debt issuance