Will Bitcoin's "magic December" bring us another long-term turning point?

Text: Wen Shuai

Production: Shallot Blockchain

In December 2017, after the bitcoin price reached a record high of $ 19,890, it immediately entered a steep diving stage. After a year-long bear market, in December 2018, bitcoin fell once. To $ 3,215, which has been a low point for the last 15 months, and also a turning point for the end of the bear market in 2018.

Although this conclusion is not very rigorous due to the very limited sample, but based on the market performance in the past two years, December is a very “magic” month for Bitcoin, at least in the past two years. In the middle of the month, the market has ushered in a turning point in the medium and long-term level. With the rapid decline of Bitcoin once again since the beginning of this month, will the inflection point of the current wave of correction bottom appear in the next two weeks? In other words, will this "historical experience" that seems to have been fulfilled twice in succession continue to take effect?

- Heavy! Wuzhen Lands The First "Blockchain" Theme Pavilion In China

- Babbitt Column | Big End of 2019: Technology Curve Rise Again

- How should the public chain be regulated?

An interesting "research result" announced by market analyst Philip Swift in July 2017 seems to add some chips to a potential historical repeat. At the time, Philip Swift proposed an analysis system called the 2-year moving average multiplier indicator on social media. In simple terms, it was calculated based on the "two-year moving average of Bitcoin" and "the price of Bitcoin multiplied by five. "Average moving average" two indicators as a reference to determine the current strength and weakness of Bitcoin.

Philip Swift pointed out that with the "growth" of Bitcoin, it will inevitably emerge from some of the cyclical performances commonly found in traditional financial markets. And this cyclical change is often caused by fluctuations in market sentiment. For example, at a certain stage, market participants may be over-excited by rising prices, which easily leads to further overbought prices, or in other words At another stage, market participants may be overly pessimistic, in which case prices may suffer from oversold. For investors, how to identify and understand what stage the market is in is actually very valuable.

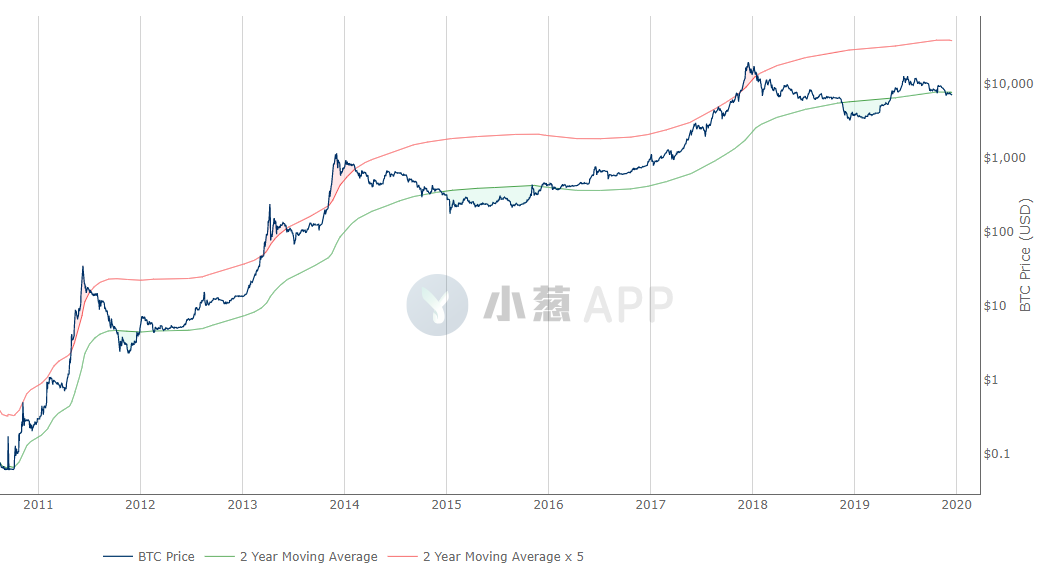

The analysis logic of the analysis system mentioned above is not complicated. As shown in the figure below, the green curve corresponds to the two-year moving average of bitcoin, and the red curve corresponds to the two-year moving average that has been magnified 5 times. The number coordinate system, so the two curves form a "parallel channel" with a fixed distance. When the price of Bitcoin is inside this channel, the market sentiment is considered to be in a stable state, and once the price rises above the red line, the market sentiment is considered to be overheated and there is a strong expectation of a callback (suitable for selling), otherwise If the price falls below the green line, the market sentiment is considered too pessimistic and the price has a strong rebound expectation (suitable for buying).

It is interesting that with the recent wave of market corrections, Bitcoin has once again fallen below the two-year moving average, which may indicate that the market has entered a relatively oversold situation. From the perspective of the indicator, the opportunity for the market to reverse the decline has already appeared.

In addition, Peter Brandt, who has more than 40 years of experience in market trading and has published in 1990 as a classic <Trading Commodity Futures with Classical Chart Patterns>, which has been regarded by many traders as a classic, is also recently socializing Very similar views have been thrown in the media.

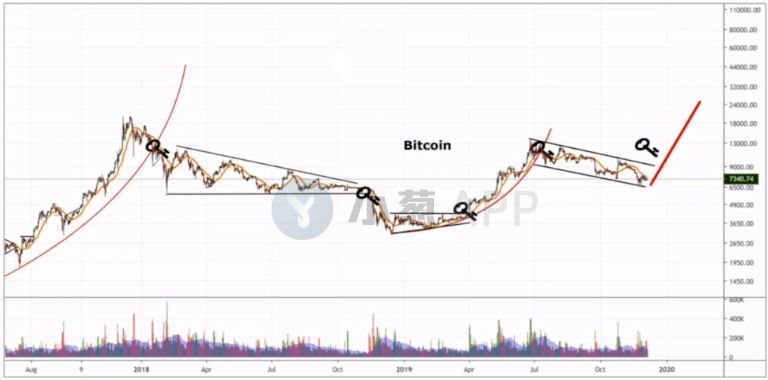

Its analysis pointed out that after hitting a high of $ 14,000 at the beginning of this year, Bitcoin has been operating in a stable declining channel for the past few months, during which the market has repeatedly touched this channel However, the rail has not formed an effective break, which has effectively consolidated the effectiveness of the support of the trend line support of the lower rail. With the recent wave of new callbacks coming out, the current price of Bitcoin has once again reached the lower edge of this downward channel, so a new bottom is likely to be formed.

And Peter Brandt also pointed out that he believes that this time Bitcoin's test of the lower track of the channel will become the "outpost" of this downward channel that has been maintained for nearly half a year and will eventually form an upward breakthrough. The parabola is rising, and the high point of this wave of potential rising prices is expected to push the currency to break through the high point early this year.

And the great god Willy Woo, who is very good at analyzing on-chain data, also reached similar conclusions through another analysis method earlier this month. He pointed out that the data on the chain showed that Bitcoin's network utilization rate has now shown relatively obvious signs of bottoming, and this is likely to be a precursor to the price “bottoming out”.

Will December 2019 be another turning point in history? Time to know the answer.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Monero's "Decentralization Movement": Lead Developer Riccardo Spagni Retires

- Tencent original works blockchain copyright deposit certificate released

- Read the relationship between the IMF and the digital currencies of central banks

- Featured | Cryptium Labs: Ethereum Foundation is unable to fund core development; 5 predictions for DeFi in 2020

- Research | How does law protect the "blockchain"?

- Jianan Technology of Jianan Technology responded to questions such as "breaking stock price, shrinking fundraising, AI transformation" and other questions

- Only 20% of hash power is required to attack BTC? Selfish mining author proposes new BDoS scheme sparks controversy