Wuzhen Review: From Defi to MOV

On November 8-9, the second World Blockchain Conference hosted by Babbitt • Wuzhen was successfully held.

In 2 days and 48 hours, blockchain practitioners and enthusiasts from all over the world gathered in Wuzhen. They discussed the application of blockchain, technology frontiers, industry trends and hot issues.

Libra, central bank digital currency, domestic public chain, 5G, Defi… a lot of hot topics have made many people see the core trend of the blockchain era.

- Anime coin scuffle: What have you been busy with in each of these two months?

- From "after-the-fact forensics" to "synchronized deposit certificate", the change of procuratorial handling mode brought by blockchain technology

- Zhongan Technology Li Xuefeng: Based on insurance, using blockchain to innovate industrial applications

Defi is the focus of the hot topic, and many well-known big coffees are mentioned in the discussion of each of the sub-meetings. Let's follow the big coffee to uncover the mystery of Defi.

DeFi is called Decentralized Finance. Unlike FinTech, DeFi (decentralized finance) refers more to decentralized financial derivatives and related services, behind distributed ledger and blockchain technologies.

Because it is decentralized, DeFi does not have a credit system. FinTech will evaluate the user's credit rating based on historical data. DeFi mainly exists in the decentralized blockchain. Most DeFi products are not tagged. The users are basically anonymous or semi-anonymous.

DeFi's vision is that all assets can be tokenized and freely traded in a globally open market.

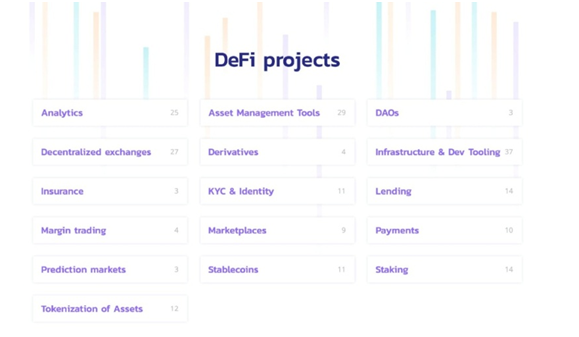

What is the current development of Defi's entire industry?

The decentralized ecosystem formed by the DeFi system includes:

1. Loans (Maker, Compound, Dharma, etc.)

2. Derivatives and forecasting market (Synthetix, Augur, etc.)

3. Decentralized transactions (Uniswap, DutchX, Bancor, etc.)

4, payment channels (xDai, etc.)

5. Asset management (Set Protocol, WBTC, Melon, etc.)

DeFi has grown rapidly in recent months, with borrowing reaching new highs. With the update of the agreement, the increase of functions and the improvement of the user interface, the overall scale is still rising, indicating that demand in this area is strong.

Digital asset lending for open financial agreements such as MakerDAO, Compound, Dharma, and dYdX reached $59.2 million in May, compared with $33.7 million in April, a 75% increase. DeFi loans have now reached a high point since the beginning of the year.

Many people think that DeFi is the best application of Ethereum smart contract, even the best landing scene of blockchain. Debit, decentralized exchanges and stable currencies basically constitute DeFi's “troika”, and the development of the lending market is particularly striking.

He Bin, the founder of imToken: From the moment I am concerned about the biggest challenge of the DeFi ecosystem, the asset scale. For example, now from DeFi's entire ecological map, Dai of MakerDAO is the first to bear the brunt, its current asset circulation, stable currency or At around $1. This will involve the design mechanism behind it, as well as the environment in which it is located. Its current issuance mechanism requires everyone to pledge, and Dai can be issued with an excess pledge of more than 150%, which is naturally limited by the market value of Ethereum and Ethereum. Overall ceiling.

What is the market prospect of Defi ?

Bella Fang, founder of WBF Exchange: The exchange is a bank + Shanghai Stock Exchange + brokerage + securities registration company, the market of millions of dollars is opening. In such a section, we come to the conclusion that a new era in the blockchain, the exchange is the "Newport Harbor" of the future world. Using blockchain technology + traditional finance, we can become the future world of Newport, New York, London and Hong Kong. This is our understanding of future trends.

The exchange is just a small piece of it. The entire traditional financial market is worth a few trillions of dollars. Defi is now just a star fire.

What challenges will Defi face in the future?

The anonymous identity on the blockchain conflicts with the KYC regulations. When Defi's users and funds become larger and larger, and the impact on the entire traditional financial market will be brought to the attention of the government, the supervision on Defi will also follow. Come here. This may reduce the liquidity of certain items and make it more difficult for people without suitable documentation to use them.

Another conflict is the contradiction between decentralization and user experience. From the data of the ten representative decentralized exchanges in the head, the number of transactions in January was only 190,000, and the number of transactions in June was nearly 400,000 times, doubled. But for users, everyone saw that there were only 20,000 users in January, and there were 32,000 users in June. There is indeed a large increase in the amount of transactions, and the number of users still needs to be improved.

Terminology such as blockchains, tokens, and smart contracts has higher cognitive thresholds for ordinary users. The public and private keys of the wallet are kept by themselves, and the user experience such as the auxiliary words to be recorded is different from the centralized banking online banking habits. All of these require the entire ecological practitioner to jointly promote improvement.

Finally, the security of the chain predictor is very important for smart contracts, whether the price of the asset from the chain is credible. The predictive machine market cannot get rid of the dependence on a few authoritative sources of information. It just means that the reliance can be minimized as far as possible through procedural fairness, after-the-fact accountability, and distributed fault tolerance. A fair and safe predictive machine is very important to Defi

Construction of Defi technology basic measures

Most DeFi solutions are currently built on Ethereum, so the application of DeFi is limited by the performance and scalability of the Ethereum network.

Cross-chain technology will play a crucial role in expanding the DeFi ecosystem, improving asset mobility, and addressing the limited performance of individual blockchain systems.

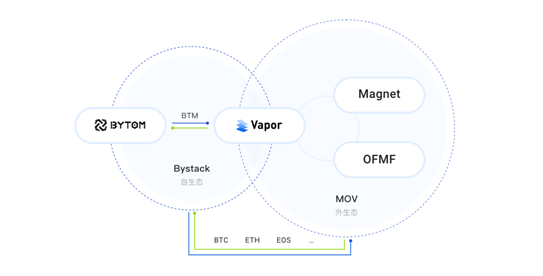

On November 8th, at the World Blockchain Conference (Wuzhen), the cross-chain eco-MOV agreement and MOV stable currency were released than the original team. The center-to-center cross-chain gateway (OFMF) supports multiple asset cross-chains. The value exchange engine magnetic contract (Magnet) makes "transaction is the right match" possible. The MOV protocol can send the demand you want to redeem assets to the chain in the form of a smart contract, and then the super node will package your needs to suit your needs.

Through the self-developed Vapor side chain, it can be packaged in 0.6 seconds, and the transaction is verified in parallel by 21K/sec.

The predictive machine on the chain guarantees the credibility of the exchange rate data between the coins, which is more accurate than the original chain predictor through the chain stepping method.

More than the original chain CEO: Heavy money to start the MOV ecological construction, which will be the first distributed blockchain business ecosystem.

The technical problems of the oracle and the cross-chain have been solved. Defi's troika is more than the original team. When Defi blooms in the traditional market of tens of billions of dollars, the phrase "MOV becomes, BTM must be" is also the future. period.

Quick Easy is a professional provider of blockchain solutions. It is fortunate to be invited to attend this feast and gather with the industry's big coffee. For business cooperation needs, please add WeChat philyang88

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Observation|Ternary Paradox: The Dilemma of Current Blockchain

- Viewpoint: Fuzzy of Business Boundary and Evolution of Blockchain Pattern

- Industry Weekly | Last week, 7 new financing projects in the blockchain, and 5 domestic support policies were introduced.

- Wuzhen·Huawei Zhang Xiaojun: Blockchain is to save costs, not to generate revenue

- Opinion | ENS: Why ENS does not create more top-level domains

- "Blockchain +" is here! Who will create great products of the new era?

- For three years, "blockchain + content" is still in place?