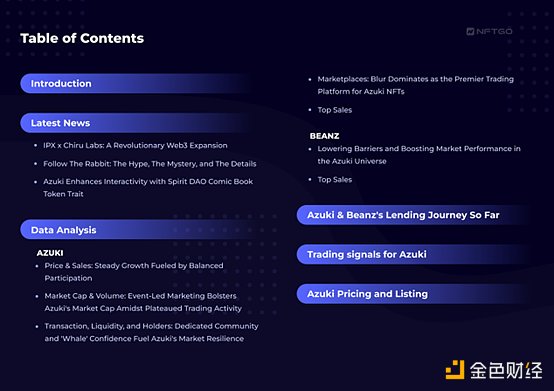

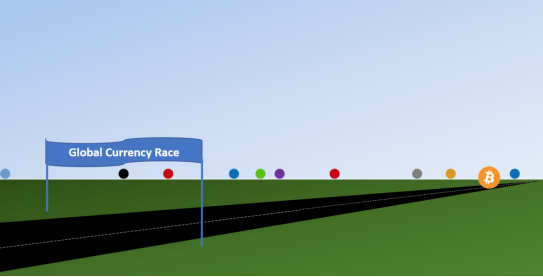

Global Internet Native Digital Currency Dispute: Bitcoin Leads Stabilization Coin, Libra Follows

As the Internet continues to evolve, its creators envision a way for users to transfer value and create Internet-originated digital currencies.

When you hear the word "bitcoin", you may first think of its price. Recently, bitcoin prices are rising steadily. There may be times when it drops sharply and occasionally it also goes sideways. So, what exactly does the price trend of Bitcoin tell?

Bitcoin prices are one of many indicators that can be used to indicate their position in the global digital currency competition. Understand that this is a competition, the following are the four major competitors in this competition:

- Industry Interpretation | About Decentralization and Practicality

- Read the latest project Kadena on the line CoinList

- How to explain to parents what is the blockchain?

1. Bitcoin (BTC) 2. Stabilizing currency for anchoring legal currency (Tether and USDC) 3. Libra 4. PBoC (People's Bank of China) project

Bitcoin (BTC)

Bitcoin (BTC) is the world's first blockchain digital asset, which was proposed by Nakamoto on October 31, 2008. It is an open decentralized ledger that is maintained through open source code and requires only one networked device to interact with Bitcoin.

Stabilizing coins for anchoring legal currency (Tether and USDC)

The stable currency that anchors the legal currency is a digital asset linked to other national currencies (usually the US dollar), such as Tether (USDT) and USDC. Stabilizing coins are built on public chains such as Ethereum, but require trusted third parties to manage and maintain the hooks. Tether relies on Bitfinex and USDC relies on Circle&Coinbase.

Libra

Libra is a private ("licensed") blockchain project proposed by Facebook. It is a cryptocurrency with lower volatility, similar to stable currencies such as Tether and USDC, but it is still evolving in terms of its structure and a basket of support currencies. So far, Facebook has dominated Libra's development, but if the project is implemented, Facebook intends to hand over its management to the Libra Association. Well-known companies such as Visa, Mastercard, Mercado Pago, PayPal, Stripe and eBay have recently announced their withdrawal from the project.

PBoC CBDC

PBoC is about to launch its CBDC (Central Bank Digital Currency). Excerpted from China Daily:

“The Central Bank Digital Currency (CBDC) is a new type of digital currency issued by the central bank that can be used as a legal currency (the country’s sovereign currency). But it does not have a physical form like cash, but the value of the central bank’s value stored by commercial institutions. Backed by asset reserves. "

Forbes reported that China's four state-owned commercial banks and financial technology giants Alibaba, Tencent and UnionPay will become the first participants of CBDC. The use cases of CBDC abroad are still unclear. It is reported that China will start regional promotion from Shenzhen.

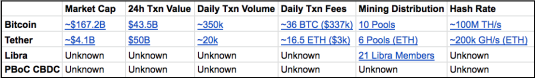

Cryptographic currency base indicator

In addition to price, digital assets have other basic indicators, including:

1. Market value: The total value of the asset. 2. Daily trading value: The total value of all transactions in one day (US$). 3. Daily trading volume: The total amount of transactions in a day. 4. Daily Transaction Cost: The total value of online transaction fees (USD) within one day. 5. Mining distribution: The approximate number of central entities that control the power share. 6. Computing power: A general measure of network computing power.

To compare the basic indicators of these four competitors:

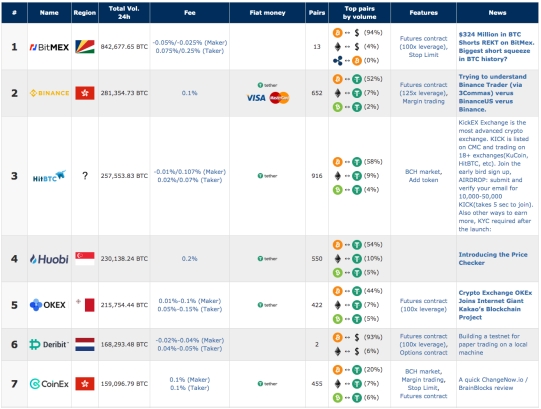

Obviously, Bitcoin is the most valuable, most used, and safest digital currency in the world. Libra and PBoC have many unknown values. In the 24-hour trading value, Tether is about $6.5 billion higher than Bitcoin, mainly because of the very large volume of transactions between Tether and other cryptocurrencies (especially Bitcoin). Big:

For many top exchanges, Tether is the only currency choice, but the Tether problem is a bit tricky. Tether should have been 100% supported by cash and equivalents. However, a Tether lawyer admitted earlier this year that only 74% of Tether is actually supported by cash and equivalents. However, it is still tied to $1 and the volume of transactions is considerable.

Why does the internet need its own currency?

As the Internet continues to evolve, its creators envisioned a way for users to transfer value and retain error code 402 (which requires payment) for future use. But they can't solve the problem of General Byzantine; the copy/paste feature of the data eliminates the possibility of digital scarcity. Bitcoin is the first technology to combine cryptography, distributed systems, and economic incentives to solve this problem.

For those who can easily connect to the online payment network (PayPal, Alipay, Venmo, etc.) bank account, as long as the party is on a compatible network, there is no need for digital currency. However, for 6.5% (8.4 million) US households without bank accounts and 18.7% ($24.2 million) for US households lacking banking services (with check/savings accounts, but relying on alternative financial products such as payday loans/ Service), this demand is more obvious.

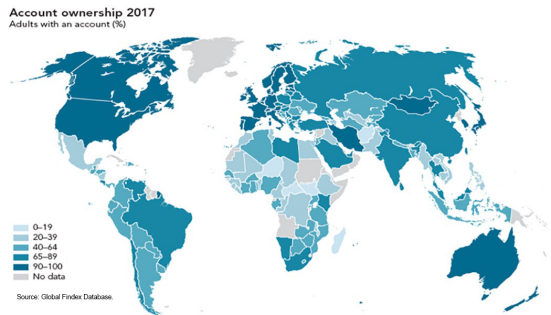

The United States is one of the most developed countries in the global banking industry, but the situation outside the United States is much worse, with as many as 1.7 billion adults without bank accounts:

As more and more business activities are gradually transferred to the Internet, those who are unable to trade through the Internet will gradually become marginalized and will face higher risk of predatory loans. In addition, in this era of large-scale surveillance, financial privacy is seriously threatened. All US financial institutions must comply with AML/KYC regulations, which require financial services companies to collect personally identifiable information from customers (usually including government-issued photo IDs) and monitor their transactions to prevent criminals from illegally financing Profit. While these regulations are effective for law enforcement, they reduce expectations of digital currency privacy.

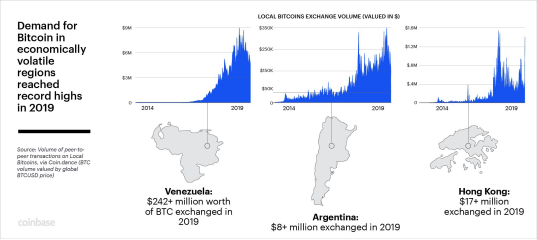

Bitcoin exchanges provide a conversion channel between French and Bitcoin, but are also subject to AML/KYC regulations. Although these exchanges need to buy and sell bitcoin, they do not need to send or receive bitcoin; anyone with a networked device can send or receive bitcoin. This has led to the booming of secondary P2P transactions such as LocalBitcoins and Paxful, and has brought hope to those who lack banking services:

Digital currency should be as open as the Internet

The Internet is a free and open borderless network that can participate without any permission. And these unique properties are only owned by Bitcoin. Tether, Libra, and especially the central bank's CBDC must survive regulatory compliance and government approval. Bitcoin relies on the Internet to survive.

There is no government-issued ID card and no domestic currency to interact with the Internet. Libra must comply with AML/KYC regulations and require some form of ID verification. Although the current requirements of the central bank CBDC are still unclear, there will certainly be some controls.

Bitcoin has not only been born for more than a decade, but has gradually grown from a project to an industry. Although it is the biggest target of the world's top hackers, it is still resilient and secure due to its open source, governance and encryption economics. It does not require authentication or personal information. Bitcoin miners always deal with transactions fairly and never submit suspicious activity reports.

Bitcoin skeptics believe that bitcoin is a kind of currency rather than a kind of investment asset. In fact, to a large extent, they are not wrong. To make Bitcoin as usable and accessible like money, it takes time, research and technological breakthroughs. We are committed to achieving this through innovative technologies such as Lightning Networks, but this is not yet possible.

Energy consumption

Bitcoin skeptics also said that bitcoin networks consume more energy than many developed countries:

Although Bitcoin's increasing energy consumption over the years can be seen as a sign of success to some extent, it still needs to be long-term. Criticizing the energy consumption of Bitcoin is understandable because energy consumption is really large. Bitcoin mining is an energy intensive business. This is a fact. Dealing with a simple credit card transaction doesn't seem to consume much energy, but it also requires:

· Powering large data centers supporting hundreds of thousands of servers for transaction processing, fraud detection, clearing, and more.

· A large amount of real estate consumes a lot of energy

· Armored diesel truck fleet

Bitcoin does not require any of the above, it may be the most energy-efficient system in global security value transfer.

Conclusion

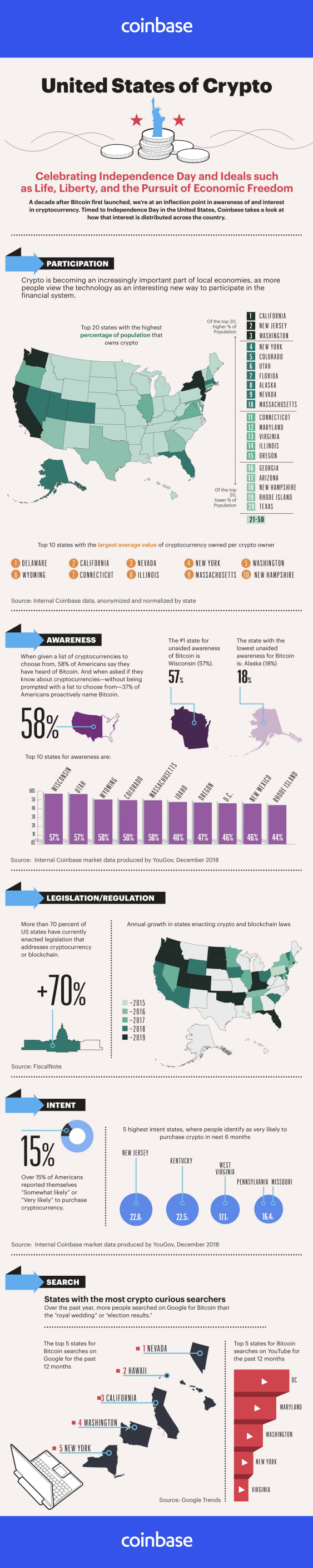

Bitcoin has gained more and more attention in the United States. According to Coinbase, the number of times Americans searched for "bitcoin" on Google last year even exceeded the "royal wedding" or "election results." The following is the data collected by Coinbase:

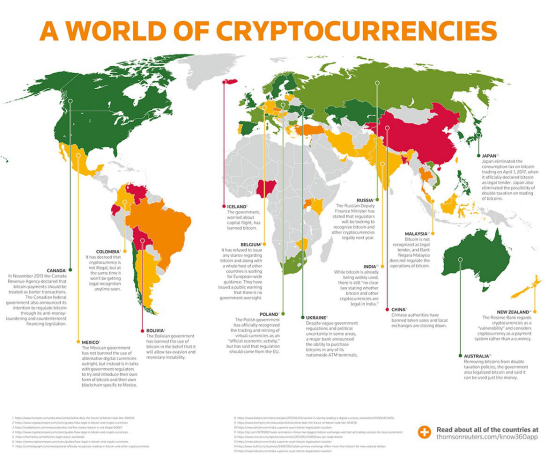

The enthusiasm of governments around the world for Bitcoin is gradually rising:

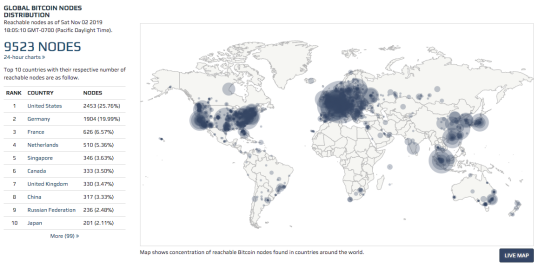

Currently, there are more than 9,500 bitcoin nodes around the world that collaborate and securely process transactions on the Bitcoin network:

The competition is still going on, and although Bitcoin is far ahead, the final result will still be unknown.

The original source is Medium, and the translation is provided by First.VIP. Please reprint the information at the end of the article.

original:

Https://medium.com/@danroseman/there-is-a-race-for-an-internet-native-currency-and-bitcoin-is-leading-it-4d37ce5dcf3a Source: https:// First.vip/shareNews?id=2381&uid=1

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Slow fog cosine: asset loss caused by blockchain security vulnerabilities will be further expanded in the future

- 106 daily limit! Read this research report and select the "blockchain +" listed company Baima shares

- Japanese media: China's blockchain is like a broken bamboo, Japan can see the fire across the bank

- Chain circle 72 hours | Application side to find technology platform overnight, technology platform to increase promotion

- DCEP is good, Libra to testify

- A share observation | inventory blockchain concept stocks, the chairman was arrested can not stop the stock price rise

- Comment: Blockchain and Red Flag Act