Zhu Jiaming: The biggest area of blockchain application is finance, which will bring significant innovation to double-entry bookkeeping

Source: 01 Blockchain

Author: Zhu Jiaming

Editor's Note: The original title was "Zhu Jiaming:" Integration of the Internet and Fintech "

"Humanity has entered the threshold of the era of computing and the digital economy. Not only the Internet, but also the blockchain has become a part of generalized infrastructure. It originated in the farming society, and the financial system and financial system completed in the industrial society have been and are moving from the idea and form. And institutional transformation. "

- The market has suddenly risen sharply. Is it a staged rebound at the bottom?

- Legendary venture capitalist Ben Horowitz talks about the blind spots of corporate culture and the future of blockchain

- Explore the huge potential of multi-parallel Dai and what changes will be brought by the introduction of MCD

On November 24, Zhu Jiaming, an economist and academic consultant of the Digital Asset Research Institute, delivered a keynote speech entitled "Integration of the Internet and Fintech" at the 2nd Guangdong-Hong Kong-Macao Financial Development Forum in Hengqin.

Zhu Jiaming said that science and technology are the most powerful driving force for the transformation of the financial system and the financial system. Finance that has been controlled by capital for a long time is giving way to finance that is increasingly subverted and transformed by technology. Finance that is strongly influenced by programmers, mathematicians, and other scientists. One that transcends the boundary between FinTech and TechFin. Fintech "integration" accelerates. A new historical period is expected for equal creation and sharing of monetary and financial resources.

The following is the text of the speech:

Good afternoon everyone, thank you host Mr. Chang Bo. The topic I share with you today is "The 'Integration' of the Internet and FinTech". It includes five questions: first, the historical image of the integration of finance and technology since the 21st century; second, the two models of financial technology and financial technology integration; third, the main contribution of blockchain to financial-technological integration; fourth The future trend of financial-technical "integration"; Fifth, several conclusions.

For today ’s seminar, I wrote a paragraph: "Humans have entered the threshold of the era of computing and the digital economy. Not only the Internet, but also the blockchain has become part of the broader infrastructure, which originated in the farming society and completed in the industrial society. The financial system and financial system have been and are being transformed from ideas, forms, and mechanisms. The biggest driving force is science and technology. Finance that has been controlled by capital for a long time is giving way to finance that is increasingly subverted and transformed by technology, programmers, Mathematicians and other scientists have strongly influenced finance, a transcend the boundary between FinTech and TechFin, the "integration" of fintech is accelerating, and a brand new historical period in which humans expect equal creation and sharing of monetary and financial resources is coming. I hope that under such a concept, the In the historical scene, we think about the relationship between finance and science and technology.

1. Historical image of the integration of finance and technology since the 21st century

Since the 21st century, the world has changed a lot and many events have occurred. However, if we arrange the most important events in the 21st century, there is no doubt that the advancement of science and technology is a top priority in the 21st century. Scientific and technological progress since the 21st century has increasingly changed the existing economic, social, and political structures and institutions. So, what is the relationship between finance and technology? The interactive relationship between finance and technology had occurred before 2000, but only after 2000, this interactive relationship showed a trend of acceleration and complexity. Nothing more than three situations:

In the first case, the evolution of finance itself has created a demand for technology.

In the second case, technological development creates new supplies for finance.

In the third case, the two curves of the respective developments of finance and technology continue to intersect.

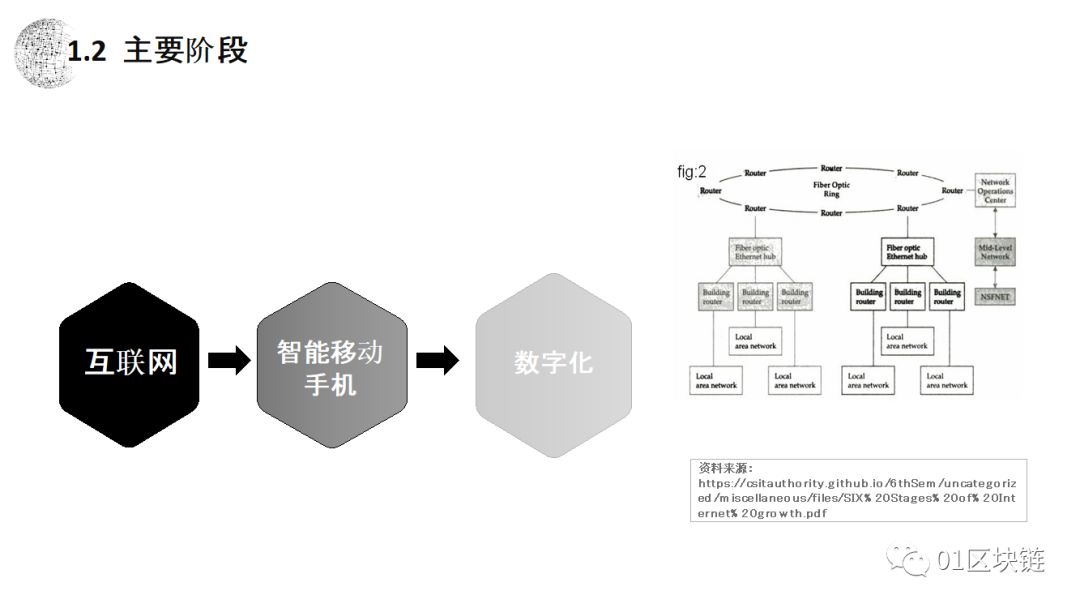

If you look after 2000, you can see that the relationship between finance and technology has crossed the Internet era, the era of smart mobile phones, and now entered the digital era. The image showing everyone's right (I did not come to translate it into Chinese) is talking about the structural change of the financial industry.

If you look after 2000, you can see that the relationship between finance and technology has crossed the Internet era, the era of smart mobile phones, and now entered the digital era. The image showing everyone's right (I did not come to translate it into Chinese) is talking about the structural change of the financial industry.  The most important contribution of the integration of finance and technology is the reduction of transaction costs and the improvement of financial operation efficiency. At the same time, new financial products have been spawned.

The most important contribution of the integration of finance and technology is the reduction of transaction costs and the improvement of financial operation efficiency. At the same time, new financial products have been spawned.  The current non-cash electronic money is the "new" financial product that enters folk life. If we broaden our horizons, we will find that technology and finance occupy a fairly dominant position in the process of mutual influence, penetration and integration. Main reasons: First, the development of science and technology has caused continuous pressure on the financial system. In the 19th and 20th centuries, this pressure was not so obvious or even non-existent. Second, this pressure is rooted in science and technology as two forms of human economic and social activity, and the speed of development between them is uneven. In other words, we clearly see the development speed of science and technology, which is now much faster than the speed of financial transformation and development. Third, more importantly, science and technology are changing traditional finance and the "financial form" we originally thought. The external environment.

The current non-cash electronic money is the "new" financial product that enters folk life. If we broaden our horizons, we will find that technology and finance occupy a fairly dominant position in the process of mutual influence, penetration and integration. Main reasons: First, the development of science and technology has caused continuous pressure on the financial system. In the 19th and 20th centuries, this pressure was not so obvious or even non-existent. Second, this pressure is rooted in science and technology as two forms of human economic and social activity, and the speed of development between them is uneven. In other words, we clearly see the development speed of science and technology, which is now much faster than the speed of financial transformation and development. Third, more importantly, science and technology are changing traditional finance and the "financial form" we originally thought. The external environment.  2. Two models of fintech and tech finance integration

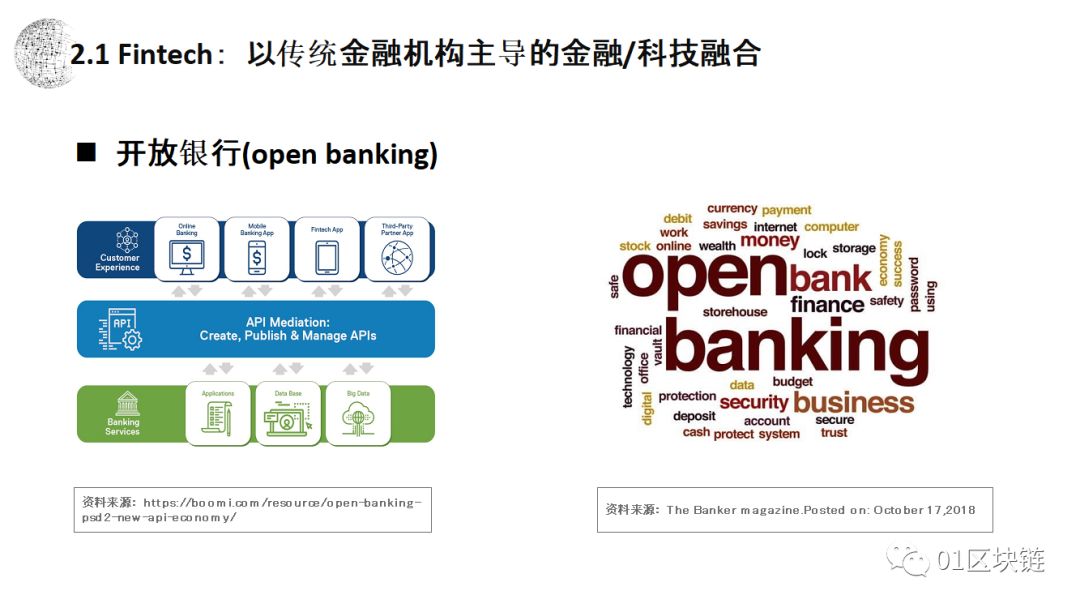

2. Two models of fintech and tech finance integration In this context, the combination of finance and technology finally formed two models: FinTech and TechFin. The general concept does not distinguish between FinTech and TechFin. However, there are very big differences between the two. Recognizing and understanding this difference is critical to understanding the relationship between technology and finance. The so-called FinTech can be defined as a traditional financial institution, which includes the combination of traditional banks and non-bank financial institutions, which promotes itself and science and technology. There are too many results in this regard, and I will mainly talk about a few open banks here. Open banking is undoubtedly a FinTech which is dominated by traditional banks. It absorbs the results of a series of scientific and technological advancements starting from the Internet to transform the traditional banking system. It has considerable revolutionary significance and is typical of fintech.

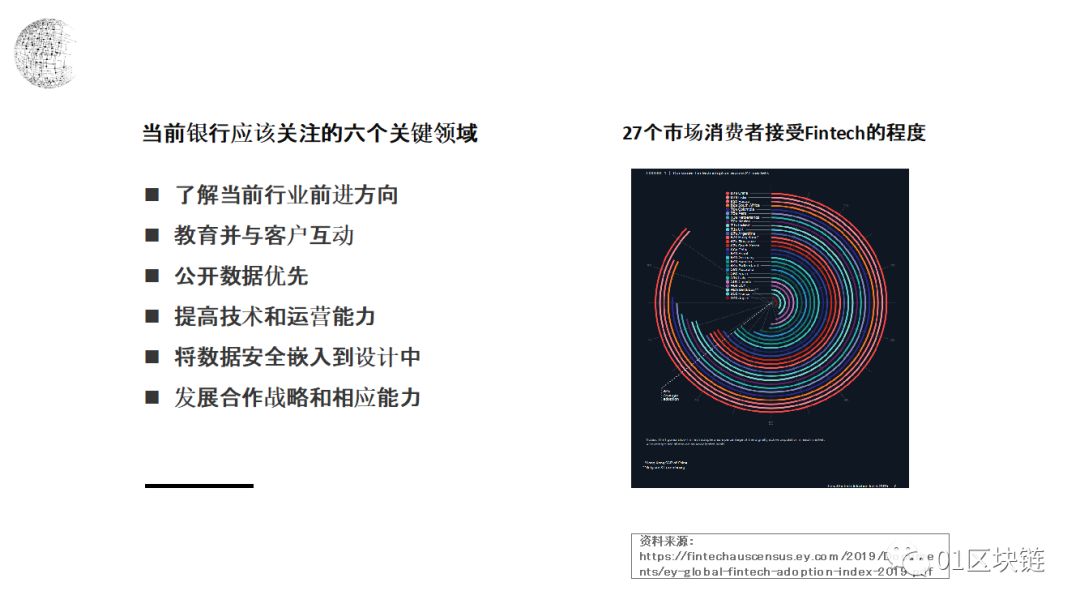

The left side of this page of the PPT shows the structure of the "open bank", explaining how to use the API (Application Programming Interface) to realize the integration of traditional banks with other financial resources and industrial resources through the Internet, and provide services to end consumers. Such a mechanism has directly integrated the main body of the bank and the terminal, which has led to changes in the main body of the bank, which in turn has transformed the basic form and service model of traditional banks. The reason traditional banks must change is because they face a changing external environment every day. This PPT enumerates six of these issues. To solve these six issues, traditional financial instruments, traditional banking frameworks, and traditional banking methods are no longer possible.

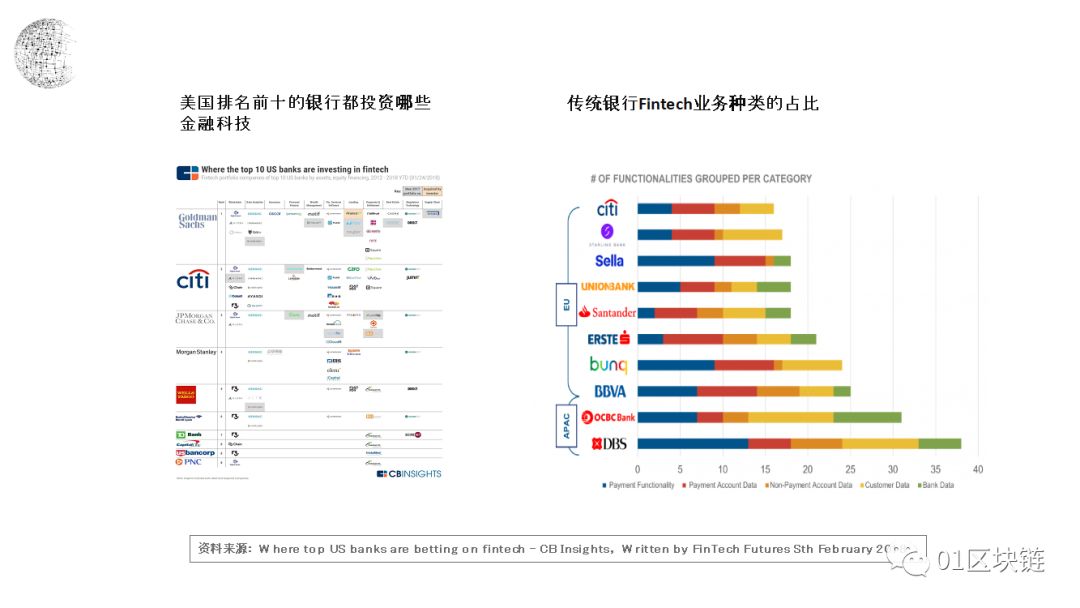

Society, markets and consumers are becoming the most important driving force for the technological advancement of the banking industry and the combination of finance and technology. The figure to the right of this page of PPT compares the acceptance of Fintech by the people of major countries in the world. China ranks first. In other words, China has a huge historical opportunity in such a historical process, because China has a huge incentive to promote the technological transformation of traditional finance. The pressure on the traditional banking industry is constantly increasing. The chart on the left of this page shows the areas where the traditional banking industry has taken the lead in the process of leading fintech transformation. Among them, one area where they focus and invest is the blockchain. The figure on the right reflects the areas in which the traditional financial system is undergoing transformation, mainly speaking about the technological transformation of the payment system. The payment system is the most direct manifestation of functions from banks to users, including institutional users and individual users.

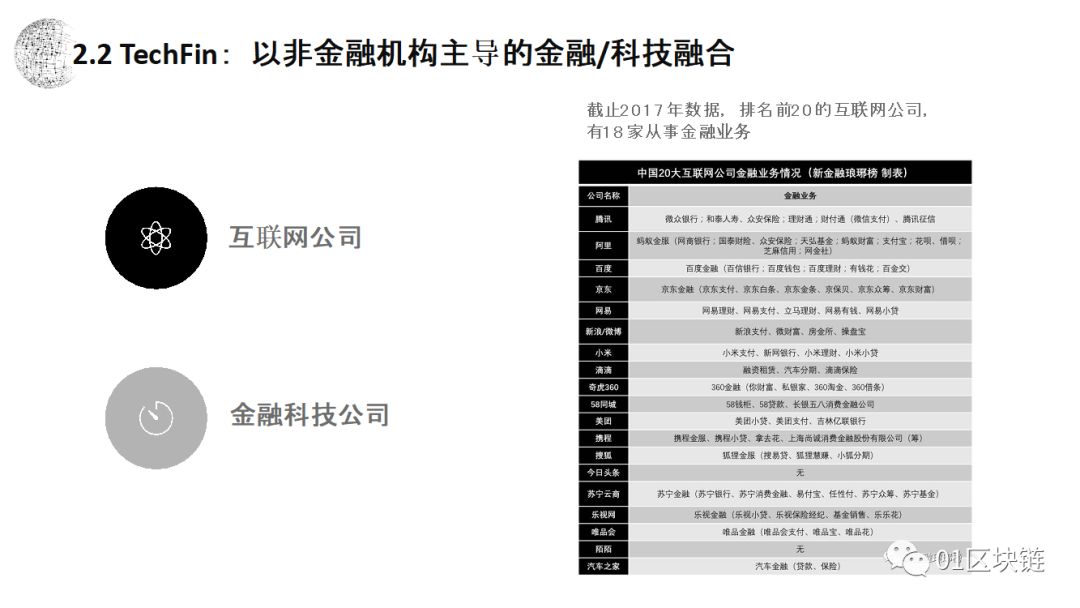

In addition to knowing FinTech, it is also worth paying attention to is TechFin. The so-called TechFin specifically refers to some financial institutions that are not in the traditional financial field and enter and dominate the financial industry through scientific and technological means. Over the years, non-traditional financial institutions outside the financial industry have entered the financial industry, not only creating flows of financial resources, but also affecting and changing the original stock of financial resources. It is divided into two categories, one is Internet companies, and the other is Fintech companies. Especially internet companies. When Internet companies were born, they had no direct relationship with finance, but Tencent, Ali, Baidu, JD.com, Netease, Didi, etc. Now almost all Internet companies have directly or indirectly entered the financial field, without exception. In the financial landscape, this situation deserves attention.

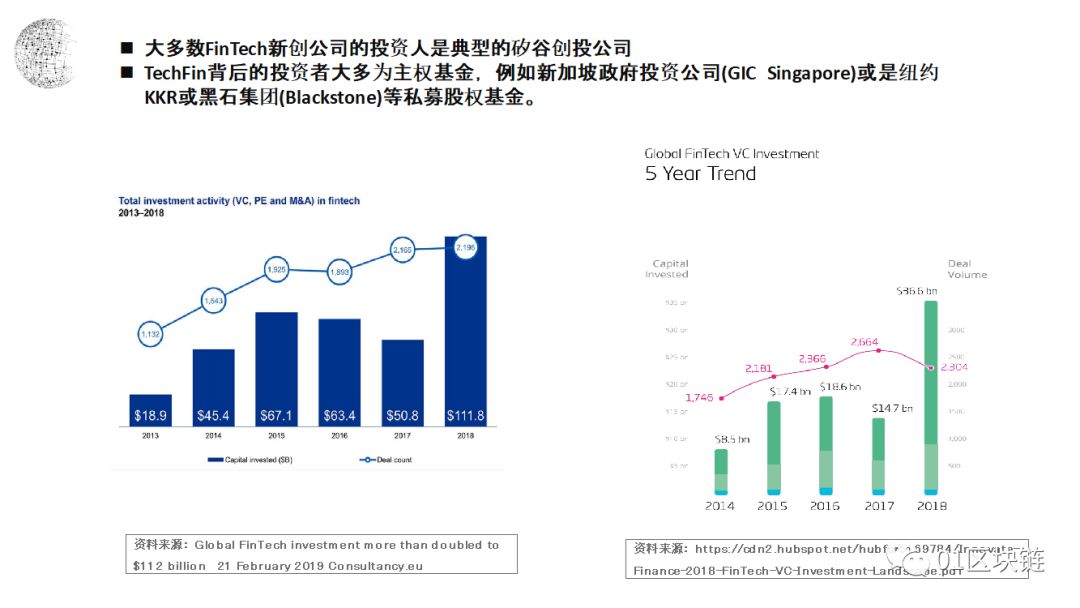

As a result, this has caused a very important phenomenon, and the internal competition model of the financial industry has changed. FinTech and TechFin are two completely different types of financial companies. Although both financial and technology are integrated, they have different inherent advantages, different resources, and different competition models. Such a phenomenon occurs at a very special historical stage, strictly speaking, it is only 10 to 15 years old. Paying attention to financial technology, we must not fail to pay attention to the role of investment in financial-technological integration. At least in the past decade, a large amount of capital, especially Venture Capital, has invested in fintech with extremely rapid growth. Some directly invest in the technological development of the traditional financial system, while others are injected into Internet companies or Fintech companies. The picture on the left shows the tremendous power of FinTech in absorbing capital from 2013 to 2018. The blue bar is the absolute value of the investment amount, and the line chart is the number of projects corresponding to the investment.

This PPT presents a more macro scene. Today, the relationship between finance and technology cannot be simply understood as electronic payment. The figure on the left shows the current types of financial-technological integration in the world, which are very broadly classified. The figure on the right shows the geographical distribution of the top fintech companies. North America, Europe and China are the three main regions that dominate and influence fintech.

3. Blockchain's main contribution to financial-technological integration

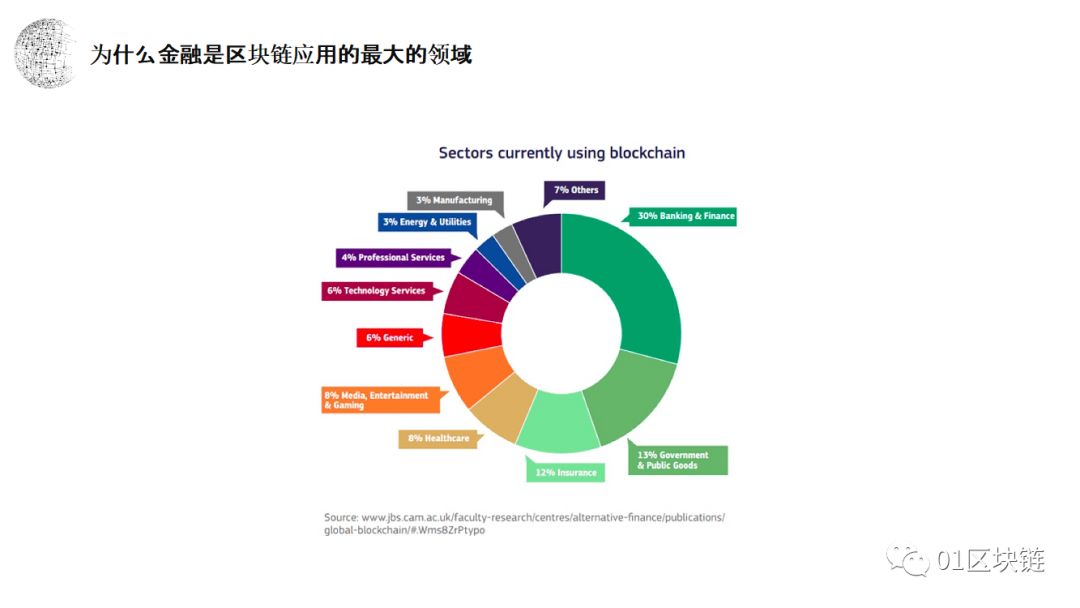

First, blockchain technology has a natural relationship with the financial industry, from the underlying design to institutional logic. The following figure reflects the distribution of blockchain application areas. When we were in 2000, or even pushed forward a few years ago, when we discussed FinTech, the blockchain did not enter our scene, but when we discuss FinTech today, we must make the blockchain a very important The elements are even considered as a background. Blockchain and fintech are a two-way relationship. Blockchain is born with the genes to transform the financial industry. If the application scenario of the blockchain is understood as a PIE (pie), the highest application scenario is finance, accounting for 30%. But other 70% of the application scenarios, such as processing industry, supply chain finance, government governance, and public goods, are also directly or indirectly related to finance. Therefore, the application scenarios of blockchain in the financial field account for more than 30%.

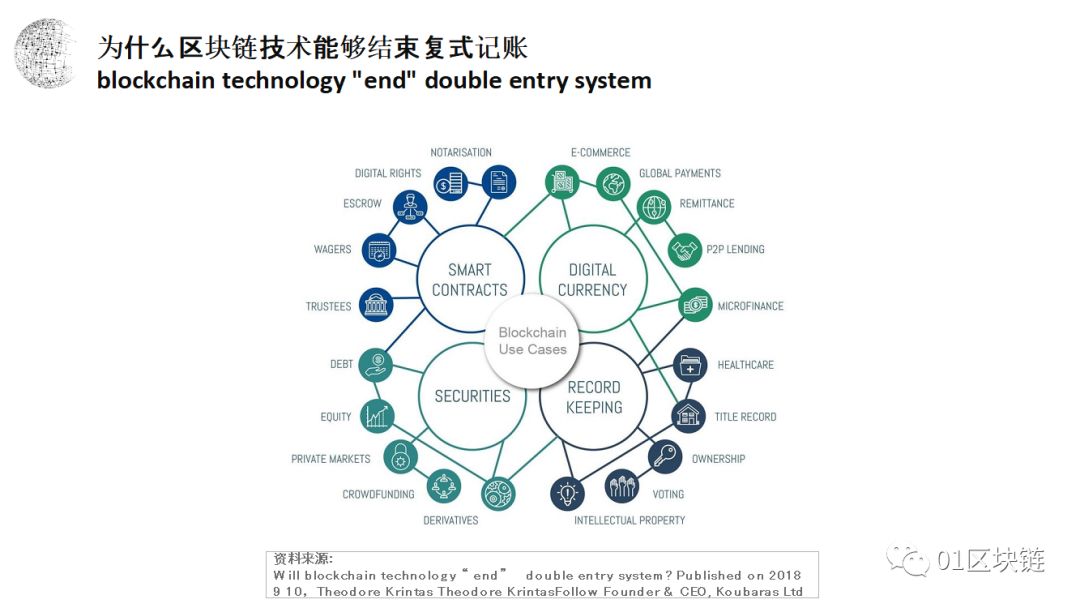

When the blockchain entered the field of fintech, first of all, the biggest impact was the creation of digital currencies. In the past, the integration of technology and finance has not been able to accomplish this. Until the birth of the blockchain, this happened. A big thing recently is that Jia Nan, a digital currency mining machine, has completed its listing.

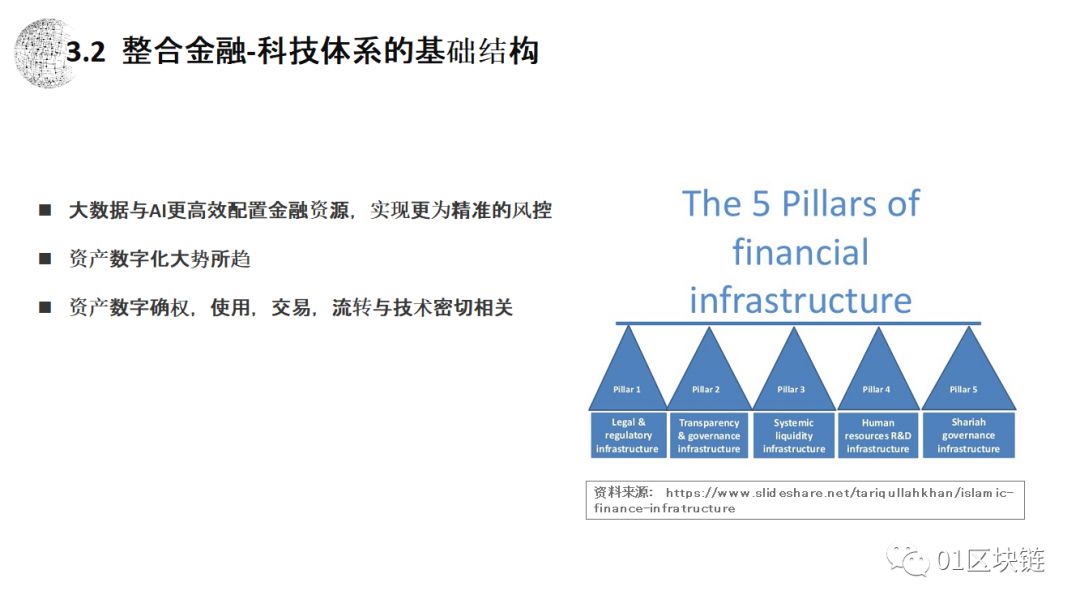

The more important impact is that the involvement of the blockchain has comprehensively integrated various technologies that have been integrated with finance, adjusted their functions and functions, and improved and improved the basic structure of financial technology. The diagram on the right presents the infrastructure that supports and supports the modern financial system and contains five basic pillars. The blockchain has directly impacted and transformed these five basic pillars.

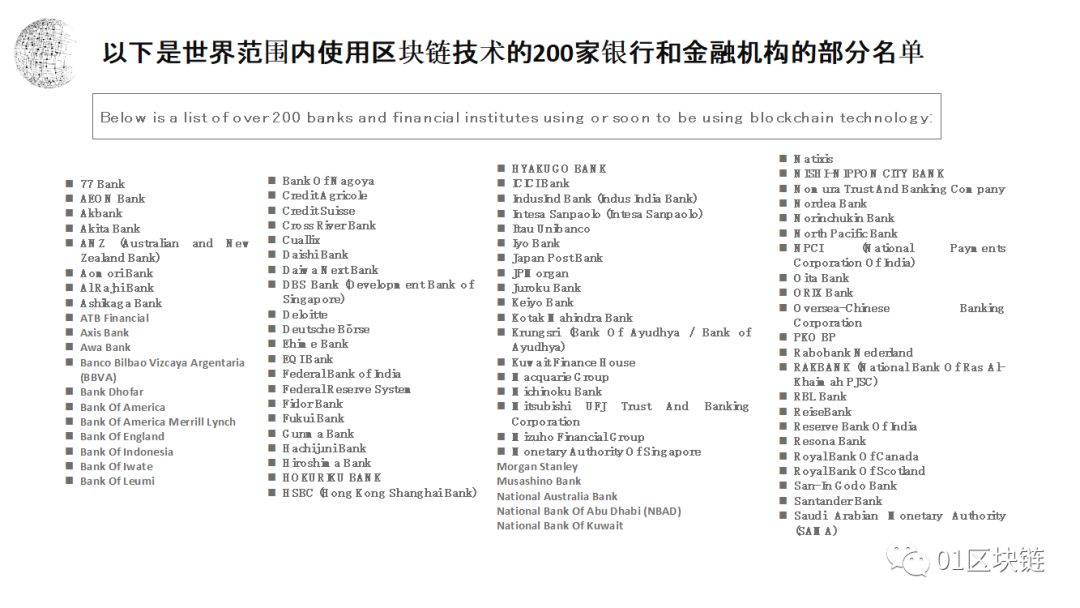

The chart below presents a partial list of 200 banks and financial institutions using blockchain technology worldwide. This list proves that the entry of blockchain into the financial system to bless the integration of finance and technology is not a trend, but an extremely realistic, already and happening thing. Now it is not the question of doing what is not being done, but who is going farther and who is doing better.

The chart below presents a partial list of 200 banks and financial institutions using blockchain technology worldwide. This list proves that the entry of blockchain into the financial system to bless the integration of finance and technology is not a trend, but an extremely realistic, already and happening thing. Now it is not the question of doing what is not being done, but who is going farther and who is doing better.

5 Conclusion

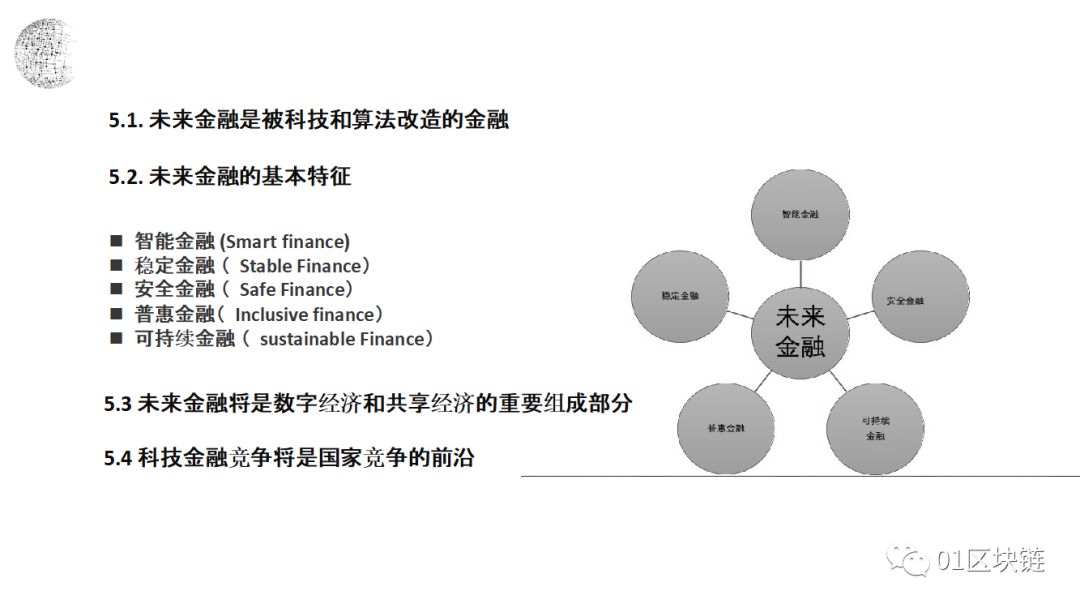

5 Conclusion  First, future finance is finance transformed by technology and algorithms. This is a basic judgment . The influence of finance on science and technology and the integration of the two are an increasingly strong trend. Finances that are rejected and cannot be combined with technology will be gradually and gradually eliminated. Second, after the further development of science and technology in the future, science and technology finance may achieve the following five aspects: (1) Smart finance . We have been able to experience intelligent finance in our daily lives. (2) Stable finance . Stability mainly refers to reducing fluctuations in finance, fluctuations in currency, and fluctuations in interest. Furthermore, it is possible to create a new financial architecture mechanism under the condition of high-level development of financial technology, which can effectively alleviate and even control the financial crisis to a certain extent. This is not impossible in theory and technology. (3) Safe finance . (4) Sustainable finance . (5) Inclusive finance . In general, after these four goals are achieved, inclusive finance will not only be a rational, but a utopia, it will become a possibility. Third, future finance is an important part of the digital economy and the sharing economy . Fourth, at the national level, fintech competition will be an important frontier for national competition .

First, future finance is finance transformed by technology and algorithms. This is a basic judgment . The influence of finance on science and technology and the integration of the two are an increasingly strong trend. Finances that are rejected and cannot be combined with technology will be gradually and gradually eliminated. Second, after the further development of science and technology in the future, science and technology finance may achieve the following five aspects: (1) Smart finance . We have been able to experience intelligent finance in our daily lives. (2) Stable finance . Stability mainly refers to reducing fluctuations in finance, fluctuations in currency, and fluctuations in interest. Furthermore, it is possible to create a new financial architecture mechanism under the condition of high-level development of financial technology, which can effectively alleviate and even control the financial crisis to a certain extent. This is not impossible in theory and technology. (3) Safe finance . (4) Sustainable finance . (5) Inclusive finance . In general, after these four goals are achieved, inclusive finance will not only be a rational, but a utopia, it will become a possibility. Third, future finance is an important part of the digital economy and the sharing economy . Fourth, at the national level, fintech competition will be an important frontier for national competition .

thank you all.

Note: This article is for information transfer and does not constitute any investment advice.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New Deal full moon, official media blockchain reports have shifted from "science popularization" to anti-counterfeiting supervision

- Viewpoint | Departure at the End: Ethereum EIP and Upgrade Process Improvement Proposals

- Viewpoint: The blockchain situation is always erratic, because its origin has a great relationship with the hacker culture

- Beijing News: Virtual currency speculation shows signs of rise

- DeFI: What should the future of open finance look like?

- Market analysis: When the news is flying around, we have to keep calm

- Supervision and oversight of regulatory oversight have paved the way for the healthy development of the blockchain industry