Everbright Securities Global Chief Economist: Platform digital currency is systemically important, and central bank digital currency has public policy value

Author: Peng Wensheng

Source: Sina

Editor's Note: The original title was "Peng Wensheng: Digital Currency Competition"

On November 22nd, I participated in the speech compilation of the Bozhi Macro Forum organized by the China Development Research Foundation.

- Visit the country's first "Blockchain + Big Data + Education" project: What happens when education meets the blockchain?

- Web 3 "Value Internet" Quantitative Indicators: From BTC to Ethereum to MakerDAO

- Ling listening 2020: the first time in the New Year's speech talks about the sense of certainty, chaos is not the abyss is the ladder

Today I want to talk about some thinking and understanding of digital currency from a macro perspective. Let's first review how we understand currency.

For the understanding of the three major functions of money, there are two schools of thought in the economic literature, namely the theory of commodity money and the theory of national money. The theory of commodity currency emphasizes the importance of private (commodity) currency, and the theory of national currency emphasizes the importance of national (credit) currency. The difference between the two factions is that the former believes that the most important function of currency is the means of payment. Based on market competition or the common acceptance of everyone to form a means of payment, it may evolve into a stored-value instrument, and finally it is the unit of account.

National currency theory believes that the most important function of currency is the unit of account. Commodity settlement and debt and debt settlement are all dependent on the unit of account. In China, one yuan is always one yuan. In the United States, one dollar is always one dollar. On this basis, it is a stored-value tool and a means of payment. According to the theory of national currency, even in primitive society, the unit of account was stipulated by the tribal leader, so currency is always the result of public power, and it is not the result of market competition.

There is a lot of controversy over the origin of the currency. We don't need to be too real. As far as the modern monetary system is concerned, the two factions are not completely mutually exclusive, but are complementary.

Currency competition in the digital economy era

Why do you say that? As a means of payment and a stored-value tool, the evolution of the form of currency mainly comes from the innovation of the private sector and market competition, but the basis of currency is its function as a unit of account (or value scale), that is, fiat currency. So how can the government maintain the status of fiat money and the unit of account in the modern economy? The government restricts or guides market innovation and competition through supervision, especially financial supervision, so the two actually complement each other. How to understand the relationship between competition and supervision is also the key to our analysis of digital currencies.

We are now discussing that digital currency is actually a matter of currency competition. Traditionally we discuss competition between currencies, and the stability of the currency is the main concern. For example, bad coins in history expelled good coins. In the early days, gold and silver coins were circulated at the same time. The exchange rate of the two was fixed, but the depreciation rate of silver coins in the market was faster. The result is that everyone collects gold coins and spends them first. It is the so-called Greshine's law, bad money drives out good money.

However, few people in modern society have discussed the Gresham Law. The global currency system is mainly under a floating exchange rate system. From the perspective of currency stability, currency competition is a good currency to drive out bad currency. An article by Hayek in 1976 was from the perspective of stored-value tools, which currency is more stable and more popular. The emphasis on market competition and recognition of Bitcoin is mostly derived from the Hayek Austrian School, which believes that the fiat currency is too much and the value of the currency is unstable. In the end, market competition may be caused by the limited supply of currency instruments such as gold or Bitcoin. Advantage.

My point of view is that the focus of the digital economy era may not be the so-called currency stability issue, but how information technology and digitization affect currency tools to perform their currency functions, mainly the efficiency and security issues of transaction and payment instruments. From a macro perspective, the lack of supply elasticity makes Bitcoin difficult to become a currency, but at the micro level, blockchain technology can be used as a reference to improve the efficiency of payment instruments. Digital economy / digital currency does not have a consensus definition, often people emphasize a certain perspective according to their own ideas. My point is that any impact on the efficiency and security of payment and stored value tools caused by the application of information and digital technology, and this impact has a certain systemic importance, and even affects the function of the bookkeeping unit, can be classified as The scope of digital currency.

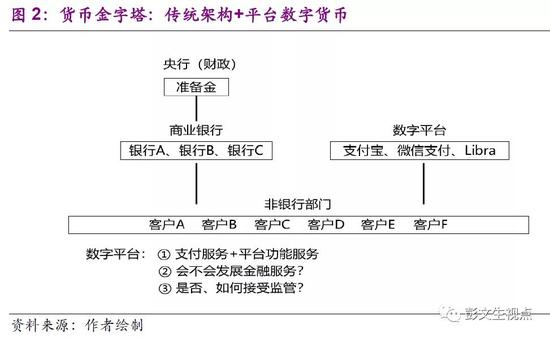

How do we think and view the impact of digital currencies, we must first review what our existing currency architecture looks like. The current currency structure is a pyramid structure, and the transaction and payment behavior of each other is completed by the transfer between their respective bank accounts. If it is two banks, it may be completed through the settlement of each other's accounts in the central bank. This forms a pyramid, with the central bank at the top. The most prominent feature of this structure is that payments and financial services are tied together. I think this is one of the most critical characteristics of our thinking about the impact of digital currencies. Here I draw cash as a dashed line. I think it is basically negligible. The amount of cash is small and it is determined by demand. It is the result of economic activity, not the cause.

From the perspective of systemic importance, I would like to talk about two major types of digital currencies. One type is platform digital currencies, such as China's WeChat Pay and Alipay, Facebook Libra. These digital currencies are dependent on the development of large-scale technology platforms. The other is the central bank digital currency. I think these are the two types of digital currencies that deserve our attention.

Platform digital currency

If the digital currency of the platform is taken into consideration, the traditional currency structure has changed, and new platforms have emerged outside the middle-tier commercial banks, including Alipay, WeChat Pay, Libra, etc. The most important impact is that the payment business is not necessarily tied to financial services, but rather to platform functions. For example, WeChat is social, Alipay is e-commerce, and Facebooklibra is a social platform. This is the biggest impact on the existing financial architecture and has very profound implications.

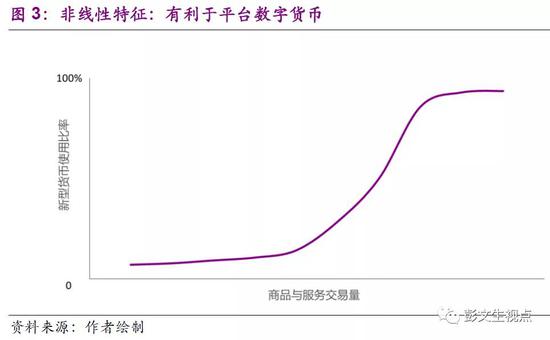

Why is platform digital currency systemically important? One of the biggest common features of platforms and currencies is network effects. Money has a network effect. Money is like a language. The more people speak, the more efficient the communication is, and thus attract more people to use it. Some network effects of currencies cause strong non-linear characteristics of currency development. New currencies are difficult to start with, and once they reach a certain scale, they will spread quickly. This is a problem faced by all new currencies, and also a problem we face when discussing international monetization, such as RMB internationalization.

The platform has similar network effects. For example, the more people use WeChat, the more people use WeChat because everyone feels that it is more convenient to use WeChat to contact friends. The network effects of platforms and currencies can complement each other and promote each other. This is why there are so many institutions in China that engage in payment services. In the end, only WeChat Pay and Alipay can do large-scale. There are also many institutions in the United States already doing payment business, but everyone does not care much about it, and Facebook Libra is just a plan that has attracted so much global attention and the attention of regulators because the Facebook platform may make Libra overnight. Become a systemically important payment tool.

The role of this is two-way, the platform achieves payment, which in turn promotes the development of the platform. Most of the behaviors of people's work and life involve payment. Whoever controls the payment will have the largest network, so it is difficult for any other professional platform to compete with the payment platform. Domestic e-commerce companies, such as JD.com and Suning, have not been able to compete with Alibaba. This may have a lot to do with payment. Ali masters payment. Everyone must use payment. Payment forms a big data, bringing special the value of.

So, how much development potential does the platform digital currency have? Obviously, the platform is most likely to develop payment methods, which have been reflected in WeChat Pay and Alipay. Based on this, it may develop into stored value tools, such as Yu'ebao. Libra may become stored value tools in some countries with unstable currency values. The more controversial is the bookkeeping unit. Alipay and WeChat Pay are not independent bookkeeping units, but if Libra is made, it will be an independent bookkeeping unit. Because of this, the regulatory agencies of various countries will be very cautious and concerned, so Libor faces The resistance is also particularly large.

How do digital platform currencies change the ecology of finance? The first is that it separates payments from traditional finance, at least at the retail level. Payment is like a water company or a gas company. We can't imagine how our economic activities will be affected if there is a problem with the payment system one day. At present, 100% of WeChat and Alipay's reserve funds are stored in the central bank to ensure the stability of their payment systems. Now everyone has become accustomed to the efficient and stable services of WeChat Pay and Alipay. In the long run, this will have a profound impact on the structure of finance.

This is because payment platforms including Ant Financial and Tencent may not be satisfied with just making payments, and payments can be derived from finance. Payments and financial services are tied together under the modern financial system, but we must not forget that modern financial services were originally derived from payments. First of all, gold was used as a payment method. Later, everyone found that it was inconvenient to carry gold. Some people stored gold in a goldsmith with a high degree of trust. The goldsmith opened a deposit certificate for him. Later, the goldsmith found that 100% gold was not needed. The reserve can be used to loan some of it to earn some interest, and it can also pay the depositors some interest, and credit is derived on the basis of payment.

Ant Financial and Tencent develop finance on the basis of payment, such as wealth management, insurance and credit. On the one hand, it promotes inclusive finance, and on the other hand, it brings new challenges. Squeezing the traditional financial system is not a bad thing. Competition is conducive to improving efficiency and benefiting consumers, but a problem worthy of attention is the new type of industry-financial integration, which refers to the combination of industries and financial services such as social platforms or e-commerce. Historically, the integration of industry and finance has brought great conflicts of interest and harm. It took Western countries, especially the United States, almost 100 years to separate industry from finance. China also took a long time to basically separate industry from finance. Now that WeChat Pay and Alipay bring new types of industry-financial integration challenges, we cannot compare this simple analogy with traditional industry-financial integration, nor can we simply deny it, but from the perspective of financial stability and consumer rights protection, from monopoly and competitive From the perspective, it brings some new challenges.

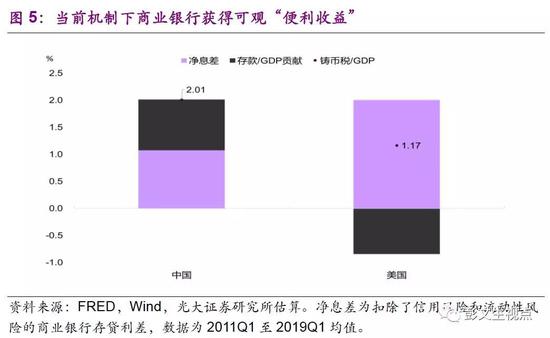

How is the platform profitable? Why do large tech giants develop digital currencies? What is the impact of the platform on the traditional financial system in terms of profitability? There is a term in economics called convenience yield. In order to enjoy the convenience of payment, everyone is willing to give up certain currency gains and hold some safe and liquid assets. This so-called convenience yield is a non-monetized gain. . This kind of income is taken by the banking system in the traditional financial structure, so the bank's profit is not only the evaluation of credit risk management, credit risk loans, but also to a large extent from the provision of payment services and the provision of liquid assets. The development of payment services by technology platforms and the derivative financial services will squeeze the traditional financial system and its profit model.

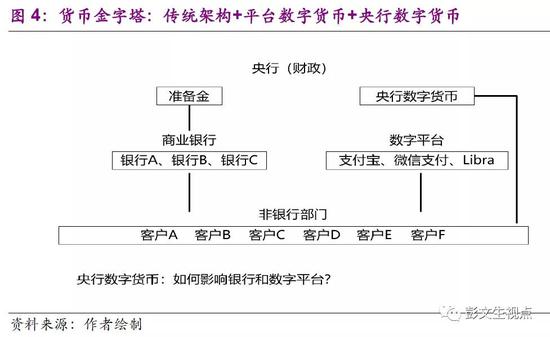

Central bank digital currency

The central bank digital currency is on top of the platform digital currency, plus a digital tool for fiat currencies. So what impact might the traditional banking system and the digital platform we just mentioned have on the financial ecology? When thinking about the impact of central bank digital currencies, a key consideration is whether the central bank pays interest. For example, in China ’s central bank digital currency, from some of the statements disclosed by the media at present, the central bank digital currency may not pay interest, but instead of M0, so the central bank digital currency is called DCEP (Digital currency electronic payment). The name of the central bank still emphasizes that it is electronic payment, which is mainly a payment tool instead of cash.

In the area of anonymity, I draw a question mark, to what extent can the central bank's digital currency be anonymous or partially anonymous. Anonymity helps protect the privacy of consumers. Certain anonymity is still important, but this is not me. The key points. I mainly want to say that the central bank does not pay digital currencies. Cash does not pay interest, but it has certain transaction costs. For example, it is troublesome to go to the bank to withdraw money, and you need to count money. In addition, the money may be damaged or lost. Therefore, although electronic money and cash have zero interest, its transaction cost is lower than cash, so it can play a role of replacing cash. In this way, the central bank will get convenience benefits.

But in China, cash has been replaced by WeChat and Alipay and other payment tools. Is the central bank's digital currency replacing cash or Alipay and WeChat payment? Of course, there is a question here. Can the central bank digital currency replace WeChat payment and Alipay? The rapid growth of WeChat Pay and Alipay is because it has application scenarios and platforms. How should the central bank's digital currency develop? I personally guess that there should still be many ways to promote the use of central bank digital currency. For example, the payment of the public transport system is equipped with the central bank digital currency interface. It is even conceivable that civil servants pay wages to issue central bank digital currency. To pay taxes, they must pay with central bank digital currency and many more.

The central banks of other countries are also researching digital currencies. I have seen some literature. They study that digital currencies are more about paying interest. The central bank digital currencies are similar to bank deposits, which may cause some bank deposits to be converted into central bank digital currencies. This effect will be greater, mainly because traditional banking institutions are affected. The convenience income that banks have obtained in the past has been squeezed, the financing costs of banks have risen, and the spread has decreased. According to our estimates, from 2011 to 2019, about 2% of China's GDP per year is facilitated by the banking system, and the United States is lower, about 1%.

Another impact of the central bank's interest payments on digital currencies is that the central bank provides a new type of safe assets and is open to all enterprises and individuals. Now only banks can hold the central bank's liabilities, and non-bank enterprises and individuals must hold the government As security assets, only national debt or local government debt.

How does the central bank's digital currency go out? It's a real problem. I think the interest payment is the key. If you do not pay interest, the central bank's digital currency is only a substitute for cash, this amount will be small, and it is completely the result of trading behavior. In that case, it is estimated that it will be reflected in the change of the central bank's liability side. The increase of central bank digital currency, the decrease of cash in circulation, or the reduction of the bank's reserve in the central bank are reflected in either replacing cash or WeChat payment and Alipay. WeChat Pay, Alipay, and bank accounts are still linked, ultimately reflected in the corresponding reduction in bank reserves in the central bank. Of course, with the increase of the economic scale, the demand for transactions will tend to rise. Is the adjustment of the debt structure sufficient? It may not be enough, and it may increase the central bank ’s entire balance sheet, but this amount should be relatively small and basically negligible.

But if the central bank's digital currency pays interest, it will be a new type of safe asset, and the demand for individuals and businesses may be relatively large. It is unrealistic to rely solely on the self-digestion and mutual replacement of the debt end of the central bank to keep the size of the entire balance sheet unchanged. The central bank's balance sheet needs to be increased to meet the non-bank sector's demand for central bank digital currencies. So how does the asset side of the central bank issue currency? For example, buying government bonds, buying risky assets, or refinancing. Of course, there are other things. For example, the example I just gave to pay civil servants is actually fiscal behavior, and the balance sheet of the central bank is linked to finance. This has profound public policy implications.

If the People's Bank of China becomes the first central bank to issue digital currencies in the world, it may be more cautious and prefer not to pay interest, because the impact of interest payments is too great, including the need to consider how to expand the central bank ’s balance sheet, which involves a lot of Complex public policy issues, especially the relationship between currency and finance, so for this reason, the first step for a central bank's digital currency may simply be to replace cash.

Public policy implications

The first is macro policy, including monetary policy, fiscal policy, and financial stability. In terms of monetary policy, if the central bank's digital currency does not pay interest, then it is similar to cash. The amount of supply is determined by transaction demand. It is the result of economic activity, not the cause, and its impact can be ignored. For a simple example, suppose the unit pays a salary this month, because for some reason it is not transferred to the bank account but is given to you in cash. Will you increase your consumption expenditure because you have more cash? The normal situation is not because real income has not changed.

But if interest is paid, the central bank's digital currency will become liquid assets, which will affect the asset allocation behavior of our individuals and enterprises. It is a new type of monetary policy tool and a powerful and effective monetary policy tool. The monetary policy of the central bank now affects our personal and corporate behavior indirectly, and it affects consumption and investment through bank credit and capital markets. But one day, if each of us and each enterprise holds digital currency that the central bank pays interest rates, the central bank can directly influence consumption and investment behavior by adjusting the digital currency interest rate or quantity.

What impact does the central bank have on fiscal policy? If the central bank does not pay interest on digital currencies, the amount will be limited, and the convenience income earned by the central bank will also be limited. But if interest is paid, it may bring about a significant increase in central bank profits. In the past, the part of the revenue from public service provided by banks returned to the central bank. As part of the government, the central bank means that the government's extra-budgetary income will increase, and there will be more room for fiscal expansion. Instead of an increase in the deficit. In a sense, with the development of the central bank's digital currency, especially the interest-bearing currency, the pendulum of history may swing back to the mode in which the growth of the early banking system, which was not very developed, mainly came from fiscal.

How does central bank digital currency affect financial stability? The non-bank sector directly holds the central bank's liabilities and has lower transaction costs than cash. It is safer. Some people say that it is more convenient to run a bank. When the wind blows, everyone may convert bank deposits into central bank digital currencies. Stability creates disadvantages. Intuitively, this is the case, but I think that the possibility of bank runs is itself a constraint on the market discipline of banks. In other words, it is conducive to the stability of the entire system. We can imagine a situation where one day if everyone finds that our bank money cannot be transferred to a truly safe place, how can we be confident in the banking system? So the impact on financial stability is controversial, not simply a denial and affirmation.

The above is about macro policy. Digital currency also involves some public policy issues that go beyond monetary finance, such as whether big data is public or private? Now Ant Financial and Tencent have mastered big data through payment and used it to improve efficiency, such as finance, reducing reliance on collateral and real estate, and developing small and micro finance and inclusive finance. The impact is positive. If the central bank replaces or squeezes it, and the payment data is in the hands of the central bank, how will the central bank use this data? But on the other hand, if big data with system importance is in the hands of the technology giant platform, will it form a monopoly? Impeding innovation? Realizing the public goods attributes of data does not necessarily need to be in the hands of the government. It can also be achieved by involving the private sector, but how does the private sector participate? How to avoid the monopoly of digital platforms? These are important public policy issues in the digital economy era.

Finally return to the question of national currency and private currency. WeChat Pay and Alipay are market competitions, and now the digital currency of the central bank has been added, but the central bank is both a participant in the market competition and a regulatory agency. How to balance the conflict of interest that may exist between these two roles? We look at the history of monetary finance. Basically, the private sector innovates and then the government regulates it. Now that the central bank also participates in competition, how to balance it?

A few days ago, the Financial Summit interviewed Greenspan and asked him what he thought of the central bank's digital currency. His answer was that the central bank does not need to issue digital currency. Then whether or not the central bank's digital currency should be issued, my opinion should still be. why? What mechanism does the government use to maintain fiat currency as a unit of account in the modern financial system? There are actually three, one is fiscal, that is, fiscal expenditures and taxes must be in fiat currency; the second is financial supervision, broad money is created by credit, and the regulation and maintenance of the stability of the financial system is to maintain the stability of fiat currency; the third is cash, allowing Ordinary people also have a final barrier. In a sense, the role of cash runs on banks is the government's mechanism to maintain the fundamental currency function of the bookkeeping unit. In the digital economy era, there are only two means of fiscal and financial supervision in a cashless society. In this sense, the issuance of digital currencies by the central bank to replace cash has the value of public policy.

(The author's introduction: Everbright Securities Global Chief Economist and Director of the Institute. Former Global Chief Economist of CITIC Securities.)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DeFI: Ethereum's currency Lego

- Central Bank Report: Blockchain simplifies risk management and increases transparency; 173 virtual currency trading and financing platforms have withdrawn

- More underground regulatory documents, the virtual currency industry goes to the bubble

- An Example of Government Affairs System: Blockchain Thinking in Public Affairs

- Central Bank Shanghai Headquarters Graphic Blockchain: Blockchain virtual currency, developing blockchain technology away from virtual currency speculation

- Professor Gong Yi of China Europe International Business School: the dusk of the company and the dawn of the blockchain

- Graphic: Why is cryptocurrency investment diversified?