The digital currency exchange has been caught in the throat by the legal currency.

Under the premise of a constant total circulation, money acts as a catalyst for rapidly transforming production materials into capital, and wherever it flows, it is possible to obtain a rapid rise. For the current digital currency market with a market capitalization of only $220 billion, the absorption of traditional funds is a short- and medium-term goal for the digital currency industry to thrive. Compliance trusts such as Gemini Trust, PrimeTrust, and Paxos have launched stable currencies; traditional exchanges such as ICE and CME have launched a Bitcoin derivatives exchange, which has a common purpose – to lower the threshold for traditional funds and to continue to expand the number. The exposure of money in the traditional market has finally reached the goal of attracting traditional funds.

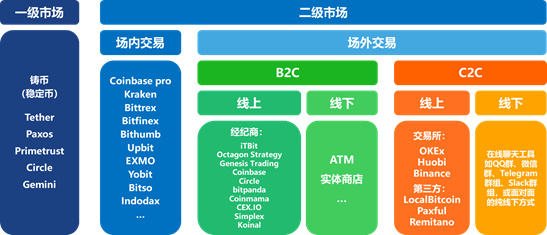

At the same time as the trust institutions and traditional exchanges continue to work hard, players in the digital currency field are also constantly testing on the edge, breaking the sub-division wall between the legal currency/digital currency by expanding more legal currency access channels. As we all know, the legal deposits can be divided into two categories: on-floor trading and over-the-counter trading. On-floor trading directly supports secondary market transactions between French and digital currencies, usually on licensed exchanges such as Coinbase Pro, Kraken, Bittrex, Bitfinex, Bithumb, Upbit, EXMO and other exchanges.

Among them, Bitso is the largest local exchange in Mexico. It has just completed a round of financing, led by Ripple, and Coinbase and Pantera Capital. The head exchanges through the local stock exchanges in various regions of the war-invested stocks, as a stepping stone to establish a local legal currency exchange sub-station, is a more conventional way of opening up the territory. For example, the currency was invested in Koi Trading for $3 million in January 2019. Koi Trading is a B2C-style OTC exchange operated by the San Francisco, China team, with poor traffic but holding an MSB license issued by Fincen. BAM Trading Services (hereinafter referred to as BAM) has the same registered address as Koi Trading and has reason to believe that it is the same company. BAM is the partner of Binance US, the US dollar currency exchange (BAM and Koi Trading have MSB licenses). The main body and operator of Binance US are BAM, but the brand is currency security, and the currency system is submitted to the exchange. This is a typical case of investing in a local exchange (even an OTC exchange) to open up the territory.

- Privacy is the future, but the privacy currency is not

- QKL123 market analysis | Bakkt options before the CME; quantum computers are not enough (1025)

- Opinion: Why is Bakkt's failure not surprising?

The author believes that the local exchange that supports the secondary currency trading of the counter currency/digital currency is one of the best integrated resources for the head exchange to carry out the global expansion route, which is not only conducive to the local distribution of the head exchange, but also high. The efficient and low-cost solution to the problem of legal currency deposits is expected to gradually set off a wave of investment in the head exchange and integration of local currency exchanges.

In addition to direct on-exchange trading, the currency can also be used for over-the-counter trading. In fact, the amount of over-the-counter trading is very large. According to the TABB research report, the OTC market is 2-3 times the volume of on-floor trading. Because of the presence of brush volume in the on-floor trade, the actual amount of over-the-counter trading is even higher. This paper focuses on the existence value of the OTC market, the main buyers and sellers, the distribution of deposit channels, the distribution of legal deposits, and how the exchange should expand the French currency channel.

What is the existence value of over-the-counter trading?

Why is there such a large amount of over-the-counter trading, we can snoop from the user's OTC motives.

The most important motivation is to have the need to reduce costs (time cost and capital cost) in the trading scenario.

Large orders: Due to the lack of depth and liquidity, it is difficult to digest 100 BTC or more orders. Once such a large amount of orders are thrown into the market, it will inevitably cause great fluctuations in the price of the market; The user of the list will also have a large slippage due to insufficient depth, and the final execution price will obviously deviate from the order price, which will result in capital loss and usually take a long time.

The deposit fee is higher: For example, in the case of a US user, when using a credit or debit card to purchase Bitcoin in Coinbase Pro, a fee of 3.99% is usually charged. If the bank transfer fee is slightly lower, it takes a long time. And subject to US regulations, such compliance websites can trade very few tokens. Therefore, for US users with strong demand for currency transactions, it is usually necessary to withdraw coins to other exchanges after the deposit is completed, which is cumbersome. Therefore, users in similar situations in the United States and other countries have the driving force to buy bitcoin in the OTC market, and directly enter the address of a certain exchange with a large number of exchanges.

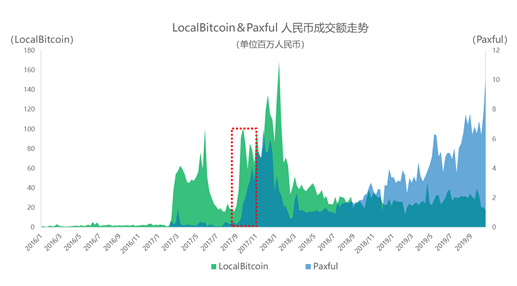

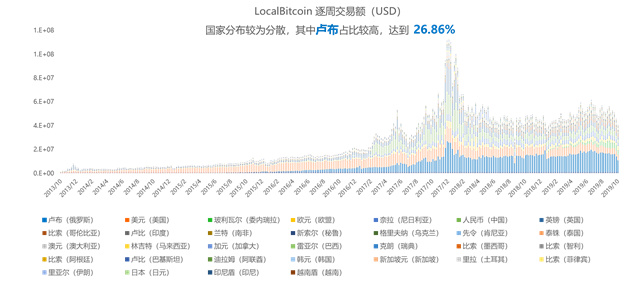

Another common motivation is the local non-compliant currency exchange. The most typical one is the “94” incident in China. The exchanges that support domestic users have gone to sea or closed down, and the secondary trading market of the RMB has been closed. From the transaction data of LocalBitcoin and Paxful, the amount of RMB settlement OTC transactions has soared.

Who are the main buyers and sellers?

Currently, the main participants in over-the-counter trading are as follows:

• Hedge funds, small-scale asset management companies, Family offices (buyers)

• Miner (seller)

• OTC Broker (buyer/seller-arbitrage)

• Exchange OTC market retail and liquidity providers (buy and sell – deposits and withdrawals)

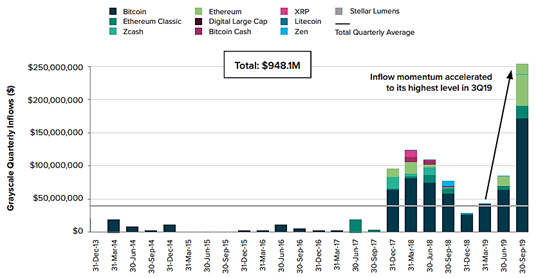

The main buyers in the over-the-counter market for digital currencies are from hedge funds. Although bitcoin is currently difficult to value, it can help investors hedge against inflation, especially for large amounts of money, especially against large amounts of money, so it can be used as part of a portfolio. So hedge funds like Horizon, ARK, Purpose, Pantera, Grayscale, FBG, etc. usually buy a lot of bitcoin stock off the court. In terms of derivatives, there are currently many sites that are similar to CME, Bakkt, etc., and are more biased towards the B-end to meet the needs of leveraged arbitrage and hedging of hedge funds.

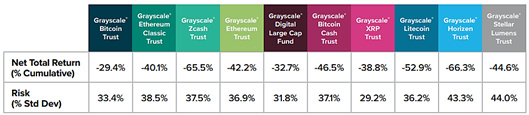

Take the Grayscale 2019Q3 investment report as an example. The total digital currency under 2019Q3 is $254.9 million, a quarterly increase of 200%. Among them, Bitcoin has the highest proportion, and ETH has the largest increase. However, the return rate of Q3 is negative.

The main seller is a miner. The coins mined by miners have a demand for shipment and usually sell BTC off-site at a fair price below the exchange to attract buyers. China is the main area for bitcoin mining, accounting for more than 80% of the total network computing power. Therefore miners from China are the main sellers of the OTC market.

Type of over-the-counter transaction

Here, we define the stable currency issuer holding the license plate as the primary market; the other sectors in the above chart are defined as the secondary market. The primary market is a scene of coinage and currency. The main participants are stable currency issuers with licenses such as Paxso, Primetrust, Circle, Xapo, BitGo, Gemini and others. This service converts dollars into stable currencies, such as Paxos (PAX) or TrueUSD (TUSD), or converts PAX or TUSD to cash. However, due to the strict KYC review and the high threshold of redemption start-up funds, there are not many users. At present, it cooperates with the exchange to expand the source of customers. At the same time, the exchange also provides more access channels for users by accessing more compliant stable currency issuance channels, or it can achieve the same purpose by cooperating with other stable coins.

The secondary market can be divided into two modes: on-site/off-exchange. The pit trade has been described previously. As far as over-the-counter trading is concerned, it can be divided into two main modes, B2C and C2C, which respectively include online/offline trading methods.

● In the online B2C mode, users can purchase or sell Bitcoin directly to the platform, and the price is specified by the platform. After the platform receives the user's payment, the platform directly releases the bitcoin to the buyer, or after receiving the bitcoin, releases the funds to the seller. The funds or Bitcoin on the B side are owned by the partner merchants. Part B participants include HiveEx OTC, Octagon Strategy, Genesis Trading, Bitpanda, CEX.io, bitstocks, circle trade, cumberland mining, genesis trading, IBC group, itBit, Enigma Securities, SFOX, B2C2, XBTO, QCP Capital, etc.

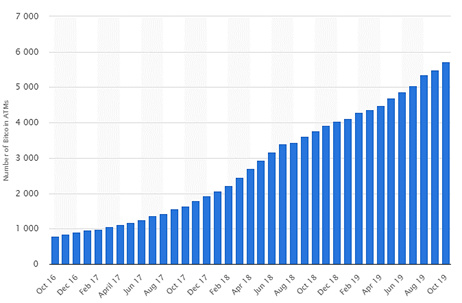

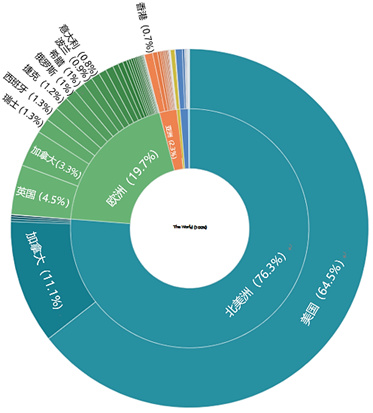

● Offline B2C mainly refers to offline purchase through Crpto-ATM and physical stores. For Crpto-ATM, instead of treating it as a deposit scenario, it is better to use it as a transfer medium. The traditional cross-border remittance time period is long and the financial friction is large. Ruibo's cross-border payment system still requires users to have a bank account to operate. According to public data, there are still 1.7 billion people in the world who do not have bank accounts, and most of them are concentrated in developing countries. When they do cross-border transfer operations, they are more likely to do it through digital currency. For example, in Southeast Asia, Latin America and other regions, there is a large amount of labor output. Labor has generated a large amount of cross-border remittance demand. These users tend to convert the earned local currency to CTC on the Crpto-ATM machine, and the recipient is local. The Crpto-ATM is exchanged for the cost of the national currency, and Bitcoin acts as a transfer medium to help users complete the exchange between different legal currencies with lower friction, and it is basically instant.

However, in general, Crpto-ATM charges a higher fee per transaction. According to Coinatmradar data, the current average rate of purchasing bitcoin through Crpto-ATM is 6.5%, which is no more than the online C2C and French currency secondary market. Direct trading has an advantage, even higher than the B2C fee. The main advantage is that it can directly trade cash, and it is relatively safer to trade with machines; the threshold is lower, and for developing countries, users are more familiar with cash transactions, Crpto-ATM is a simpler The choice, whether in a local grocery store or a beauty salon, can be found accidentally in the vicinity of the Bitcoin machine, and the process is very simple. In addition, KYC is not required for transactions that are not large. However, the problem is that Crpto-ATM easily bypasses foreign exchange controls in certain countries and there is a risk of money laundering, so China still prohibits Crpoto-ATM.

Crpto-ATM is experiencing a period of rapid growth. As of now, the global Crpto-ATM has approached 6,000 units, mainly in North America and Europe.

Crpto-ATM global growth

Crpto-ATM global distribution

● There are two main types of online C2C mode. One is the C2C legal currency trading area set up by the exchanges such as OKEx and Huobi. Usually, the user directly enters the user in the OTC place after completing the purchase demand. The exchange's account is the most important deposit channel for such exchanges. For exchanges, the large volume of OTC transactions often means that the depth and liquidity of spot products is better. In addition to opening the CTC form of the OTC market, the exchange can also access various B2C deposit channels. For example, the currency is connected to Simplex and Koinal. It should be noted that such methods are also just a means of recharging digital currency and do not support direct secondary market transactions between fiat currencies and digital currencies.

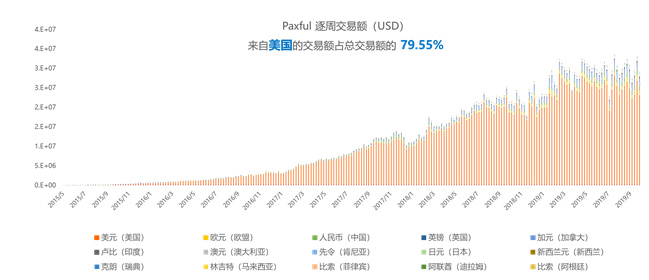

The other category is an independent third-party independent C2C trading platform, such as LocalBitcoin, Paxful, Remitano, Bitsquare, LocalCoinswap, Hodl Hodl, altcoin.io, CrptoBridge, Victorium, and so on. This type of platform provides a place for both buyers and sellers to publish information. The model is similar to “Taobao”. Buyers and buyers can publish their own message information or make one-to-one transactions based on the published information. Relatively speaking, the independent C2C trading platform supports more trading areas and legal currencies. Among them, LocalBitcoin and Paxful are ranked first in terms of transaction volume and monthly activity. Founded in 2012 and registered in Finland, LocalBitcoin is recognized as the largest C2C over-the-counter trading platform, providing Bitcoin over-the-counter trading services to users in 479 countries and 7,792 cities, including RMB users. From the perspective of weekly trading volume, LocalBitcoin's transaction volume from Russia has gradually surpassed the United States since 2017 and has become the largest contributor to the transaction.

Founded in 2014, Paxful is registered in Delaware, USA, and holds the MSB Digital Money Business (Monetary Services Business) issued by the US Treasury's Financial Crimes Enforcement Network (FinCEN), which can legally serve US users. LocalBitcoin does not have an MSB license and has strong regulatory risk in LocalBitcoin trading. As a result, most of the USBitoicn US users have gradually flowed to competing products Paxful, and US users contributed 79.55% of Paxful's total transaction volume. However, from the perspective of total transaction volume, although the two are gradually moving closer, Paxful is still about 37.5% lower than LocalBitcoin. From the monthly work, according to Similarweb data, Paxful's average monthly activity for the past three months is 4.409M; LocalBitcoin is 3.638M, and Paxful has surpassed LocalBitcoin for traffic. Moreover, Paxful is still in the dual growth period of traffic and transaction volume. It is expected to surpass LocalBitcoin in 2020 and become the world's largest C2C OTC trading platform.

● Offline C2C means that based on a certain trust relationship, buyers and sellers can conduct online or offline online chat tools such as QQ group, WeChat group, Telegram group, Slack group, or face-to-face pure line. Very traditional trading mode.

Distribution of legal currency deposits

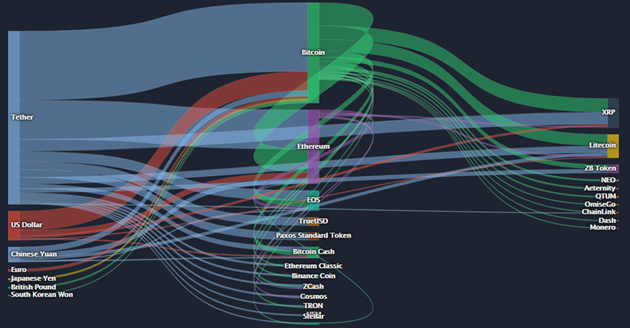

The method and scope of the legal deposits are different, and it is easy to get different results. The data from coinlib.io shows the recent 24h (10/18-10/19) capital flow. Except for USDT, the French currency is ranked in US Dollar, Renminbi, Euro, Japanese Yen, British Pound and Korean Won. It can be inferred that the United States, China, the European Union, Japan, the United Kingdom and South Korea are the main French currency imports.

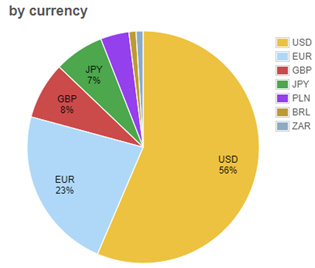

Data from bitcoincharts shows that the US dollar, the euro, the pound, the yen, the Polish zloty, the Brazilian real, and the South African rand are the main deposits.

But in terms of the US dollar, it is not just for US users, but also includes many US dollar circulation areas. For example, in Russia, the Russian Foreign Exchange Regulation Regulations stipulate that the ruble is a freely convertible currency. At any financial institution, exchange point in Russia, the ruble can be exchanged with the US dollar and the euro at any time. When the ruble fell sharply, the people exchanged the ruble for the US dollar, so we can see that the Russian local exchange exmo is more than usd instead of rub. For the renminbi, because the main amount is concentrated in the C2C French currency area of OKEx and Firecoin, it is difficult to count, so the data has a greater probability of being reduced; while the Korean won is directly supported by Bitumumb and upbit. In market transactions, considering that Korean exchanges are usually the hardest hit, the data is likely to be magnified.

Legal currency deposit channel expansion cheats

For the exchange, the summary of the French currency deposit channel we have summarized is as follows:

1. Self-built C2C fore currency OTC trading area (very tested the exchange's Broker cooperation ability).

2. Cooperate with PrimeTrust, Paxos, etc. to launch stable currency (multiple exchanges have been implemented, but the exchange threshold is higher, users are not friendly).

3. Strategic cooperation with C2C platforms such as Locabitcoin and Paxful, and B2C platforms such as Bitpanda, Coinmama, CEX.io, and Simplex for diversion (which can efficiently support multiple legal currency deposits).

4. Strategic cooperation Locally support exchanges in the secondary currency trading of the French currency (for example, Coin's investment in Koi Trading allows BAM Trading Services to open the Binance US sub-station, but cannot be quickly copied in different regions).

5. Promote compliance business or expand cooperation in the legal currency/digital currency secondary market transactions in the loose areas of the French currency policy (this method is the most direct and effective)

For the last one, many exchanges are expanding.

On October 24, 2019, Coin announced that it has reached a cooperation with payment solution service provider Flutterwave. Users can recharge Nigerian Naira (NGN) to Binance.com through Flutterwave, and open BUSD/NGN, BNB/NGN, BTC/NGN transactions. market. Flutterwave is a B2B payment service founded in Nigeria. It mainly provides overseas companies with payment channels for African users. Flutterwave also includes Ali in its domestic partners to provide payment services for Alipay and African merchants. In addition, at the recent Moscow conference, the announcement of the legal currency of the ruble that was announced within two weeks by the currency, was also revealed through the form of third-party cooperation. We expect to also cooperate with a third-party payment company in Russia. .

The above Nigerian legal currency Naira and the Russian legal currency ruble are all secondary market transactions opened directly at binance.com. In addition, there are currently four legal currency exchange sub-stationes in the currency security:

Ugandan Ugandan: Going online in June 2018, through cooperation with the local government to complete compliance, Binance Labs incubation / investment in African blockchain startups, Binance Charity continues to pay attention to Africa's social welfare, etc. have played a certain role. The currency Uganda station currently supports Uganda legal currency UGX and BTC, ETH, BNB, PAX, LTC, BCH transactions.

Coin Anzei: Launched in January 2019, it is the first legal currency exchange operated in Jersey under the auspices of the Jersey Financial Services Commission (JFSC). JFSC is equivalent to the SEC of Jersey, and the Anzexi Station has been approved by JFSC to be able to comply with the regulations. Jersey’s national defense and diplomatic affairs are the responsibility of the United Kingdom and are closely related to the United Kingdom. The currency can be radiated throughout the Eurozone through the United Kingdom. Jersey Station currently supports GBP GBP, Euro EUR and BTC, ETH, BNB, LTC, BCH, BGBP transactions. (BGBP is a stable currency anchored by the currency of the pound.)

Coin's Singapore: Launched in April 2019, in October 2018, Coin Ann announced that it has obtained a strategic investment from Singapore's sovereign wealth fund Temasek's Xiangfeng Investment, which will support the establishment of a French currency exchange in Singapore. In part, the investment is more like setting up a joint venture to develop a regional business than an equity investment. The compliance of the currency in Singapore can make sense. The speculation is done by Temasek. Singapore Station currently supports Singapore SGD and BTC, ETH, BNB, LTC, BCH and XRP transactions.

Coin An American station. Going online in September 2019. In the above, we mentioned that the main body and operator of the US dollar station are BAM (the investment relationship between the currency security and BAM), BAM holds the MSB license, and the compliance issue is solved by BAM.

In terms of fire coins, the current sub-stations of Firecoin include Firemoon Korea Station, Firecoin Middle East Station, Firecoin Indonesia Station, Firecoin Russia Station, Firecoin Argentina Station, and Firecoin Thailand Station. The South Korean station can directly support the Korean market's secondary market transactions; the Middle East, Indonesia, Russia, and Argentina stations do not support the direct currency secondary market transactions, but only the C2C legal currency trading zone; Thailand has acquired Thailand. The digital asset business license issued by the SEC. In addition, Firecoin recently announced that it will open the secondary market transaction of the Turkish currency Lira in the global currency station in 2019.

The above is the author's thinking about the legal currency deposit market. If there is anything wrong, welcome to discuss it.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin prices continue to fall, will the mining machine stop?

- Galaxy Digital will launch new bitcoin fund in November

- Speed reading | 5 sentences summarizing Vitalik's ETH2.0 series blog post, Nic Carter talks about the evolution of bitcoin as a safe-haven asset

- Google, Internet Stock and Ethereum

- BiClub realizes full automation of OTC platform and helps build a large-scale digital asset financial service system

- Let the transaction speed reach 1 million TPS in the future, and the Ethereum expansion solution officially released

- Bitcoin options are coming, will Bakkt help or help?