A comprehensive look at the BTC ETF: the holy grail of crypto market participants

Author: LARRY CERMAK

Translation: Zoe Zhou

Source: Crypto Valley

Editor's Note: The original title was "Understanding the BTC ETF"

- Hubei Red Cross leader was removed from office, but how to use technology to prevent evil?

- Research | What can blockchain technology do to fight the epidemic?

- Clarity and to-be-defined content of the central bank's digital currency issuance

- The approval of the U.S. Securities and Exchange Commission (SEC) for the launch of an ETF is mainly dependent on three conditions: the size of the derivative must be large enough, third-party custodian institutions can be regulated, and there are manipulation measures;

- The remaining concern appears to be that potential price manipulation exists on unregulated exchanges and that most price discovery occurs on these exchanges;

- The current market structure is unlikely to change soon, which makes the prospect of BTC ETF very slim;

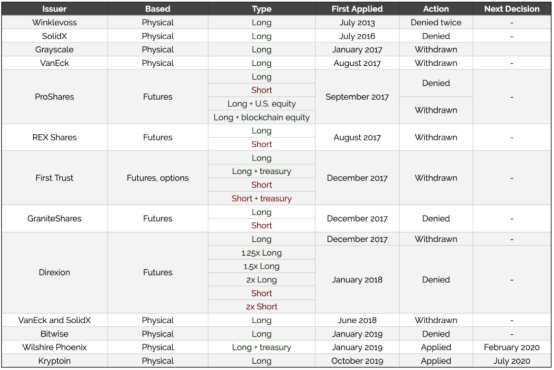

- So far, a total of 26 BTC ETFs have been issued, but 12 of them have been rejected by the CSRC, and the rest have been withdrawn by the issuers themselves.

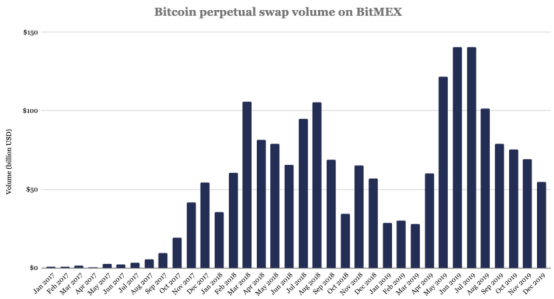

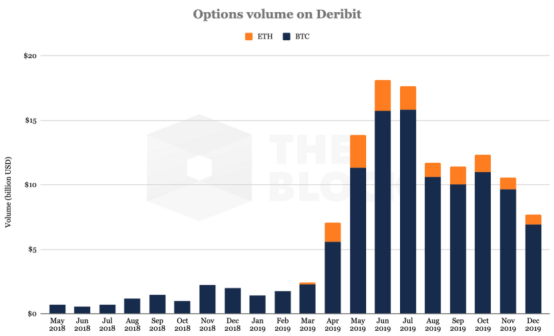

- The BTC derivatives market does not have sufficient trading volume to support ETFs;

- Lack of qualified hosting services (regulated third-party hosting agencies);

- Compliance alone is not enough to prevent fraud and manipulation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Voice from the front line: how blockchain companies fight the "epidemic"

- Hackers are getting smarter, with the largest number of exchange attacks ever in 2019

- Cosmos director broke: Jae Kwon stepped down as CEO to avoid responsibility

- Is the option market, which suffered a shrinking trading volume at the beginning of the year, still worth watching?

- The central bank's trading gold blockchain platform helps corporate financing, and national project support breaks through development difficulties

- Blockchain + epidemic fight: expose data to the sun

- Baton secures another $ 4 million in funding and completes $ 12 million in Series A financing