A hundred times of space or worthless? Learn about the three valuation methods for digital assets.

As a new asset class, digital asset valuation formulas and methods have always been the subject of intense industry concern. At the HashKey 2019 Digital Assets Global Summit, HashKey Pro Chief Strategy Officer Ben El-Baz and CryptoLab Capital Partner Dmitry Kalichkin conducted a fireside talk entitled "Digital Asset Valuation Approach: Current State and Future Trends." The two guests had a heated discussion on the origins and debates of the early valuation methods of digital asset projects, the advantages and disadvantages between different valuation methods, the similarities and differences between traditional asset valuation methods, and the recommendations on the consensus of new technology industries.

Ben: My name is BEN and I am the Chief Strategy Officer of the HashKey Pro trading platform. Before joining HashKey Pro, he worked in the consumer technology products and IT products industry for 8 years, and also had 2 years of financial industry background. He graduated from Stanford Business School and organized the Stanford University blockchain organization. Dmitry, introduce your personal background?

Dmitry : Cryptolab Capital is a quantitative investment and digital asset management company based in San Francisco, California. At the beginning of the company, my partner and I were both mathematics majors. We felt that the digital currency investment field lacked a data-based reverse analysis model. To this end, we spent a lot of time thinking about the evaluation model, and did a lot of different statistical modeling and definition modeling, in an attempt to understand the value of Bitcoin?

- The road to rights protection is not seen? Mt. Gox creditor organization leader opt out

- Babbitt Column | Virtual Currency Classification and IEO Investor Protection

- Is there a inherent cost vulnerability in Lightning Networks? Users will still lose money without error

About my personal background, this is roughly the case. I personally studied mathematics. I started consulting at a management company, managed at a European technology company, and graduated from Stanford like Ben. The other members of our team have different backgrounds, some from venture capital and some from quantitative trading.

Ben: The focus of this “fireside chat” is to explore different forms of valuation by early investors in the industry. Can we talk about what is value? How to make a valuation?

Dmitry : Everyone sees digital assets as a new form of asset. I think that everyone has overlooked the fact that digital assets have to be accepted as a form of asset for the public investors. You will not invest in things that cannot be valued. If you don't know that the investment is too high, too low, or just right, you won't buy or sell. This is not a rare thing today, and the situation of Internet companies in the 1990s is exactly the same. Now there are words such as life cycle value, customer cost, etc. People only chase eyeball effects and traffic, which is very significant. I personally feel that today's cryptocurrency is at the same level as the valuation of technology companies in 2000. It is time to make some changes.

Specifically, what is value? From a traditional perspective, the value of securities for investors lies in the benefits. It is a way to define value and map future returns, and return them to the present. This is the DCF valuation model. Securities have cash flow, and bulk commodities do not. There is no cash flow in digital currency, but it has certain microeconomic trends and microeconomic indicators such as inflation and interest rates. These indicators are used to indicate how much their actual value is.

Ben: I know that you have done a lot of top-down, bottom-up and other valuation methods. Can you share their strengths and weaknesses here?

Dmitry : Valuation can be done in three conceptual ways.

The first is top-down, which is the favorite way for old-school venture capitalists and stock exchanges. Gold is worth 8 trillion US dollars, and bitcoin is 10% of it, equivalent to 800 billion US dollars, 10 times the current value. This is not a valuation because it does not answer the question "Is the value of Bitcoin overvalued or undervalued?" It is an estimate of the value of a moment in the future. There is no practical operability. I feel that this is not a valuation, but more of a guessing nature.

The second way to estimate is from the bottom up, which is the DCF model (repeated). First define the company's business direction, define a set of assumptions, and then estimate the company's operating conditions at some point in the future. Valuation is carried out by evaluating this ability. This is a quantitative valuation method similar to the absolute valuation model commonly used in traditional financial industries. For example, the GDP in the economic system, when its calculation formula is determined, only needs to update each parameter every year.

The third method is to compare the valuation methods. The comparison method is similar to the relative valuation model in traditional finance, and estimates the investment value of the project by comparing it with other similar assets. The comparison method can be based on a variety of data, such as price-earnings ratio and price-to-book ratio.

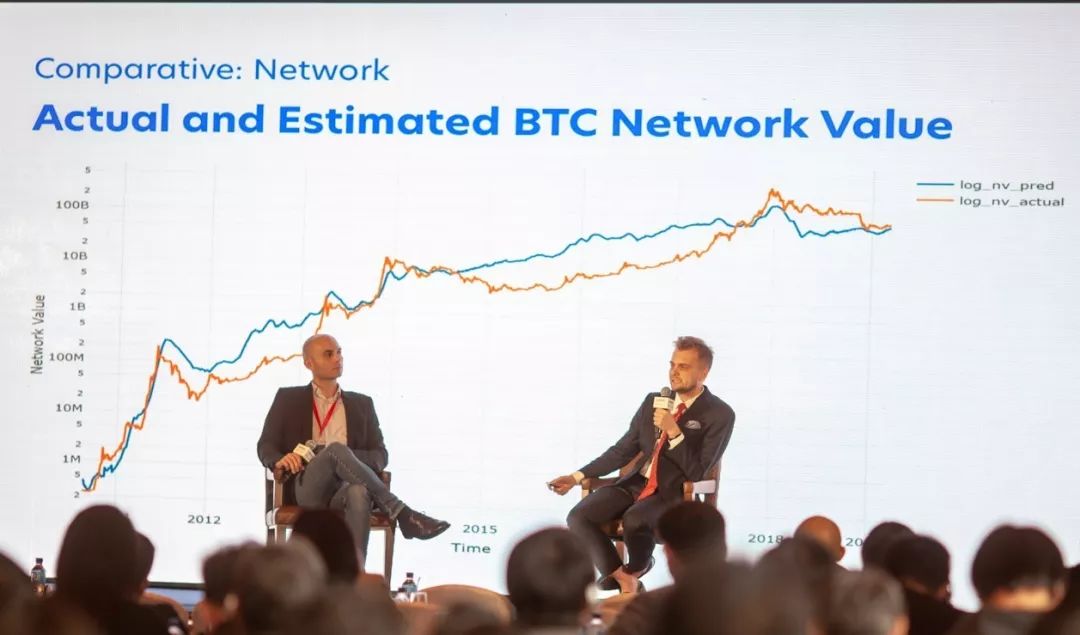

I will focus on the most famous valuation method in the field of bottom-up digital cryptocurrency, which is called the theory of quantity of money. Here is an example of a token. Here we can think of it as an economy. It has a corresponding GDP, which is obtained by multiplying the number of bytes in the system by the corresponding price. The GDP, which is PQ, is the product of the base currency M or the market value node M and the turnover rate V, reflecting the number of times the currency changes in a year. The flaws in this model are very similar to DCF. You have to predict the price in advance and the number of bytes that can be stored at various points in the future. You have to go ahead and create a list of expected assets. I personally like this model, but it needs to make a lot of assumptions. Why no one uses the DCF model to value startups, which is not without reason. You can use this model to value Apple, but you can't predict the future. Therefore, the model can be used to help understand the driving elements behind valuation and price changes. But it is not suitable for everyday operations, otherwise it becomes useless input and output. The value of the network is not proportional to the number of users, but proportional to the connections formed between users. This theory has also been successfully used to explain the valuation of Facebook and Tencent. Specifically, digital currency and bitcoin are the first time in history that all transaction data is transparent and transparent. You can verify all transactions that have occurred in history, which is significant from a valuation perspective. As a result, you can compare actual and projected value, with a correlation of more than 90%. In addition, you can divide the estimated value from the actual value to get a ratio, which is the NVM ratio. Another indicator is the NVT ratio, which can be obtained by dividing the network value from the transaction volume. The data correlation between the two is also high.

Ben: Can you make a comparative summary of the indicators used in traditional assets and digital assets?

Dmitry : In general, the purpose of making these slides and this conversation is to let the institutional investors in the audience understand the knowledge behind them and the various ways to evaluate digital currencies. Similarly, when you value a company's transactions, you will adopt the DCF model, and then you will compare it with PE and many other basic elements to determine the accuracy of the direction and understand the driving factors behind it. So in general, you can compare the DCF model to the PQ model because the two are very similar in structure. From a comparative valuation perspective, you can compare the PE ratio to the NVT ratio/Price to Matcalfe ratio. In addition, there are some digital currency-specific content, such as the NVM ratio, which I personally like most because it is the best way to value digital currency.

Ben: What do you and Cryptolab Capital want to do next?

Dmitry : In basic research, we have long maintained relationships with professors at Stanford and the Massachusetts Institute of Technology. They also regard digital assets as a financial asset and conduct research evaluations. In addition, we are also working on this topic with traditional financial assets and virtual asset management practitioners. To this end, I would like to communicate with anyone in the traditional financial or digital assets who would like to know more about this, and we will complete the research together. I will tell people how to value pension funds and insurance companies and how they relate to asset allocation. At the company management level, we are currently in the second round of financing. We will focus on quantitative trading in the follow-up. We have been doing quantitative trading for the past few years and have made some achievements.

HashKey Group, the full name of HashKey Digital Asset Group Limited, is a financial technology company specializing in blockchain and digital assets. Founded by veterans of the financial industry and technology, HashKey Group is a forward-looking strategic vision, professional investment philosophy and in-depth layout. It is committed to linking the global financial technology ecosystem, promoting innovation and entrepreneurship, and promoting industry development.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Understand the blockchain 24 issues | See these two situations, dare to say that you understand the cross-chain!

- Babbitt column | Fragile mirage: blockchain + finance (on)

- Short comment: Why is the price of layer2 project long-term weak?

- The power of the world of encryption

- Oracle Blockchain Vice President: 50% to 60% of companies will use blockchain in the next few years

- The city of Bitcoin was a smash hit, but it was defeated in the words "no one used".

- Is New York the benchmark for exchange compliance? The 19th BitLicense is released, and compliance supervision steps into the fast lane.