In those years, the traditional financial sponsorship system practiced on the trading platform

This article is probably: 6900 words Reading needs: about 13 minutes

(Deep long text, it is recommended that the collection have empty reading)

In the currency circle, there is a basic understanding:

Believe in the value of one's existence, two ways,

- Viewpoint | Why is progressive decentralization a viable way to develop contracts?

- Musk's super high-speed rail and blockchain

- "Open source" wealth: the data on the chain is a neglected gold mine

One is the approval of others, but it is unstable and tends to fluctuate;

Another is the objective cognition and reflection of the self on the world. It clearly stands in the perspective of God and examines the effective distance between itself and the world. This is stable and firm, but the requirements are very high. It is good at learning, practicing, thinking, and distinguishing. As well as self-criticism and self-respect, the ability to predict and choose is spiraling upwards, and one strong is strong. Wealth, reputation, life value, and inner peace are all well-established.

Let me first say that 3 things that seem to be irrelevant, you feel the inner connection:

1 Wang Feng of Mars Finance issued a statement on the acquisition of 100 million FT, which caused a lot of trouble in the past few days;

2 “The first person in the net red”, the live broadcast of the “Bag King” Zhang Dazhao and her Chinese online red e-commerce company Ruhan Holdings were listed on the Nasdaq Stock Market on the evening of April 3, with an issue price of US$12.50. Citigroup and UBS are joint underwriters of the offering;

3 The old man of the coin circle and the Chinese naming person of Ethereum said that he had passed the CFA. The CFA Chartered Financial Analyst is a pass for Wall Street and is a must-have certificate for the gold industry.

Literal summary,

One is the thing of the currency circle,

One is the traditional financial listing,

One is that the cattle in the currency circle have something related to the traditional financial world.

Innovation is based on the rules of things created by predecessors. The desirable place must exist and need to be learned. The shortcoming is the direction of the future. The brilliance of classical VC is still a reference. Traditional finance has come along. The rules that dominate the world's wealth should be well understood.

This is what we are in the blockchain industry, and when we are holding this newborn baby, we need to have the perception. How do we think about the blockchain industry? Without Copernicus, I am afraid that Einstein’s discovery of black holes will be infinitely postponed, and there will be no first black hole photos that have been revealed in human history today. Our time and space are just like black holes. They are related to each other. We should find out the innovations that dare to combine traditional finance and new finance, and look at success or failure and summarize attribution.

Last year, the FCoin trade, which was once a sudden rise, was the mining exchange. It didn't hold or step on it. Just think about it. In the announcement of the arrogant, many white people realized a bunch of financial concepts that they had never understood before. There is a concept "sponsor institution", I am afraid that few people can really understand the meaning of the word and the meaning of existence.

If a boring thing has to enter your field of vision, you need an opportunity. Just like the concept of a sponsor institution, if you are not engaged in traditional finance, but also go to the securities association qualification examination, you will not be exposed to this boring concept. It is a variety of dogmatism on the Internet, and a search video is also a class training. Zhang Jian threw out this concept, and the whites were dizzy. Looking at the description of the big section in the announcement, they would want to give up, forget it, and don't understand.

I think FCoin's early announcements are actually very research-oriented. Those who really want to invest in this industry should not only understand the traditional financial knowledge system, but also understand the financial innovations that are undercurrent in the currency circle.

A company wants to issue stocks in the stock market, newcomers, first do not understand, the second pair of rules are ignorant, do not understand the rules do not understand the norms do not understand the steps, need to have referrals, then this time you need sponsors to play, These securities companies that have been specifically granted rights can issue documents to ensure that the listed company has fulfilled all the listing conditions set by the CSRC, endorsed the company, and recommended the company to go public. After the listing, it must fulfill certain supervisory responsibilities instead of one. When you go public, you leave. Joining a listed company has problems such as fraud, and the sponsor representative is also subject to the law. To put it bluntly, the sponsoring agency has a great responsibility.

The sponsorship system of any country needs to be gradually improved, not perfect. This is why China’s sponsorship system has been criticized for many years. For example, it is impossible to completely eliminate fraud or a lot of verification work is not fulfilled. The company has also exposed many scandals, which has caused bad consequences.

The sponsor representative is a toon industry with certain powers, so there is corruption in places where there is power, high wages, and lack of laziness. In addition, after the listing, the company’s bonuses have been used to cover up a lot of problems for the company. In short, the money is at the head and the system needs to be perfected.

FCoin introduced the sponsorship system. From a certain perspective, it is an open mind. After all, the centralized exchanges are going to be decentralized. What is needed is not a one-word and one-vote veto. More institutions are needed to join in and work together. The currency circle needs to learn some good tools from finance. However, it is not always possible to use the sea. After all, this is an innovative activity.

The original intention of the approval system and the sponsorship system are all good, all in order to avoid the listing of inferior enterprises, but it is inevitable that there is a problem in implementation. On the one hand, the capacity of the CSRC and the sponsors is always limited. The investors who are inferior to the thousands of investors are comprehensive and in-depth, and there are inevitable omissions. On the other hand, the power of individual people is too large, and the gray phenomenon cannot be eradicated.

The securities industry knows that the approval system + sponsorship system is problematic and imperfect, but there is no better system to solve it.

The sponsor system originated from the UK's second-market AIM (Alternative Investment Market) market. Subsequently, the US NASDAQ market, China's Hong Kong GEM market, and China's A-share market were also introduced. The establishment of the sponsor system stems from the high information asymmetry and high-risk characteristics of the second board market. The purpose is to ensure the quality of information disclosure of listed companies, enhance the credit of listed companies, and ensure the stable operation of the market.

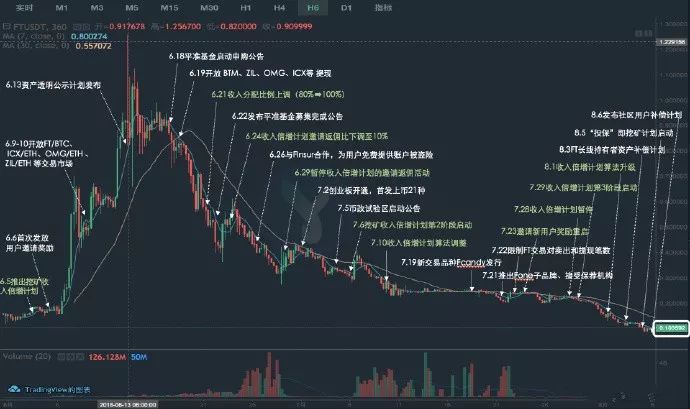

The sponsor system of community-based autonomy is open and innovative in the original history. Although no one knows the result, Zhang Jian’s spirit of innovation will benefit the industry. Try it, always right. If no humans dare to try, I am afraid that we are still a caveman now. I am self-satisfied with the fire. I am afraid that there is no electric light, because more people think that the low-cost electric light is not as good as the kerosene lamp because it uses a light. It takes too much energy and takes up too much land, but with Edison’s invention, Morgan’s capital push, and Eddie’s apprentice Tesla’s more exploratory steps, the world’s popularity of call lights is finally ushered in. FCoin's early incomplete statistics of financial innovations can be seen in the 2018 Zhang Jian team must be overloaded and dare to try and test the team. As a matter of fact, some attempts have failed, and some attempts have been retained.

I hope that one day, there will be a world-class sponsoring institution such as JPMorgan Chase, Softbank, Wanxiang, Goldman Sachs, Citigroup, Merrill Lynch, etc. appearing in our industry list, which will be a blessing for each of us. Do you dare to believe that Bitcoin is today? Countless possibilities are in the future. After all, there is no cross-border sponsor institution that forms a unified standard. A good sponsor institution should be a world list and can be shared. There should be no national boundaries.

The sponsorship system in the United States and China is different because the United States does not have a special statutory sponsor system. The sponsor system originated from the London stock market and is the legal system of the London series rather than the New York series. In the United States, the sponsor's role can be seen as being replaced by underwriters, market makers, and analysts. In particular, underwriters are required to provide post-marketing services, while in the NASDAQ market, there will be an exchange director. To participate in the guidance of listed companies.

For example, the Nasdaq First China Net bonus shares – such as Han Holdings, Citigroup and UBS as joint recommenders.

From the prospectus, Ruhan Holdings will issue 10 million American Depositary Receipts (ADS) at an issue price of US$12.50, which is at the mid-end of the previous issue range of US$11.50-13.50. Each of the American Depositary Shares represents 5 Class A common shares. At the same time, the underwriters were given over 1.5 million shares of American Depositary Receipts. Citigroup and UBS are the joint lead underwriters of R&F's initial public offering, and Tiger Securities is the deputy underwriter. The funds raised are mainly used to: a) identify other monetization channels and make strategic investments in the network red e-commerce industry; second) identify and cultivate net red; and c) conduct technical, artificial intelligence solutions and big data analysis. Investment; 4) General corporate use.

Although the system is different, the role of the introduction is the same, linking the bridge between the listed company and the authority. The size of the issuance of securities, if the amount of issuance is large, can also be jointly sponsored. There can be no more than two joint sponsorships in China. The lead underwriting of securities issuance can also be sponsored by a sponsor institution or a securities company with sponsorship qualifications.

So, sum up what situation does the sponsor need to play a role? In the case of an initial public offering, a filing document, a stock application, a charter is submitted to the relevant department, an agreement between the promoters, and so on. In addition, when public offerings of new shares, sponsor institutions are also required; in addition, when applying for public issuance of bonds, some people need to come out to ensure the recommendation; finally, when they need to be listed and traded on the exchange, such as the listing report, board agreement, Wait, put the public information to disclose information to the public. In short, the sponsor institution is responsible for publicizing information and compiling some information forms for disclosure.

In a simple comparison, FCoin's sponsors are also very obvious. There are not so many jobs, but it is the most basic obligation to guarantee recommendations and to recommend and guarantee investors. The basic requirement is not to mislead the induction, which is what they have in common.

In contrast, in the announcement of FCoin's first sponsors last year, there was a simple sentence for the responsibilities: "The FCoin GEM sponsor is responsible for reviewing the project white paper and the authenticity of the fundraising process." There are no special provisions for others. But this is the basic principle of the sponsor. Whether it is traditional finance or blockchain finance, true integrity remains the benchmark. Of course, how to distribute and community autonomy in the future will be the breakthrough point for the next innovation.

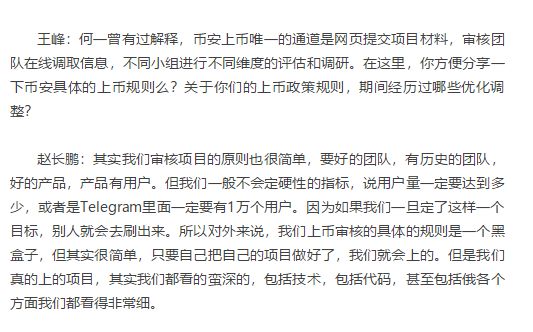

At present, the major trading platforms that explicitly propose this financial concept are only FCoin. Some innovations are virgin land, and there is nothing in the middle; there is also a new combination of innovation, like building blocks, and bitcoin is mathematics. , multi-disciplinary innovation models such as cryptography, economics, and computer science. The FCoin Exchange also combines the existing exchange-based currency model with the traditional trading market listing model to innovate, and combines the sponsor recommendation model in the community-autonomous voting model. Other trading platforms such as Coinbase, Coin Security, Fire Coin, OKEX, etc., are currently the world's most famous exchanges. Most of them use the project side to apply for platform review or users who hold platform coins vote in the manner of specific gravity. OKEX is also currently joining the professional investor support mechanism.

That is to say, the current common currency model in the market has the following three types: platform review, voting on the coin and top-up ranking.

First: the main currency of the fire currency board is directly audited by the platform. The risk of the coin currency is increased, so it has increased the support of professional investors who need 3 platform approvals;

Second: OKEX professional investors can participate in project recommendation, but not the only recommendation;

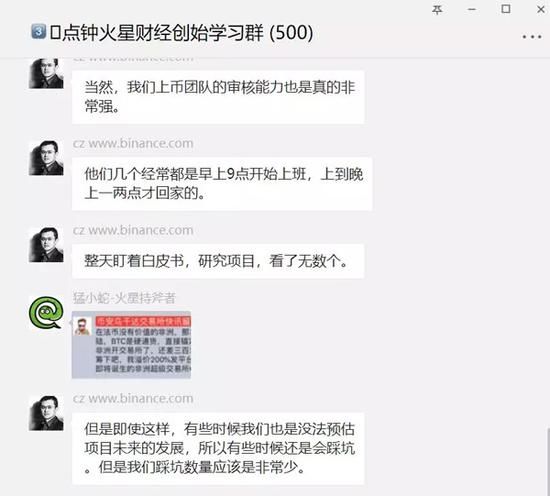

Third: The coin-on-coin rule is currently a platform review; this issue can also be felt from the dialogue between Wang Feng and Zhao Changpeng. It can be seen from Zhao Changpeng's answer that there is currently a lack of the currency system in the trading platform and the lack of manpower and material resources, which is the pain point that the industry needs to solve.

We can see that the centralized review mechanism represented by the currency security actually dominates. At present, there is no such thing as the best, but we believe that the trading platform that is very central in nature should take the first step toward the road of innovation and try various possibilities.

It is clear that FCoin is doing a more thorough attempt to learn from the sponsoring mechanism of the traditional world. Of course, I don’t know if the future is a system that is ineffective in the future, or will further update the ecological harmony of the future. It is estimated that even Zhang Jian can’t answer. Everyone is crossing the river by feeling the stones. The difference is that the stones are different and the rivers are also different.

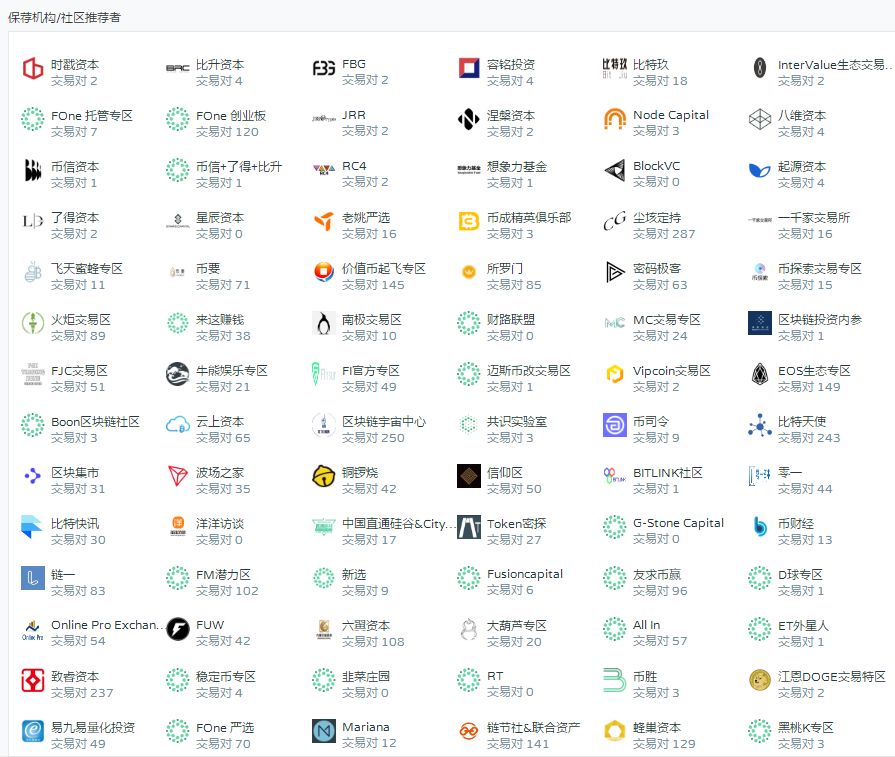

However, we have found some problems in the current FCoin sponsor list. We tried to understand the ins and outs, and then do a list of sponsors' statistics and make some tentative conclusions.

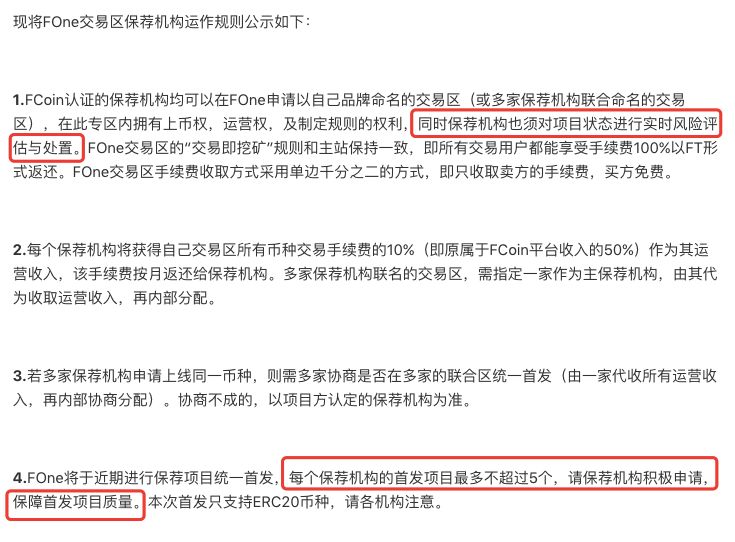

The organization that specifically accepts the sponsor's application at FCoin is called FOne, which is a sub-brand. The recommendation process and rules for the sponsors are established through this sub-brand. To apply for becoming a sponsor or sponsor, you can also have the right to own the trading area, the right to make your own rules, the independent trading area that you can name after you settle in, and so on. This is decentralization and encourages autonomy.

In the announcement, we found the obligations to the sponsor:

1 The sponsor institution must also conduct real-time risk assessment and disposal of the project status.

2 Guarantee the quality of the first project

For investors, it is more desirable for sponsors to have more obligations. The greater the power, the greater the responsibility. How to ensure the quality of the first launch, how to do the wind control room, whether there are quantitative indicators, etc., I am afraid that further refinement is needed.

Of course, I think the Zhang Jian team actually consciously attached importance to this issue. The "FTFT Proof of Funding (PoFT)" mechanism is precisely because the team is afraid of missing the unicorn project, and fears that the support is not too high to miss high growth. The technical project is also afraid that the authenticity of the fundraising process will be artificially discounted. The rules clearly stipulate that “if there is a dereliction of duty in the GEM sponsoring institution, the sponsorship qualification will be suspended, and the recommended filing schedule will also suspend the deposit.”

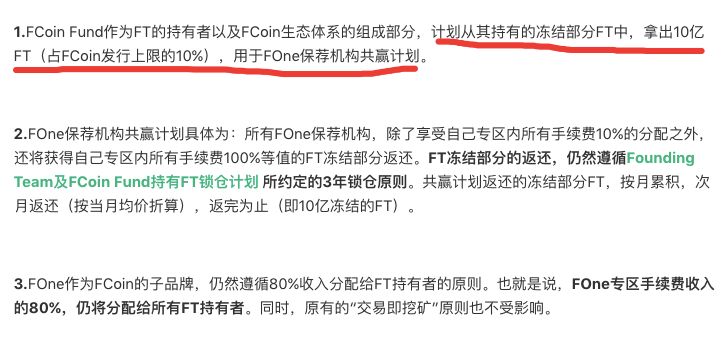

The adjustment of these rules is not a matter of lightness. As a medium that has been paying attention to this trading platform for a long time since last year, we can feel this urgency in synchronization, and in each announcement, we can follow the progress and the shortcomings to explore the possibility of success. At this point, the entity now has two words "win-win". They regard the win-win situation of the sponsors in the community as a very important part. Among them, 1 billion FT (10% of the FCoin issue limit) is used for FOne sponsors a win-win plan.

FCoin's sponsors have their own platform for launching on FOne, but since FOne is a GEM, most of the above projects are not well-known, the transaction volume is extremely low, and many transactions are zero; we have selected a few famous names in the sponsors. I have done a certain understanding. For example, Danhua Capital, Origin Capital, Creation Capital, and Eight-Dimensional Capital are not listed on the official website as FOne's sponsors. Some only have the FCoin logo in the cooperation unit column. Therefore, follow-up may be a challenge as to the closeness of sponsors and communities. The process of communityization is directly related to the cohesiveness of each component. Activating each organic component of FCoin, an additional question plus a sub-item, will greatly promote the process of communityization.

Finally, what I want to say is that this is something that no predecessors have done before, just as the beginning of the blockchain is accompanied by suspicion and ununderstanding. In this process, among those who do not give up, they are separated. Some people are trying one thing. We think about this thing so far, that is: Is traditional finance used? Can it be used for us? How is it used for us?

In the past few years, I have already got the answer to the first two questions.

1 traditional finance, useful! The new world we are going to is not to be a high-rise building, we can take it;

2 Traditional finance, can be used for us! For hundreds of years, how many talented people have exhausted their wealth, the history of the currency, the economic cycle, the debt crisis, the bank exchange rate, the history of the Federal Reserve, the names that have been slammed, and the students of the ivory tower. They are jealous, dreams, hearts that they want to surpass, they are Keynes, Adam Smith, Ridario, Friedman; William Gozman, John Hurst; Frederick Mish Kim, John Berg, Paul Samuelson. They may not belong to the same economics school, they are inextricably linked, and they are red-faced, but they systematically tell us the financial nature of the world. The blockchain industry is still so young. There are already many people who know the insiders. Just like the words that V God said, every field is a hero that we know ourselves.

But what I want to say is that between the fields, only knowing ourselves and knowing the past will go to the future. Rather than being in the gap between each other's knowledge, they are complacent. Bitcoin is not a new creation. It combines multiple disciplines and only one interdisciplinary talent can lead the world in the future. At this point, I want to praise Zhang Jian's team. After all, the attempt is to cross-border knowledge. This is why in 2018, FCoin's ideas and announcements have made people rush. Still dizzy. At least, some people are ahead of the game. If you want to be a qualified investor, you should follow it. The running here is not stupid, but learning.

This is also the reason for this article. We need to understand the traditional knowledge system to know how to solve the third problem: "How to use it for us?"

Everyone in the Internet venture capital circle and product circle knows one thing, know how most important! It's not because I have high requirements, because our team is so demanding. For example, regardless of the currency circle, chain circle or pure amaranth circle, there is reason to study finance. There is at least a quantitative indicator of finance here. You are a securities practitioner and a fund practitioner. Have you qualified for the qualification exam for futures? In fact, it is not difficult.

Also, there must be at least three books in total for the intensive reading of currency history. If I have enough resources, I really feel that the Internet product logic and user psychology have to read at least one industry classic.

In fact, I really want to say that the qualifications for banking should also be tested. If you have studied the white paper of Nakamoto, you have to go back and understand why I said this.

Maybe you might say that this doesn't seem to have a book related to the currency circle, because you want to be in this circle, read blockchain books, read cryptography books, and at least four white papers per month. Isn't it something that should be? If you want to invest, when you look at the market, what technical indicators will not look good is not good, just know Stud?

It is estimated that some people do not like to listen. I just want to say that many people in the currency circle only pay attention to follow the trend, watch the leek news, and nothing else. What do you think about Zhang Jian? He is a CTO, will be a coder, a good programmer, can speak, can publish books, Bitcoin white paper is backward, let alone FCoin is at the forefront of innovation, imagination also knows the speed of progress; also for example, also Chinese The creator of the Ethereum white paper, the translator, and the CFA, I think that the example is enough for the CFA, which is the gold sign of classical finance. Anyone who has a little thought will be conditioned. "Have he tested this?" Right, if you want to raise the bar, they are all cows, I want to be a leek. Then I have nothing to say.

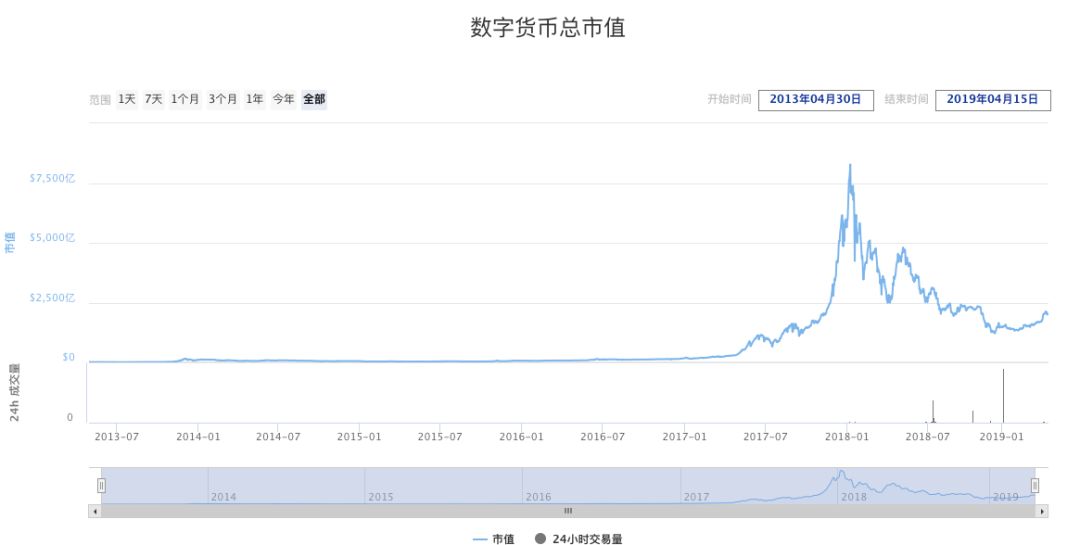

In the future, we will publish a series of articles on the integration of knowledge, mainly in the integration with the blockchain industry, broaden the awareness of various industries, and try to find a way to land, whether it is a public chain or focus on Application, whether it is doing media or investing, we believe that the future of the blockchain industry is still coming. Now its volume is still so small. As of today, the total market value of cryptocurrency is less than 210 billion US dollars, and Apple's company far exceeds the entire market value of digital currency. We must know that the market value of Maotai today is 1.14 trillion. .

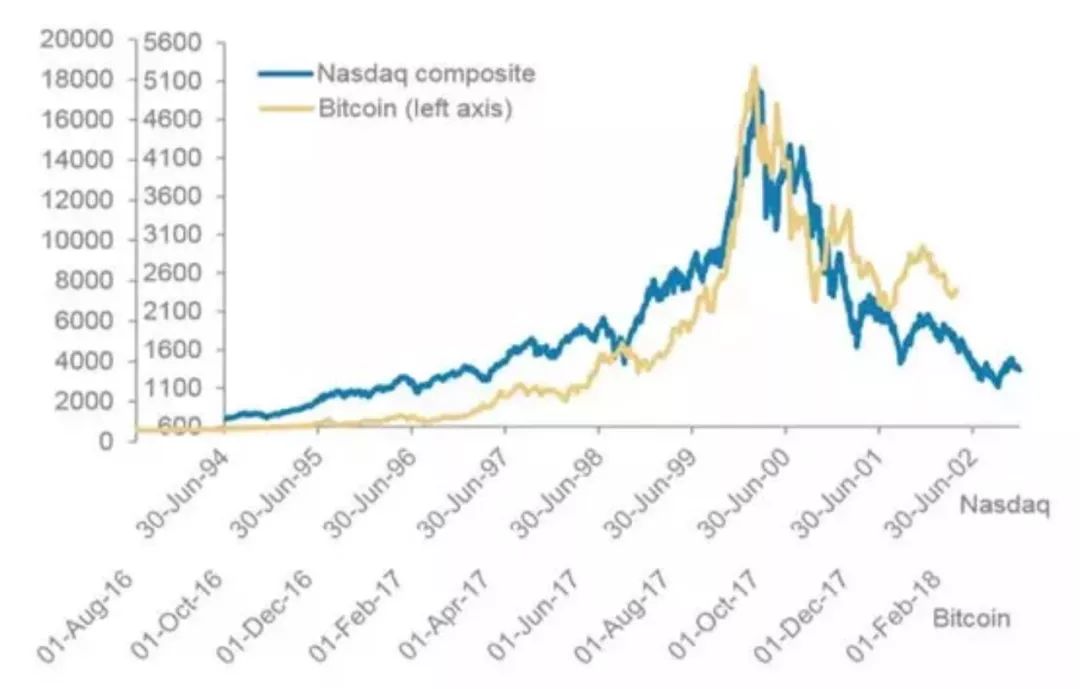

Digital currency has experienced this decade from no market to market. It has already entered the global mainstream investment market. In the future, there will be more new innovative technologies and mechanisms in the blockchain field until time. The intrinsic value will also rise more than the stock market value of most sovereign countries! If you don't believe that it will always be so small, you should learn quickly, integrate, and verify when that day comes.

Fortunately, no matter what posture you are in, you always enter the industry, and this industry requires you to be omnipotent. Emerging industries are always so impetuous. There are only a few heroes in the so-called "chaotic world". Those few are definitely not following the trend, and they are not waiting for the good fortune on your head. As for the blockchain media industry, there is absolutely no benefit in impetuousness. There are so many meetings and waste of time. Advertising is very profitable, but it hurts the brand. If there are so many meals, the so-called friends who cover you may not stay. live. How many editors can come out to achieve the level of university professors, and how many of them can be released for technical presentations? Last year, at the Media Responsibility Forum, some people shouted out loudly: "Now the Chinese media are all emotional, and few are in-depth analysis!!!" Three exclamation points

In fact, the media industry, the retail sector, can cultivate a true economist! The British Economist magazine, more than 100 years: the Bank of England has two presidents, the editor can be directly the governor of the Bank of England, or as a professor of Cambridge. "The Economist" legendary editor Walter Bagehot put forward the concept of the central bank acting as the "final lender", also known as Bagehot's Dictum, an all-around player in multiple fields.

Only the cross-border elite can see the truth. I don't believe in closed things, let alone the blockchain itself is an open gesture.

Finally, end the article with the words of a cryptographer Eric Hughes, because this sentence contains the fusion and consciousness:

"All crypto is economics."

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- New York Financial Services Agency: Why do we refuse to issue BitLicense to Bittrex

- John McAfee: I know who is Nakamoto.

- India's central bank issued a regulatory sandbox report to support blockchain innovation testing

- It is not BCH that beats BSV, but the currency security?

- Informed: Bakkt is applying for a license license from the New York financial regulator

- Local maximal paradox: Is the securities pass permit chain not feasible?

- QKL123 Research Report | DPOS algorithm's leading coin grapefruit, will the market surpass Ethereum?