Getting started with blockchain | USDT off-market price is more than 7 yuan, why is unstable currency unstable?

In many people's impressions, stable coins should be stable in price and not affected by market fluctuations. Recently, however, many people have found that USDT's over-the-counter price has exceeded $7, and the premium rate has exceeded 4%.

Why is the stable currency unstable? Today, let's talk about the reasons and the associated risks.

01 USDT essence is a commitment of the company

Stabilizing coins, as the name suggests, is a token that maintains a stable exchange ratio with a certain target. In the tweet before the vernacular blockchain, "What is Stabilizing Coin and What is the Relationship with Legal Digital Money?" , we introduced three main ways to stabilize the currency to maintain the stability of its value:

1. Maintain stable value through “legal currency mortgage”;

- Understand the decentralized identity: Where is the bottleneck? Which solution is right?

- Gu Yanxi: The SEC's supervision

- Babbitt Column | Blockchain: Innovations Based on Cryptography

2. Relying on “digital asset mortgage” to maintain stable value;

3. Rely on algorithms to ensure value stability.

The USDT is the first way to maintain the stability of its value. The USDT is issued by the centralized Tether company. Tether promises to strictly abide by the 1:1 reserve guarantee, that is, for every USDT issued, the bank account will have 1 US dollar as the guarantee, and the user can fund the Tether platform. Query to ensure transparency.

Despite this, due to imperfect laws and regulations and regulatory measures, Tether's bank account really has sufficient margin, and many people are skeptical. Therefore, in a strict sense, the USDT cannot even be called a bond issued by Tether. It can only be said to be a promise.

02 USDT is not very stable

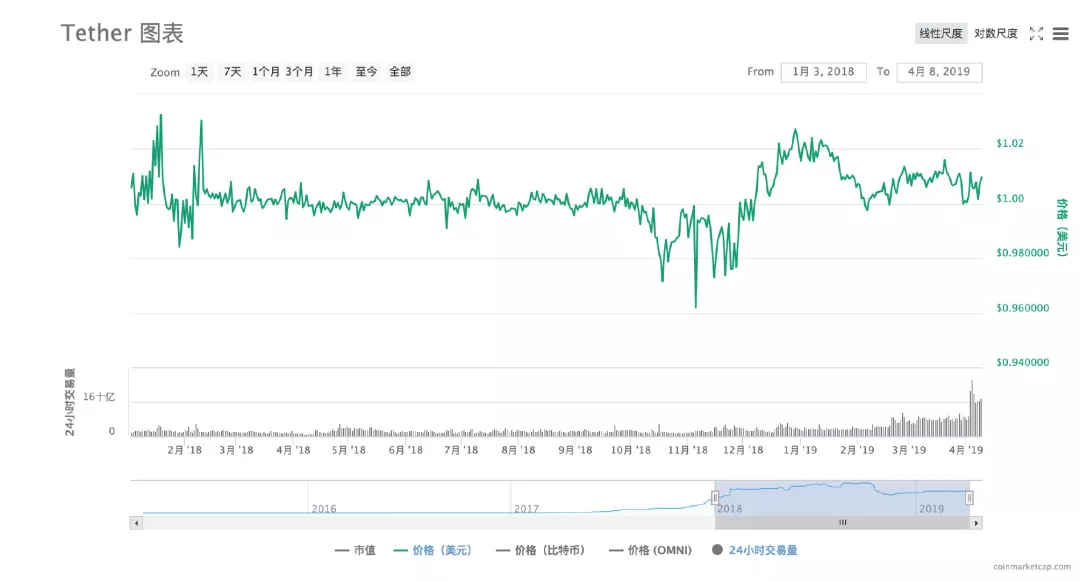

Although it is the stable currency with the largest market share, the USDT has always been unstable. The chart below shows the USDT dollar price curve from January 1, 2018 to April 8 this year:

In theory, because 1:1 is anchored with the US dollar, the price of USDT should be a horizontal straight line , but we can see from the above figure that the actual performance of USDT has been unstable.

So, what are the reasons that may cause the stable USDT to be unstable?

The first factor affecting the price of USDT is the supply and demand relationship of the market. This is easy to understand. When the supply exceeds demand, the USDT premium rate is low or even a negative premium; when the supply exceeds demand, the premium is high.

So, when is the gap between supply and demand likely to be large, that is, the USDT premium rate is obvious? Generally speaking, when the market is hot, the funds outside the market continue to enter the encryption world. As an import, the USDT naturally grows rapidly, and there will be a high premium in the short term. When the market declines sharply, many investors need to convert Token into stable or legal currency for hedging. At this time, depending on the demand changes, USDT may be a premium or a negative premium.

Some platforms offer lending services that can borrow USDT from the platform by collateralizing Token assets. When some projects are hot, some people will choose to borrow USDT from the platform, resulting in a short supply of USDT in the short term.

In addition to supply and demand, some rumors from Tether will also affect USDT prices. For example, on October 15 last year, an article by Bloomberg said that “If the government authorities began investigating Tether’s wrongdoing, USDT would soon lose value.” Due to the news, USDT was sold wildly by investors, and some platforms were short. Dropped 11% in time. On November 2nd, Tether finally announced the deposit certificate issued by the Deltec Bank & Trust Bank of the Bahamas, "positive response" rumors.

03 Summary

Stabilizing coins is a bridge between the real world and the encrypted world, and its importance is self-evident.

The USDT is the stable currency that Tether has issued and has the largest market share, but its price has been not stable. The main influencing factors are supply and demand and rumors about Tether. But in the final analysis, the biggest risk of USDT is that it is essentially a promise of Tether.

Of course, more and more stable coins have emerged in the encryption market, and there are also many TUSD and GUSD with high transparency and legality.

The recent USDT premium mentioned at the beginning of the article is very high. What factors do you think are caused? Feel free to share your opinion in the message area.

Author | Fangfang produced | vernacular blockchain (ID: hellobtc)

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis | Giants (BTC, ETH, XRP, etc.) are stalled in other hot currency currencies

- Will Hong Kong be a paradise for blockchain? Read the current situation of Hong Kong's speculative currency

- Only when there is no cold winter, the industrial blockchain era has arrived.

- Bitcoin Bifurcation Main Cause: Extending Attacks Caused by ECDSA Algorithm Vulnerabilities

- Iran mining, a thrilling "money game"

- White hat hackers are quietly emerging: repairing 20 cryptocurrency vulnerabilities in a month and winning $23,675

- People's Daily issued a message: Blockchain allows data "who owns, who benefits"