Analysis | Bitcoin's dual structure breaks at the same time, and $ 8,000 has become a thing in the bag?

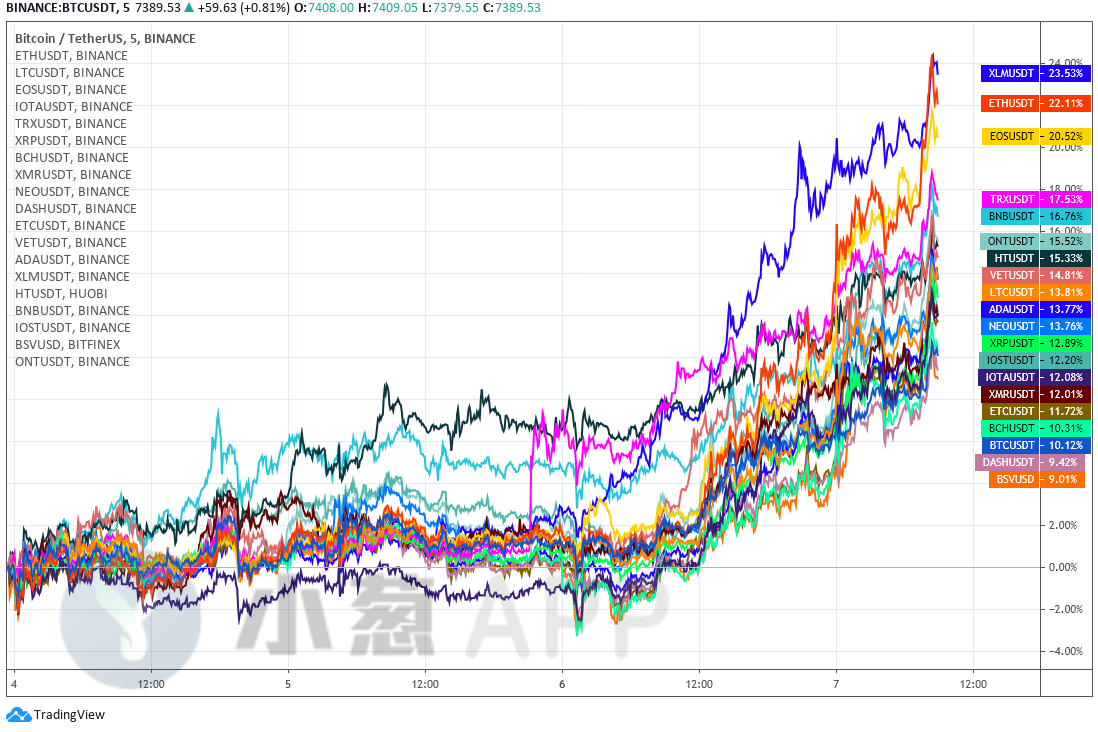

The mainstream currencies represented by BTC rebounded quickly in the short term. Almost all the currencies covered by the heat map in the past three trading days have achieved a staged increase of more than 10%. The leading currencies such as XLM, ETH, and EOS have generally prevailed during this period. It has risen by more than 20% and mainstream currencies have averaged an increase of nearly 15%. BTC has also regained the 7000 integer mark with a considerable increase of more than 10%. The further breakthrough expectations that were concerned in the second half of last week are gradually being realized. The market The overall atmosphere quickly picked up.

BTC

After completing a quick breakthrough on the upper rail of the triangular structure marked in the figure below last week, the market once entangled laterally within the range of 6680-7000 for more than two days, although the market has been three consecutive times after this wave of upward breakthroughs in key resistance The impact of 7000 integer support was unsuccessful, but as the 4-hour 50-period moving average continued to rise and the market also showed a very strong stabilization and toughness around 6680, the market has maintained a long and short balance during the shock of the narrow box. The rapid breakthrough of the resistance of 7000 integers completed yesterday and the rapid step-back stabilization judgment in the 1-hour graph have become the best footnotes for this short-term acceleration of the upward trend.

In addition to the triangular structure marked in the figure below, this short-term rapid rise has also helped BTC to effectively break the resistance of the neckline of an irregular double-bottom structure since mid-March, or it can be regarded as the latest week The up-break of a cup handle structure that has been completed for a long time is confirmed, and the sideways entanglement of the previous trading days has become a classic "handle". According to the highly anticipated "cup" of this pattern, the theoretical completion target for the market after the break of 7000 can be seen above 8000.

- ETH's single-day increase is close to 20%, and mainstream coins have followed suit

- Babbitt column | Case study: Exchange "downtime", does the holder lose any compensation?

- Millions of people watched, and the entire industry participated heavily. This cloud summit is stirring the "online rivers and lakes" of the blockchain

The current short-term important support reference of the 4-hour 50-period moving average has moved up to the 6680 first line, further consolidating the effectiveness of the strong support area (6680-7000) below. It is true that in the recent wave of rising prices, the 4-hour level of 7 Lianyang has caused short-term technical indicators to generally go into the serious overbought area, but as long as the market can adhere to the 7000 integer support during the regular technical callback correction process, then Stepping back should be regarded as the most ideal multiple follow-up layout opportunity.

To put it simply, directly chasing more at the current position is not a very objective trading idea. Do n’t worry too much about the short-term market callback. After returning to the probe and giving 7000 or 1 hour level stabilization judgment, you can do more decisively Single follow-up, if there is no effective backstepping and direct upward, then it is recommended to wait for the market confirmation station to do 7620 before doing more single-chase. The first goal of multiple orders under the two ideas is the same as 8000 integers. The stronger resistance above 8000 is seen up to the line of 9190 on the box where the high flat was located in early March.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin is up 8%, and the bull market is in doubt?

- A week in review: Zhou financing event fell to 3, CMC was resigned by the founder of Binance M & A

- The Secret History of Bitcoin: The bitter Bitcoin puzzles of those years

- Yao Qian: What is the role and value of blockchain construction in epidemic prevention and control?

- 3D virtual reality social platform Sensorium Galaxy game exclusive currency then boarded the international leading trading platform

- The implementation of blockchain technology has blossomed, and the transaction scale of several banks has exceeded 100 billion yuan

- Buffett's "cutting meat" sells aviation stocks, my analysis of the future investment market