Analysis of the global volatility index (VIX) rose, the bitcoin bull market is coming?

Key point overview

- The data shows that the correlation between BTC price and Volatility Index ( VIX ) is close to the annual high;

- Global economic uncertainty pushes up VIX and may create more opportunities for the digital asset market;

- Investors are advised to refer to the correlation data of relevant financial indicators before making investment decisions.

Overview

August was a turbulent month for traditional financial markets and digital asset markets. Recently, the decline in bond yields and the reversal of the yield curve have been widely discussed. The potential economic recession may lead to large fluctuations in global stocks, foreign exchange and commodity prices, and bitcoin and digital assets have not been spared.

It is worth noting that in addition to the strong correlation between BTC and gold, the correlation between BTC and the Chicago Board of Trade (CBOE) Volatility Index ( VIX ) has become increasingly close.

The uncertainties brought about by the Sino-US trade war, the Brexit, and the geopolitical tensions have made the possibility of volatility rising in the medium and long term. In these uncertainties, how do we make full use of the relevance of the index to make more reasonable BTC investment decisions?

- In-depth data reporting | Global digital currency market activity status

- QKL123 blockchain list | Market value continues to concentrate, domestic media is hot (August 2019)

- Is the opportunity for Bitcoin coming? Global $17 trillion negative-yield bonds allow more investors to vote for Bitcoin

What is the Volatility Index (VIX)?

The Volatility Index or VIX, created by the Chicago Board Options Exchange (CBOE), is a real-time market index that tracks the implied volatility of the 30-day S&P 500 package option and is also a “panic indicator” or “panic index” on Wall Street.

- A higher VIX indicates that traders expect the S&P 500 to be more volatile and more stressful.

- A lower volatility index indicates that option traders expect the S&P 500 to be less volatile and more stable.

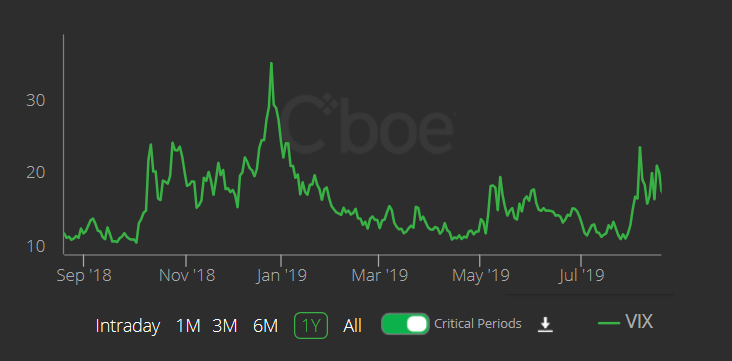

Under the dual pressure of more Sino-US trade relations and global economic recession, VIX broke through 24 on August 24, and then VIX fell back to 18 with the easing of trade negotiations and the discussion of global economic stimulus policies.

Figure 1: Chicago Board Options Exchange (CBOE) Volatility (VIX) Index, Source: CBOE

Bitcoin's relevance to VIX and other indices

Before we studied the correlation between BTC and gold, BTC is a leader in digital assets. Its inherent characteristics make it a risk hedging tool and a safe-haven asset. We also believe that some specific properties of BTC are also recently promoting its new Part of the momentum of a round of gains.

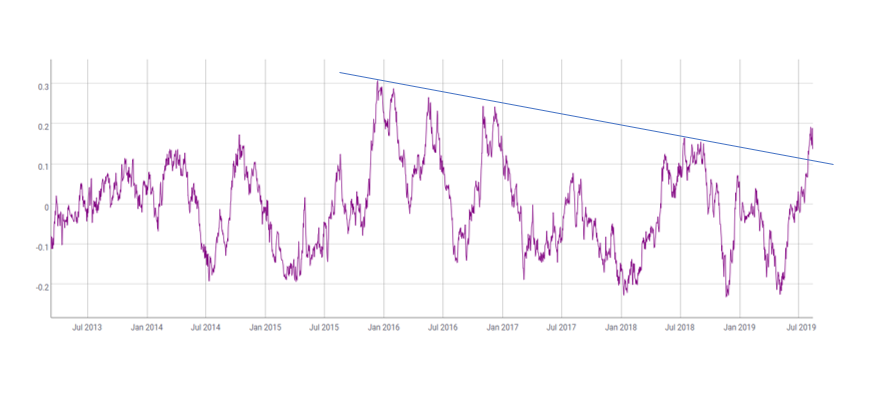

In addition to the correlation between BTC and gold, we also noticed that VIX is more and more relevant to BTC. Figure 2 shows the rolling history data of BTC and 90-day VIX correlation, and the correlation coefficient is close to +0.2. Although this figure is not very good, however, considering the high degree of uncertainty in global economic development, breaking through the new coefficient may form a new round of positive correlation trends. The correlation between the BTC and the VIX index is approaching the highest point since January 2017. The correlation coefficient between VIX and BTC reached +0.3 in December 2015. At the same time, the S&P 500 index plummeted to 1880, while the BTC price rose from $300 to $500.

Figure 2. BTC-VIX revenue rolling correlation (90 days), source: coinmetrics.io

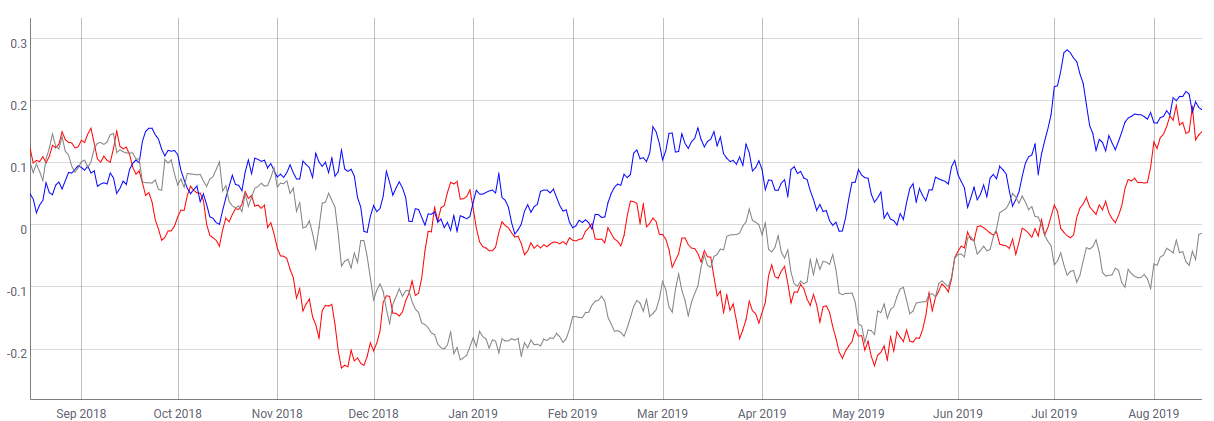

Despite the growing correlation between BTC and VIX, the relevance of BTC to gold remains high. Figure 3 compares the correlation between BTC/VIX, BTC/Gold, and BTC/US dollar indices. The yellow line and the red line are basically in a positive correlation area in 2019, and the correlation between the US dollar index and BTC is in a negative correlation area, that is, there is no correlation.

Figure 3: BTC-VIX (Red) / BTC – Gold (Blue) / BTC – US Dollar Index DXY (Gray) Yield Rolling Correlation (90-day), Source: coinmetrics.io

Figure 3: BTC-VIX (Red) / BTC – Gold (Blue) / BTC – US Dollar Index DXY (Gray) Yield Rolling Correlation (90-day), Source: coinmetrics.io

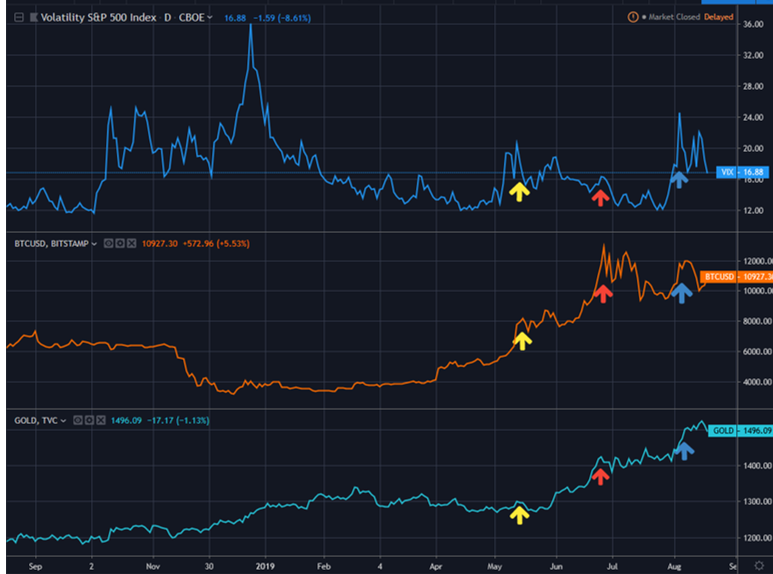

Interestingly, the correlation between the price performance of these assets and the index is self-evident. We can see that the correlation of these indices is gradually increasing. From the arrow in Figure 4, the correlation becomes more apparent after the second quarter of 2019. The correlation between VIX and gold and BTC is mostly positive, while the US dollar index ( DXY ) and BTC show a certain negative correlation.

Although it is still too early for risk-averse investors to believe that BTC is a safe investment, recent veteran investor Mark Mobius believes that rising digital assets will increase investor demand for hard assets such as gold. Mobilis once called BTC fraud, but he recently changed his view that BTC and other digital assets will survive in the future.

Figure 4: One-year dynamic table of VIX, BTC, Gold and US Dollar Index, Source: www.tradingview.com

Traditionally, the US dollar index ( DXY ) has an inverse relationship with gold, which is also negatively correlated with VIX and commodities. Although BTC and digital assets are a broad asset class, they are still emerging assets for traditional financial markets, and its long-term relevance to traditional assets remains to be determined. However, in the face of global low inflation and stagnant growth, traditional fund managers seeking higher return on investment have become more challenging, and many have turned their attention to the digital asset industry. To be fair, digital assets are more likely to be closer and closer to traditional financial assets than to go further.

At the end of January 2018, Masao Muraki, global financial strategist at Deutsche Bank, emphasized the growing correlation between digital assets and VIX. In a report to clients, Muraki said, “The relevance of these indices is related to the current low volatility environment, prompting many investors to move to more risky assets such as digital assets in order to achieve higher return on investment.”

Check your data

You may have noticed that the BTC-VIX correlation in Figure 2 has been changing, from a low of -0.2 to the current +0.3, which means that investors can't make investment decisions with just one perspective or with the same index correlation. For example, as early as 2018, BTC and VIX showed a reverse correlation in 2018, and the correlation between them was also changing. Therefore, the ideal strategy is to use aggregated data, such as combining other correlations, exchanges, or asset flow data to make positive decisions.

in conclusion

In the macro environment with extremely low interest rates and highly uncertain global sustainable development, the increase in market volatility is a more reasonable forecast. We have reviewed the relevance of VIX and BTC and compared their relevance to other assets and indices. VIX will be another reference indicator for BTC investors and traders to discover trends in digital asset markets. However, the relevance of BTC-VIX does not mean rushing to invest in BTC, but rather one of the signals that are increasingly mainstream in digital asset trading and investment.

Risk Warning: All articles in OKEx Research do not constitute investment recommendations. Investment is risky. Investment should consider individual risk tolerance. It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

Welcome to reprint, please indicate the article from

OKEx ( www.okex.com )

Contact Email: [email protected]

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Boxing champion Pacquiao wants to send coins, heavy punches or digging holes?

- Uncover the secrets of cryptocurrency algorithm trading

- Ethereum is recognized by Islamic scholars as "halal certification", and the digital currency is also halal.

- The price is about to break through? Senior trader said: BTC has entered the fourth round of the rising cycle

- Confession of a Bitcoin Mania Powder: Why do I only recognize Bitcoin?

- Why did Ethereum 1.0 fail and Bitcoin succeeded?

- USDT, DAI, Libra, do we really need so many stable coins?