April blockchain financing monthly report: the amount decreased by 69.7%, the Chinese and American Qi cooled

In April 2019, the global blockchain investment and financing market cooled sharply.

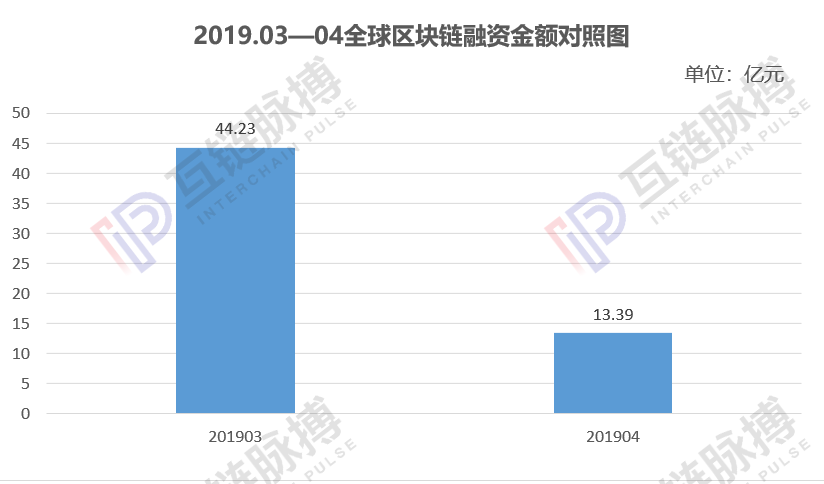

According to the incomplete statistics of the Inter-Chain Pulse Institute, in April 2019, a total of 37 financings were obtained in the global blockchain field. The number of projects was close to March, but the total financing was only 1.339 billion yuan, a decrease of 69.7% from the previous month.

Judging from the disclosure, the number of projects that did not disclose the specific financing amount in April was five more than in March, which affected the accuracy of the financing amount statistics in April to a certain extent. However, from the perspective of the overall financing environment, the enthusiasm of the blockchain capital market has been gradually cooling after the gradual warming of the previous months.

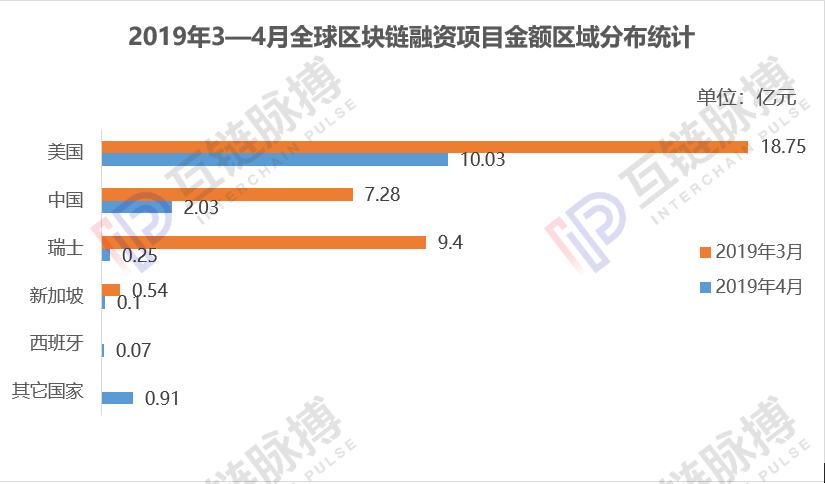

This is evident from the financing performance of the two block forces in the global blockchain capital market, China and the United States in April.

- Countdown to 10 days! Xiao Feng confirmed to attend the Hangzhou Blockchain Week, I am waiting for you in Hangzhou!

- Wanchain Galaxy Consensus Exploration 02 – Random Number Generation Algorithm

- 2019 blockchain technology trend analysis and outlook blue book

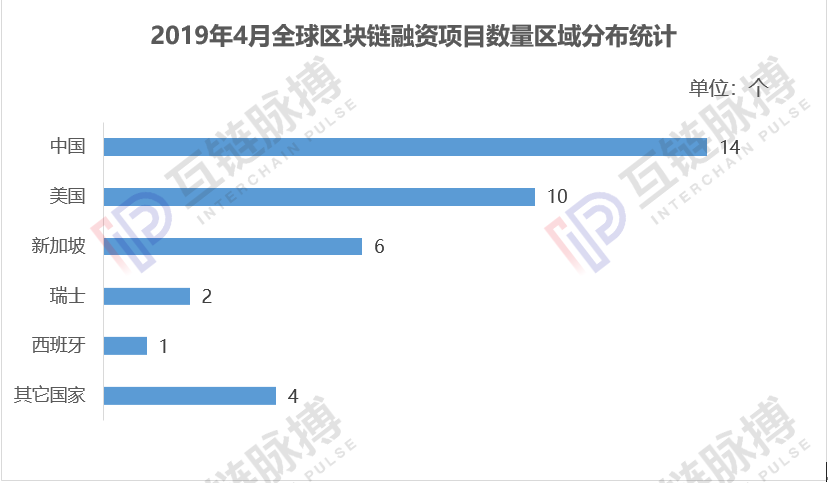

In the 37 financing events in April 2019, although the domestic blockchain financing project was as high as 14 times, the financing amount was only 203 million yuan, a decrease of 72.1% from the previous month; while the United States had 10 blockchain projects. Financing, financing amounted to 1.003 billion yuan, a decrease of 46.5% from the previous month.

Mapping: Mutual Chain Pulse Research Institute

Mapping: Mutual Chain Pulse Research Institute

Mapping: Mutual Chain Pulse Research Institute

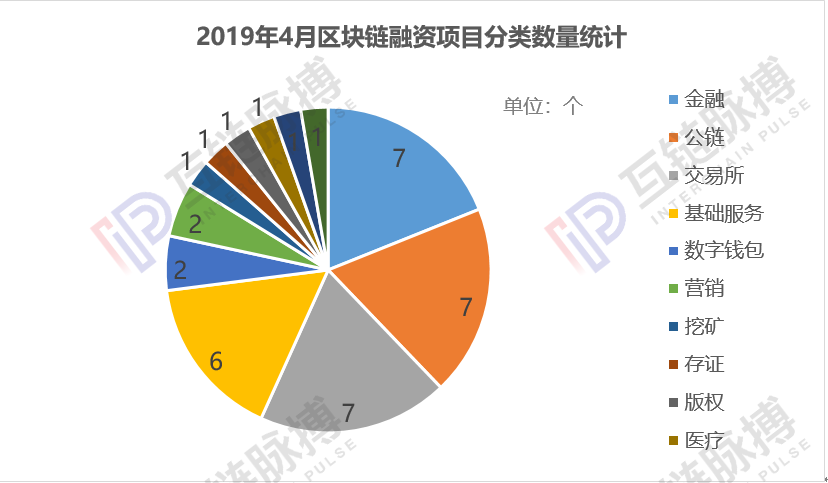

In terms of industry distribution, the most popular blockchain project in April is still focused on the financial sector. Statistics from the Mutual Chain Pulse Institute show that in April 2019, a total of seven financial projects were financed, with a cumulative financing amount of more than 566 million yuan, accounting for 42.27% of the total financing in April.

Among the financial projects, the largest amount of financing was Celo, a US cryptocurrency payment service provider, which seized US$25 million (approximately RMB 168 million) in April. This was followed by the US retailer payment network Flexa project and the digital payment and compliance platform Alt Thirty Six, which received $14.1 million and $10 million in financing, respectively.

Mapping: Mutual Chain Pulse Research Institute

In April, there were fewer financial projects that were financed in China. Only the decentralized gold application project, Zengold, received $4 million (about RMB 27 million) in financing.

In addition to financial projects, the blockchain basic services sector has become the second largest area of capital optimism. Statistics from the Mutual Chain Pulse Institute show that in April 2019, a total of six projects in the blockchain basic services sector were financed, with a total financing amount of approximately 499 million yuan.

In the blockchain basic services sector, the US Trusted Key and O(1) Labs projects received $50 million (approximately RMB 373 million) and $15 million (101 million yuan) of large amounts of financing, respectively. In China, the small fish blockchain, which focuses on blockchain technology R&D and application services, also received a financing of 32 million yuan.

In addition, public chains and exchanges are still optimistic about the capital market. In April, seven projects in each of these two areas received financing, but the amount of financing was not large, respectively, of RMB 54 million and RMB 64 million.

Public chain projects are mainly concentrated in China and Singapore. Of the seven public chain financing projects in April, China accounted for four, namely NULS, Ladder Network, Unitopia and NISUS, of which Unitopia has the highest financing amount, with a financing amount of US$5 million (approximately RMB 34 million). Of the three projects in Singapore, only BACC has disclosed the specific financing amount, which is about 10 million yuan.

Mapping: Mutual Chain Pulse Research Institute

Among the 7 projects in the exchange field, 4 projects did not disclose the specific financing amount. Among the remaining 3 projects, the US Sparkswap exchange received $3.5 million in financing, UBI.Bi in Hong Kong, China and ZBX in Malta. .COM has received millions of dollars in financing.

This article is [inter-chain pulse] original, the original link: https://www.blockob.com/posts/info/13639 , please indicate the source!

Author: Mutual Research Institute pulse chain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Does Buffett still have enough bitcoin? I have already written annoyed.

- Inventory: A-share blockchain concept stocks are over 70% profit, less than the overall performance of listed companies

- Want to get a strategic investment in a public-chain eco-fund, what do developers need to know?

- It’s faster than expected! Why is Facebook eager to launch stable coins?

- Trump has a finger, how will the currency market go?

- Blockchain changer, UPE resonance starts strong

- Find this bus! The Wenkleworth brothers launched the 1 BTC challenge