Inventory: A-share blockchain concept stocks are over 70% profit, less than the overall performance of listed companies

On April 30, the 2018 annual report of the A-share listed company officially closed. PAData analyzed the performance of 61 blockchain concept stocks in Straight Flush and Wind and found that compared with 20% of the 2018 blockchain concept stocks in the 2018 report, the annual report disclosed that only 20% of the blockchain concept stocks in 2018 Profit, and nearly 40% of companies' profitability slowed down. Most companies are making efforts in the second half of the year, and their profit performance is better than the first half.

Although the media is the industry with the widest blockchain in addition to computer applications, the 50% blockchain concept media companies are losing money, and the most profitable companies are still light asset companies.

Over 70% profit exceeded 70% in the second half of the year

Judging from the total revenue and net profit performance of 61 A-share blockchain concept stocks, 46 companies achieved profitability in 2018, accounting for approximately 75.41%. The remaining 15 companies accounted for a loss of approximately 24.59%. In contrast, according to the published 2018 annual report of the Shanghai Stock Exchange and the Shenzhen Stock Exchange, about 90% and 85.48% of listed companies achieved profitability. The A-share blockchain concept stocks are significantly lower than the overall performance of listed companies.

- Want to get a strategic investment in a public-chain eco-fund, what do developers need to know?

- It’s faster than expected! Why is Facebook eager to launch stable coins?

- Trump has a finger, how will the currency market go?

From the year-on-year growth of net profit, 28 of the 61 listed companies achieved positive net profit growth, accounting for 45.90%, and net profit of 33 companies increased negatively, accounting for 54.10%.

Among the 46 companies that achieved profitability, 28 companies achieved profitability while net profit increased year-on-year, accounting for 60.87%. The remaining 18 companies were profitable, but their net profit declined year-on-year. 39.13%. This means that in fact, nearly 70% of the 70% of profitable companies are slowing down.

What is more noteworthy is that the 15 companies with performance losses all have negative net growth year-on-year, which means that the losses are still expanding. Three of them even entered the ST ranks in the second half of the year. They were renamed ST Ronglian, Oupu Zhiwang changed its name to ST Oupu, and Gaosheng Holdings changed its name to ST Gaosheng.

Regardless of the number of companies that achieve profitability or the growth of corporate net profit, according to the disclosure, the performance of 2018 is slightly worse than that of the 2018 mid-year report. According to PAData's earlier statistics, a total of 55 companies achieved profitability in the first half of 2018, accounting for about 90%. 38 companies achieved positive net profit growth, accounting for about 62%, accounting for 55 companies that achieved profitability. While 37 companies achieved profitability, their net profit also increased positively year-on-year, accounting for about 67%.

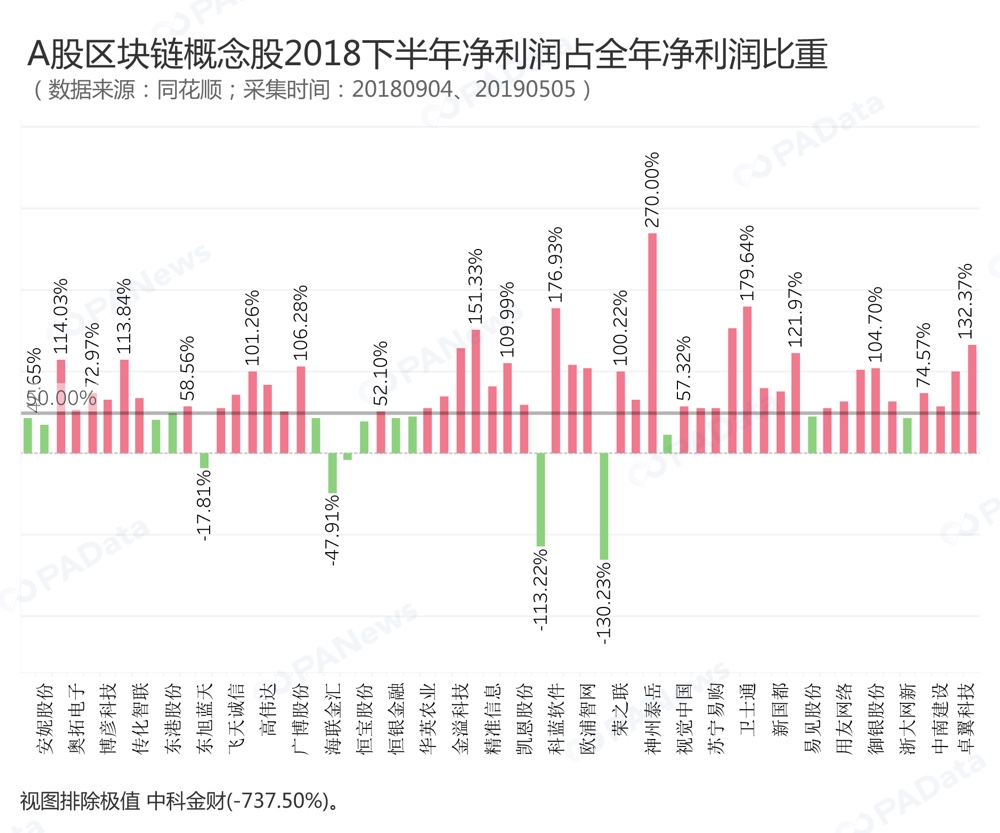

Although the related concept stocks performed better in the first half of the year, PAData statistics found that the profit performance of over 70% of enterprises in the second half of the year was better than that of the first half of the year. A total of 41 companies accounted for 50% of net profit in the second half of the year, accounting for 50% of the annual net profit. It is about 72.13%. In addition, only 17 companies accounted for 50% of net profit in the second half of the year, accounting for about 27.87%.

It can be said that most of the blockchain concept stocks are concentrated in the second half of 2018. Among them, Shenzhou Taiyue lost 136 million in the first half of the year, and achieved a profit of 0.8 billion in the whole year, equivalent to a profit of 216 million in the second half. The blockchain chain concept stocks were the most aggressive in the second half of the year.

80% of computer application companies earn half of media companies' losses

From the perspective of the industry distribution of A-share blockchain concept stocks, 33 companies in the computer industry (including computer applications, computer equipment, communication equipment) accounted for 54% of the listed companies in the blockchain sector, accounting for absolute dominance . In addition, there are 8 listed companies in the media industry that have arranged blockchain business, which is the largest sub-sector in the blockchain in addition to computer applications.

The computer industry is the most profitable industry in any industry that is involved in the blockchain concept, as the number of companies that are profitable throughout the year (ie, the number of red squares in the chart below) is a measure of the industry's profitability. Twenty of the 23 computer application companies achieved profitability, and 6 of the 7 computer equipment companies achieved profitability. Two of the three communication devices achieved profitability, with a total profitable enterprise accounting for 84.85%.

In contrast, the media industry, although there are already eight companies in the blockchain chain, but four are losing money, and the profits of the four companies are relatively meager.

In addition, the power and logistics industry is also often mentioned as an industry scenario where blockchain technology can be applied. Although there are not many enterprise chain blockchain businesses in the two A-share listed companies, there are only one and three However, the industry's profitability is relatively leading among the concept stocks. One power industry company Dongxu Blue Sky achieved a profit of 1.12 billion in 18 years. The two companies in the logistics industry saw the shares and Chuanhua Zhilian achieved profitability in 18 years respectively. Billion and 8.2 billion.

Lightweight companies are more profitable

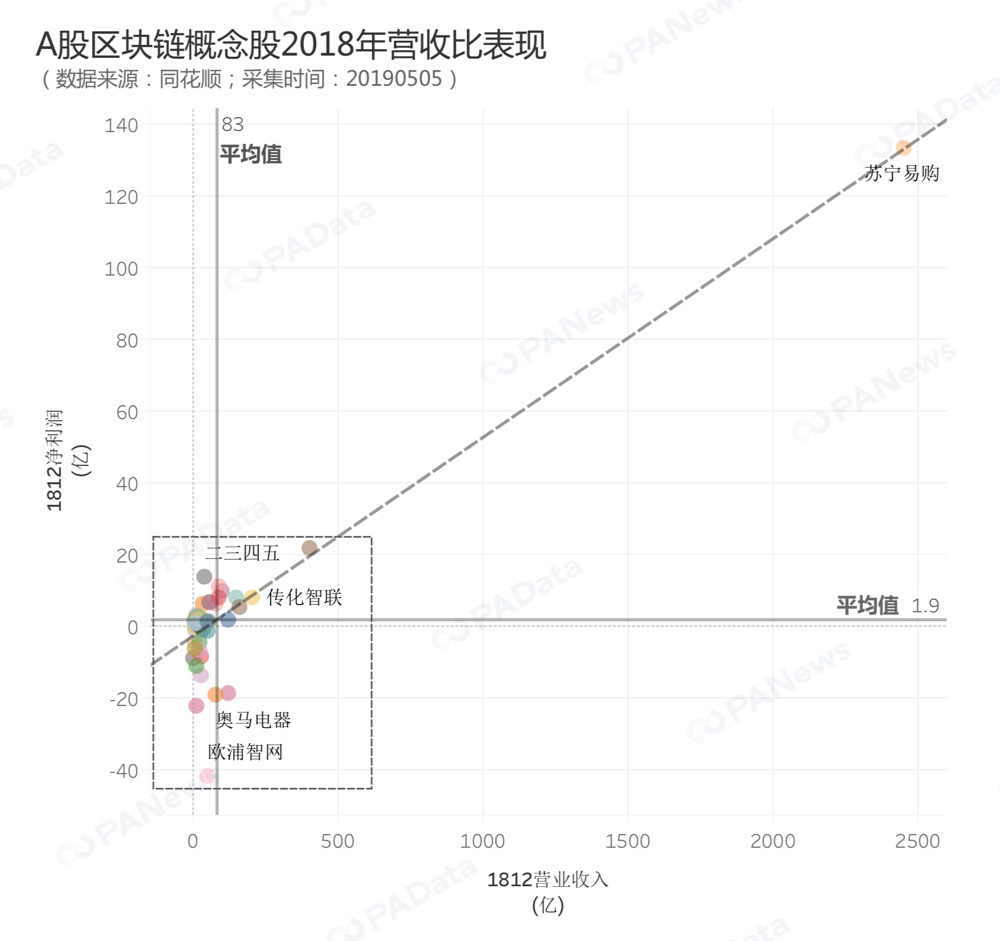

From a micro perspective, consistent with the performance of the China Daily, the blockchain concept stocks profit champion is still Suning Tesco, based in Nanjing, Jiangsu. In the blockchain segment, Suning Tesco's total revenue and net profit were the highest, reaching 244.957 billion and 13.328 billion, respectively. It is worth mentioning that in the first half of the year, Suning Tesco's net profit grew at the highest rate year-on-year, reaching an astonishing 1959%, but with the performance in the second half of the year, Suning Tesco's annual net profit growth rate was 216.38%, in the district. The blockchain concept section ranks fourth.

However, Suning Tesco, which has a large plate and large volume, is actually “heterogeneous” in the blockchain sector. Most blockchain concept stocks are mainly small-cap stocks. Therefore, a large number of enterprises were gathered in the lower left corner of the above figure. In order to more clearly observe the performance of these enterprises, PAData removed the extreme value of Suning Tesco and made a partial enlargement.

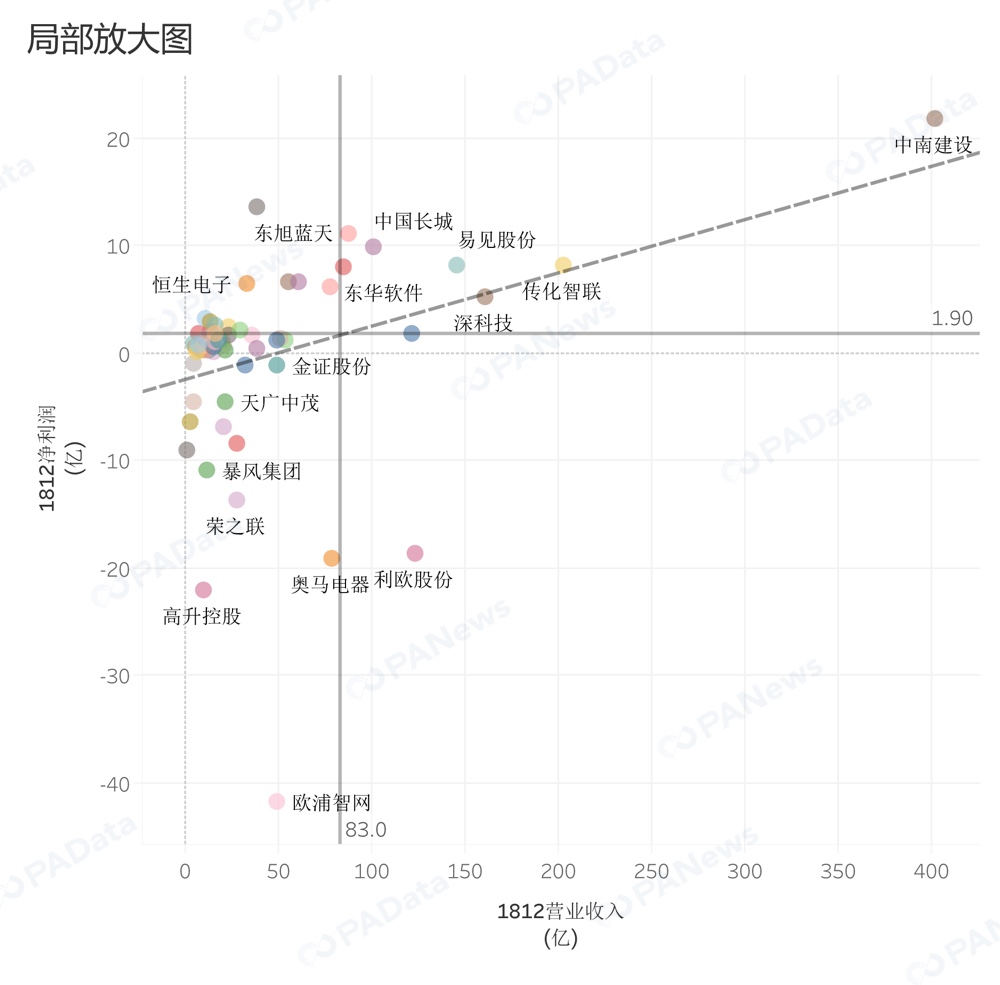

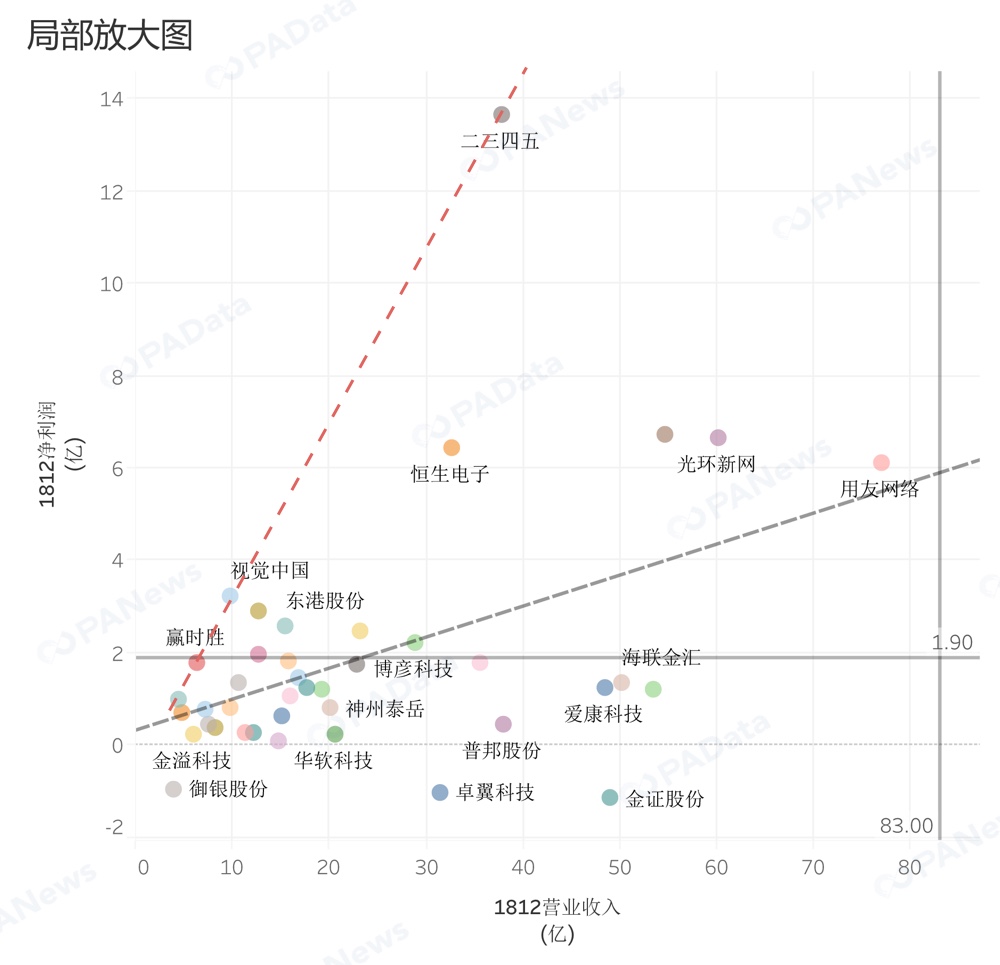

In the analysis of the mid-year report, PAData proposed that in terms of profitability and net profit performance, most of the current blockchain segments are lightweight companies based on computer applications and media industries. This view is still established in the annual report.

As can be seen from the above figure, although the traditional industries (real estate, logistics) represented by Zhongnan Construction, Chuanhua Zhilian and Yijian are strong, their cost is far higher than that of computer applications and media. Lightweight companies such as the industry, so they are dwarfed in terms of net profit.

At present, the highest net profit margin of the entire sector is still 2345, reaching 36.22%, becoming the most profitable and most efficient enterprise among the A-share blockchain concept stocks. Secondly, it was the visual China that was caught in the public opinion storm some time ago. The net profit rate reached 32.49%, and the third place in revenue capacity was win-win, and the net profit rate was 27.86%.

If you connect the three points of 2,345, Vision, and Win-Win in the partial enlargement, you can find that the slope of this line (the red dotted line in the above figure) is much larger than the entire plate (except Suning Tesco). Outside the line of correlation between operating income and net profit (ie, the grey dotted line in the figure, but not strictly statistically significant). This also explains from the side that the gap in corporate profitability in the entire A-share blockchain concept is very large.

(Source: PAnews)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain changer, UPE resonance starts strong

- Find this bus! The Wenkleworth brothers launched the 1 BTC challenge

- Zhu Yan, a professor at Tsinghua SEM, blockchain technology can contribute to global governance

- Blockchain Weekly | Bitcoin hit a new high in the year, up to more than $6,000

- False certificate helped Wu Xieyu escape three years behind: ID card lost 99% was bought and sold, the Ministry of Public Security blockchain technology is on the road

- Half a year in the year, soaring! Will the history of Bitcoin's 7-year history reappear?

- Those things in Tether (USDT)