Arbitrage in a plunge: Coinbase discovered these 3 unusual methods

Coinbase discovered derivatives arbitrage and stablecoin speculation opportunities, which were created in the recent crash.

Despite the sharp fluctuations in the crypto market from March 12 to 13, Coinbase has identified several unusual ways to make traders profit from the chaos.

Through the "crypto arbitrage" method for derivatives arbitrage, stable currency speculation and the failure of the MakerDAO auction protocol, traders can generate considerable profits in the crash of the crypto market.

- Mu Changchun, Di Gang: Supply Chain Finance Analysis Based on Blockchain Technology

- Viewpoint: After halving, the Bitcoin network security model may need to be adjusted

- Viewpoint | Why is Ethereum a true representative of open finance?

Derivative arbitrage through "crypto arbitrage" transactions

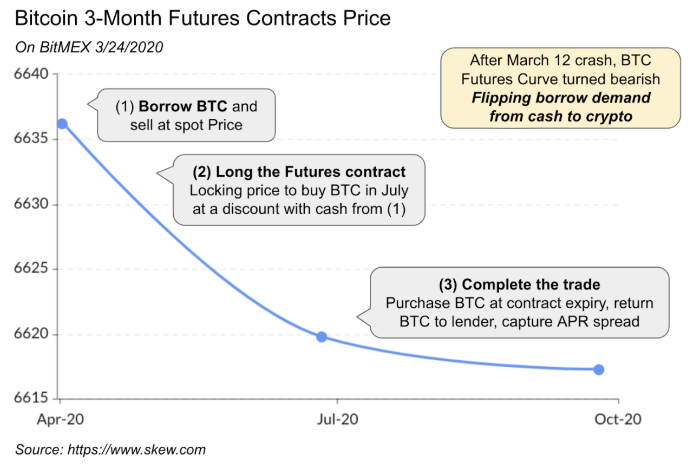

Coinbase asserted that market sentiment suddenly changed from bullish to bearish, creating opportunities for derivatives arbitrage through "crypto arbitrage" trading.

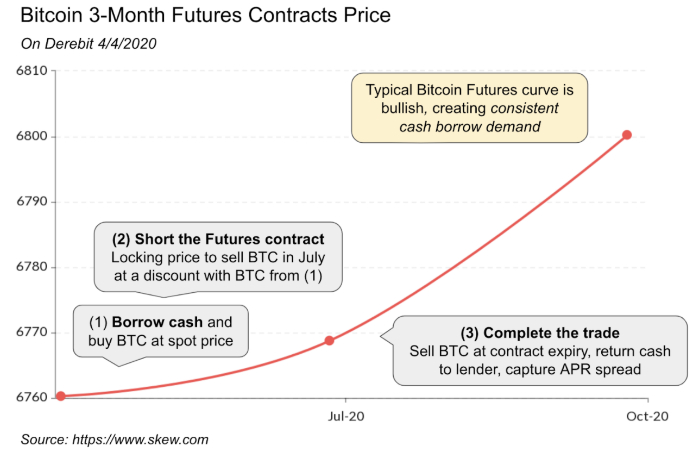

According to exchange estimates, the crypto market is usually bullish at 60% net, with futures prices higher than spot prices. Coinbase said that arbitrage through derivatives is usually done through "spot holding" transactions.

When the price of a derivative expands relative to the spot price, a trader can borrow more than one bitcoin (BTC) in fiat currency while shorting futures to lock in the profit of the spread when the futures contract expires. Because this strategy requires a large spread to cover the cost of holdings, usually during peak volatility periods, derivatives have the most opportunities for arbitrage.

As the market suddenly turns bearish, traders can do more bitcoin horizontally when selling bitcoin on the spot market to lock in profits through "crypto arbitrage" transactions during the March plunge.

Benefits for stablecoin holders

The report pointed out that as the sell-off of crypto assets escalated during the plunge, traders locked in the value of their cryptocurrencies, and various stable currencies broke the exchange rate linked to fiat currencies.

The USDC transaction price has a 2% premium, and the price of Tether (USDT) reached US $ 1.05 during the peak period of market fluctuations, but the failure of the clearing engine supporting the MakerDAO agreement caused the DAI transaction price to appear several times in a few weeks Premium.

Maker bidders buy Ethereum worth $ 4 million with a small amount of money

These difficulties created a unique opportunity for the only bidder to participate in the 3-hour Maker auction. They bought Ethereum (ETH) at a price of $ 1 per batch, and Ethereum was worth $ 4 million and was almost free .

Original link: https://cointelegraph.cn.com/news/coinbase-crypto-crash-created-rare-opportunities-for-savvy-traders

More information: CointelegraphChina / Login https://cointelegraph.cn.com

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular Science | Auditable security and approximate activity of Casper FFG

- Is the crypto lending market a time bomb?

- Micro-fiction | Economic Reversion and Human Brain Mining Machine in 2049

- Cobo second generation hardware wallet new product launch conference | Chain Node Live Room

- Lose user trust? "Black Thursday" has reduced BitMEX bitcoin holdings by nearly 40%

- Miners rushed to switch networks before Bitcoin halved, and Bitcoin's computing power continued to rise

- Completely solve the liquidity problem? Staking new game attack, traditional PoS mining pool