Babbitt Column | Pan Chao: Automated Market Maker DEX Economics

Author: Pan Chao

"If traditional exchanges are large private supermarkets, then Uniswap is a crowdfunding vending machine. "

DEX (Decentralized Exchange), as its name implies, removes all decentralizable links of traditional exchanges, from matching to clearing and settlement, and even including market making.

Generally speaking, decentralized exchanges are mainly aimed at the matching, clearing and settlement links. Pure DEX puts these two processes on the on-chain contract. Hybrid DEX often adopts on-chain settlement and off-chain matching through the server or relay layer, and compromises some centralization to support higher transaction frequencies.

- Bitcoin Secret History: How Dorian Nakamoto became Satoshi Nakamoto?

- India's central bank plans to file review of Supreme Court's crypto ruling

- Spreading epidemic is hitting global mutual trust, why is it difficult to rebuild transnational trust with blockchain

For different types of trading objects, DEX can adopt the order book mode or over-the-counter trading mode adapted to it. Regardless of the order book mode or the over-the-counter mode, the market-making (market making) link is dominated by humans .

There is a special DEX, represented by Uniswap, which will automate market makers (Automated Market Maker) and replace manual quotes with established algorithms, which not only removes centralized matching and clearing, but also eliminates market makers in transactions. It is also very popular in the extreme decentralized world.

Before understanding the nature of automated market-making DEX, we first need to know what a market maker is .

Market makers are different from ordinary traders. They are risk-neutral, with stocks in one hand and cash in one. In the order book mode, buy and sell orders are placed at the same time, with the spread in the middle. Similarly, a market maker in over-the-counter mode will make a profitable quote when a customer makes an inquiry.

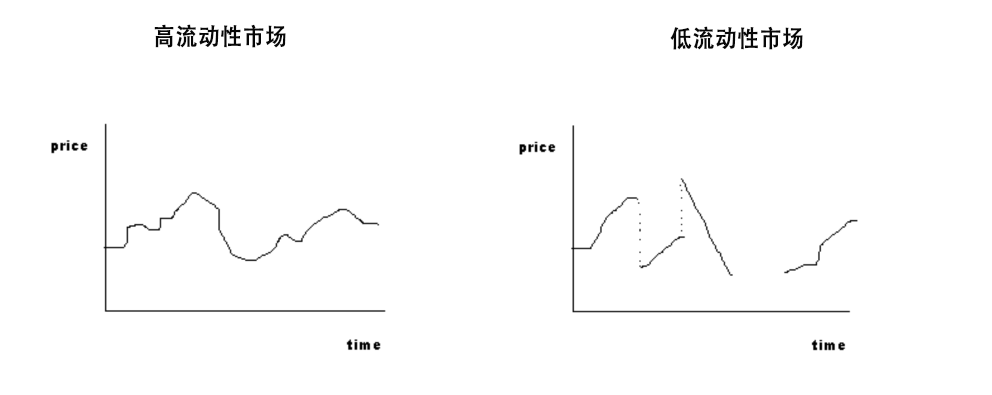

Market makers are the source of liquidity. High liquidity markets require market makers and in turn will attract large-scale market makers to participate. We often talk about liquidity. What are the characteristics of a liquid market?

A liquid market means that you can make a large purchase quickly without affecting the current price too much . Intuitively, although the market with good liquidity will fluctuate, the trend will continue to be smooth without intermittent gaps.

How can market makers still guarantee continuous prices while earning spreads? The two seem to contradict each other.

The answer is inventory .

Inventory is a time-based business. As long as the risk is within the controllable range, market makers can use the inventory on both sides to absorb short-term demand changes without changing prices. Just like large supermarkets, although the flow of people is different in the morning and evening, the price of goods does not change throughout the day, thanks to the buffering of inventory in shelves and warehouses. Wal-Mart is a highly liquid market: fast, large transactions, without affecting prices.

Wal-Mart is a unilateral market that only provides liquidity for pay. The cryptocurrency trading market is similar to the stock trading market, requiring market makers to provide bilateral inventory and maintain relative balance.

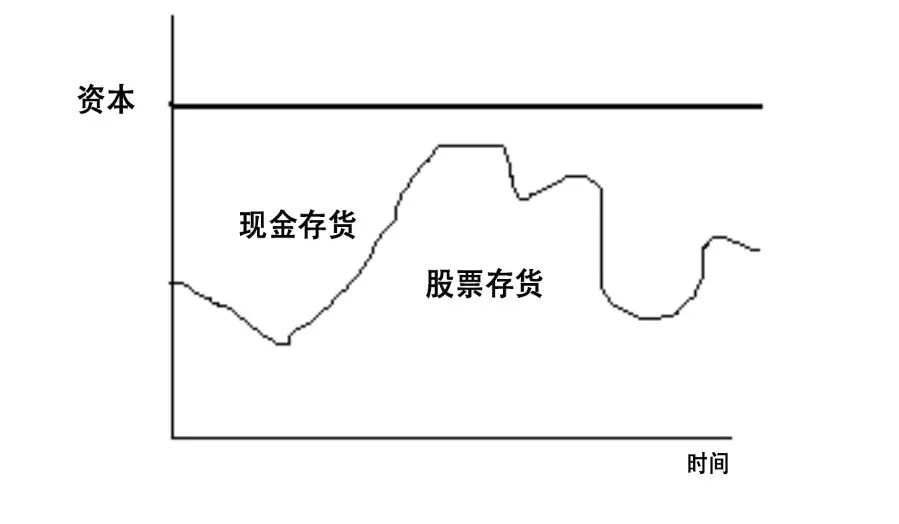

The above chart is not the price trend of a stock, but the change in the proportion of the market maker's inventory and the total capital constraint.

The market maker's stock / cash inventory ratio and stock price movements are highly coincident . When people start buying from the market maker, the stock maker's stock will decrease and cash will increase. When people are not optimistic about the stock and start selling to the market maker, the market maker will accumulate More stocks, less cash. Since own capital is limited, after the market maker thinks that the inventory on both sides is unbalanced, it will adjust the quote. If there are too few stocks, consider raising the offer to cherish the chips. If you have too many stocks, you will consider lowering the inquiry to sell as soon as possible.

Therefore, changes in inventory are the result of changes in market demand and indicators of prices, and further affect prices and supply and demand. As an analogy, the change in inventory is that the price is applied to the mirror, which will cause the price to adjust, but not the price itself.

Uniswap and other automated market-making agreements fundamentally do what they do, using this mirror of liquidity pool inventory to simulate price changes.

Everyone can join the liquidity pool, as long as the specified two assets are deposited, the system uses the "constant product" model to obtain the asset price. The "constant product" model sounds complicated, the actual principle is simple, and it is the same as the behavior of individual market makers described above- under the condition that the total capital is constant, the balance of the inventory on both sides is guaranteed. If an imbalance occurs, adjust the price. The difference is that the market maker adjusts the price change range according to its own judgment, while the automated market maker model is based on a fixed ratio.

The question is, how does the change in the fixed ratio reflect the real market supply and demand? The key is arbitrage . After each transaction, due to changes in inventory, the model will assign a new price to the trading asset. If the price deviates from the market price, an arbitrage opportunity will appear. The arbitrageur can trade at the deviated price to obtain the difference in return while making up the missing assets. Into the pool.

Uniswap is like a special vending machine. As long as someone buys the product, the price of the product will increase, and the more it is taken, the faster the price will rise [1] until the market maker and arbitrage replenish.

Unlike the traditional market maker's profit model, under this model, arbitrageurs make a difference and market makers pay dividends. Uniswap's market makers are not really market makers . They are mostly ordinary users who use their own funds. The market maker obtains a share based on the proportion of its deposited assets in the fund pool, and receives transaction fees.

In other words, Uniswap's market making process is actually a crowdfunding of a special vending machine to share profits in real time.

Crowdfunding is not without risks. Market makers need to abandon their position control on the asset portfolio and submit to a constant algorithm to change in market fluctuations. For example, suppose Alice invests 50% of ETH and 50% of Dai (US dollar stablecoin) into the market making fund pool and obtains 1% of the shares. After one month, the price of ETH has plummeted, and the market making fund pool will close at this time. After a large amount of ETH is sold and a large number of Dais are bought, the inventory ratio of ETH and Dai in the fund pool changes to 80% and 20%. For Alice, the proportion of ETH and Dai that can be redeemed for 1% of its shares will no longer be half and half, but the ratio of 80%: 20% of the fund pool at this time. Alice passively increased the price downside risk of ETH (50%-> 80%), and the probability of a month's fee income cannot hedge the loss.

Compared with large supermarkets such as traditional exchanges, vending machines placed in public places are freely available for everyone, convenient and fast, and suitable for small transactions. The limitation is that the vending machine does not have the right to price the assets. Its price basically comes from the mirror image of the price of the centralized exchange. It also relies on arbitrageurs to continuously inject funds to erase the premium.

In real life, we not only need vending machines to meet temporary needs, but also rely on large supermarkets to meet the daily needs of the general public. In the world of cryptocurrencies, automated market making DEX is an interesting part of DeFi Lego, but it cannot become the mainstream .

why?

There are two types of liquidity: market liquidity and financing liquidity. Market liquidity comes from own capital, that is, the assets on hand are sold as cash, as is the case with Uniswap's crowdfunding fund pool; and financing liquidity comes from the ability to borrow cash with future income and credit or collateral, It is modern finance.

Modern market makers do not need their own capital. They use cash to borrow stocks and stocks to borrow cash in order to achieve a balance on both sides and maximize capital boundaries. In fact, modern market makers have become intermediaries for capital . They use their balance sheets to connect various markets and earn the difference .

The link that the automated market maker DEX really removes is not the market maker itself, but the same as any blockchain application- intermediary . However, intermediaries and credit are two sides of the same coin. A market without a market maker making a difference is like losing the natural water of a porter and not reaching the best flow.

[1] Automated market making DEX such as Curve.fi adopts a smoother price curve based on Uniswap, which is suitable for transactions between stable coins.

Reference: Mehrling, Perry. 2016. “Re-Theorizing Liquidity.”

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Governance Practice of Ethereum from ProgPow Controversy

- Bitcoin developers: Increasing Bitcoin block size will affect bandwidth-limited validators

- Babbitt Column | Blockchain Simulates Capitalism, Not Democracy-On Steemit Control

- #ForkGoogle: Cryptocurrency community resists Google's "hegemony"

- Billionaire, former government official and widow of Steve Jobs, Telegram investor lineup is luxurious

- A French court ruling claims Bitcoin is equivalent to currency, recognizing it as a valuable asset

- Three indicators of bitcoin's "escape and dip"