Number said | In the first half of 2019, blockchain private placement financing of 11.851 billion yuan exceeded 60% of funds invested in the US market

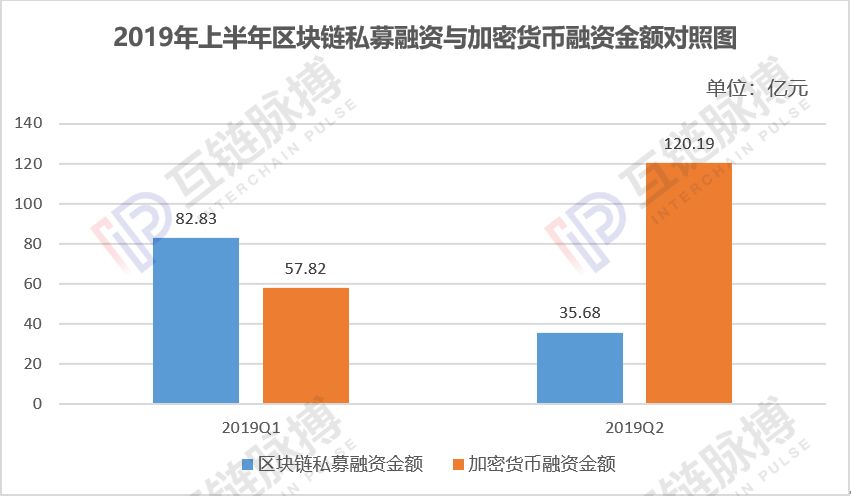

Inter-chain pulse statistics show that in the first half of 2019, the total amount of global blockchain private equity investment and financing was 11.851 billion yuan, of which the first quarter financing amount was 8.283 billion yuan, and in the second quarter it was reduced to 3.568 billion yuan. In contrast, the cryptocurrency financing market has grown to 12.019 billion yuan in the second quarter, an increase of 236.85% from the previous quarter.

In the blockchain private equity financing market in the first half of this year, the head effect became more and more obvious. From the perspective of geographical distribution, China and the United States are the two main battlefields. China has the largest number of blockchain financing projects, while the US market has the largest amount of financing, and 64% of the funds are invested in the US blockchain project. 50% of the funds are concentrated in the three major areas of cryptocurrency exchanges, finance and cryptocurrency.

(Cartography: Inter-Chain Pulse Institute)

- Attack on the big body! Goldman Sachs sets up a digital asset team or competes with Morgan

- Market Analysis: USDT issuance, BTC giant single

- Beijing Haidian District uses blockchain technology for the first time to break down information barriers

The largest amount of financing projects in the United States

Overall, the activity of the global blockchain private equity financing market in the first half of this year has significantly increased.

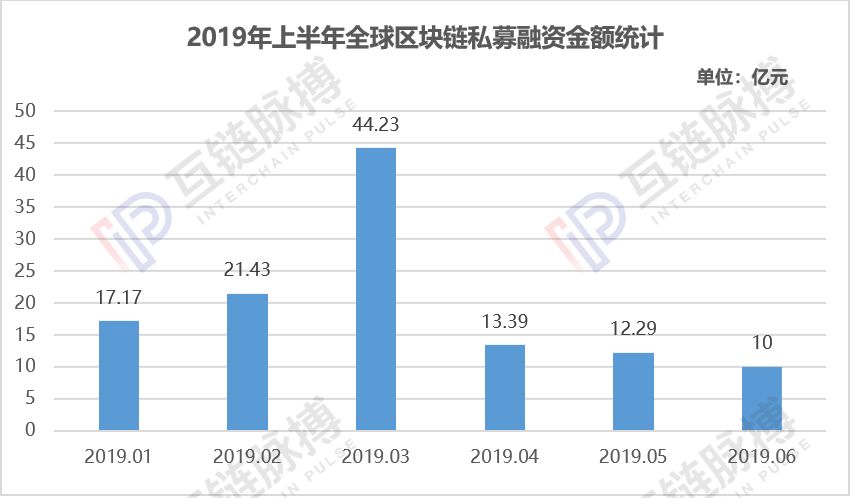

According to statistics from the Mutual Chain Pulse Institute, in the first half of 2019, a total of 191 blockchain projects were financed worldwide, with the highest peak in May, and 41 projects were financed in the month. In terms of financing amount, it reached its peak in March. The amount of financing in the month reached 4.423 billion yuan, and then began to decline rapidly. To a certain extent, it was negatively correlated with the recovery of the cryptocurrency market.

(Cartography: Inter-Chain Pulse Institute)

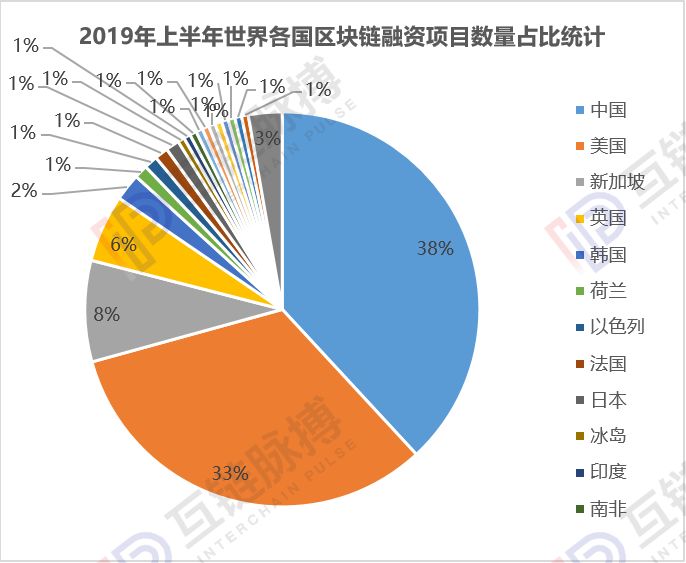

(Cartography: Inter-Chain Pulse Institute)

It is worth noting that in the global blockchain private financing market, China and the United States have been playing a leading role, but in terms of specific comparison, the development of the two is quite different. China has more financing projects than the United States, but the amount of financing is far less than that of the United States.

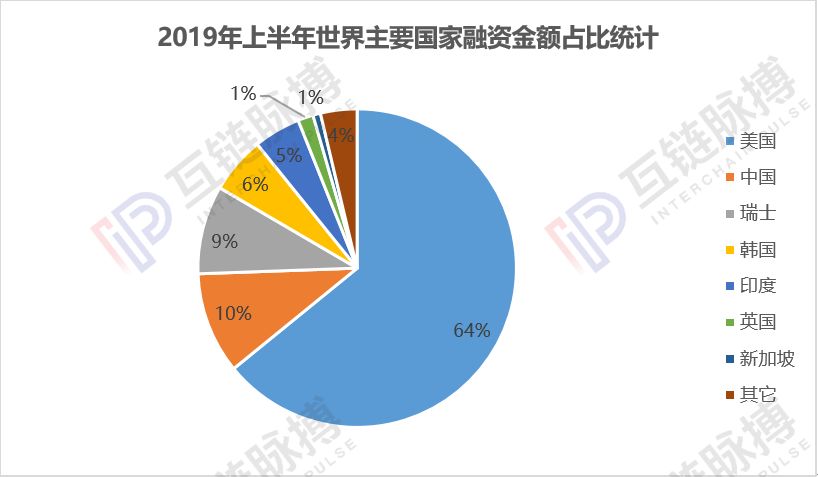

(Cartography: Inter-Chain Pulse Institute)

According to statistics from the Mutual Chain Pulse Institute, in the first half of 2019, China disclosed 69 blockchain private financing projects, accounting for 38% of the global total. The publicly disclosed financing amount was only 1.22 billion yuan; There are 59 private equity financing projects in the blockchain, accounting for 33%, but the publicly disclosed financing amount is as high as 7.6 billion yuan, which is six times that of the Chinese market.

In terms of quantity distribution, more than 70% of global blockchain private equity financing projects in the first half of this year were concentrated in China and the United States, followed by Singapore and the United Kingdom, with projects accounting for 8% and 6% respectively.

(Cartography: Inter-Chain Pulse Institute)

In terms of financing amount, the US blockchain project in the first half of this year has captured 64% of global private equity financing, while the Chinese market accounted for only 10%, followed by Switzerland, South Korea and India, respectively. 9%, 6% and 5%.

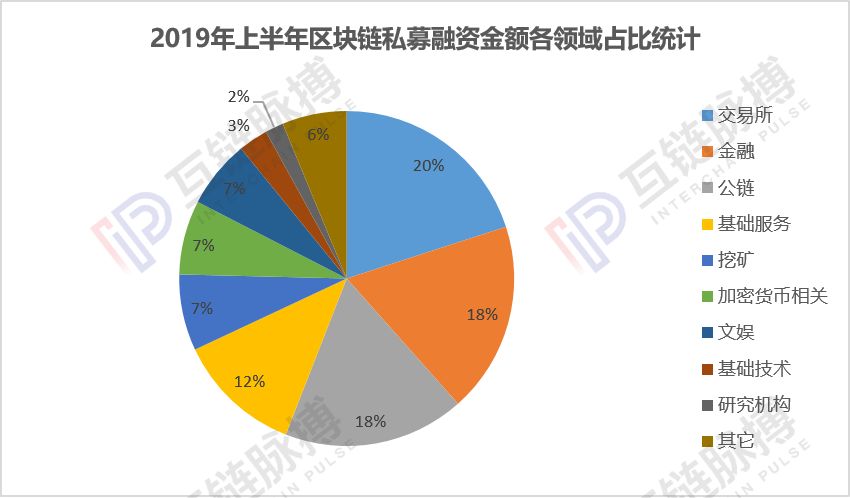

56% of funds are invested in exchanges, finance and public chains

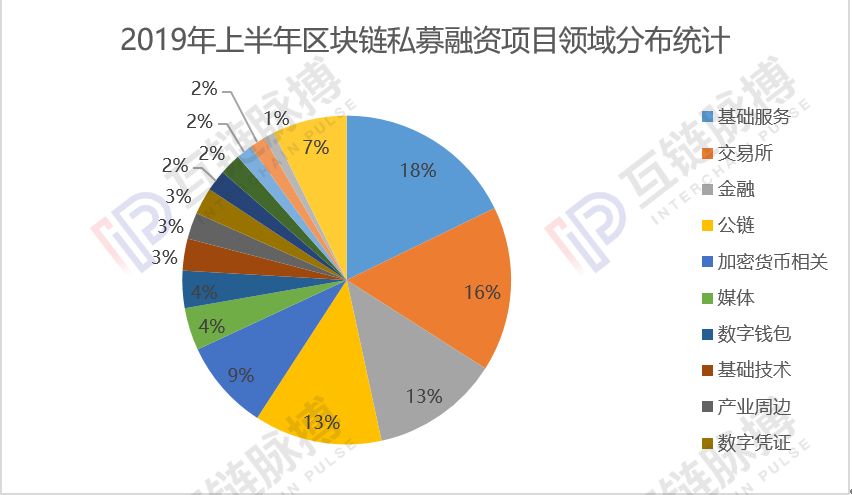

Among the 191 projects that were financed in the first half of this year, the number of basic services, exchanges, financial and public-chain projects was the largest, accounting for 18%, 16%, 13% and 13% respectively. In terms of financing amount, the exchanges, financial projects and public trusts have the highest three areas, with financing amounts of 2.371 billion yuan, 2.184 billion yuan and 2.073 billion yuan respectively, and the financing amount in the three major sectors accounted for 56%.

(Cartography: Inter-Chain Pulse Institute)

In terms of the number of integrated projects and the amount of financing, the focus of blockchain private placement financing in the first half of this year was mainly concentrated in the three areas of cryptocurrency exchange, finance and public chain, and the head effect was very obvious in these three areas. A single project for financing has contributed.

In the field of cryptocurrency exchanges, 31 projects in the first half of this year received a total of 2.371 billion yuan of financing, but the financing amount of the three exchanges of Bakkt, ErisX and BillDesk in the United States reached 1.922 billion yuan, of which the Bakkt project is It has a global financing of US$182 million (equivalent to RMB 1.22 billion).

The same is true in the financial sector. Among the 24 financing projects, including the US blockchain venture capital agency Pantera, the blockchain loan project Figure, the payment network Flexa, and the payment startup Celo, etc., the financing amount of the five financial projects reached 1.57 billion yuan.

In the field of public chain, in addition to new financing models such as ICO, IEO and STO, traditional private equity financing has become one of the financing methods for some public chain projects in the first half of this year in the context of stricter regulatory policies in various countries.

According to statistics from the Mutual Chain Pulse Institute, in the first half of this year, a total of 24 public-chain projects were financed, with a total financing amount of 2.073 billion yuan, including only 7 public-chain projects including Beam, ThunderCore, Renren, and NISCO. The amount reached 1.73 billion yuan.

(Cartography: Inter-Chain Pulse Institute)

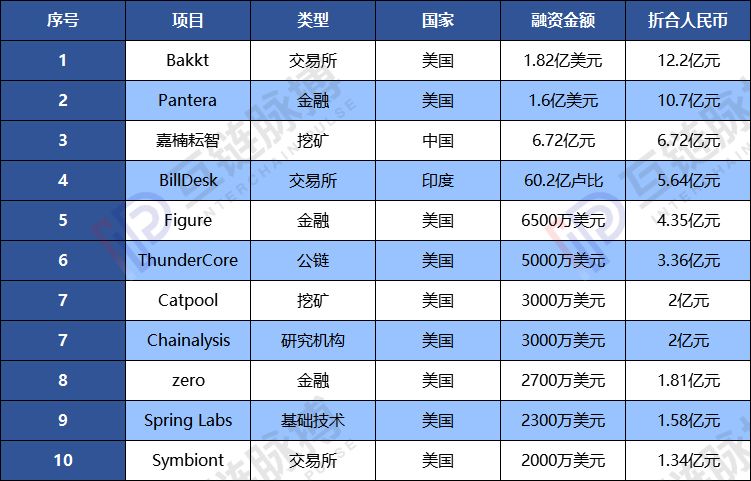

In the first half of 2019, the blockchain private equity financing top 10 in the United States accounted for 80%

According to the level of financing for a single project, the Mutual Chain Pulse Research Institute revealed that the top 10 private equity financing in the blockchain in the first half of 2019 found that 80% of the financing projects were from the United States, and most of the top 10 projects were concentrated in exchanges, finance and digging. Three major areas of mine.

Although China and the United States are the two main forces of blockchain private placement financing, the gap between China and the United States is still huge in the head project. In the top 10 list, there are 11 projects, 9 in the US, and only 1 in China.

In terms of domain distribution, exchanges and financial projects have the most, each accounting for three. Among them, the three exchanges of American Bakkt, Symbiont and India's BillDesk got a total of 1.918 billion yuan of financing; in addition, the three financial projects of Pantera, Figure and Zero in the United States totaled 1.686 billion yuan of financing.

Followed by two mining projects, China's Jia Nan Zhi Zhi and the US mining pool Catpool project together seized 872 million yuan financing.

Finally, the public chain, research institutions and basic technology projects each accounted for 1. The US public chain ThunderCore, the research institute Chainalysis and the basic technology project Spring Labs received 336 million yuan, 200 million yuan and 158 million yuan respectively.

(Cartography: Inter-Chain Pulse Institute)

Wenyu Mutual Chain Pulse · Liangshan Huarong

Unauthorized, may not be reproduced!

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Market Analysis: BTC is approaching $13,000, and short-term risk increases should not be chased

- Opinion: Why not optimistic about BitTorrent speed

- Take stock of central bank officials' important points: What is Libra's inspiration for the central bank's digital currency?

- Exchange captures EOS super nodes

- Opinion: power is power

- New York State Attorney General's Office: New Evidence Proof that Bitfinex Serves New York State Users

- New Battlefield for Encrypted Exchanges: High Frequency Trading