Three executives resign, Binance faces challenges.

Binance faces challenges as three executives resign.Author: James Cirrone, translated by Shanouba and LianGuai for blockworks

Since being sued by the US SEC in June, Binance has lost several executives. In the past two weeks, after reports of multiple Binance executives resigning, CEO and founder CZ responded to the situation. Fear, uncertainty, and doubt, or FUD for short.

“Some of our team members are taking on more important roles, and some have left Binance. Some are pursuing exciting new entrepreneurial projects. I have even introduced new opportunities to many people. We support everyone. We are a community,” CZ posted on X (formerly Twitter). He concluded the post by saying, “Ignore FUD and keep moving forward!”

The latest departing employees mentioned by CZ in the X post include Gleb Kostarev and Vladimir Smerkis.

- Bankless Partner David Burning Man Exploration – Unstoppable DAO Experiment and the World’s Largest Networked Nation

- Will Micro-Rollup be the next wave when applications become Rollups?

- One of the biggest competitors of Maestro and Unibot, how does Banana Gun perform in terms of data?

Kostarev worked at Binance for over five years, serving as the Operations Director for Eastern Europe, the Commonwealth of Independent States, Turkey, as well as Australia and New Zealand. He has resigned. Smerkis has been the General Manager for the Commonwealth of Independent States for nearly two years.

Bloomberg reported that Binance’s Head of Product, Mayur Kamat, resigned for personal reasons. Last week, Binance also lost its Head of Asia Pacific, Leon Foong. Despite CZ claiming that all these situations are FUD, industry participants and regulatory agencies still believe that Binance has been on the back foot, especially since early June 2023 when the company and CZ himself were sued by the US Securities and Exchange Commission.

The former head of internet enforcement at the US Securities and Exchange Commission said on Thursday that the departure of Binance’s leadership provides “unique and rich enforcement opportunities” for law enforcement agencies.

For law enforcement agencies, the group of former executives from a company under investigation has always been one of the best sources of whistleblowers, defectors, and informants. Former insiders of the target company can provide detailed information about potential fraudulent activities, easily identify the parties involved, guide prosecutors to other strong witnesses, and provide a large amount of documentary evidence.

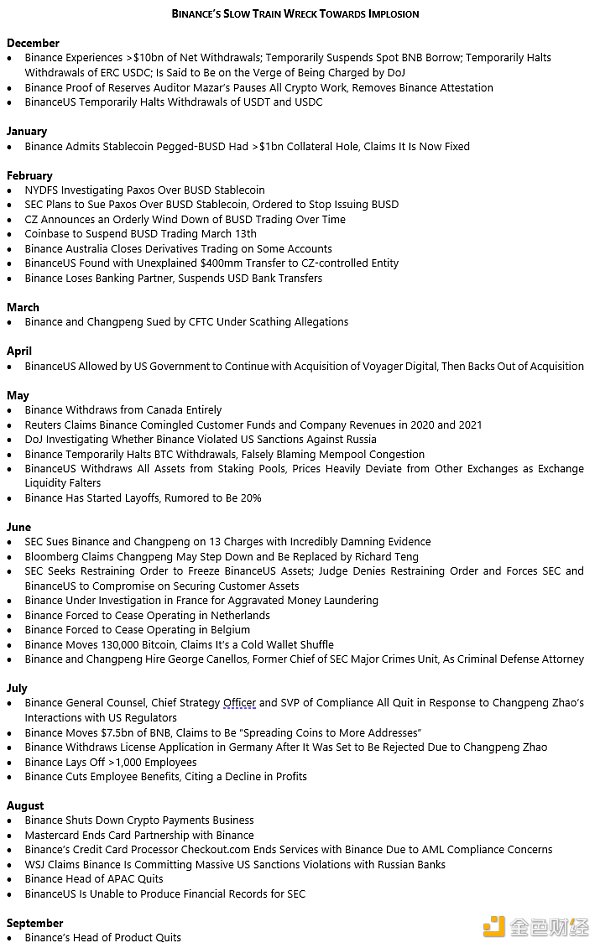

Travis Kling, Chief Information Officer of crypto asset management company Ikigai, believes that Binance is experiencing a “slow train wreck.” In an article on X, Kling listed all the negative events that have occurred at the crypto exchange since December last year. Some of the more recent key events include Binance allegedly violating US sanctions in Russia, ending its partnership with Mastercard, and reports of large-scale layoffs in July.

The fate of Binance is currently the most important factor in the crypto field and will be the focus in the coming months.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Synthetix Founder Reassessing Synthetix’s Multi-chain Vision and Liquidity Sharing

- Vitalik Buterin’s latest paper How Privacy Pool Protocol Protects User Privacy and Meets Regulatory Requirements.

- Consensys Strategic Director Decentralized Infura to be launched by the end of this year

- Data Interpretation Performance Comparison between GMX V1 and V2

- The Gospel of DeFi? Synthetix plans to launch the Synthetix V3 protocol in the fourth quarter.

- Coinbase Considering expanding primarily to the European Union, Canada, Brazil, Singapore, and Australia

- Base Ecosystem Fund announces the first batch of six investments Avantis, BSX, Onboard, OpenCover, LianGuairagraph, and Truflation.