Understanding Cross-Chain DeFi in One Article

Cross-Chain DeFi Explained in One ArticleCross-chain DeFi is a financial application that spans different blockchain ecosystems, allowing data and tokens to freely circulate between different blockchains.

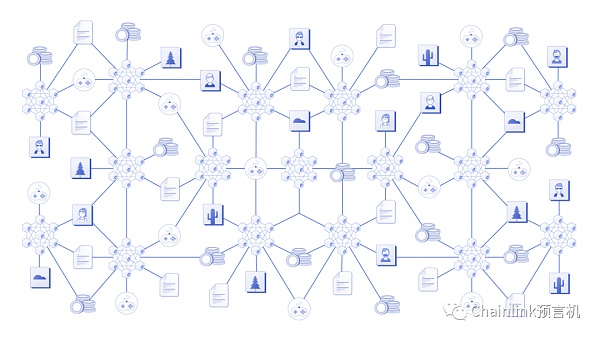

The Web3 ecosystem has entered the era of multi-chain, forming a thriving decentralized application economy among hundreds of blockchains, layer 2 solutions, and application-specific chains. While these rich on-chain ecosystems have made trust minimization the new industry standard, they have also dispersed assets and applications across isolated networks.

Cross-chain DeFi is a new paradigm for decentralized finance, utilizing cross-chain interoperability to enable cross-chain applications and facilitate the free circulation of messages and tokens between different networks.

This article will briefly introduce cross-chain DeFi and its operation mechanism, as well as explore how Chainlink CCIP will drive the wave of cross-chain innovation.

- Biographer of Elon Musk reveals heavyweight insider information 10 years ago, he began to worry about AI destroying humanity.

- Story Protocol Self-introduction Devoting a Lifetime to Fixing the Business Model of News and Media

- Guide to opening an account for a cryptocurrency exchange in Hong Kong How to identify two types of bank accounts

What is cross-chain?

Let’s first briefly explain why cross-chain interoperability protocols are the missing link in DeFi and blockchain economies. Blockchains themselves cannot interact with external systems, which means they cannot communicate with other chains or Web2 infrastructure. With a large number of blockchains already deployed, reaching hundreds, and this number expected to grow further in the future, achieving interoperability among these on-chain environments has become crucial.

Cross-chain interoperability protocols are the key infrastructure that ensures the free circulation of data and tokens between different blockchains. Cross-chain interoperability can enhance the integration of the Web3 ecosystem and strengthen the connectivity between existing Web2 infrastructure and the Web3 economy.

If cross-chain interoperability cannot be achieved, each blockchain will become an isolated island, unable to share resources or information with each other, including assets, applications, and market liquidity. Cross-chain technology can connect these isolated islands, enable interoperability for applications, and integrate liquidity dispersed across different networks.

Bottlenecks of DeFi

DeFi has great potential to create a financial system without conflicts of interest based on cryptographic technology. However, without robust cross-chain connectivity and interoperability, this vision will be difficult to achieve. The key challenges that DeFi faces in achieving cross-chain capabilities are as follows:

Restricted liquidity:

Liquidity is crucial for DeFi protocols. If liquidity pools in different blockchain networks are isolated from each other, the ecosystem will be fragmented, and liquidity will be locked within their respective pools without interoperability. The greatest potential of DeFi lies in creating unified liquidity pools based on standards such as fungible and non-fungible tokens. Without cross-chain interoperability, liquidity will be restricted to individual platforms, and the market will become a collection of isolated islands, hindering innovation.

Isolated assets:

Blockchains, by nature, cannot communicate with the external environment, which means that assets on one chain cannot interact with assets on another chain. This leads to ecosystem fragmentation, preventing DeFi from being widely adopted and inhibiting the creation of native composable financial applications. In a multi-chain landscape, the liquidity of applications (e.g., automated market makers – AMMs) is dispersed across different blockchain environments. Since each deployed application on a blockchain can only access a portion of the liquidity, traders have to bear greater slippage, and the transaction fee revenue of applications will also decrease.

Reduced Fund Efficiency:

Funds are restricted within their respective pools, which means that funds can only capture opportunities on one chain instead of across all networks. As a result, market efficiency decreases, hindering the development and adoption of DeFi applications.

Inability to Scale:

As applications are dispersed across different blockchain environments, the scalability of the entire ecosystem is limited.

Operating Mechanism of Cross-Chain DeFi

In order to build cross-chain smart contracts, it is necessary to securely transmit data, tokens, and messages between different chain environments. Cross-chain smart contracts are deployed on different blockchains separately, and communication can be established between chains, forming a unified application.

Cross-chain smart contracts are an emerging field of innovation and can be achieved through various solutions. At the lowest level, developers can decompose applications into multiple modules and deploy them in different networks to perform different tasks. These modules remain synchronized and jointly support a specific use case. This modular approach allows developers to fully leverage the advantages of different blockchains, such as using a more secure blockchain to ensure application security and a high-throughput blockchain to achieve low latency.

Cross-chain smart contracts enable easy interoperability of contract code dispersed across different blockchain networks. This can unify the user experience across chains. Therefore, cross-chain smart contracts can not only solve the problems of the current multi-chain paradigm but also activate a series of new smart contract use cases.

Advantages of Cross-Chain DeFi

If the DeFi ecosystem can achieve secure cross-chain interoperability, it can have more advantages compared to the multi-chain model.

Increased Liquidity:

Connecting different blockchain networks allows funds to enter larger liquidity pools, thereby increasing liquidity. Once cross-chain is achieved, funds will no longer be limited to a single network. This will narrow the liquidity gap, improve market efficiency, and reduce transaction slippage.

Improved Fund Efficiency:

Assets can easily cross chains, meaning that fund utilization will increase. Additionally, funds can generate profits by entering more protocols and applications.

Enhanced Resilience:

Since resources and assets are dispersed across different networks, the risk of single point failures or targeted attacks is reduced.

Enhanced User Experience:

As applications are dispersed across different blockchain environments, the scalability of the entire ecosystem is limited.

Types of Cross-Chain DeFi Applications

Lending

Users of cross-chain decentralized currency markets can deposit collateral assets in a lending market on one blockchain and borrow other assets in a market on another blockchain. Users can place collateral assets on a more secure blockchain while borrowing token assets on a blockchain with higher throughput, and generate income by participating in applications on that chain.

The cross-chain currency market can also unify the yields of various markets, thus creating more advanced hedging tools and reducing loan interest rates for lenders in low-liquidity currency markets. Users can also borrow token assets on another blockchain with lower interest rates and then cross-chain the assets back to the original lending chain.

Trading Platform

Users of cross-chain decentralized exchanges (DEX) can search for liquidity in token pools across different blockchain networks, thereby solving the problem of liquidity dispersion in multi-chain mode. In this way, liquidity on all blockchains will be activated, users can enjoy lower transaction slippage, and liquidity providers on each chain can earn higher transaction fee income.

Users of cross-chain DEX can also exchange native tokens of one blockchain for another without using wrapped assets or centralized trading platforms. For example, users can use cross-chain smart contracts to exchange Ether on Ethereum for SOL on Solana.

Staking

Users can stake assets across chains and earn rewards on one chain. This can broaden the coverage of staking mechanisms and better ensure the security of blockchain networks and Web3 services. The staking mechanism of the protocol can cover multiple blockchain environments, attracting more funds and users.

Yield Aggregator

Cross-chain yield aggregation allows users to deposit their funds into DeFi protocols on various chains. In this mode, users can earn higher yields without manually cross-chaining their assets. Cross-chain yield aggregators can greatly enhance the user experience of multi-chain yield farming, as users do not need to manually cross-chain, thus significantly improving liquidity.

The Role of Chainlink in Cross-chain DeFi Ecosystem

To better meet the market’s demand for secure and reliable cross-chain interoperability standards, Chainlink has launched the Cross-Chain Interoperability Protocol (CCIP), which seamlessly transfers data and tokens between different blockchains and interacts with existing web and enterprise infrastructure. The first batch of partners of CCIP includes Synthetix (cross-chain synthetic assets) and Aave (cross-chain governance), and it has been adopted by various DeFi applications to create innovative cross-chain use cases and promote the adoption of smart contracts.

Chainlink CCIP enables cross-chain applications and a range of innovative smart contract use cases

CCIP is the most secure, reliable, and user-friendly interoperability protocol that can be used to create cross-chain applications and services. Developers can use the Arbitrary Messaging feature to flexibly build their own cross-chain solutions. Moreover, CCIP can also achieve the Simplified Token Transfer feature. Therefore, the protocol can use its audited token pool contract to cross-chain transfer tokens without writing customized code. CCIP also adds additional security mechanisms, such as the ability to flexibly set the maximum amount of cross-chain tokens. In addition, a separate Risk Management network is established to monitor the validity of all cross-chain transactions.

CCIP is powered by Chainlink’s decentralized oracle network. Chainlink’s oracle network has achieved remarkable results, securing billions of dollars in assets and enabling over $80 trillion in on-chain transaction value. CCIP shares the same underlying infrastructure as Chainlink’s existing services, so there is almost no need to add new trust assumptions. If a dApp has already integrated Chainlink Price Feeds, there is no reason not to choose CCIP for cross-chain interactions.

CCIP has the potential to transform traditional single-chain or multi-chain applications into powerful cross-chain dApps, enabling a wide range of rich application scenarios such as DeFi, NFTs, identity solutions, and governance.

If you also want to integrate Chainlink CCIP, please refer to the official website’s product page. If you want to dive deeper into the underlying architecture and code of CCIP, please refer to the CCIP developer documentation.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Berenberg Analyst FASB’s New Regulations Will Benefit Microstrategy Company

- With investment from a16z, how does Story Protocol build IP infrastructure for the Internet era?

- Synthetix Founder Reassessing the Feasibility of Synthetix’s Multi-Chain Vision

- Interpreting Vitalik’s Latest Paper Privacy Pools, Making Compliance No Longer at the Expense of Privacy and Decentralization

- Genesis Global Capital sues DCG and DCGI, demanding repayment of over $600 million in loans.

- MetaMask wallet connects to fiat currency transactions, with total costs of various fees reaching up to 9%.

- Penetrating the current stablecoin landscape Opportunities and challenges for newcomers beyond USDT and USDC.