What impact does BlackRock’s submission of a physical Bitcoin ETF application have on the industry?

What is the effect of BlackRock filing a Bitcoin ETF application on the industry?Author: BlockingBitpushNews Mary Liu

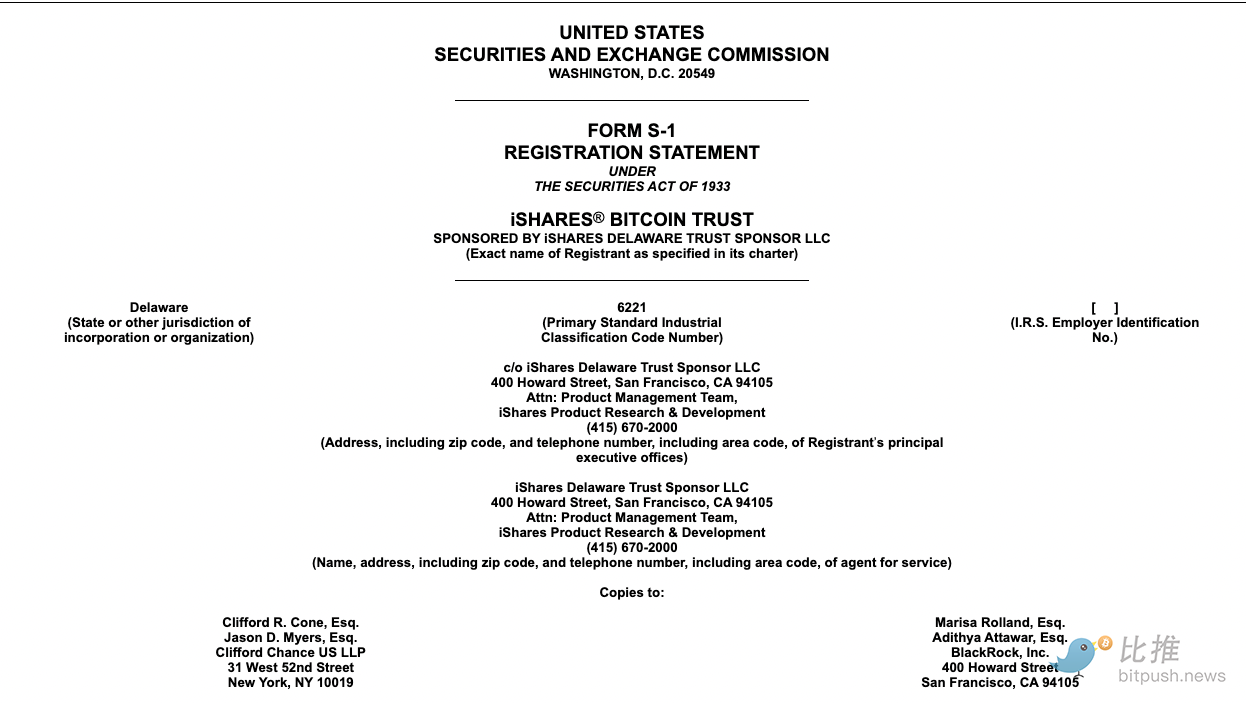

According to a public document, on the afternoon of June 15th New York time, investment management giant BlackRock submitted an application for a spot Bitcoin ETF to the US Securities and Exchange Commission (SEC).

This move comes as the crypto industry is embroiled in a regulatory battle with the US SEC over allegations of securities law violations, with the top exchanges Coinbase and Binance being sued by the SEC earlier this month.

- Age of Inscription 2.0: Can Recursive Inscription Enable Bitcoin On-Chain Smart Contracts?

- Full testimony of Avalanche founder: We are standing at the edge of a new era

- How is the NFT market performance of Azuki and Beanz? Let’s start from the borrowing and lending activities.

As of March 2023, BlackRock manages $9.1 trillion in assets, and the company outlined its plans for iShares Bitcoin Trust, which will entrust Coinbase Custody as the Bitcoin custodian and New York Mellon Bank as the cash custodian. The product in the plan will use the Bitcoin reference exchange rate from CF Benchmarks, a subsidiary of Kraken, to continuously track spot pricing data collected from exchanges.

BlackRock previously partnered with Coinbase in August last year, allowing clients to have and trade digital assets using BlackRock’s investment management platform Aladdin, starting with Bitcoin. Through the deal, BlackRock’s clients can use Coinbase’s trading, custody, bulk brokerage, and reporting services.

Prior to establishing the connection with Coinbase, BlackRock launched the iShares and Blockchain Technology ETF (IBLC) in April 2022. More than a year after its listing, the assets managed by IBLC are only $7 million, although the fund has risen 75% so far this year.

Regulatory Resistance

Registering a Bitcoin ETF in the US has always been a difficult task, especially for funds that deal with spot market trading. So far, the SEC has not approved any such spot ETF applications due to concerns about potential fraud or manipulation in the spot market, including those from Grayscale, VanEck, and WisdomTree. 21Shares and Cathie Wood’s Ark Investment have also been trying to register spot Bitcoin ETFs since 2021.

By contrast, the agency has approved four Bitcoin futures ETFs. The largest of these is the ProShares Bitcoin Strategy ETF (BITO), with assets under management of about $800 million. According to FactSet data, the fund has incurred total losses of more than 40% since its launch. Bitcoin has fallen by more than 60% since its all-time high shortly after BITO’s launch.

Grayscale has filed a lawsuit against SEC over its refusal to convert its Bitcoin trust to a spot ETF, with a decision expected later this year. If ETFs start trading, they typically take several months to launch after the initial application. Aisha Hunt, head of asset management law firm Kelley Hunt & Charles, doesn’t think this will happen, tweeting that BlackRock’s application could face strong resistance from the SEC and ultimately be withdrawn.

Impact on the Industry

“An estimated 20% of Americans have owned Bitcoin at some point. BlackRock’s proposed ETF could offer a more familiar and accessible option for the other 80%,” said Sui Chung, CEO of CF Benchmarks, in a statement. BlackRock CEO Larry Fink has also expressed optimism about the technology over the past year, calling tokenized securities the “next generation” of the market.

BlackRock’s application for a Bitcoin spot ETF could mark a turning point for the industry as prominent players in traditional finance recognize the potential of Bitcoin. If the SEC relaxes its policy, these products could flood the market, providing investors with safer investment opportunities and opening up a new wave of crypto adoption through regulated and user-friendly investment tools.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will the regulatory crackdown on Binance fall through? Analysis of recent market data changes in Binance

- Viewpoint: How to view the prospect of the cryptocurrency market?

- SEC has launched a comprehensive political battle over cryptocurrency.

- Delphi Digital: Analyzing the Five Types of Instances of LSDFi: Interest Rate Swaps, CDP Stablecoins, Multi-Asset LSD, Money Markets, and DEX. Author: Delphi Digital

- What happened to the cryptocurrency market with a 30% drop in altcoins due to the “610” attack?

- SEC Complaint Reveals the Truth: Major Players Have Stumbled in the Crypto World in Recent Years

- Is the collective waterfall of altcoins just the beginning of regulatory impact?