LianGuaiWeb3.0 Daily | Binance will support the Celo (CELO) network upgrade and hard fork

Binance to support Celo network upgrade and hard forkDeFi Data

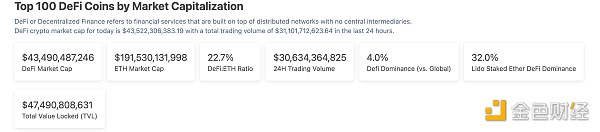

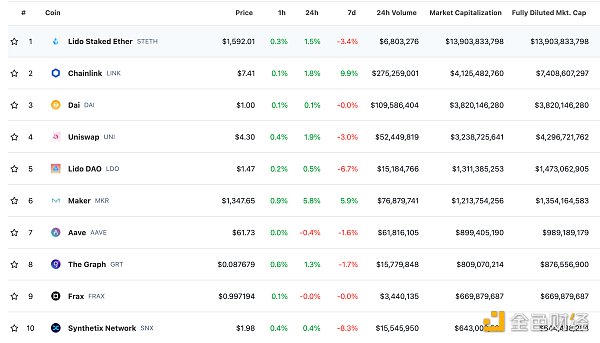

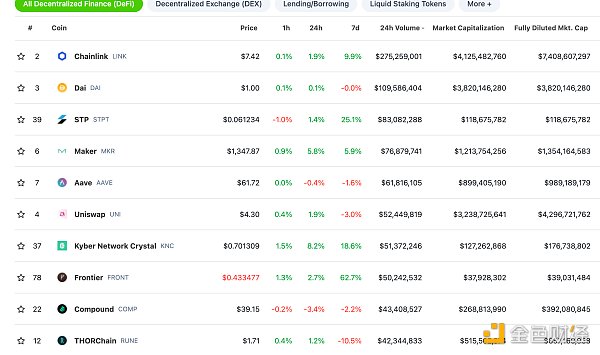

1. Total Market Cap of DeFi Tokens: $43.49 billion

- Multicoin Capital The Dawn of Fhenix and On-chain Fully Homomorphic Encryption

- The epitome of CEX behind OKB destruction The investment logic behind platform tokens

- Bybit’s suspension of operations is just the beginning an analysis of the UK’s new regulatory policies in October

DeFi total market cap and top ten tokens data source: coingecko

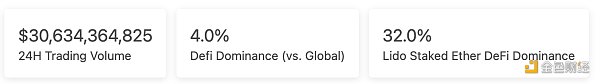

2. Trading Volume of Decentralized Exchanges in the Past 24 Hours: $3.063 billion

Trading volume of decentralized exchanges in the past 24 hours data source: coingecko

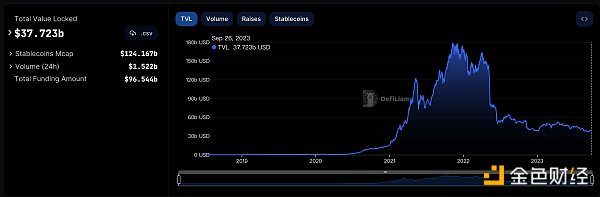

3. Locked Assets in DeFi: $37.723 billion

Data source: defillama

NFT Data

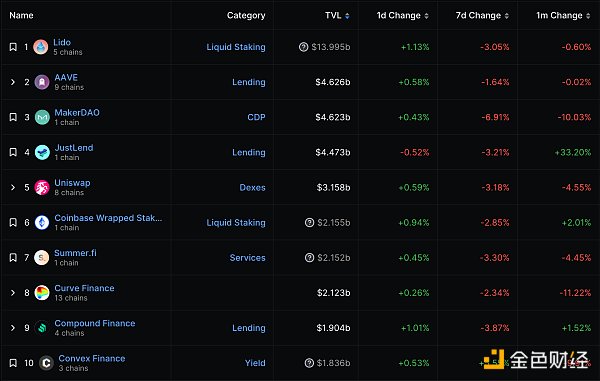

1. Total Market Cap of NFTs: $13.785 billion

Total market cap and top ten projects by market cap data source: Coinmarketcap

2. 24-Hour NFT Trading Volume: $742 million

24-hour NFT trading volume and top ten projects by trading volume data source: Coinmarketcap

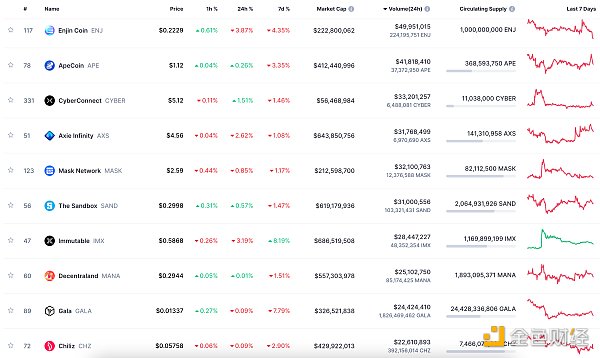

3. Top 10 NFTs in the Past 24 Hours

Top ten NFTs sold in the past 24 hours data source: NFTGO

Headlines

Binance to Support Celo (CELO) Network Upgrade and Hard Fork

On September 26th, according to an official announcement, Binance will support the Celo (CELO) network upgrade and hard fork. The specific arrangements are as follows:

– The project team will perform the network upgrade and hard fork at block height 21,616,000 (estimated to be 01:15 on September 27th, 2023, Eastern Standard Time).

– Binance is expected to suspend token deposits and withdrawals for the aforementioned network at 00:15 on September 27th, 2023, Eastern Standard Time.

Note:

– Users can trade the tokens supported by the aforementioned network as usual.

– Please deposit in advance, and Binance will assist users in handling any technical issues involved.

– After this network upgrade and hard fork, Binance will reopen the deposit and withdrawal services for the relevant tokens when the network is stable, without further notice.

NFT/Digital Collectibles Highlights

1. Ordinals Founder Introduces Runes as an Alternative to BRC-20 Tokens

LianGuai reports that Casey Rodarmor, the founder of Ordinals, has launched an alternative BRC-20 token standard protocol called “Runes” based on unused transaction output values (UTXOs).

He explained that while using BRC-20 allows tokens to be issued and transferred through the Ordinals protocol, it has the drawback of generating garbage UTXOs, which Runes can prevent. Garbage UTXOs refer to UTXOs that are unused and no longer needed.

2. BAYC collaborates with the trendy brand BAPE to launch limited physical products during the ApeFest event in Hong Kong

On September 26th, it was announced that Bored Ape Yacht Club (BAYC) has reached a collaboration with the trendy brand BAPE. They will release a limited physical collection for the first time during the ApeFest event in Hong Kong, and BAYC holders can also purchase the products online. The official statement mentioned that BAYC holders have priority, but the collection will soon be available in BAPE stores worldwide.

3. BAYC may collaborate with the Japanese brand BAPE

According to LianGuai’s report, Bored Ape Yacht Club (BAYC) may collaborate with the Japanese streetwear brand BAPE. The official BAYC tweet featured images of BAPE and Bored Ape, along with the caption “Fans since forever”. The BAPE official account quoted the tweet and added the phrase “Apes Together Strong” (a commonly used phrase among Bored Ape NFT holders). The official account of the Bapetaverse NFT project also quoted the same tweet. As of the time of writing, BAYC has not released more details about the collaboration.

DeFi Highlights

1. Circle’s Euro stablecoin EURC to expand to the Stellar network

On September 26th, it was announced that Circle’s Euro stablecoin EURC will expand to the Stellar network. It is reported that EURC has already been issued on Ethereum and Avalanche.

2. Orbiter Finance upgrades its positioning to an Ethereum acceleration engine based on ZK technology and plans to introduce a decentralized front-end

On September 26th, Layer2 cross-rollup bridge Orbiter Finance announced that it will upgrade its positioning to an Ethereum acceleration engine based on ZK technology, aiming to improve L2 performance and reduce gas consumption. In addition, Orbiter Finance will introduce a decentralized front-end and the role of Dealer to promote DApp empowerment. Orbiter Finance stated that this decentralized incentive front-end marks a milestone in its path towards full decentralization and trustlessness. By utilizing open protocols to establish direct collaboration arrangements between Makers and Dealers, a decentralized Maker relying on SPV circuits will be introduced on the upcoming roadmap, allowing Makers to contribute liquidity and generate income within the Orbiter Finance ecosystem. In the future, Orbiter Finance will focus on adopting ZK recursive proof technology to reduce gas consumption and integrate ZKP on compatible ZK Rollups.

3. EigenLayer’s Chief Strategy Officer sold the remaining 61,729 LDO 30 minutes ago

According to Lookonchain monitoring, EigenLayer’s Chief Strategy Officer Calvin Liu sold the remaining 61,729 LDO 30 minutes ago at a price of $1.47, receiving 90,825 USDC in return. Calvin Liu had purchased 370,370 LDO from Lido:Treasury on May 7, 2021, spending 80 ETH (worth $279,000) at a price of $0.75 per LDO.

4. Data: Ethereum generated over $10 billion in revenue in 7 years

According to data compiled by analysis platform Token Terminal, Ethereum has generated approximately $10 billion in revenue over a span of about 7 years, second only to Alphabet, which took about 6 years. Ethereum’s revenue mainly comes from its transaction fees, measured in gas fees. Depending on the complexity of the transaction, the network charges different gas fees. However, the generated revenue depends on network activity, with higher transaction volume resulting in higher fees per block.

5. StarkNet will modify the feeder gateway in the fourth quarter of 2023

LianGuai reports that the Ethereum Layer 2 scaling solution, StarkNet, will modify the feeder gateway in the fourth quarter of 2023 and will stop providing various types of query services. It will only retain endpoints related to synchronization for full nodes.

The StarkNet feeder gateway serves as a gateway to query the StarkNet state centralized sequencer. Until full nodes that support StarkNet JSON-RPC mature and can meet the needs of the ecosystem, it is only a temporary solution.

It is recommended that StarkNet developers turn to API services or full nodes, such as LianGuaithfinder, Juno, and LianGuaipyrus.

Disclaimer: As a blockchain information platform, the articles published by LianGuai are for information reference only and should not be considered as actual investment advice. Please establish the correct investment concept and be sure to raise risk awareness.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- It’s time to have a discussion about the current state of the metaverse.

- Overview of the Latest Situation of Hong Kong’s First Licensed Virtual Asset Exchanges

- Sei Ecosystem Review What ‘New Things’ are Being Created on L1 for Trading?

- Arbitrum Alliance Optimistic or ZK? Why do I still prefer the former?

- Binance, a cryptocurrency exchange, reopens trading services in Belgium.

- What is the background of the four licensed cryptocurrency trading platforms confirmed by the Hong Kong Securities and Futures Commission?

- Robinhood promotes ‘inclusive finance’ Is it really a good thing to ‘rob the rich to help the poor’?