The epitome of CEX behind OKB destruction The investment logic behind platform tokens

CEX and OKB destruction Investment logic of platform tokensBear markets are often the best time to make a move. Investors are looking for and allocating value investment targets. Recently, the news that OKB set a new record for destroyed value once again focused the public’s attention on platform coins. On September 18th, OKX announced that it repurchased and destroyed over 6.14 million OKB in the quarter, worth about $255 million, setting a record for the highest repurchase and destruction amount in history.

Although the overall performance of the cryptocurrency market is not good, exchanges with real profit support are still prominent. With everyone’s firm expectations for the future bull market, platform coins are also seen as one of the encrypted sectors with growth potential. The value support of platform coins comes from platform trading volume and profits. The repurchase and destruction data can directly reflect the current income situation of the platform. On the other hand, there is potential for growth, such as whether it can operate safely and steadily in the future, how the product leads the Web3 market through iteration, and how to continuously obtain new traffic.

This article will take OKB as the starting point to explore the value-capturing logic of the platform coin track in order to discover more potential high-quality assets.

Investigating the true situation of the platform coin track, the head effect is significant

As one of the core businesses of cryptocurrency exchanges, platform coins are an important manifestation of their own value and ecological boundaries. The trend of tokens can intuitively reflect the performance of the exchange. Many investors also regard such assets as one of the investment targets with more value capturing ability and appreciation potential.

- Bybit’s suspension of operations is just the beginning an analysis of the UK’s new regulatory policies in October

- It’s time to have a discussion about the current state of the metaverse.

- Overview of the Latest Situation of Hong Kong’s First Licensed Virtual Asset Exchanges

Looking back on the value casting road of platform coins, it is mainly divided into two ways: usage scenarios and repurchase and destruction. Among them, application scenarios and rights and interests will create demand for platform coins, thereby increasing the number of users and increasing their value. Repurchase and destruction is similar to share buybacks, which are often used as powerful tools and routine weapons to stabilize or even raise the stock price of companies in traditional financial markets. Such strategies are also effective in the encryption field. Major exchanges will reduce the supply to increase the value of platform coins.

Based on this value judgment logic, in order to facilitate readers’ observations, this article selects the top 5 platform coins with higher market value as the observation objects, namely BNB, OKB, BGB, GT, and HT, and interprets the platform coins with more investment value from a data perspective.

Repurchase and destruction is a common mechanism to stabilize the price of stablecoins. Usually, the platform of the exchange will use profits, income, or fees to repurchase platform coins from the market. The repurchase and destruction methods, frequency, and intensity of platform coins are different, but they can reflect the performance of the platform at a certain stage.

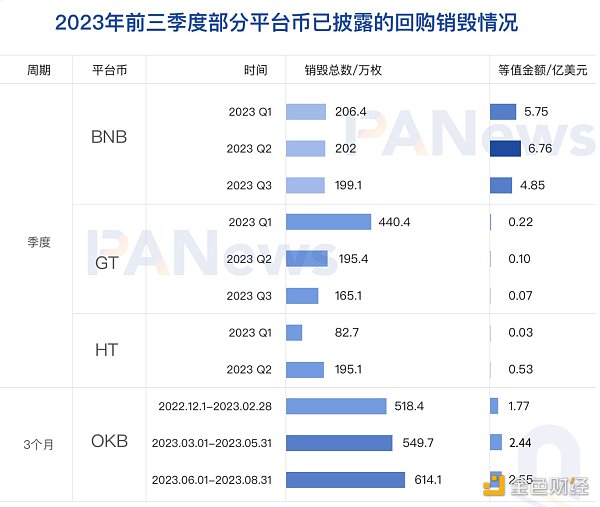

Among the above-mentioned mainstream platform coins, except for BGB, which may launch related mechanisms in the future, BNB, OKB, GT, and HT have all conducted repurchases and destructions this year. Among them, as of September 22nd, HT has not announced the total amount of repurchase and destruction in the third quarter, so there is a lack of relevant data.

As shown in the above figure, according to LianGuaiNews statistics, the total amount of these platform coins destroyed in the first three quarters of this year is about 2.507 billion US dollars. In terms of the amount of destruction, BNB and OKB are far ahead of other platform coins. Among them, BNB has the highest amount of repurchase and destruction, reaching 1.736 billion US dollars, followed by OKB with 690 million US dollars, HT and GT respectively destroying tokens worth 56 million US dollars and 39 million US dollars. At the same time, from the trend perspective, the total number of repurchases and destruction disclosed by BNB and GT has shown a quarterly decline, with a decrease of 3.5% and 62.5% in the third quarter compared to the first quarter, while OKB and HT have shown an upward trend, with an increase of more than 18.4% and 135.9% respectively. However, in terms of quantity, OKB has a significantly higher total number of destructions with 16.822 million, followed by BNB with 6.075 million, and GT and HT with 8.009 million and 2.778 million respectively. From this data, repurchase and destruction undoubtedly provide a direct means to enhance the value of the platform.

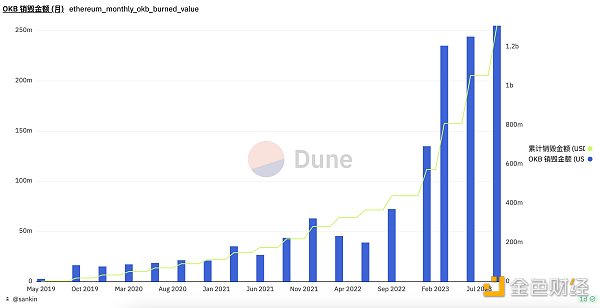

It is worth mentioning that according to Dune data, OKB has accumulated more than 70.18 million coins destroyed so far, accounting for nearly 23.4% of the total supply. Among them, since June 2021, the number of OKB destructions has shown an upward trend month by month, and from the repurchase data, it has not been affected by the bear market at all.

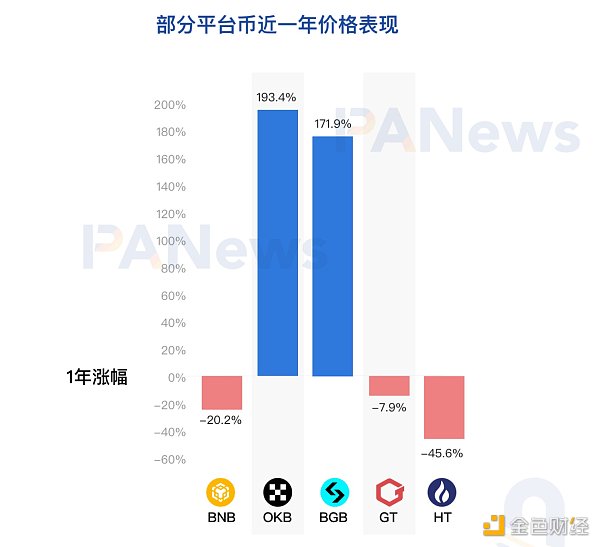

Although the repurchase and destruction mechanism can stimulate the appreciation of platform coin value to a certain extent, it is faced with a bear market environment. In the past year, the average increase of the above platform coins reached 58.3%, among which only OKB and BGB showed an upward trend, with an increase of 193.4% and 171.9% respectively, while BNB and HT both experienced a decline of more than 20%, and GT showed a slight downward trend. From the data, OKB and BGB have shown resistance to decline, breaking the current price dilemma of platform coins.

In terms of market value, according to CoinGecko data, as of September 22, the market value of these five platform coins accounted for 83.4% of the market value of platform coins on centralized exchanges (CEX), of which BNB and OKB contributed nearly three-fourths of the substantial value, while the rest accounted for only 3.5%. This also means that the “head effect” in the platform coin race is obvious, and mainstream platform coins like BNB and OKB are more recognized and sought after by investors.

The growth of platform coin market value is largely inseparable from ecosystem empowerment. Most platform coins are used for trading and equity certificates, which give them more practical value. For example, OKB can be used for trading fee discounts, OKX Jumpstart, OKB wealth management, etc.

From this perspective, OKB investment has a higher cost-effectiveness, which also indirectly confirms that the value of platform coins largely comes from the construction of ecological functions and repurchase and destruction.

Exploring the Development Potential of Platform Coins and Capturing the “Arsenal” of Value

One of the important factors in measuring the value of a platform coin is its future potential. The stronger the platform’s development potential and strategic planning capabilities, the greater the appreciation space for the platform coin. To achieve sustainable development in the ever-changing Web3 market, we can explore the tactics of OKX.

In the view of LianGuaiNews, in the arms race of the exchange track, OKX has reserved a large “arsenal” for future growth. This includes products that best meet the needs of users, innovative product capabilities to discover potential demands, the highest level of asset security and transparency, and brand appreciation under international influence. These “weapons” in the business war are all safeguarding the growth of OKB.

Optimizing Trading Products, Web3 Wallets Will Become the Gateway for Traffic

First, let’s talk about products. Although OKX is an established exchange, it is constantly optimizing its trading products. For example, the powerful tool of high-frequency trading, the reverse opening position feature, which was launched in August, allows users to adjust their position direction in real time with just one click when facing a market reversal. The strategy copy feature launched on the APP in July reduces user operational costs, captures trading opportunities, and helps signal providers earn profits.

Another noteworthy product is OKX’s Web3 wallet, which has received widespread acclaim among users and has unique product strength among various exchanges. The launch of the Web3 wallet is not only a product derived from OKX’s insight into user needs, but also a strategic deployment for future Web3 traffic. As a non-custodial, decentralized multi-chain wallet, users can efficiently manage their assets and actively participate in on-chain activities, allowing them to freely explore the world of blockchain with low entry barriers. The Web3 wallet unifies the app, plugin, and web interfaces, supports over 70 public chains, over 120 DeFi protocols, over 30 NFT market aggregation platforms, and multiple ecosystems such as Game, Social, MEME, and Tool, with a total support for over 300 platforms and protocols. The Web3 wallet supports rich features such as creating MPC and AA smart contract wallets, Ordinals market, gas exchange, and custom networks. In the future, with the help of the Web3 wallet, OKX can not only attract native cryptocurrency users but also attract new users who are new to the world of cryptocurrencies, becoming a gateway to access Web3.

Highest Level of Security and Transparency

Now let’s talk about security and transparency, which are indispensable topics in the field of cryptocurrencies and the most concerning factors for users. Security incidents have a “devastating” impact on platforms, which is an eternal issue for exchanges. Recently, OKX announced that it has successfully completed the SOC (Service Organization Control) 2 Type II audit, meeting the highest global standards in governing service processes, managing sensitive data, and protecting data privacy. This proves the unremitting efforts made by OKX to ensure the highest level of security and compliance standards.

In terms of transparency, OKX insists on updating the Proof of Reserves (PoR) data of previously launched reserves every month. Users can also verify whether the exchange has 100% fund reserves and whether their own principal has 1:1 real asset support. Currently, OKX has released 10 issues of Proof of Reserves, and the latest issue shows that the reserve ratios of its 22 listed coins are all over 100%.

Strong Global Brand

If the above trading data and product capabilities are tangible and measurable standards for platform tokens, another factor that cannot be quantified but can open up future imagination is the accumulated brand influence over the years. As early as the 1970s, Nobel laureate in economics Herbert Simon pointed out, “In this era of rapid information development, the value of attention will surpass the information itself.”

Among various exchanges, OKX is the platform with the most brand activities. It enhances its brand influence in the traditional and Web3 world through sponsoring multiple events and gatherings. Its partners include English Premier League champion Manchester City Football Club, McLaren Formula 1 racing, Tomorrowland Music Festival, and the recent crypto summit “TOKEN2049,” among others.

The improvement of the platform’s global reputation and influence not only allows the cryptocurrency market to break through its boundaries but also helps OKX capture more user mindshare, achieve customer acquisition and potential trading volume growth, and thus build an upward “ladder” for the development space of its platform token.

In other words, while OKX captures more value from the cryptocurrency ecosystem and meets more user needs through various products, it also increases the value of its platform token in an intangible way. It becomes the confidence for OKX to continuously increase its repurchase and destruction of OKB tokens in a fearless bear market. This strategy of OKX has a demonstrative significance worth learning from.

In summary, the platform token is not only a magnifying glass for measuring the value of an exchange but also a powerful weapon to support its own business. However, at the end of the day, the purpose of the platform token is to create a closer relationship between users and the platform through bundled interests. When an exchange truly accompanies users and walks with them, it will achieve a two-way journey between users and the platform.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Sei Ecosystem Review What ‘New Things’ are Being Created on L1 for Trading?

- Arbitrum Alliance Optimistic or ZK? Why do I still prefer the former?

- Binance, a cryptocurrency exchange, reopens trading services in Belgium.

- What is the background of the four licensed cryptocurrency trading platforms confirmed by the Hong Kong Securities and Futures Commission?

- Robinhood promotes ‘inclusive finance’ Is it really a good thing to ‘rob the rich to help the poor’?

- It’s time for a frank discussion about the current state of the metaverse.

- Pledge Status 5 Key Points After One Year of Ethereum Merge