Bitcoin difficulty adjustment and soaring BSV prices

Source / LongHash

The continuous increase of Bitcoin's computing power has been a hot topic in the community recently. LongHash also recently published an article discussing the impact of the continuously increasing computing power on the price of Bitcoin and its future, especially after Bitcoin halved this year. Miners have a significant impact.

First, let's quickly review the principle of Bitcoin mining. Miners compete with each other to generate new Bitcoins by solving computational challenges. In order to ensure that Bitcoin can generate a block within 10 minutes, as the computing power increases, the difficulty of the entire system calculation must be adjusted continuously. If the difficulty is not adjusted in time, then as the computing power increases, the interval between block generation may become shorter and shorter. Therefore, the entire Bitcoin system will dynamically adjust the difficulty of the system based on the computing power of the recent period.

- Analysis: Bitcoin's Value Logic and Its Prospects

- Science | This technology escorts two-thirds of Bitcoin transactions

- The turbulent situation in the United States and Iran and the rise in Bitcoin price, how strong is the risk aversion property of Bitcoin?

At present, compared with the miners in the United States and Europe, the mining pools dominated by the Chinese still occupy an advantage. Not only do Chinese miners control most of the computing power, they also usually have lower electricity costs.

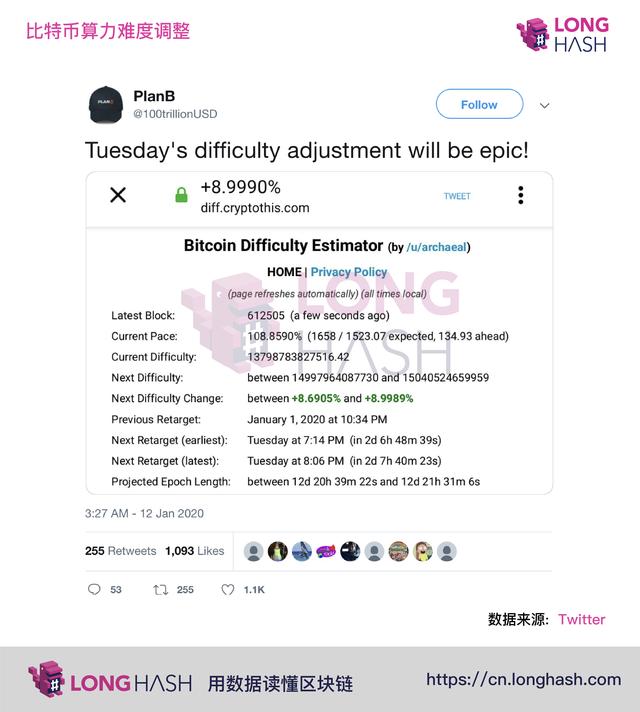

On January 15th, the difficulty of Bitcoin was raised by about 7%. The main reason is that the hashrate of Bitcoin has recently increased significantly. This is the second time that the difficulty of Bitcoin has been raised so far this month. On January 2, the difficulty of Bitcoin mining was raised by 6.6%. Starting in the second half of 2019, the increasing computing power has also continued to increase the difficulty. Except for the exception of November 18, 2019 (the difficulty of Bitcoin has been temporarily reduced by about 7.1%), the difficulty of Bitcoin has increased rapidly most of the time.

The increase in computing power means that miners have invested heavily in Bitcoin mining, and the rising difficulty also means that everyone's competition has become increasingly fierce and mining has become more difficult.

So, is the Bitcoin difficulty adjustment also affecting other cryptocurrencies? On the eve of the Bitcoin difficulty adjustment on January 15, the price of Bitcoin SV suddenly began to soar sharply.

Bitcoin SV is the product of the 2018 Bitcoin Cash hard fork. So far in 2020, its performance has impressed the market. In fact, around January 10th, the price of Bitcoin SV has already risen once, and then on the 14th, the price of Bitcoin SV has soared rapidly, and the price has increased by nearly 150% within 24 hours.

As of the writing of this article (January 15), the price of Bitcoin SV has fallen from its highest point (more than $ 400) to about $ 320, which is no different from its rival Bitcoin Cash ($ 342), compared to a week ago The price has increased by about $ 200. The skyrocketing Bitcoin SV has shifted the focus of many miners from Bitcoin to its blockchain.

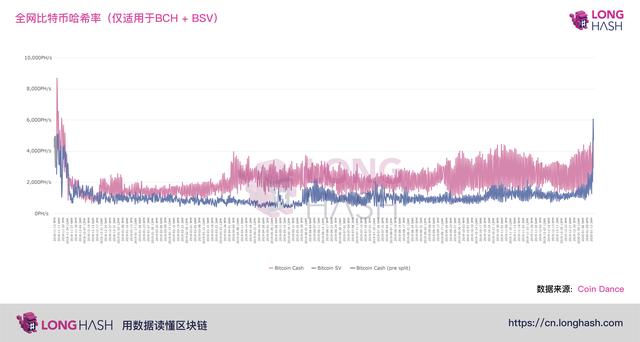

Of course, in response to the sharp increase in prices and rising computing power, the difficulty of Bitcoin SV has also changed significantly in the past two days.

Bitcoin hash power adjustment occurred at 7:42 (UTC + 8) on January 15. Judging from the first chart above, the difficulty of Bitcoin SV has also undergone a major adjustment in those two days.

There is no evidence that the soaring price of Bitcoin SV has any direct relationship with the adjustment of Bitcoin's hash power. This is most likely just a coincidence. The opinion of the market part is that the change in price is related to the favorable progress of the founder of Bitcoin SV-Craig Wright, who calls himself "Satoshi Nakamoto" in a case related to the so-called "Tulip Trust".

However, it is generally believed in the industry that computing power is very important for the security of digital currencies using the PoW consensus. Although the change of BSV's computing power will not have much impact on Bitcoin at present, if the rising BSV robs some of its direct competitors Bitcoin Cash's miners, causing its computing power to decrease, it may pose a greater threat to BCH .

It is also worth noting that with the current increase in the overall price, Bitmain's S9 can be turned on again to mine BSV, because the current price and electricity costs are profitable, while the previous mining machine S9 can only be turned off. This prompted more miners to choose to switch to Bitcoin SV, because now they will no longer lose money in terms of difficulty and equipment and electricity costs.

LongHash , read the blockchain with data.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Inventory of Bitcoin's technology development in 2019 (1)

- Weekly data report on BTC chain: The currency exchange strategy of the head exchange triggers the illusion of active promotion on the chain

- Getting Started with Blockchain | Why Does Bitcoin Blockchain Need SegWit?

- Article estimates Bitcoin halving date in 2020

- Opinion: Bitcoin must return to Satoshi Nakamoto's original intention

- Learn about the giant whale grayscale investment fund and understand the encryption market trend

- Large institutions continue to expand: Bakkt launches BTC futures contract in Singapore