Viewpoint | Demystifying the culprit behind the bitcoin plunge

In the past month, Bitcoin has been oscillating around $8,300, with no upswing and no waterfalls, making it the ultimate gateway. However, after 8 o'clock in the evening yesterday, Bitcoin broke the previous range with lightning speed, and explored $7,300, a decline of more than 10%. At this point, bitcoin prices hit a new low since May 24.

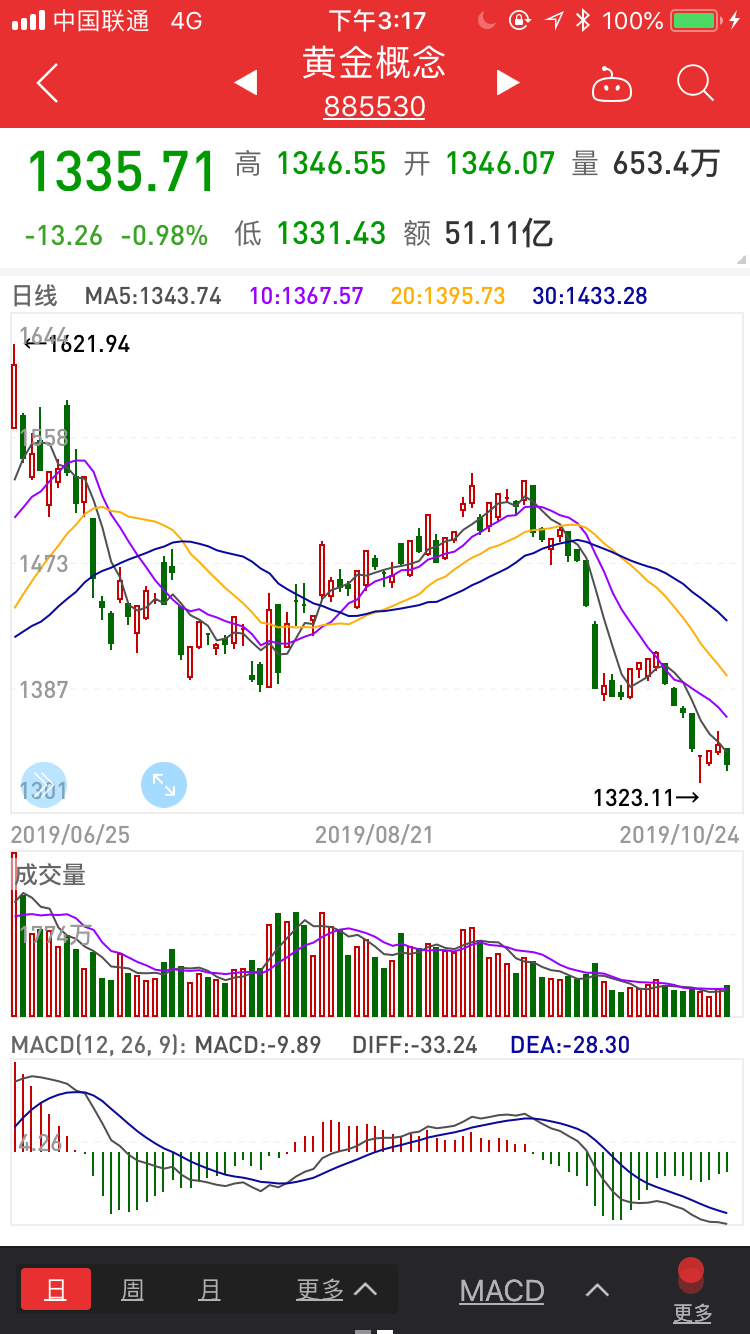

As a digital asset that has been recognized by investors around the world, its hedging attributes have even been compared to gold. However, when the US dollar index continued to rise, gold also began to show the trend of the sunset. From the high point to the current price level, it has fallen by nearly 20%. Under the nest, there are bits. This time, the trade war is also difficult to save the "Lord". Once the trade warfare caused Bitcoin to stand at the peak of $13,000. Today, the war has also brought it back to "7." If you look at Bitcoin from the "trade war" and "safe haven" alone, it seems that you are too rushed. From the rise and fall of history, we can easily find that it is never a word to let it sing all the way. Of course, it is hard to say a fall.

- Why is Bitcoin unrepeatable?

- Think Bitcoin is a Kind of "argument" of scam – talk about thinking and progress

- Bitcoin is very secure: the fear of reduced block rewards is exaggerated

You can look at a few points first:

Byte Tree CEO James Bennet believes that Bitcoin's current round of decline is caused by a slower trading rate. As the market demand for stable USDT is gradually surpassing BTC and data can be seen from CoinMarketCap, BTC's trading share has dropped to 29 %, while USDT increased to 35%. The simplest price determination theory, in the case of a certain supply, the demand declines. The final equilibrium market price must have fallen. It is equivalent to having 100 clothes in a shopping mall, buying fewer people, and the price will naturally drop.

In addition to this relatively new view, exchanges and large funds have always been Bitcoin's biggest rivals. Some insiders said that it is not ruled out that the 925 smashing, the 925's big drop made it fall from $9,500 to $8,300, and the Japanese currency circle mourned. Almost all of the spearheads point to the exchange, suspected to be the fuse of bitcoin's decline, alleged that they first made a short currency price through joint hot money, resulting in a large number of futures contracts exploding, and then panic-stricken. If the source of the plunge is unfortunate, then it is very likely that the investor is waiting for a more turbulent waterfall.

In addition to the above two remarks, the market also gave its own views.

The first is technical reasons. It broke through $7,800 eight times in a month. The short-term trend has been bearish, and the probability of long-term bearishness has also increased greatly.

The second is that the social media giant Facebook CEO Mark Zuckerberg’s hearing is not expected to be good. The big fall happened just two hours before the hearing, and the performance of the past few days, as well as the Fed, the House of Representatives and other regulatory agencies. The heavy obstacles have caused investors to lose confidence, and the last one will become the last straw to overwhelm the price of the currency.

In addition, technology giant Google's breakthrough in the field of quantum computers, the company announced that its development of a computer can perform calculations that require supercomputers to complete in 10,000 years. The benefits of this traditional field are undoubtedly a major blow to cryptocurrencies.

In the 19-year journey, Bitcoin has not broken through the record set at the end of 17 and turned downward. Among them, there are various news to promote and suppress, but also there is a foot in the industry to be a bad person, and more investors have contributed. However, the industry is moving forward. As a part of the industry, we should invest more rationally and keep a clear mind.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Talking about Bitcoin Investment from the Perspective of Large-Scale Asset Allocation

- The Brazilian exchange was sued for $13 million and the CEO was exposed to 25,000 BTC

- This time, Bitcoin is a safe-haven asset.

- Video: Those Internet companies that are surpassed by the market value of Bitcoin

- Bakkt is finally on the line, industry insiders said: In the long run, it is conducive to the development of cryptocurrency

- Bitcoin computing power broke the first hundred EH/s, gold mining is at the time?

- Nic Carter: Bitcoin's currency experiment