Learn about the giant whale grayscale investment fund and understand the encryption market trend

In the cryptocurrency market, there is a special group of people who have a large amount of cryptographic assets in their hands. It seems that every time the market fluctuates greatly, they are related to them. In the industry, they are collectively referred to as "cowices."

In general, “whales” are considered to have more than $56 million in bitcoin holders. They may be early investors, miners, trading platforms or crypto funds. Grayscale Investments is one of the famous bitcoin whales. According to statistics, the fund currently has more than 200,000 bitcoins. It is the world's largest encryption asset management company, and its customers are mainly institutional investors. The investment trend and layout of the company have the meaning of vane.

By understanding the grayscale investment, we may directly "foresee the future."

- Large institutions continue to expand: Bakkt launches BTC futures contract in Singapore

- The miners began to surrender, how will the bitcoin market react?

- Twitter Featured | Encrypted Cats Entangled Ethereum, Gods Unchained can screw it up

Backed by giant crocodile, powerful

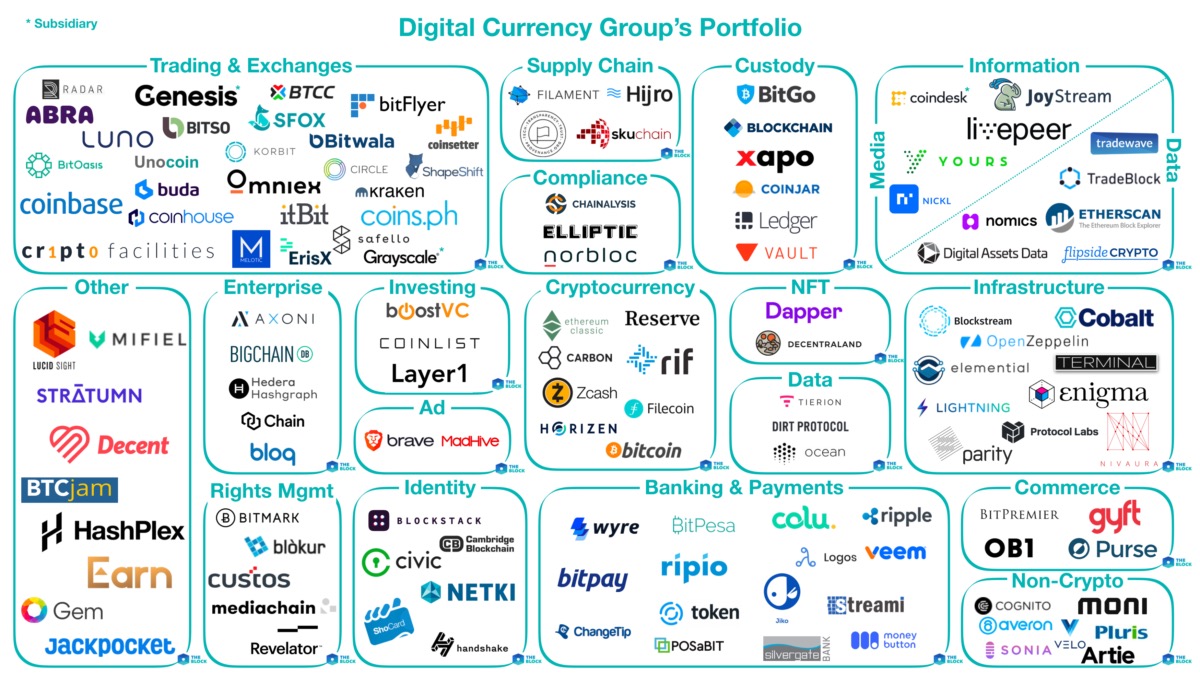

Grayscale investment was established in 2013 and was founded by the Digital Currency Group. Many people may not be familiar with DCG, but DCG has a pivotal position in the encryption market and has expanded its encryption investment landscape in recent years.

According to statistics, DCG has invested in more than 100 blockchain companies in more than 30 countries around the world, including exchanges, underlying agreements, media, wallets, etc., and has been active in many blockchain investment institutions for many years. .

At the end of last month, Grayscale said that the company's total investment in 10 investment products for institutional investors reached $2.2 billion. Single trust fund products include BTC, ETH, BCH, ETC, LTC, XRP, XLM, ZEC, ZEN, accounting for 99.1% of total assets. The only diversified product, the Grayscale Digital Large Cap Fund, accounts for less than 1%.

GBTC remains the company's largest asset, breaking through the $2 billion mark in Q3 in 2019. As of the end of October, the fund received a total of $255 million in capital inflows in 2019, an increase of 51% over the same period in 2018. The GBTC has a return rate of 108% so far this year, and the return rate for the past 12 months is 21.32%.

Compliance with the fund's operating model, coupled with the organization's growing interest in Bitcoin, investing in grayscale investment funds has become the institution's choice, circumventing the cumbersome steps of holding Bitcoin and the potential for stolen and uncontrollable Risk, which also makes grayscale investment very popular.

Grayscale research: Reasons for investing in cryptocurrencies

In the 2019 cryptocurrency upswing cycle, institutional investors saw the huge potential of the cryptocurrency market and made it recognized by sectoral institutional investors. Grayscale investment conducted some research on more than 1,000 traditional securities investors a few months ago, and got some interesting conclusions.

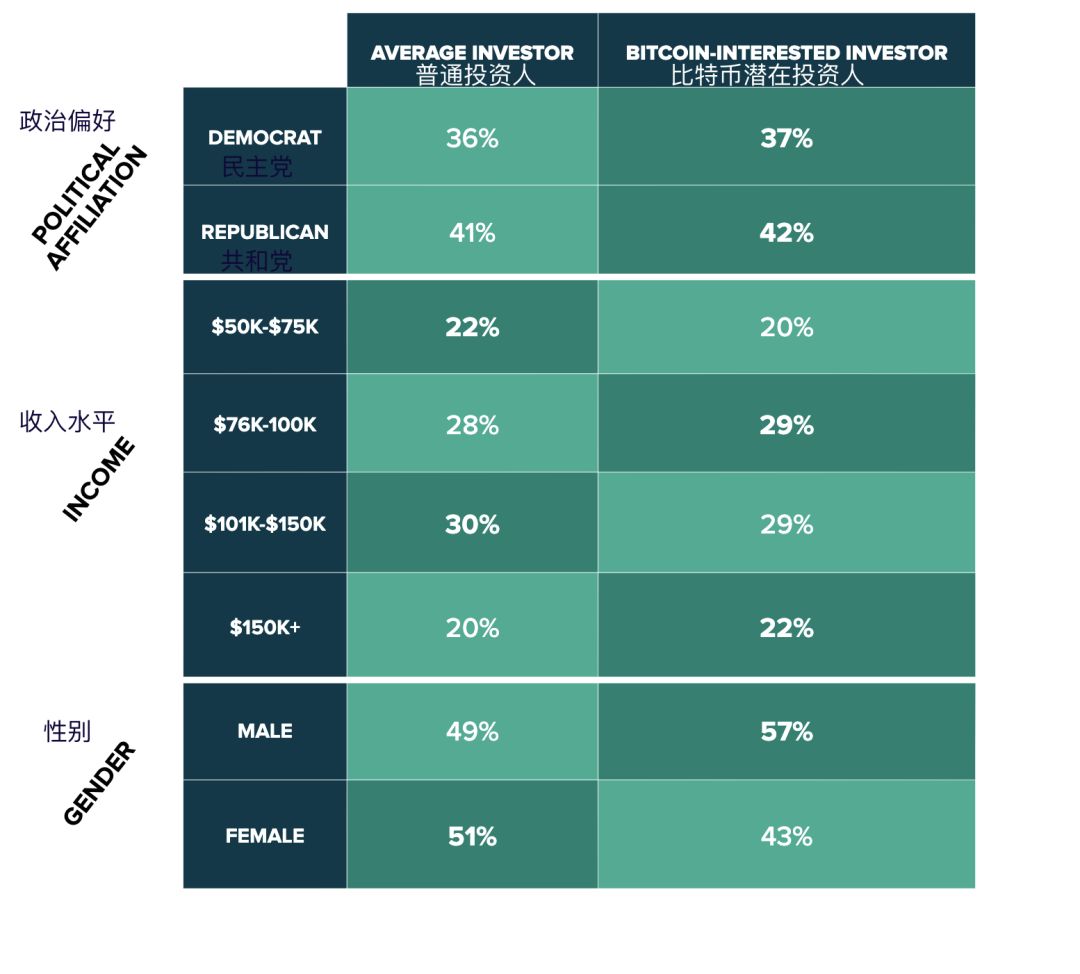

1. 36% of US investors will consider investing in Bitcoin. This is far beyond the expectation of grayscale, which also shows that Bitcoin has been recognized by a considerable number of traditional investors as an investment product.

2. Bitcoin investment is no longer exclusive to the digital currency community. The survey shows that there is no significant difference between the portraits of potential investors and the portraits of ordinary American investors, but such people are usually more risk-tolerant.

3. Bitcoin has many features to attract investors. 83% of the surveyed people said that they can vote for a small part and see if they follow suit. The reason for attracting them is the scarcity, growth potential and low threshold of Bitcoin.

Since the first bitcoin was dug up by Nakamoto in 2009, Bitcoin has experienced many ups and downs. In these 10 years, Bitcoin has been recognized by more and more people.

But in this grayscale survey, investors also expressed concerns about investing in cryptocurrency. In the part of the population that is not interested and neutral to Bitcoin, they say that the following problems are factors that they need to seriously consider.

These include: hacker threats faced by exchanges, regulatory issues faced by cryptocurrencies being used for crimes, and lack of relevant knowledge.

In this survey of grayscale, we have seen relevant investors' optimism about the potential of the cryptocurrency market, and also saw the current problems, but there is no doubt that crypto assets such as Bitcoin are steadily moving towards quality investment. On the way to the standard, in the long run, the current problems can not fundamentally hinder the future of cryptocurrency.

The gray scale is expanding a lot, is the organization really making a big step into it?

Institutional admission is regarded as one of the necessary conditions for the arrival of the bull market in the cryptocurrency market. From 2018 onwards, we are arguing over the question of “Is the institution admitted?” and we are eager to represent such a kind of investment from grayscale. Funds or agencies looking for answers.

In mid-October, the grayscale investment released the Q3 report, and the investment inflows in the third quarter exceeded $250 million, a two-fold increase from the previous quarter.

According to the report, in the third quarter, institutional investors represented by hedge funds were still a strong driver of gray-scale capital inflows, 84% of which came from institutional investors, up from 80% in the past year. The interest of institutional investment in cryptocurrencies has only increased.

In addition, nearly 80% of the capital inflows are related to the conversion of digital assets into gray-scale family series “in-kind” products in exchange for share of stock contributions, and this trend has recently accelerated, in the past 12 months More than only 71%.

Rayhaneh Sharif-Askary, director of grayscale sales and business development, also told the media last month, “There is such a remark in the media about when institutional investors will step in and when to start investing. This is interesting because it is ironic. We have seen institutional investors have been investing with us and this has been around for a long time."

From the grayscale report and the executive's comments, the agency has indeed entered, but the reality is that there is still no real bull market.

A report released last month by The Block pointed out that the vast majority of grayscale GBTC assets come from unknown customers whose asset management scale is less than $100 million.

According to the report, according to the 13F form submitted in grayscale, 1.3% of the gray bitcoin trust (GBTC) assets come from AUM (total asset management scale) over US$100 million in US institutional investors. The remaining 98.3% came from an unknown customer with an AUM of less than $100 million, which is not within the scope of the 13F form. In addition, since the launch of the Ethereum Trust product, the AUM of the organization that owns the product has not exceeded $100 million.

The US SEC stipulates that institutions that manage more than $100 million in stock assets need to provide the SEC with a position report at the end of the quarter within 45 days of the end of each quarter. This report is the 13F form.

Therefore, from various performances, institutional investors are becoming more and more active in related investments, but most of them are still in a temptation mentality. Large-scale funds have not yet entered the market, although institutions are optimistic, but cryptocurrency is high risk. It is still a factor that organizations need to consider.

But no matter what, grayscale investment allows us to see the enthusiasm of the organization, the organization is only the first step, the cryptocurrency still needs to prove itself further.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyst: There are four long-term prospects for Bitcoin, will it return to the bull market?

- Getting started with blockchain | Bitcoin's success book: How does it solve the double flower problem?

- Twitter Featured | Euro Pacific Capital CEO: The idea of turning bitcoin into digital gold is wrong

- Babbitt Column | Bitcoin White Paper 11th Anniversary: Here are 11 amazing common sense about Bitcoin

- Bitcoin options products are coming soon, what do you think of the head of CME?

- Market Analysis: The decline is still there, when can it be more?

- Viewpoint | Demystifying the culprit behind the bitcoin plunge