Bitcoin is a safe haven for Chinese investors? Let’s first understand a strange market trend in early August.

Since the second quarter of 2019, China and the United States have been involved in another trade war, with tariff pressures and political threats coming one after another.

Bitcoin played an important role in this trade war because analysts called it a "hedging" or "safe haven" for periods of macroeconomic uncertainty. However, there is ample evidence that Bitcoin is not the best hedging option for dealing with trade wars, as analysts believe.

In this article, we will delve into the views of people on Bitcoin during the trade wars and analyze whether their views are reasonable based on data.

Bitcoin blends into the Sino-US trade war stage

- Explore the central bank's digital currency: What is the impact on the electronic payment industry?

- Really God! NASA interested blockchain technology to understand

- PayPal, Visa retired, supervised pinch, Libra main online line is just around the corner

If you have been paying close attention to the tweets of cryptocurrencies in recent months, you may have noticed a trend: investors and analysts see Bitcoin as a potential for trade wars, whether they are from Wall Street or other major roads. haven.

Recently, the political trade gap between China and the United States has intensified under the catalysis of the Hong Kong chaos, which once caused the traditional market to panic. The VIX panic index used by CBOE to measure the S&P 500 volatility has risen from 12.87 on May 4th – the day before Trump’s claim to impose tariffs on Chinese goods, to 17.09 during the writing period. At the beginning of August, it reached the highest value of 24.59.

At the same time, the world's preferred safe haven assets, namely precious metals, the yen and the Swiss franc, have begun to rise significantly. From a certain perspective, the same safe haven gold has risen to $1,500, about $240 higher than the beginning of the year.

It seems that it has benefited from the advancement of the trade war, and bitcoin has also risen decisively in 2019.

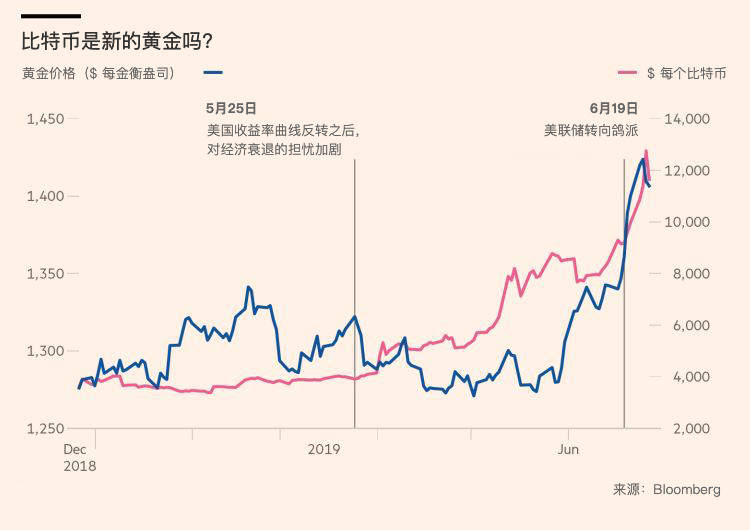

Tim Culpan discovered in early August that the correlation between Bitcoin and gold has risen from 0.496 to 0.827 since May, showing a strong positive correlation. As you can see from the chart below in the Financial Times, Bitcoin seems to have been following the trend of gold. Although this connection is not perfect, it is enough to attract the attention of the financial community.

In addition, Bloomberg also found that the 30-day inverse correlation between Bitcoin and the renminbi hit a new high in early September.

The correlations presented at these points in time have spawned the social trends mentioned above, and everyone has begun to tout the role of Bitcoin as a safe haven, especially among Chinese investors.

In fact, Quant Fiction (General Motors engineer and amateur data scientist Brian Blandin's pseudonym tweet) found that institutional investors increased the frequency of posting bitcoin-related tweets. He sampled and analyzed 171 Twitter users (average number of followers was 55,217) and found that users who are certified as “investment portfolios, funds, assets or wealth managers” frequently refer to “bitcoin” and “safe haven”/ The term "safe haven" is twice as many as the beginning of the year.

Obviously, everyone’s argument that Bitcoin is a trade haven is a bit overwhelming.

Not a perfect haven; trading may have no effect

However, the data tells us that this "safe haven" argument may not be so reliable.

At the beginning of August, a strange market trend emerged during the fierce confrontation between the two sides of the trade war. According to the data of the OTC over-the-counter transaction, the Tether (USDT) transaction has a discount of nearly 1.3% – it is well known that the users of the Firecoin are mainly mainland Chinese investors. China's cryptocurrency venture capitalist Dovey Wan said that Bitcoin also has discounted transactions in China.

Of course, the 1.3% discount is about $150, based on the price of Bitcoin at $11,800 at the time. It doesn't look like a lot. However, in the market where everyone is constantly labeling it as a “safe haven” and expecting a high premium, any discount should be shocking, isn’t it? As Larry Cerma k, Research Director of The Block, pointed out in an article on August 12, “This is evidence. Chinese investors affected by the devaluation of the RMB last week are not the ones who bought Bitcoin. And the depreciation of the renminbi is a result of the intensification of the trade war."

This is not all. Alex Krüger, a pro-bitcoin economist and global macroeconomic analyst, recently pointed out that news about the trade war, whether it is the news of launching billions of dollars in tariffs, or the recent long-term criticism that Trump accuses China of being responsible for X, None of them have a substantial impact on Chinese consumers.

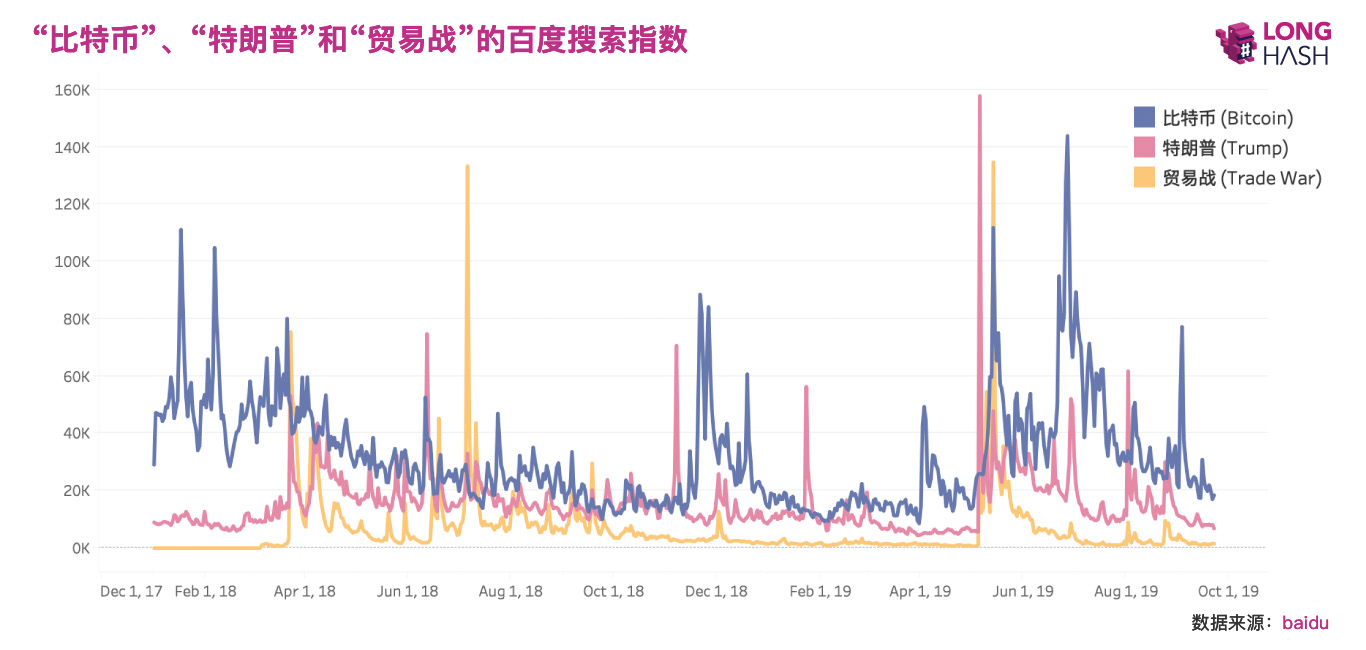

The analyst pointed out in a theme tweet released on September 20 that the search volume of "bitcoin", "trade war" and "Trump" has increased at the same time in China's Baidu search engine. Appeared once. This situation occurred on May 14, when the Chinese government called for a "people's war" against the United States. As can be seen from the figure below, during the period from April 2019 to June 2019, the almost simultaneous surge in the search for these three keywords occurred during this period:

In terms of price, Bitcoin only once responded to the news of the trade-related explosion in real time. Krüger pointed out under another tweet that this incident was Trump's mention of the so-called "Intellectual Property Theft" issue in China and a plan to impose hundreds of billions of dollars in tariffs on China in a multi-segmented tweet. In the few minutes after the release of Twitter, bitcoin prices actually rebounded by about 0.5%. But this is all. In the intensified trade war, everyone is looking forward to becoming a “Gold 2.0” asset, bringing in less than 1% of the proceeds.

In terms of price, Bitcoin only once responded to the news of the trade-related explosion in real time. Krüger pointed out under another tweet that this incident was Trump's mention of the so-called "Intellectual Property Theft" issue in China and a plan to impose hundreds of billions of dollars in tariffs on China in a multi-segmented tweet. In the few minutes after the release of Twitter, bitcoin prices actually rebounded by about 0.5%. But this is all. In the intensified trade war, everyone is looking forward to becoming a “Gold 2.0” asset, bringing in less than 1% of the proceeds.

If you even have a tweet about "adding 5% tax on Chinese 550 billion US dollars" (not to mention how Trump has labeled all kinds of suspicious behaviors on Chinese people), you can't be motivated in the bitcoin market. Take a little spray and talk about the perfect safe-haven assets? That is not fair. Just as Trump made a big eulogy, the price of gold rose by 2%, which is quite impressive for assets worth $7 trillion.

If you think that a 0.5% increase is a clear signal that Bitcoin is affected by macroeconomics, then you may be misled.

The famous liberal, investor and gold supporter Peter Schiff pointed out that after the trade tariff news release, the price performance of Bitcoin is more like people bet that "bitcoin will become a safe-haven asset" rather than really avoiding it. risk. Schiff believes that the evidence is that Bitcoin fell back shortly after the news of the trade war news, which shows that it can not maintain the benefits of its speculation as a safe-haven asset.

This is an independent market for Bitcoin – not related to the renminbi and any other assets

Not only did Bitcoin not play a "safe haven" this time, it did not react to fundamentals or news. Investors have gradually adapted to the fact that Bitcoin has skyrocketed for no reason.

Readers may recall that on a certain day in early April, Bitcoin skyrocketed by $1,000 and has since kicked off. Although some people think that it is the institution's place, or you think so, there is no clear catalyst to promote a 20% daily increase. In addition, if you look back on Bitcoin's other major ups and downs, you will find that there are very few changes in prices due to news or events.

Even the executives in the cryptocurrency industry are struggling to find the reasons for the price changes in Bitcoin. They can't even say that "the change in price every day is affected by fundamentals." In a mid-May episode of Bloomberg TV, ShapeShift's CEO and early bitcoin advocate Erik Voorhees also said that the bitcoin rebound is only a by-product of the cryptocurrency performance, and that "the retail group" decided to keep buying Bitcoin. result.

What is certain is that in the period of geopolitical turmoil and recession panic, the performance of Bitcoin over traditional assets may indicate that it is independent and unaffected by the traditional market downturn. However, calling it a reliable safe haven asset may be a bit of a smattering… at least for now.

Author: Nick Chong

Source: longhash

Editor's Note: The original title is "Bitcoin is a safe haven for Chinese investors?" 》

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- BTC bottoming project continues, mainstream currency market is worthy of attention

- Wholesale digital legal currency payment system to reconstruct financial market: Interpretation of Fnality white paper (below)

- The blockchain industry raised more than $150 million in September, and the exchange became a hot track.

- Research Report | The new favorite of hedge funds: cryptocurrency fund

- DeFi loan monthly report | Maker even cut interest rates, lending platform arbitrage space shrink

- Babbitt column | The unique development of currency, hiding the important direction of Dapp development

- Schnorr+Taproot soft fork, an invincible proposal with expansion and privacy?