Research Report | The new favorite of hedge funds: cryptocurrency fund

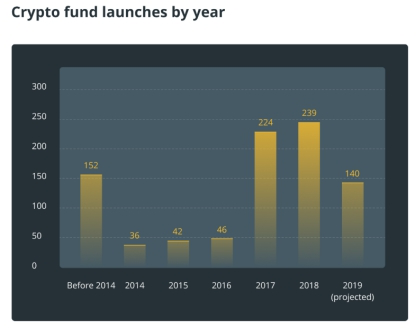

Recently, the crypto-equity fund that has erupted for more than six years seems to be a strong agent for the blockchain industry. Nowadays, crypto-equity funds are like a catalyst for the blockchain industry, madly pushing huge business opportunities to sprint forward. From the 224 new fund in 2017 to the unprecedented launch of 239 files in 2018, the investment engine of crypto assets seems to be forever. Do not stop.

However, many people predict that this number will start to decline by 2019, but some research institutions report that the crypto-equity fund market will continue to make great strides in 2019, when the prospects of crypto assets are unclear.

Risk avoidance or venture capital?

- DeFi loan monthly report | Maker even cut interest rates, lending platform arbitrage space shrink

- Babbitt column | The unique development of currency, hiding the important direction of Dapp development

- Schnorr+Taproot soft fork, an invincible proposal with expansion and privacy?

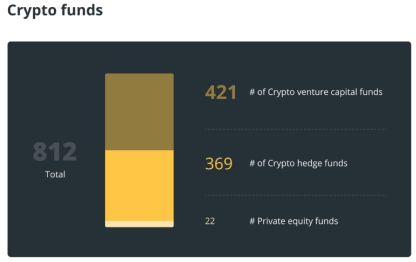

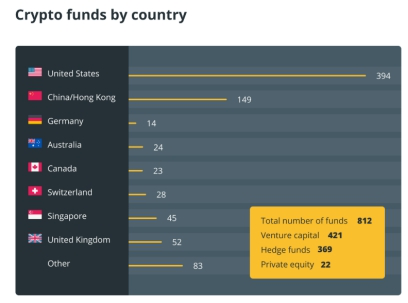

A total of 812 cryptographic asset funds worldwide, including 369 encrypted hedge funds and 421 venture capital funds, the rest are ETFs or private equity funds (source: cointegragragh). There is a belief that the VC model of VCs has created an excellent incubation platform for the blockchain. Therefore, it is a new trend for VCs to create and distribute crypto assets for the blockchain. For safe-haven investments, the effective maximization of cryptographic assets diversifies the risk of portfolios, especially based on the volatility of crypto assets. For example, some volatility options have enabled many hedge-investing institutions to successfully establish global markets in 2018. A portfolio of low correlations in recession. Most hedge-investing institutions use long-term investment strategies to face cryptographic assets, including issuing certificates and incubating innovative ventures. This is similar to VCs.

Figure 1: Encrypted Asset Fund Source: Website Crypto News

Small but complete

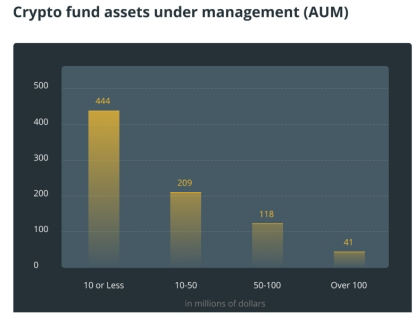

Although the crypto-asset fund industry is booming, according to the PWC report, more than 60% of fund operations are under $10 million. In other words, these hedge funds are mini-companies, that is, the whole company is not More than five people, but manages funds worth more than 50 million.

Figure 2: Encrypted Asset Management Amount Image Source: Website Crypto News

It can be seen that the crypto-equity fund is far less than the amount managed by the traditional hedge fund, and the entire crypto-asset fund only accounts for about 1% of the total hedge fund management amount.

Invest in Bitcoin or hedge funds?

In the traditional industry, it is difficult to see that the hedge fund investment return rate exceeds its target index, but the blockchain industry has done it. The traditional hedge fund investment method is old and outdated under decentralized digital finance, from 2017- In 2019, the average profit of investing in the bitcoin market was 100%, but the statistics of 40 crypto asset hedge funds, their income is 1400%.

What's more interesting is that when the bull market was booming in 2017, the return rate of the crypto-equity fund was slower than that of the general digital asset investment. However, by the time of the bear market that everyone feared in 2018, the crypto-equity fund dominated the market. Of course, the bear market will have a loss for any kind of investment, but compared to -96% of the bitcoin rate of return, the -46% of the encrypted asset is a victory.

After the bear market in 2018, venture capital analysts began to look for potential and innovative blockchain projects in low-priced markets. It was their help that made the crypto asset market come back after this heavy blow. It's a lot simpler.

Figure 3: Annual Encrypted Fund Issuance Source: Website Crypto News

So how do we predict the benefits of crypto assets?

In terms of experience, the profit cycle of a venture fund is 52 months, and the first year's earnings will be three times that of the fifth year. We can be very optimistic that the crypto assets fund is still in the initial period, and the crypto assets fund The average age is about 16 months, so we can guess that it is still the main profit cycle of crypto assets, which is the time to get rich rewards.

The future of the United States and China

Figure 4: Number of National Encryption Funds Source: Website Crypto News

In general, small hedge funds usually do not become the focus of attention, but crypto assets are not. The US Securities Regulatory Bureau is drafting regulations for the issuance of certificates and tokens, due to the issuance of crypto assets and certificates. There are close links to token issuance, so they face more severe regulation than traditional hedge funds. For example, Pantera Capital of the United States faced a high fine at the end of 2018 due to the investment in the issuance of a pass. The relevant institutions in the Chinese market predict that the number of China's crypto asset hedge funds will surpass the United States as the largest country next year, and relevant regulations are also in the process of preparation.

The risk of hedge funds is fierce. Whether it is a safe-haven investment or a diversified business project, the encrypted asset fund has been affirmed by a group of financial people. It can be seen that the prospect of the blockchain market is very clear. As far as the current investment situation is concerned, the crypto-equity fund is also a kind of “singular investment”, which is a high-risk and high-yield. Perhaps after several periods of undulating, the crypto assets will become another unique type of stocks and bonds. Investment Products.

Translated from the website Crypto News Original title "The Story Behind the Explosive Growth of Crypto Funds"

Original author Kogan

———— end ————

Legal statement: Intellectual property statement

All texts that indicate that the author is “Zhen Chain” and “Dazhi Think Tank” are copyrighted by the company. No organization, organization or individual may reprint, link or repost without the written authorization of the company. , interception and other ways to copy and publish.

Disclaimer

All the contents contained in this report are produced by the unique data and analytical resources of “Zhen Chain” and “Dayu Think Tank”, aiming to provide technical reference for practitioners in the blockchain industry. The various reports produced by the company are for reference only and do not constitute investment advice. If the visitor suffers losses according to the report issued by the company for investment or trading, the company does not assume any liability for compensation. For other acts performed by visitors based on reports issued by the company, the company does not assume any form of responsibility unless there is a clear written commitment of the company.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- World Blockchain Conference · Wuzhen countdown to 30 days, the first batch of heavy guest list was released, BATJ came

- After the National Day holiday returns, the market is fully warming up. Is it a red envelope or a bull market?

- Formal verification of the Ethereum 2.0 deposit contract, ETH to PoS into the countdown?

- Coinbase's effect on the currency is not strong, mainly because the market is at work.

- QKL123 market analysis|October "Autumn event", or market volatility (1008)

- Libra's detailed roadmap is open: developers focus on the Libra main online line

- To die, the altcoin that was almost forgotten by the market is going to be killed?