Bitcoin’s volatile price swings cause $360 million in losses for traders

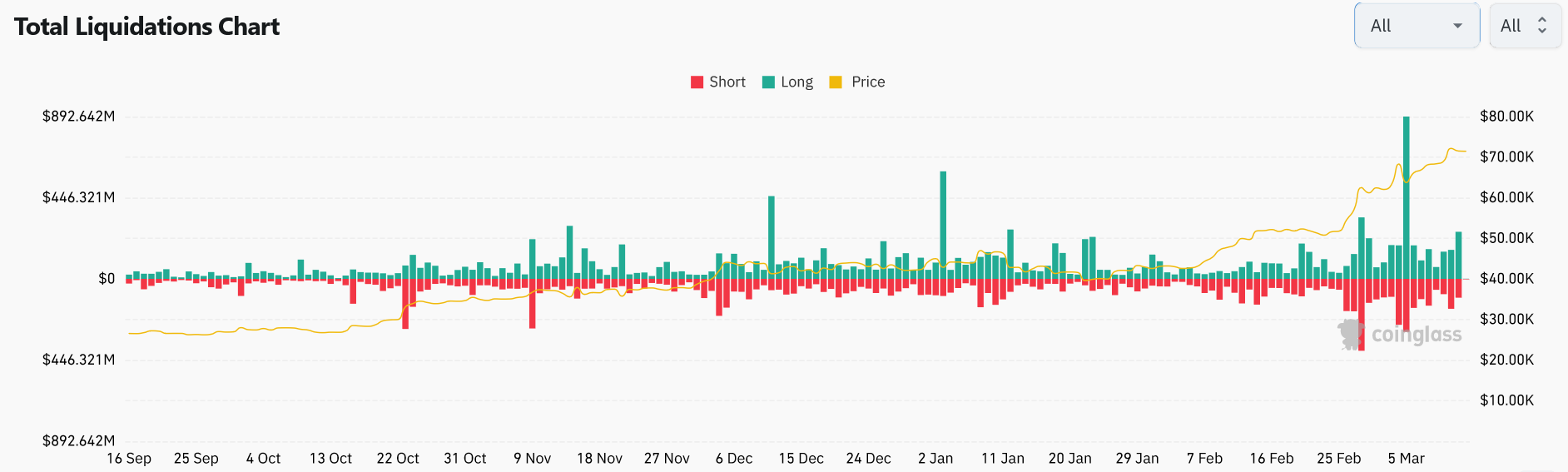

Over $360 million worth of long and short positions were liquidated on March 12 as Bitcoin reached a new all-time high before dropping by almost 5%.📈 Bitcoin Volatility: $361 Million in Leveraged Trades Liquidated in 24 Hours

Introduction and Analysis

Bitcoin’s recent surge to a new all-time high of $73,050 on March 12 has caused significant volatility in the market. In the last 24 hours alone, over $361 million worth of leveraged trades have been liquidated. This sharp price swing has predominantly liquidated long positions, with around $258 million being erased. Short sellers, meanwhile, lost over $103 million.

The magnitude of this liquidation is noteworthy, marking the largest long flush-out since March 5, when Bitcoin experienced a similar ordeal after reaching its previous all-time high of approximately $69,000.

While the volatility this time was less severe, with Bitcoin’s price swinging only 4.85% between its low of $69,365 and its high of $72,733, market observers are attributing this turbulence to traders anticipating a price correction. However, the exact timing of this correction remains uncertain.

It is important to note that despite the possibility of a correction, there is also a significant amount of FOMO (Fear Of Missing Out) among traders, which could potentially fuel the continuation of the rally. The combination of nerves and FOMO creates an interesting dynamic in the market, making it difficult to predict exactly how Bitcoin’s price will behave in the near future.

- Bitcoin Drops as Inflation Concerns Take Hold

- Ether Price Analysis: Is the Spot Ethereum ETF Approval the Sole Catalyst?

- Coinbase Shares Upgraded by Raymond James, Highlighting the Impact of Spot Bitcoin ETF Flows

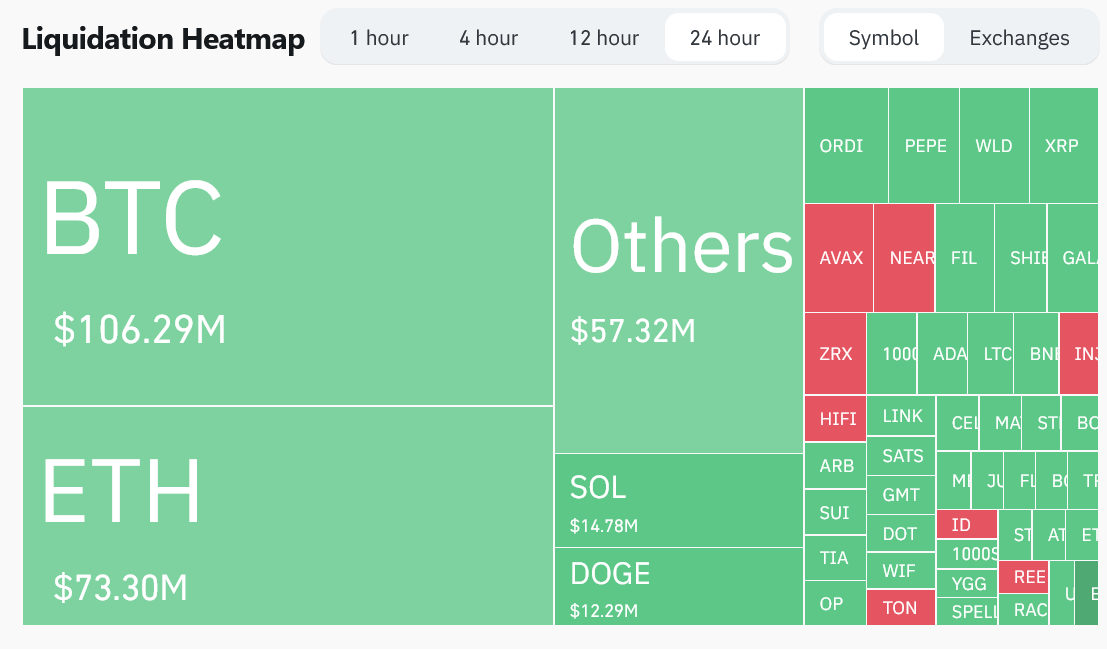

Bitcoin versus Ether Trades

Bitcoin and Ether were at the forefront of this liquidation frenzy, accounting for the most significant losses in leveraged trades. Bitcoin saw $106.3 million in liquidations, while Ether experienced $73.3 million. Other cryptocurrencies such as Solana (SOL), Dogecoin (DOGE), and the Bitcoin-based memecoin Ordi (ORDI) also faced substantial liquidations.

The Impact of Liquidations on Exchanges

The cryptocurrency exchanges most affected by these liquidations were OKX, which saw a total of $152 million in short and long liquidations, and Binance, where traders collectively incurred losses of $128.4 million.

This highlights the importance of risk management in the world of cryptocurrencies. Traders must be cautious and implement strategies to protect themselves from losses during periods of high volatility.

🔎 Q&A: Addressing Additional Reader Concerns

Q: What causes such high volatility in the Bitcoin market?

A: Bitcoin’s volatility can be attributed to various factors, including market sentiment, macroeconomic events, regulatory developments, and institutional investor activity. These factors can amplify price movements and result in significant volatility.

Q: How can traders protect themselves from liquidations during periods of high volatility?

A: Risk management is crucial when trading in such a volatile market. Traders should set stop-loss orders to automatically exit positions if the price reaches a predetermined level. Additionally, diversifying the portfolio and avoiding excessive leverage can mitigate potential losses.

Q: Should I invest in Bitcoin during periods of market turbulence?

A: Investing during volatile periods requires careful consideration and risk tolerance. It is essential to evaluate your investment goals, conduct thorough research, and consult with financial professionals before making any investment decisions.

Future Outlook and Recommendations

As we look ahead, it is clear that the cryptocurrency market, particularly Bitcoin, remains highly unpredictable. While the anticipation of a price correction persists, the presence of FOMO suggests continued upward momentum. Traders and investors should approach the market with caution, considering both potential risks and rewards.

In light of recent events, it is important to stay informed about the latest developments and trends in the cryptocurrency space. Researching and understanding market dynamics can help individuals make informed decisions and navigate the volatility effectively.

References

- Coinglass: Bitcoin Long and Short Liquidations

- Bitcoin short sellers are out $161M as Bitcoin surprises with 11% rally

- Coinglass: Cryptocurrency Liquidation Heatmap

- S3 Partners: Short Sellers’ Losses in Crypto Firms

- ‘Crypto is inevitable’ so we went ‘all in’ — Meet Vance Spencer, permabull

Image source: Coinglass – Daily cryptocurrency short and long liquidations over the last six months.

Image source: Coinglass – Daily cryptocurrency short and long liquidations over the last six months.

Image source: Coinglass – Cryptocurrency liquidation heatmap over the last 24 hours.

Image source: Coinglass – Cryptocurrency liquidation heatmap over the last 24 hours.

😄 Share Your Thoughts

Are you surprised by the extent of the liquidations in the Bitcoin market? Do you think the volatility will continue or stabilize? Share your thoughts and join the conversation on social media!

💡 Did you learn something new? Spread the knowledge by sharing this article with your friends and crypto enthusiasts!

Disclaimer: This article does not constitute financial advice. The information provided is based on current market conditions and trends. Please conduct your own research and consult with financial professionals before making any investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain Market Update: Winners and Losers in the Crypto World 🏆📉

- Expert predicts Cardano price to surge by 60% in 7 days.

- Dominance of Stablecoin Issuance: USDT and USDC Surge 📈💸

- Coinbase Takes Legal Action Against SEC for Regulatory Ambiguity in Crypto Industry

- El Salvador’s Bitcoin Treasury Soars to $206 Million: A Success Story

- Binance Executives Detained in Nigeria: A Tale of Crypto Confinement

- Nigerian Authorities Detain Binance Executives in Ongoing Dispute 🚫🖐️