Destiny and reincarnation: the moment of Bitcoin's production reduction

I. Introduction:

In early February 2020, the price of bitcoin regained the $ 10,000 mark. However, just two months ago, Bitcoin spent nearly six months in a bear market, falling to $ 6,800, a drop of up to 40%, and the market was once full of pessimism. In just two months, Bitcoin has staged the return of the king, and investors have also discussed whether the Bitcoin bull market is coming. According to forecasts, Bitcoin will be halved at the beginning of May this year. At present, there are still about three months before the official halving of Bitcoin, and the halving of Bitcoin has already become a recognized opportunity in the industry. In addition, in 2020, cryptocurrencies such as BCH, BSV, and ZEC will usher in half.

Although everyone is excited about Bitcoin's breakthrough of 10,000 U.S. dollars and expects the halving of Bitcoin in optimism, it is unknown that the crisis under the halving of Bitcoin has quietly brewed. In the past few years, we have witnessed the feat of Bitcoin rising from US $ 2,000 to US $ 19,000. We have also encountered the dilemma that Bitcoin has plummeted by nearly 80% within one year, and it is the constant operation of the Bitcoin market that is constant The economic law behind it is the so-called "success and failure turn heads, the green hills are still there, and the sunset is red."

In "The Official Book of Heaven", Sima Qian described the changing law of the movement of the universe: "Fu Tianyun, a small change at the age of 30, a change in a century, a change in 500 years; : This also has large numbers. " As part of the laws of the world, the economy's recovery, prosperity, recession, and depression also present the established rhythm of order change. The same is true for bitcoin-with the cycle of reducing production as the limit, the bitcoin market is about a four-year cycle. At present, Bitcoin has gone through three rounds of market cycles. In each cycle, we can clearly observe Bitcoin's prosperity and depression, recession and recovery.

- Perspectives | Zheng Lei, Hong Kong International New Economic Research Institute: Blockchain is naturally suitable for social welfare scenarios

- Analysis: Is 2020 the first year of the blockchain?

- Is the privacy feature useful? A quick overview of the usage of privacy coins and coin mixing services

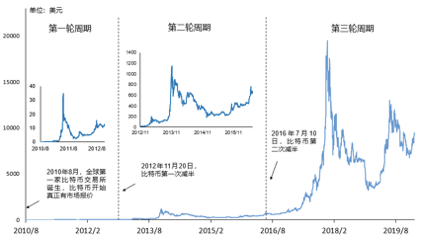

Figure 1. Two halvings of bitcoin production in history and three rounds of market cycles

Destiny and reincarnation: Bitcoin's production reduction and three cycles of history

Why is the market looking forward to this halving of Bitcoin? Because Bitcoin has experienced two halvings in history, and each time the market is halved, the price of Bitcoin will usher in a bull market. Although history is always surprisingly similar, it will not be simply repeated, and a complete copy is tantamount to carving a sword. The purpose of our review is to master the key of "the occasion between heaven and man" and "changes from ancient times to modern times" by reviewing history to achieve "knowing the world and examining the number of opportunities".

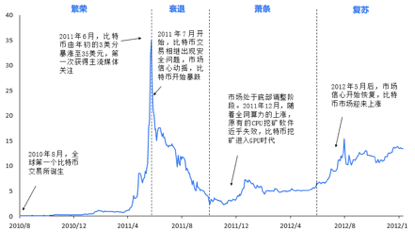

( 1 ) The first cycle: the beginning of chaos and emergence ( 2010.8-2012.11 )

Earlier Bitcoin was only an idealistic experiment. It did not receive the attention of the public at the beginning of its introduction. It was limited to the spread between technical hackers and a few computer programmers. On May 21, 2010, a programmer in Florida, the United States, bought a $ 25 pizza coupon with 10,000 bitcoins, marking the first time that bitcoin had a price in the real world. In July 2010, the Bitcoin exchange Mt.Gox was established in Japan, and Bitcoin began to have real market prices. With the advent of bitcoin exchanges, more and more people are beginning to try to trade between fiat currencies and bitcoin in various countries. At this point, Bitcoin's first business cycle officially began.

- Figure 2. Bitcoin's first market cycle ( 2010.8-2012.11 )

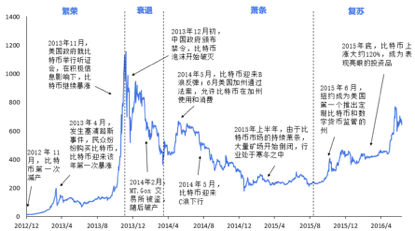

( 2 ) The second cycle: Towards maturity and deep exploration ( 2012.12-2016.7 )

2013 is the first year of Bitcoin's global vision. At the end of March 2013, a financial crisis broke out in Cyprus, and bank depositors faced serious losses. Cypriot depositors chose to use Bitcoin as a hedging tool. Bitcoin drew the attention of the world for the first time; the time came to October 2013, the U.S. Senate discussed The impact and opportunity brought by Bitcoin. Affected by the positive news of the hearing and the large media coverage of Bitcoin, Bitcoin continued to rise. Driven by market buyers, the price of Bitcoin stood at a record high of $ 1,200.

Bitcoin's wild rise has attracted the attention of governments. In order to prevent potential financial risks, in December 2013, the five ministries and commissions of the Chinese government jointly issued the "Notice on Preventing Bitcoin Risks", which clarified the non-monetary nature of Bitcoin and banned all financial institutions and payment institutions from conducting Bitcoin-related transactions. Business. At this point, the Bitcoin bubble was pierced, and Bitcoin turned into a plunge.

After the plunge at the end of 2013, Bitcoin ushered in a recession period of up to one and a half years, especially in the first half of 2015. Due to the continued low price of Bitcoin, a large number of companies in the industry began to close down. But just like the competition mechanism for survival of the fittest in all markets, after going through the cold winter, high-quality blockchain companies represented by Bitmain began to rise rapidly in the market recovery in the second half of 2015 and become industry giants.

- Figure 3. The Second Market Cycle of Bitcoin ( 2012.12-2016.7 )

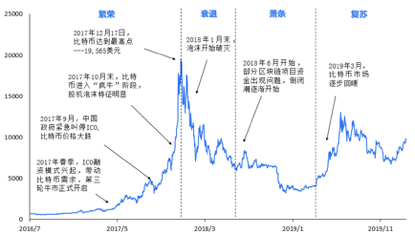

( 3 ) The third cycle: the stone is shaking , Hongfei frosts ( 2016.8-2020.5 )

The time has come to July 2016. With the second cut in Bitcoin as the mark, Bitcoin has entered the third phase. In the previous stage, a new crowdfunding financing model represented by Ethereum (Ethereum) began to emerge, and gradually matured with the launch of the Ethereum mainnet and the development of ERC20 contracts in the third stage-in 2017 In the spring, this ICO model began to rise. Specifically, investors invested in a blockchain startup project with Bitcoin (BTC) or Ethereum (ETH) in their hands and obtained initial production from it. Of cryptocurrencies in return.

Driven by the new business model of Ethereum, Bitcoin's half-year bull market has attracted more investors to enter, and Bitcoin has begun to enter the "mad bull" stage. The influx of funds has caused the price of Bitcoin to increase daily As high as a few thousand dollars, the signal of speculative bubble in the market is obvious. By December 17, Bitcoin stood at the highest point in history-$ 19,565. In 2017, the annual increase of Bitcoin reached 1700%, and the huge investment income once again attracted the attention of the world.

However, at the end of January 2018, as the market's incremental capital growth slowed, the price of Bitcoin began to collapse and entered a recession phase; by June 2018, some blockchain project team funding difficulties appeared, and the market began to show a cold winter. From the "shock of the earth" in 2017 to the current "Hongfei Frost", Bitcoin is just in the normal business cycle.

- Figure 4. The Third Market Cycle of Bitcoin ( 2016.8-2020.5 )

Structural changes: Why is it so important to reduce Bitcoin production?

From historical experience, every time Bitcoin cuts, it will bring a wave of bull market. Intuition tells us that the price will rise after Bitcoin cuts, so what is the reason behind it? Now we analyze from the theory of supply and demand.

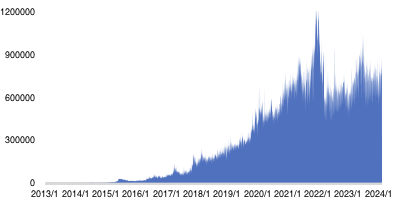

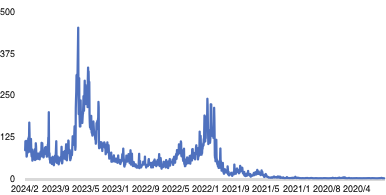

From the perspective of demand, it can be seen from Figure 5 and Figure 6 that the main demand for Bitcoin comes from application demand and speculative demand. We can use Bitcoin's active address number and daily average transaction volume to reflect this. Two needs. Bitcoin demand fluctuates significantly in the short term and continues to increase in the long term.

Figure 5. Number of active Bitcoin addresses (unit: units)

Figure 6. Bitcoin's average daily transaction volume (unit: USD 100 million)

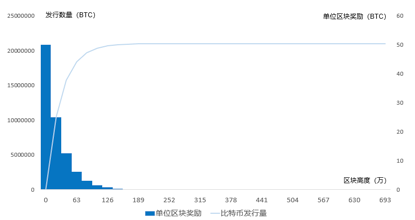

From a supply perspective, the total number of Bitcoins to be issued in the future is 21 million. Currently, the blockchain network generates a block about every 10 minutes. At the beginning of the birth of a block, 50 Bitcoins are issued, and then every 210,000 Blocks (about four years), the number of releases is halved. Although Bitcoin will continue to be produced, its circulation has been determined in advance, which has nothing to do with mining capacity. It is not possible to increase the total output of Bitcoin in a unit time by increasing the mining capacity, so the supply of Bitcoin is rigid . In addition, bitcoin cuts output about every four years. In the long run, the amount of issuance per unit of time has continued to decline.

From a demand perspective, we can use Bitcoin's activity and average daily transaction volume to reflect the market demand for Bitcoin. As can be seen from Figures 5 and 6, demand for Bitcoin fluctuates significantly in the short term and continues to increase in the long term.

Figure 7. Bitcoin circulation change

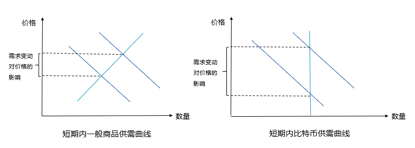

It can be seen from the above that, due to the rigid supply curve of Bitcoin and the relatively elastic demand curve, and the demand for Bitcoin fluctuates violently in the short term, in the short term, the price of Bitcoin will fluctuate significantly.

Figure 8. Supply and demand curves of general commodities and Bitcoin in the short term

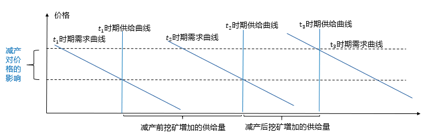

Now we look at the impact of bitcoin production cuts on prices in the long run, assuming that the supply and demand of bitcoin increase at the same rate over time (from the actual observations, the growth rate of demand is greater, but this factor will not affect our analysis Cause substantial impact), then from the above figure, it can be seen that over time, the supply and demand curve of bitcoin is shifting to the right. When bitcoin is halved, the price of bitcoin will rise due to the slowdown in supply growth. .

Figure 9. The impact of bitcoin production cuts on prices in the long run

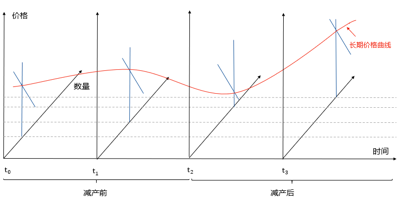

We further relax the assumptions and comprehensively consider the long-term and short-term changes in the demand for bitcoin and the impact of reduced supply, then we will get a curve of the price of bitcoin over time as shown below. In the short-term, due to the rigidity of the Bitcoin supply curve, Bitcoin has experienced drastic fluctuations in the short-term due to changes in Bitcoin demand. In the long run, due to the impact of reduced production and increasing demand, the price of Bitcoin is generally on the rise.

Figure 10. Bitcoin price changes over time

Crisis under prosperity: market optimism and miners' anxiety

With the expectation of halving the market, people are optimistic about the future market trend of Bitcoin, but will the reality really be as many people want?

From the above analysis, it can be seen that the reduction of Bitcoin production will indeed stimulate the price increase. Of course, this is only a conclusion drawn from the commodity attributes of Bitcoin, but the price of Bitcoin is not only affected by the relationship between supply and demand. Because Bitcoin has financial attributes in addition to commodity attributes, this is why Bitcoin, like other financial assets, will have bubbles. In addition, we can observe the promotion of innovation in each cycle of Bitcoin, such as the birth of the Bitcoin exchange in the first cycle, the birth of altcoins in the second cycle, and the third cycle. The birth of the token crowdfunding model, these innovations directly stimulated the soaring price of bitcoin. From the current observations, in the forthcoming fourth market cycle of Bitcoin, regulatory innovation will most likely determine the start of the bitcoin bull market.

Therefore, halving the output of Bitcoin is only one of many factors affecting its price, not the only factor. From the perspective of experience, many investors have come to the conclusion that "the price of Bitcoin will double from half a year before the halving of the market". Maybe it is true in the future, but from the perspective of bitcoin mine operation, the rise of bitcoin price is uncertain, but the increase in mining cost after reduction of output is certain. This is the biggest problem that miners face in the reduction of output. Dilemma.

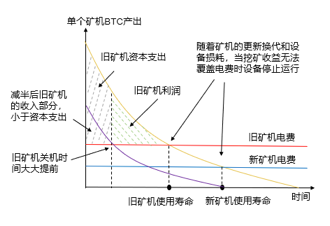

In Bitcoin mining, the difficulty value determines how many hash operations a node (computer) has to go through before generating a legal block. The higher the difficulty, the more computing power required to obtain a valid block. No matter how the computing power of the entire blockchain network changes, the difficulty value will be adjusted to ensure that the generation speed of the block remains basically unchanged. Generally speaking, every 2016 block of the Bitcoin network is mined (about two weeks), the difficulty will be adjusted once according to the computing power of the entire network. According to the new target value, we can calculate the probability of winning a hash operation. In reality, Bitcoin's entire network has more and more computing power, which means that the probability of a single mining machine winning is getting smaller and smaller, that is, the bitcoin output of a single mining machine will gradually decrease with time, as shown in yellow in Figure 10. Shown in the curve.

, That is, the curve in Figure 10 translates downward, which has two serious effects:

(1) First, because the mining industry is a capital-intensive industry, the capital expenditure of the old mining machine is fixed, so the operating leverage is high. When the output of the mining machine suddenly halves, the profit of the old mining machine will be severely squeezed Pressure or even loss;

(2) Secondly, the mining site needs to pay for electricity when mining, which is the variable cost of the mining machine. We know from the foregoing that the output of a single miner decreases with time. When the daily mining revenue of a miner is less than the variable cost (electricity + labor costs, here we ignore labor costs), the miner shuts down. Due to the halving of production and the miner's revenue halving, the timing of the mining machine's operation was greatly advanced.

Figure 11. Bitcoin mining profitability analysis

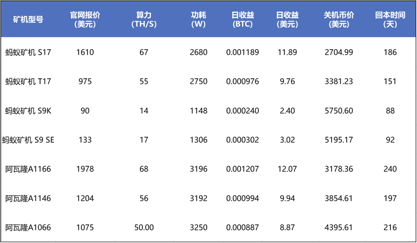

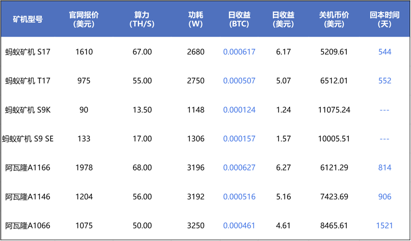

Taking the actual situation as an example, on February 10, 2020, the price of Bitcoin was around USD 10,000, and the computing power of the entire network was 103,022 PH / S. Assuming that the price of Bitcoin and the computing power of the entire network will remain unchanged in the future, we refer On the same day quotation and performance parameters of the mining machine of Bitcoin Continental and Jianan Yunzhi's official website, the following income table can be obtained.

Table 1. Mining machine static profit before halving (assuming that the entire network computing power and price remain unchanged)

Generally speaking, the service life of a mining machine is about 1-2 years. It can be seen from the above static income statement that the above miners can return to the cost within one year, which means that excluding the return time, the remaining life of the miner can bring profits. However, as mentioned above, this year, Bitcoin will be halved, that is, Bitcoin's blockchain reward will drop from 12.5 BTC to 6.25 BTC. At this time, we calculate the static income of the mining machine, as shown in the following table:

Table 2. Static profitability of miners after halving (assuming the computing power and price of the entire network remain unchanged)

From the miner's static income statement after halving, it can be seen that the return time of the miner is more than one year, which indicates that the miners purchased at the current price can hardly be profitable after halving. Extremely, such as the Ant S9 series miner, the daily revenue (mining reward-electricity cost) after the halving occurs is negative, and the return is far away. This means that the Ant S9 series miner needs to be shut down immediately after the halving occurs.

Does this mean that the miners can no longer be used? No. Under Moore's Law, the price of mining machines is gradually decreasing. For example, the Ant S17 mining machine was quoted at $ 2,700 in September last year, but in February this year, its price has dropped to $ 1,610. Therefore, after halving, the price of existing mining machines will continue to fall, and the return time of mining machines will return to the range of one year. Of course, the bad news is that the users who bought the mining machine now are silent costs, which are already fixed, so they will face larger losses in the future.

Of course, the above calculations are based on the constant price of Bitcoin and the computing power of the entire network. If the price of Bitcoin doubles after halving, then there is a possibility for miners to make a profit. It is regrettable that this is just a possibility, and the continuous rise of Bitcoin's entire network computing power and the halving of its production are indisputable facts. Unlike the encrypted digital currency secondary market's optimism about Bitcoin's future market, miners are facing great risks. This is even a bet: the increase in the price of Bitcoin must be large enough to offset the increase in computing power across the network. And the loss caused by the reduction of production, the miners are likely to make a profit. Perhaps the only good news for the mine is that based on historical experience, after the halving of the market, the price of Bitcoin will double.

V. Future Prospects and Suggestions under the Cryptocurrencies Halving Market

Based on historical experience, many people are optimistic that the arrival of halving the output of Bitcoin will usher in a bumper season. But for the bitcoin miner community, this is the crisis behind the market carnival. Because after the production halving occurred, for the capital-intensive business of mining, under the high operating leverage, the reduction of Bitcoin mining income will easily lead to losses. After all, miners cannot fully pin their hopes of profit on Bitcoin. The price of coins has more than doubled. Therefore, for miners, especially the miners who bought the miners at a high price before halving, and the miners who still have a long service life after halving, use tools such as Bitcoin contracts or Bitcoin options to hedge , It is most appropriate to lock the price to avoid risks,

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Italian securities regulator establishes cryptocurrency regulations, has closed 2 cryptocurrency trading sites

- Investment is risky: who is more at risk from Bitcoin and Apple stocks?

- In-depth analysis: the transition of the national digital governance system after the epidemic

- These two crypto companies are valued at hundreds of millions of dollars. Which big-name investors are investing?

- The members of the Golden Chain Alliance have “stand on their own feet”, where is the path of the Chinese Alliance-type blockchain open source platform?

- The Secret History of Bitcoin: In which regions is Bitcoin more popular?

- Zhang Xiaojun: Huawei promotes the application of blockchain in medical data sharing and public welfare fundraising, and uses science and technology to fight the epidemic