Bitcoin weekly report | 3.12 impact further weakened, core data on the chain dropped by more than 20%

Editor's Note: This article has been deleted without altering the author's original intention.

Judging from the data of the past week (03.23-03.29), the data on the chain has fallen further compared with the previous week (03.16-03.22), and the impact of the "3.12 plunge" event has been further reduced.

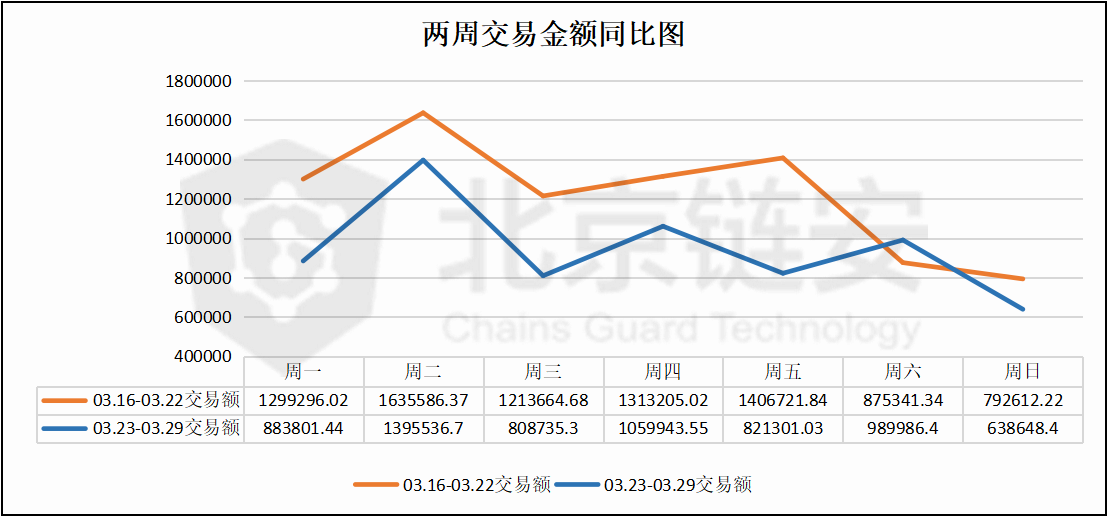

Transaction amount:

03.16-03.22: 8536427.49 BTC

- Opinion | Si Xueming: Blockchain applications are diversifying, and they will be widely deployed in the real economy in the next three years

- PA Weekly | FCoin Filed Case in Hunan; Multiple Exchanges Cooperate with South Korean House Investigation

- History of blockchain 1.0 to 3.0: is Bitcoin dead in Satoshi's vision?

03.23-03.29: 6597952.82 BTC

Decrease from the previous week: 22.71%

The detailed data chart is as follows:

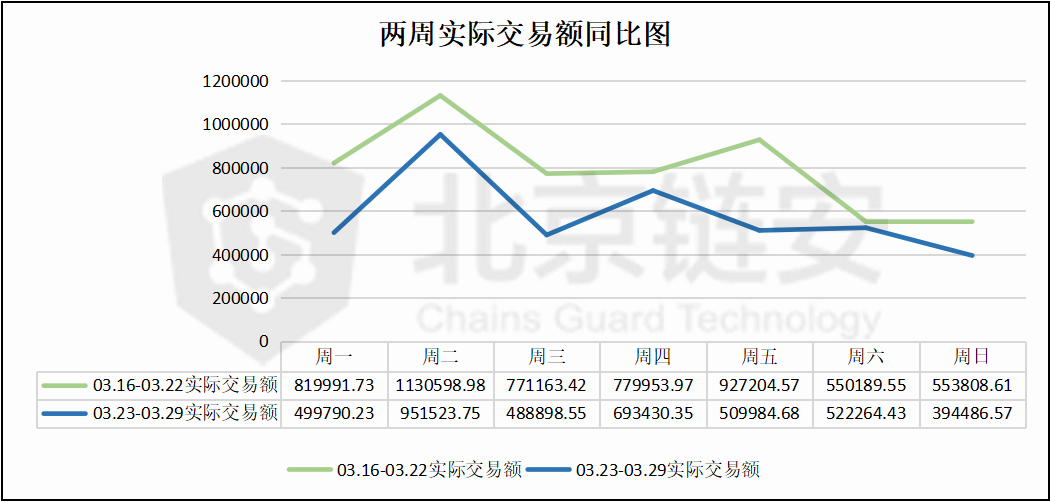

Actual transaction amount:

03.16-03.22: 5532910.83 BTC

03.23-03.29: 4060378.56 BTC

Decrease from the previous week: 26.61%

The detailed data chart is as follows:

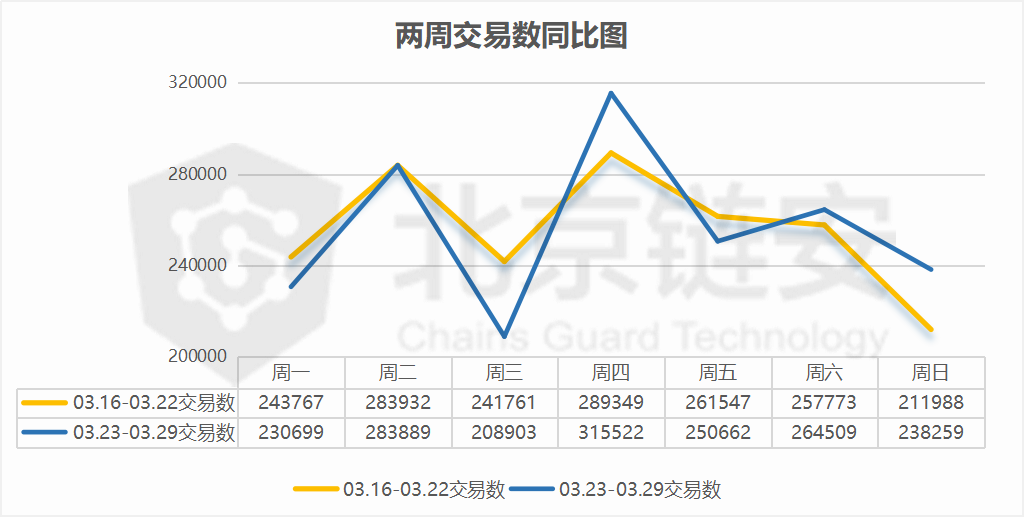

Number of transactions:

03.16-03.22: 1790117

03.23-03.29: 1792443

Increase from the previous week: 0.13%

The detailed data chart is as follows:

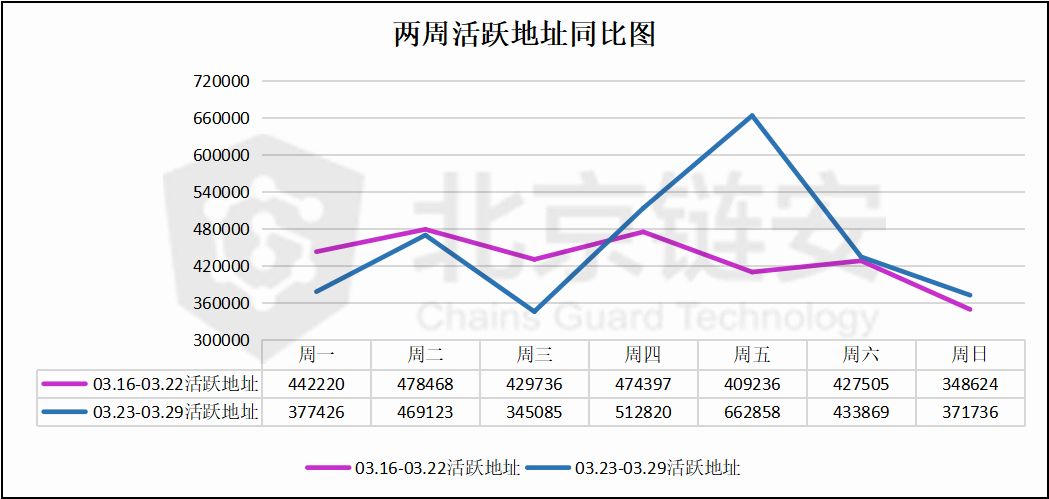

Number of active addresses:

(The address that initiated the transaction is considered the active address)

03.16-03.22: 3010186

03.23-03.29: 3172917

Increase from the previous week: 5.14%

The detailed data chart is as follows:

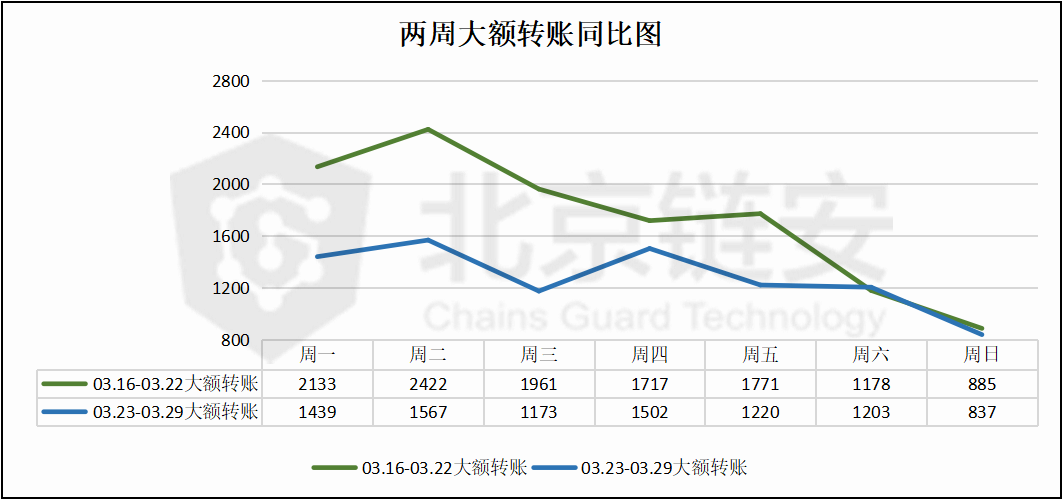

Large transfers:

(Single transaction initiated amount greater than 100BTC is considered a large amount transfer)

03.16-03.22: 12067

03.23-03.29: 8941

Decrease from the previous week: 25.91%

The detailed data chart is as follows:

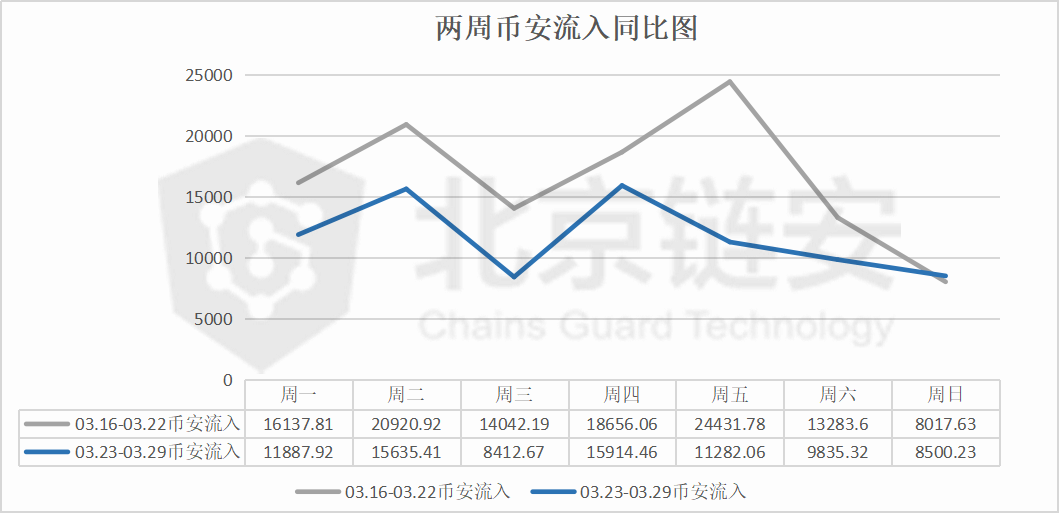

Binance exchange BTC flow data

Inflow: 03.16-03.22: 115489.99 BTC

03.23-03.29: 81468.07 BTC

Decrease from the previous week: 29.46%

The detailed data chart is as follows:

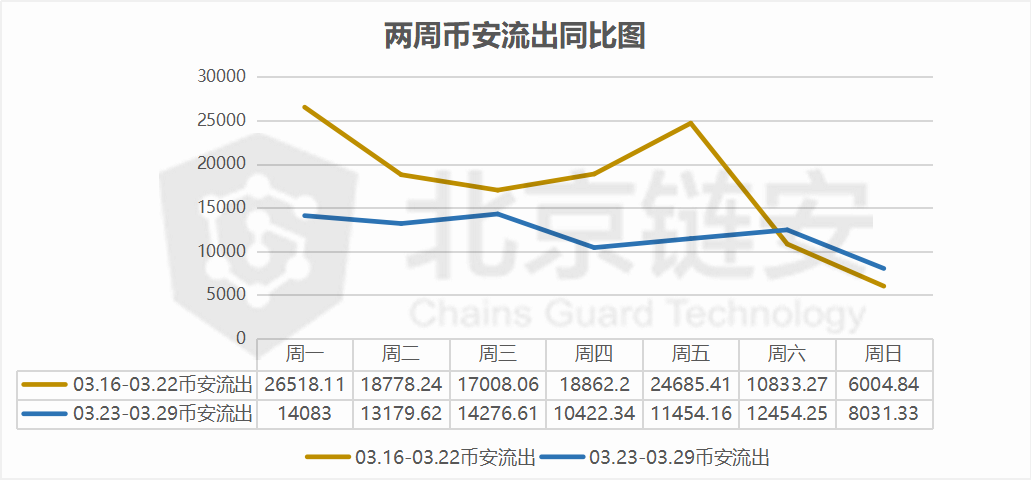

Outflow:

03.16-03.22: 122690.13 BTC

03.23-03.29: 83901.31 BTC

Decrease from the previous week: 31.62%

The detailed data chart is as follows:

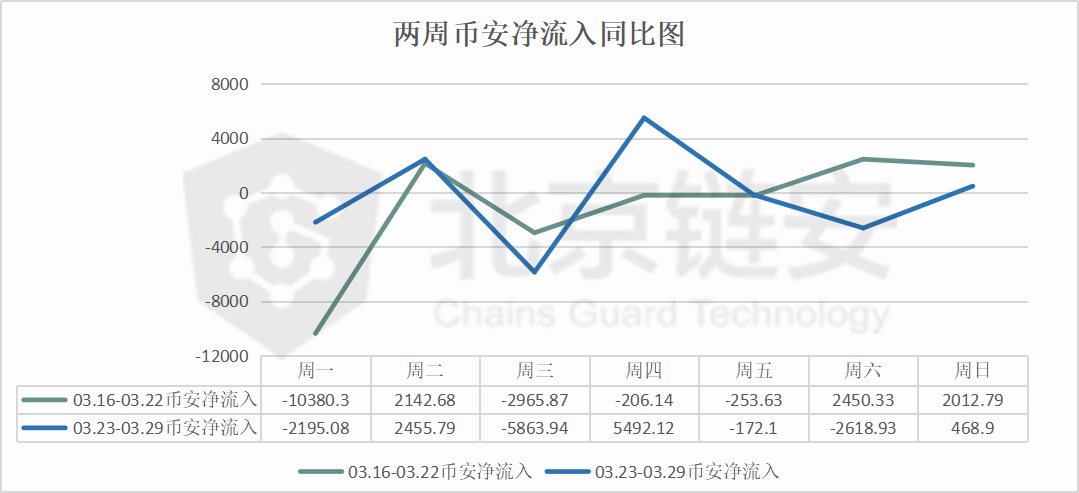

Net inflow:

03.16-03.22: -7200.14 BTC

03.23-03.29: -2433.24 BTC

Increase from the previous week: 66.21%

The detailed data chart is as follows:

From the data of Binance Exchange, we can further feel that the market has returned to a relatively calm state. Bitcoin inflows and outflows from the exchange have dropped significantly. Investors' trading activity was triggered on March 12. After the high level fell, the market entered a period of consolidation after a sharp rebound, waiting for the next round of market variables.

Security and data highlights:

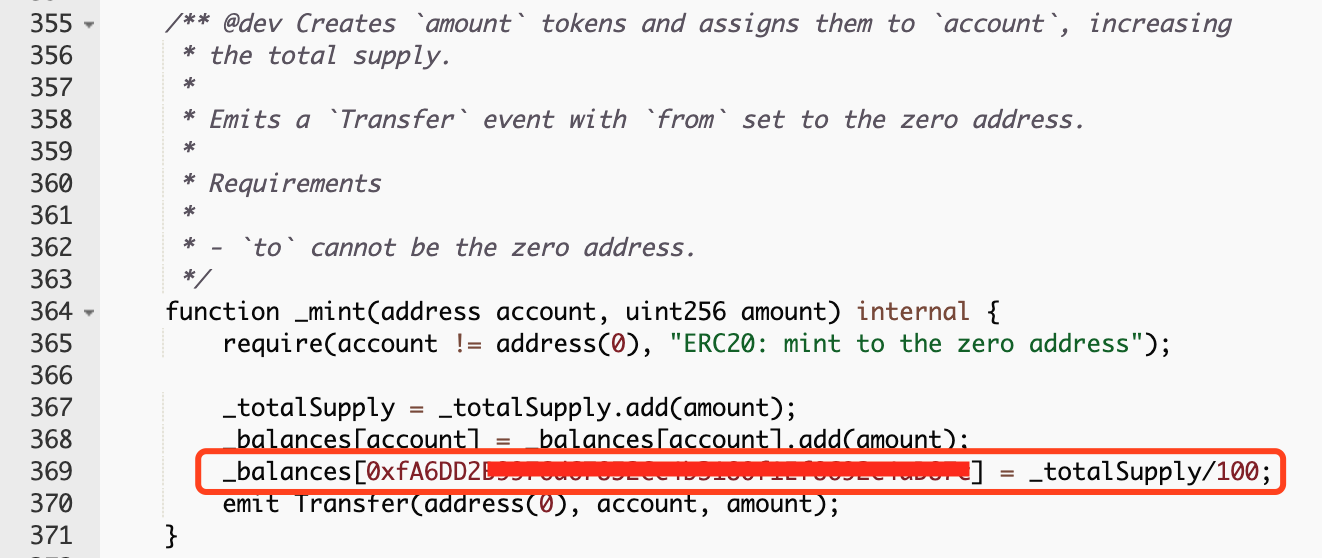

Security alert: third-party token issuance platforms or hidden backdoor code issue and steal substitute coins

Beijing Lianan Security Center recently received a report from the project party that after its ERC20 contract was deployed to generate tokens, it was found that there were unknown token transfers on the chain. After investigation, the project party used a third-party ERC20 contract release platform in the process of setting and publishing the contract. This platform automatically generated a contract code based on the project's token supply and other settings, and added a piece of code to privately oversupply. Tokens totaling 1% and transferred to the designated address.

According to Zer0Man, a security expert at Beijing Chain Security, we conducted relevant tests on the platform. During the entire process, the platform did not give any hints about the related multiple tokens and private transfers, which is consistent with the project party's experience. In essence, this is a kind of hidden malicious backdoor without its customer's permission, which aims to multiply and steal substitute coins, and the transaction will be realized when it is listed on the exchange. From its now hidden address, it has obtained the limit of seven tokens, and has transferred the project tokens listed on it to relevant exchanges.

Part of the "Weibo Data Leakage" information from the sale of ETH collected into the exchange

According to the monitoring system, 57.31 ETH suspected to be related to the “Weibo Data Leak” event were collected and flowed to the HitBTC exchange.

According to data analyst SXWK, after the relevant data breach, we monitored the transaction address provided by the newsletter. Although the data sellers gave different addresses to different buyers, they recently collected a total of 57.31 ETH from 155 addresses, including our monitoring address, into the new address, and then transferred to the exchange. Most of these addresses were traded after the data breach, and most of them were traded only once, and most of the amounts involved were between 0.3 and 0.5 ETH.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt Column | I see the "three 1s" of cryptocurrency investment

- Data | DeFi Transaction Cannibalizes Ethereum Block Capacity

- Week in review: Bitcoin prices fluctuate, US stocks laugh

- DeFi Ultimate Getting Started Collection, the basics of DeFi you want to know are here

- New progress in the regulatory sandbox! Fintech institutions can declare independently, and there is no hope for coin-issuing blockchain companies

- "No Feed" Synthetic Tokens: Minimizing the Use of the oracle

- Zhu Jiaming's latest thinking on digital currencies: traditional loose monetary stimulus policies are fully ineffective