Bitfinex and Tether insist that there are no New York users, and their IEO projects are falling.

On July 23, Beijing time (UTC July 22), Bitfinex and Tether on behalf of legal counsel Stuart Hoegner submitted a new legal document stating that the New York Attorney General's Office (New York State prosecutor) accused "it has been in the New York State area The argument that the customer provides the service is inaccurate and misleading.

According to the submitted documents, in the terms of service of Bitfinex and Tether, the “ECPs” (Qualified Contract Participants) that are trading on Bitfinex or Tether must be foreign entities, but the shareholders of these foreign institutions cannot be avoided. And the staff may live in New York State or have contact with New York State. Bitfinex and Tether do not have the authority to control the shareholders and employees of ECPs.

Finance Network – Chain Finance in the "New York State prosecution counterattacks Bitfinex and Tether LEO fell 7%" has mentioned that the New York State prosecutors are eyeing the platform currency LEO issued by Bitfinex, the New York State prosecution said that LEO each The characteristics reveal that the essence is securities, and therefore also applies to the Martin Act, and the New York State prosecutors have reason to believe that the release of this LEO is related to the investigation.

In this regard, Bitfinex and Tether's representative lawyer Stuart Hoegner mentioned in the submission that in May 2019, iFinex peddled LEOtokens through the IEO (Initial Exchange Offerings). IEOs are similar to IPOs (Initial Public Offerings). Users subscribe to LEO tokens to obtain Bitfinex trading platform transaction fee discounts, and use iFinex all services (including Bitfinex, Bitfinex Derivatives, Eosfinex, Ethfinex Trustless, etc. 10 businesses) last month's profit of at least 27%, in monthly units, according to the time The market price repurchase LEO, no deadline limit.

- Academic to big coffee | Hu Jie: Blockchain is just a tool, awesome for finance

- I read through Ethereum 2019: Ecological development is too fast like a tornado

- The pace of competition is accelerating, how can the new exchange break with the finer operations?

LEO tokens are not publicly available and do not provide a subscription channel for US users or foreign ECPs (shareholders and staff members may reside in New York State). No American can trade LEO tokens on the Bitfinex trading platform. In addition, Bitfinex intends to repurchase and destroy the corresponding number of LEOs with at least 95% of the net assets (excluding legal and operational funds) that were thawed from Crypto Capital.

Bitfinex and Tether believe that this repurchase arrangement allows Bitfinex to repay the funds borrowed from Tether while satisfying the loan agreement. Bitfinex's funds used to repay loans from Tether are derived from current corporate revenues and funds raised from IEO. In fact, on July 1, Bitfinex completed the prepayment of loans and interest as of June 30.

Stuart Hoegner added that although the loan has not been paid off, it can be used as evidence of the good financial growth and steady growth of Bitfinex. During this time, Tether has not experienced any difficulties in redemption, and this will not happen again. In April, the New York State prosecutor sued Bitfinex for transferring $850 million in customer and corporate funds to Crypto Capital Corp. and using Tether's reserve funds to make up for the deficit, but the amount of losses and Tether's capital flow were not Disclosure to customers. On July 1, 2019, Bitfinex announced that it had repaid $100 million in outstanding loans to Tether. On July 29th, the New York Supreme Court will hold a hearing on the motion to stop providing documents for Bitfinex and Tether.

On the one hand, Bitfinex and Tether are actively preparing for a four-month tug-of-war with the New York State prosecutor; on the other hand, Bitfinex hopes to fill the 850 million asset hole through the rise of the IEO flash in 2019, while entering the Chinese market.

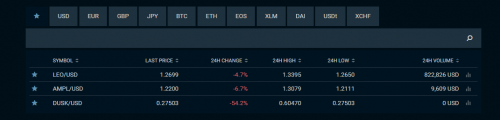

Currently, Bitfinex has launched three currencies through IEO, namely DUSK, Ampleforth and ULTRA. According to Bitfinex data, LEO fell 4.7%, AMPL fell 6.7%, and DUSK fell 54.2% within 24 hours. It is worth noting that DUSK has a trading volume of 0 in 24 hours.

IEO coin

Source: Finance Network·Chain Shang Finance

Author: David

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- CIC Research: The "Dollar-Libra" System May Create the Next Peak of US Dollar Hegemony

- What is the future of Bitcoin? These 7 CEOs may be able to tell you the answer.

- Should the loss of $23 million in cryptocurrency due to the theft of the SIM card, should not blame the telecommunications company?

- The latest evaluation of the blockchain by 11 national leaders and politicians, or the future global regulatory “wind vane”

- Director of the Institute of Financial Law of the Central University of Finance and Economics: the circumstance of digital currency issuance

- QKL123 market analysis | Change soon, Bitcoin explores $ 9,000 again? (0723)

- The first Reg A+ ICO-based project, Blockstack, will go online in 3 months.