Blockchain entry | Blockchain encryption market skyrocketing, who has gone for money?

So, is there really so much money out of this industry? Where did the money come from? Where have you gone?

To answer these two questions, we first need to carefully study the process of price fluctuations. The price is mainly determined by the market through the trading process. When the buyer's strength is stronger than the seller, the price will rise; in turn, it will fall.

We use Bitcoin as an example to illustrate the process of the rise and fall of bitcoin prices in the market.

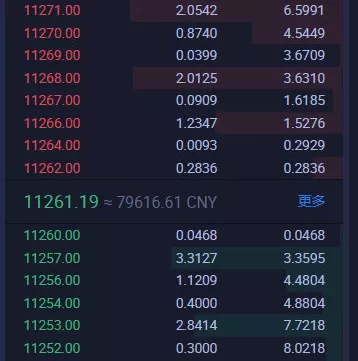

Suppose Bitcoin's current price is 11260 USDT, and only if you are trading alone, you want to buy 1 million USDT BTC. You can only buy the required number of BTCs by continuously raising the price and eating the pending sell orders.

- The Shenzhen Stock Exchange blockchain application base is called a stop wave: business adjustment or other hidden?

- Market Analysis: BTC stopped falling and rebounded at the 10,000 US dollar mark, and the market turned into a shock stage.

- Zimbabwe stops dollar trading, bitcoin prices up to $76,000

Assume that after the purchase, the BTC price has reached 11270. In the process, the total market value of BTC increased by 170 million USDT (currently BTC circulation is 17.775 million), but the actual inflow of funds is 1 million USDT. The key is that the actual transaction volume of Bitcoin is 110, which is very small compared to the total number of Bitcoins. This means that price volatility is actually only caused by a bit of bitcoin trading.

(Source: Fire Coin)

Similarly, when Bitcoin fell from 11270 USDT to 11260 USDT, the amount of funds flowing out was less than 170 million USDT. Therefore, the current BTC with a market value of nearly 200 billion yuan is actually supported by a small amount of funds. It is not really possible to exchange 200 billion USD of cash. (Note: The above process is only simplified, the real transaction is more complicated than the above)

So, in addition to a small amount of money, what are the main factors supporting the market value of Bitcoin?

To clarify this issue, we can simplify the trading process between buyers and sellers. If all the bitcoin is in the hands of a person, then he has to sell it at a high price, but he can't do it at all. Why is this so? Because the value of Bitcoin is more based on people's consensus.

People's consensus on Bitcoin is similar to antique calligraphy and painting, luxury goods, the value of antiques and luxury goods, and more is the public's recognition of culture and brand. Why do people buy bitcoin? And willing to hold for a long time? The fundamental reason is that everyone thinks that the current value of Bitcoin is undervalued, and there will be higher value in the future (long-term).

When a large number of sell orders appeared, the consensus gradually collapsed, causing prices to fall; when a large number of purchase orders appeared, the consensus gradually strengthened, resulting in price increases. Although some of the data in this article are not very accurate, the process of price increases and declines in this industry is probably the same.

In a sense, in the short term, cryptocurrency investment is a negative and a game, because every transaction, there will be a trading platform to extract a part of the fee. Some unscrupulous trading platforms will even take the user's currency to move bricks and arbitrage, and even manipulate the market to carry out long and short double bursts and harvest users.

To sum up, where did the money that increased and evaporated go during the rise and fall of the cryptocurrency? Because of the ups and downs, a large part of the money is not there, it only exists in people's imagination. The other part of the money flows into the trading houses of this industry, in the pockets of large institutions.

What factors do you think will lead to a rise in the price of cryptocurrencies and which factors will lead to a decline? Welcome to leave a message in the message area.

Author | day by day Produce | vernacular blockchain (ID: hellobtc)

『Declaration : This series of content is only for the introduction of blockchain science, and does not constitute any investment advice or advice. If there are any errors or omissions, please leave a message. 』

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ruibo wants to make big moves? Plan to build xRapid entities to provide liquidity for XRP

- Babbitt column | Xiao Wei: Digital wallet "running the road", is it a strange sin?

- Libra blockchain paper analysis – introduction, data logic model (part 1)

- How does China act as the rotating chairman of FATF and how will it promote global cryptocurrency regulation?

- Depth | Libra positioning, application value and external influence

- Decentralized exchange Newdex strength to play "fake"

- Developer Dialogue Supervisor: G20 Encrypted Assets Workshop Boosts Healthy Development of Blockchain Ecosystem