What is the status of China’s central bank’s digital currency waiting to be sent to China?

In the eyes of the International Monetary Fund (IMF), the central bank's digital currency (CBDC) may have become a part of the future.

A report released yesterday by the IMF indicated that it conducted a survey with the World Bank to collect 189 member states' views on various topics in the field of financial technology and received 96 responses.

The IMF believes that central banks may issue central bank digital currencies in the future. According to reports, some central banks (such as Uruguay) have piloted CBDC on a limited scale, and other countries are also trying and exploring (such as the Bahamas, China, Sweden and Ukraine). Some central banks support private sector legal digital currencies (DFCs) under the regulatory sandbox regime, such as Barbados and the Philippines.

The report shows that the motives for the introduction of central bank digital currencies vary from country to country. Developed countries are mainly looking for CBDC to seek alternatives to provide cash in the case of a decline in the frequency of cash use. For emerging economies such as developing countries, the main purpose of CBDC is to reduce bank costs . But central banks are not interested in issuing fully anonymous CBDCs.

- Popular Science | Cosmos Blockchain works: How to cross-chain, why cross-chain?

- PlusToken crashes, promise me not to be cheated again in the future?

- "Central Bank of the Central Bank" BIS President: The arrival of the global central bank digital currency may be faster than expected, we support the efforts of countries

Researcher Zoltan Jakab said in the IMF research comment that the central bank's digital currency will soon become a reality. The IMF study shows that its popularity and influence depend to a large extent on its design characteristics, and although there are risks, policies can be introduced to reduce costs and increase revenue.

Bank for International Settlements: 70% of central banks are studying central bank digital currency

With the acceleration of the cashless, digital society, the central bank's digital currency seems to be a problem that all countries in the world must consider.

The general manager of the Bank for International Settlements (BIS) recently said that the global central bank may have to issue its own digital currency earlier than expected, and BIS also supports central banks around the world in their efforts to create a digital version of the national currency.

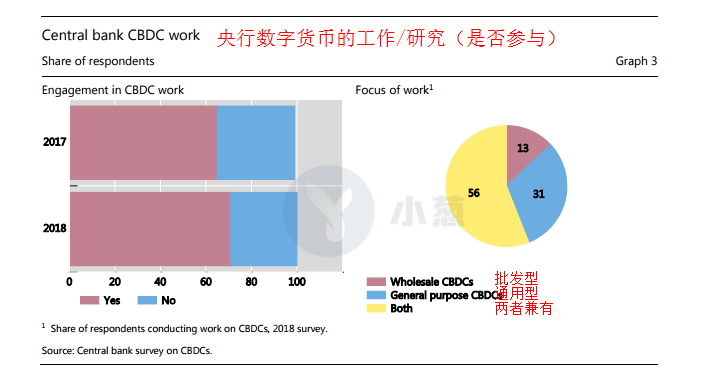

In January of this year, the Bank of International Settlements issued a report on “Cautious Action – Central Bank Digital Currency Survey”, which showed that 70% of the central banks participating in the survey are participating (or will be involved) in the work or research of issuing CBDC, and compared to 2017 in 2018. The number of years has increased.

(Note: The general-purpose CBDC is mainly for retail transactions and will be widely distributed to the public; wholesale CBDC is limited to specific inter-bank settlement services)

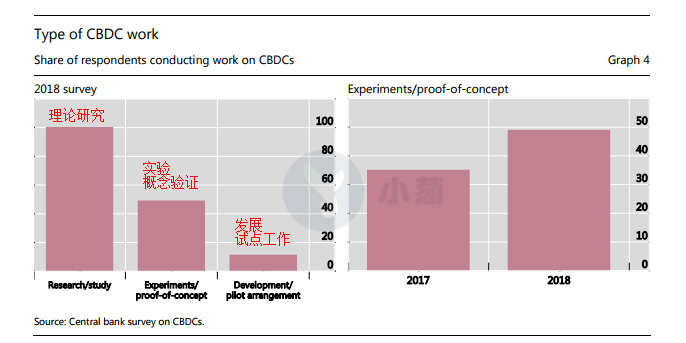

In addition, many countries are moving from the theoretical phase of CBDC to the stage of verification and testing. The Bank of International Settlements said that half of the central banks have started testing or proof-of-concept of CBDC, and the data for 2018 has increased by 15% compared to 2017.

China's central bank digital currency research institute has been piloted

The People's Bank of China has been in the digital currency field for five years. As early as 2014, the People's Bank of China established a special research group on legal digital currency to study the feasibility of issuing legal digital currency. In 2017, the Chinese people The bank officially established the Digital Currency Research Institute in Shenzhen.

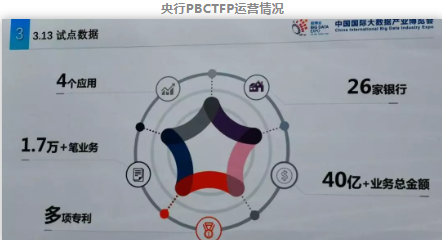

In just a few years, the Central Bank Digital Money Research Institute built a trade finance blockchain platform and published a series of blockchain patents and reports.

In addition, at the Big Data Expo held in Guiyang in 2019, the PBCTFP trade finance blockchain platform developed by the Central Bank Digital Currency Research Institute was unveiled. It serves the trade finance of Dawan District in Guangdong, Hong Kong and Macau, and has been truly real.

It is reported that four blockchain applications have been set up on the PBCTFP platform, with 26 banks participating, achieving 17,000 businesses and more than 4 billion yuan in business.

(Source: Interchain Pulse)

Source: Shallot blockchain

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Can cross-chain open the application new track? The project side revealed these new developments.

- Dialogue Jameson Lopp: My two things with Bitcoin

- Demystifying Chainalysis, tapping your privacy is their job

- A Dapp market with a total transaction volume of $11.1 billion in stock | 2019 data report for the first half of the year

- QKL123 Encrypted Assets Market Daily (July 01)

- Getting started with blockchain | What is fragmentation?

- Before the "Ten billion funds" PlusToken crash, users recharge their faith every day.