Blockchain Industry Weekly | Contract regular army Bakkt, leek savior or harvester?

Guide

Late at night on August 16th, Beijing time, Bakkt, a digital clearing futures platform under the Intercontinental Exchange Group (ICE), published an article on the official blog saying it has been approved by the New York State Department of Financial Services (NYDFS) and will be on September 23. Officially launched the BTC futures contract. This is also the world's first physical delivery BTC futures contract, providing institutional investors with a legal, compliant, safe and convenient way to invest in BTC.

Summary

Topic: Contract regular army Bakkt, leek savior or harvester? Bakkt is part of the New York Stock Exchange's parent company, the Intercontinental Exchange Group (ICE), which sheds the blood of traditional finance. Currently, Bakkt has obtained the New York State Trust of the New York State Department of Financial Services to establish a compliance custodian, Bakkt Trust, to provide custody services for BTC futures contracts for physical delivery. Bakkt claims that it is not a trading platform itself, its core services are “secure compliance escrow business” and “institutional level transaction settlement”. Bakkt's contract products are divided into daily contracts and monthly contracts, but their competitors should not be underestimated. Bakkt's advantage is to solve the problem of lack of liquidity in traditional futures exchanges, poor market depth, lack of price discovery mechanism, strict supervision and KYC, and poor reliability. Bakkt's long-term vision is to open up the ecological closed loop of spot and futures trading to digital pass payment. The launch of physical clearing contract is also good for BTC.

- Rereading Mu Changchun’s speech: The central bank’s digital currency is coming out, but the people in the currency are over-excited.

- Observation | False is a year-round, entertainment and education

- The market continues to fluctuate, and the ETH market seems to have improved.

Quotes: The rebound is blocked, and the support is back. The total market value of digital passes this week was $270.74 billion, a decrease of 11.3% from last week's decline of $34.42 billion. Average daily volume was US$56.87 billion, down 4.0% from last week, and the average daily turnover was 20.2%. The current price of BTC is US$10374.3, with a weekly decline of 12.5%; the average daily turnover is US$18.2 billion. The current price of ETH is 185.4 US dollars, with a weekly decline of 11.9%; the average daily trading volume is 6.78 billion US dollars. This week, the exchange's BTC balance was 886,000, an increase of 4,870 from last week; the ETH balance was 9.193 million, an increase of 10,000 from last week. In the BICS secondary industry, the market value of payment settlement and the number of certificates have decreased.

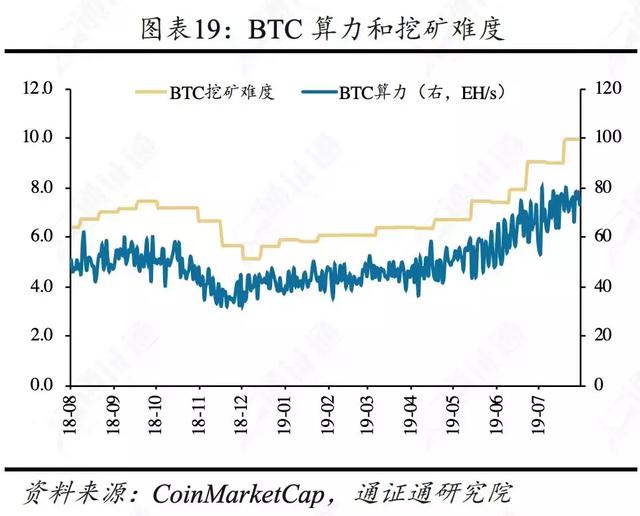

Output and heat: Difficulty and computing power remain stable, and public attention is low. The difficulty of mining this week is 9.985T, and the average daily computing power is 74.45EH/s, which is 0.21EH/s lower than last week. The difficulty of mining this week is 2286, which is 3.6 lower than last week. The average daily power is 183.5TH/ S, down 1.6TH/S from last week.

Industry: The channels for institutional investment in digital certificates are constantly expanding. The central bank's digital currency is about to be launched and will adopt a two-tier operating system; the US Securities and Exchange Commission will delay the decision of three BTC ETFs until the fall; Seed CX will begin testing the physical settlement of BTC margin swaps, which are scheduled to be launched in the next three months; Bakkt It is planned to launch a physical settlement of BTC futures contracts on September 23.

Risk Warning: Market Volatility Risk

text

1 Topic: Contract regular army Bakkt, leek savior or harvester?

Late at night on August 16th, Beijing time, Bakkt, a digital clearing futures platform under the Intercontinental Exchange Group (ICE), published an article on the official blog saying it has been approved by the New York State Department of Financial Services (NYDFS) and will be on September 23. Officially launched the BTC futures contract. This is also the world's first physical delivery BTC futures contract, providing institutional investors with a legal, compliant, safe and convenient way to invest in BTC.

1.1 Bakkt's past and present

Since the birth of BTC, digital pass enthusiasts and practitioners have never stopped trying to get digital pass into the mainstream public view. Similar to Bakkt, Coinbase and other compliance trading platforms, it is to guide traditional institutional investors to invest in BTC, etc. Digital pass. On the one hand, the funds of institutional investors can inject a lot of liquidity into the market; on the other hand, the entry of traditional institutions makes it easier for digital pass to enter the public view, and it is forced to re-establish the regulations related to digital pass .

In August 2018, the New York Stock Exchange (NYSE) parent company Intercontinental Exchange Group announced that it would use Microsoft Azure cloud services to "build an open, compliant global digital asset ecosystem" and set up subsidiary Bakkt, Its partners include well-known companies such as Starbucks and Boston Consulting. Bakkt's goal is to enable individuals and institutional customers to seamlessly purchase, sell, store and consume digital assets, bringing trust, efficiency and commercialization to digital assets. Bakkt's involvement in digital assets began with futures trading and digital asset custody. Its ambition is to build a comprehensive blockchain infrastructure for institutional investors and to create a complete digital pass payment system.

Bakkt was founded in the cold winter of the blockchain secondary market, but it has an enviable investment in the industry and even the entire financial sector. As a subsidiary of ICE, Bakkt easily obtained 12 institutions and follow-up investors from Boston Consulting, Li Ka-shing's Victoria Harbour Investment, Microsoft Venture Capital M12, South African Press Group FinTech, Galaxy Digital, Protocol Ventures and Pantera. Billion dollars of financing. Among them, Horizon Ventures is an investor in technology companies such as Facebook, Skype and BitPay. The South African Newspaper Group is the largest shareholder of Tencent, and there are also top-level blockchain ventures among other investment institutions.

The Bakkt management team is also highly valued by ICE . Bakkt CEO Kelly Loeffler is the wife of ICE CEO Jeff Sprecher and a veteran of ICE's acquisition of the New York Stock Exchange and the ICE IPO. Most of the other managers are from well-known blockchain companies such as Coinbase and Digital Asset Research.

Bakkt's road to compliance is not always smooth. Bakkt set a target for December 2018 at the time of its release, but Bakkt announced that it will extend the release time indefinitely due to “needs to continue to work with regulators to obtain the necessary approvals”. In 2019, as the secondary market gradually warmed up, Bakkt also started testing its new futures contracts as planned, and cooperation with regulators continued. The current compliance of Bakkt's main products is as follows.

The Bakkt futures contract user acceptance test has been approved by the US Commodity Futures Commission (CFTC) and successfully launched. Bakkt has obtained a New York State Trust from the New York State Department of Financial Services to establish a compliance custodian, Bakkt Trust Company, to provide hosting services for BTC futures contracts for physical delivery.

1.2 Bakkt core business is managed, the contract is divided into daily and monthly

Bakkt claims that it is not a trading platform itself, its core services are “secure compliance escrow business” and “institutional level transaction settlement”. Bakkt will use the existing infrastructure of the parent company ICE for transaction matching and clearing by ICE. Bakkt will provide a custody hosting service for BTC contracts for physical clearing through independent management and BakktWarehouse, a trust product with strict security measures.

At present, there are two main types of contract products for Bakkt: daily contracts and monthly contracts. According to Bakkt CEO, the daily settlement contract will use margin trading to provide trading functions that can replace unregulated spot exchanges. The monthly contract can provide price expectations for each month in the coming year, and investors can conduct arbitrage and hedging transactions.

The benchmark price of a Bakkt contract does not depend on an unregulated spot exchange. Bakkt has a series of measures to prevent false transactions, malicious transactions and other behaviors that may undermine market stability. It adopts the same risk control standards as ICE's gold, crude oil and stock index futures, and is more professional and safer than other futures exchanges.

1.3 Digital Passport Futures Contract Red Sea Market, Intense Competition

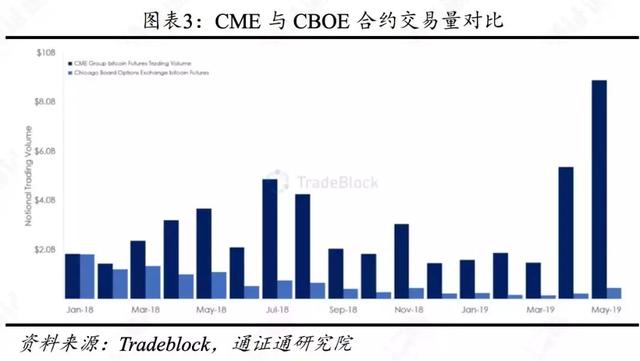

The birth of BTC has been close to ten years, and the volume of transactions in the digital pass secondary market has experienced explosive growth . In addition to spot exchanges, futures also account for a large portion of the total trading volume.

There are two ways to deliver futures contracts: cash delivery and physical delivery. Currently, digital passbook futures contracts such as BitMEX, OKEX contracts, RM contracts, CBOE and CME BTC futures contracts on the market are cash-delivered. This is because cash delivery does not involve the custody and delivery of BTC physical objects. A series of regulatory issues such as evading KYC and anti-money laundering are favored by spot exchanges and traditional financial institutions when they launch products that open up the market.

The physical delivery of futures contracts involves the custody, transaction and clearing of digital certificates. According to the relevant regulatory requirements of the United States, enterprises with DCO (Derivative Clearinghouse License) licenses can conduct custody business, and enterprises with DCM licenses can carry out liquidation business. The entry threshold is higher than the cash-settled contract product. Bakkt obtained a license by acquiring DACC, a digital asset escrow company with a DCO license, and is expected to obtain a DCM license before it is officially launched.

Bakkt's main competitors include:

ErisX : Licensed with DCM and DCO. Shareholders include CBOE, Bitcoin, Fidelity Investments, NASDAQ Ventures, Monex Group, PenteraCapital, etc. Its main product is the BTC contract for physical delivery.

LedgerX : Also has a DCM, DCO license. Shareholders include Digital Finance Group, Miami International Holdings, Blockchain Capital, and more. Its main product is the BTC contract for physical delivery.

Other cash-delivered futures exchanges such as CME, BitMEX, etc. Their products are released earlier and currently have a certain market share. Compared to the existing digital clearing exchange with futures contract business, Bakkt has the advantage that it is tailored for institutional investors.

Bakkt focuses on solving the problems of lack of liquidity in traditional futures exchanges, poor market depth, lack of price discovery mechanisms, strict supervision and KYC, and poor reliability. On July 19th, BitMEX was allowing US citizens to conduct BTC futures trading on their platform and other KYC issues were being investigated by the US Commodity Futures Trading Commission, causing large amounts of funds to flee on the exchange; some futures exchanges have a market demand (ie short-term The phenomenon of violent fluctuations in the market, the accumulation of positions, and the early explosion of positions have been criticized by investors. The launch of Bakkt will improve these issues.

1.4 A small step in Bakkt, a big step in the blockchain

Bakkt uses physical delivery for a long time or will benefit BTC. The delivery contract can obtain the physical BTC, rather than the settlement of the currency, which makes the settlement of the contract more efficient than the decentralized stable or traditional bank payment settlement system; on the other hand, the Bakkt user must have a certain BTC as a margin. In the short term, it will stimulate the demand of BTC in the market. In the long run, there may be more physical clearing of digital certificate contracts, which may push the price of BTC up.

Bakkt's vision includes not only futures contracts, but also the ecological closed loop of spot and futures trading to digital pass payments. According to blockchain media The Block, Bakkt will launch a mobile payment application called Bakkt Pay, and hired Google payment product specialist Chris Petersen to be responsible for the development of this application.

Bakkt said, “Whether it’s consumers, businesses, or blockchain companies, they want to have the ability to trade digital assets, because the significance of digital certificates goes beyond value storage or speculation. With the development of distributed ledger technology, Bakkt will work with more merchants."

Starbucks will be one of Bakkt Pay's key partners. In addition, Microsoft, AT&T, chain department store Nordstrom and game retailer GameStop are also likely to participate in the Bakkt Pay project. Bakkt's futures contract is only a small step, but it is a big step in the compliance and institutionalization of the digital pass market. Bakkt may increase the mainstream society's recognition of digital certificates. In the future, people may be able to use Starbucks to buy a cup of coffee with the profit of the Bakkt contract.

2 Quotes: BTC rebounds and resists, back to support

2.1 Overall market: rebound resistance, back to support

The total market value of digital passes this week was $270.74 billion, a decrease of 11.3% from last week's decline of $34.42 billion. Affected by factors such as a slight easing of Sino-US trade relations and a gold correction, BTC led a sharp correction in the digital pass market and re-entered the support level around $9,500.

The average daily trading volume of the digital pass market was US$56.87 billion, down 4.0% from last week. The average daily turnover rate was 20.2%, up 0.8% from last week. The market value of BTC accounted for 68.5%, a slight decline.

The exchange's BTC balance this week was 886,000, an increase of 4,870 from last week. The exchange's ETH balance was 9.193 million, an increase of 10,000 from last week. The exchange's BTC and ETH balances showed an increasing trend, indicating that the selling pressure on the market was aggravated.

The USDT market value was $4.053 billion, an increase of $15 million from last week. The USDT premium rate is 0.2%. With the fall in BTC prices, funds are rekindling the willingness to enter the market.

2.2 Core Pass: BTC fell, the main circulation certificate fell sharply

The current price of BTC is $10374.3, a weekly decline of 12.5%, and a monthly increase of 7.0%. The average daily turnover of BTC this week was 18.2 billion US dollars, and the average daily turnover rate was 9.5%. BTC rebounded this week and will be consolidating at the position of $9,500~10,500.

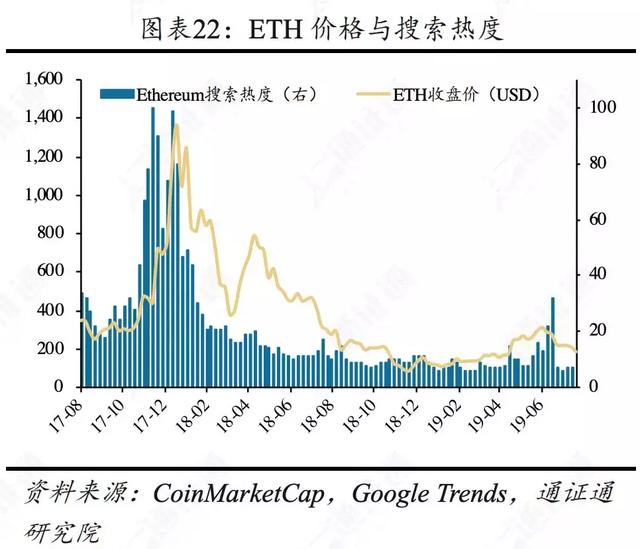

The current price of ETH is 185.4 US dollars, with a weekly decline of 11.9% and a monthly decline of 12.3%. The average daily trading volume of ETH this week was 6.78 billion US dollars, and the average daily turnover rate was 31.8%. ETH hit a new low in March, and the selling pressure was heavier.

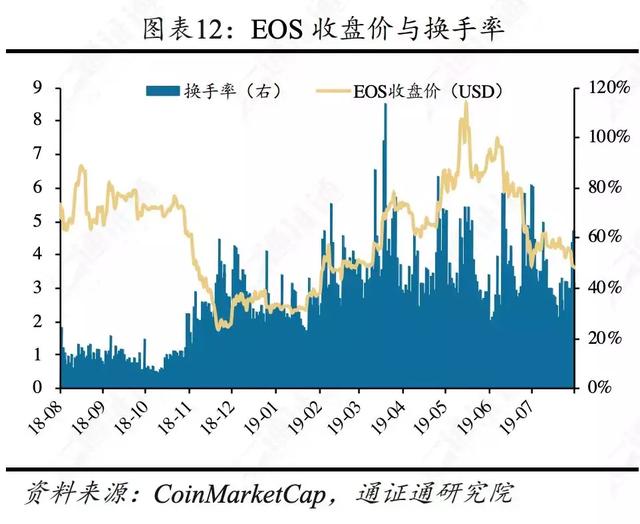

EOS is currently trading at $3.59, down 8.1% on a weekly basis and down 6.6% on a monthly basis. The average daily trading volume of EOS this week was 1.63 billion US dollars, and the average daily turnover rate was 45.6%. EOS fell slightly less than BTC and ETH, but trading activity declined and is close to the previous low of $3.3.

The current price of XRP is 0.262 US dollars, with a weekly decline of 11.9% and a monthly decline of 15.7%. The average daily volume of XRP this week was $1.1 billion, with an average daily turnover of 9.3%. The XRP trend is weak and has fallen below the long-term support level and should be avoided in the short term.

The volatility of the main pass continued to fall this week . The monthly volatility of BTC was 19.8%, down 6.9% from last week. The ethical volatility was 19.5%, down 8.9% from last week. The EOS monthly volatility was 24.6%. Last week, it fell 8.8%; XRP monthly volatility was 16.5%, down 3.0% from last week. The BTC volatility has gradually narrowed, and the triangle convergence trend is about to come to a change point.

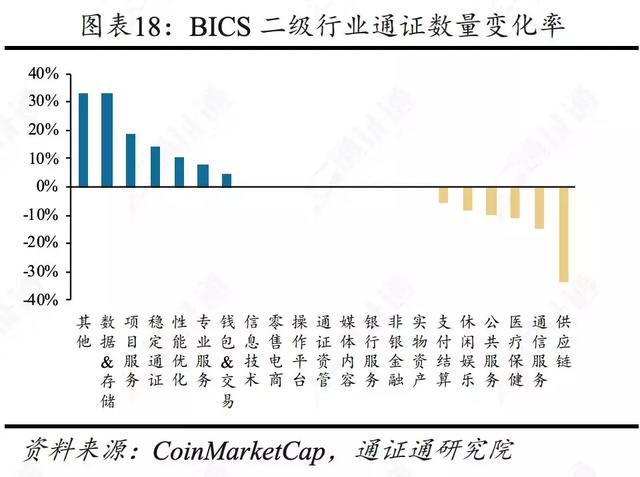

2.3 BICS industry: the market value of payment settlement and the number of certificates have decreased

In the secondary industry of BICS (Blockchain Industry Classification Standard), the market value of the payment and settlement industry decreased from 76.4% to 75.8%. From the perspective of the change rate of market value, the market value of performance optimization, project service, and stability certificate industry accounted for a higher growth rate, which increased by 48.2%, 14.9% and 13.6% respectively compared with last week; supply chain, non-bank finance, medical The proportion of health care market value decreased more obviously, down by 26.4%, 18.3% and 4.8% respectively from last week.

The BICS secondary industry with more obvious increase in the number of passes this week is the project service, which is 3 more than last week, and 2 industries with stable pass and data storage are added. The BICS secondary industry with obvious decline in the number of passes is Payment settlement, entertainment and communication services decreased by 5, 3 and 3 respectively compared with last week.

2.4 Market View: Interim finishing or ending, ushered in a change in early September

Since BTC broke through $10,000 for the first time this year, the BTC has risen to nearly $14,000, and the callback has fallen below $9,100. During the period, accompanied by the tension between China-US trade relations and the expectation of global economic recession, BTC fluctuated widely in the range of 9000-12000 US dollars.

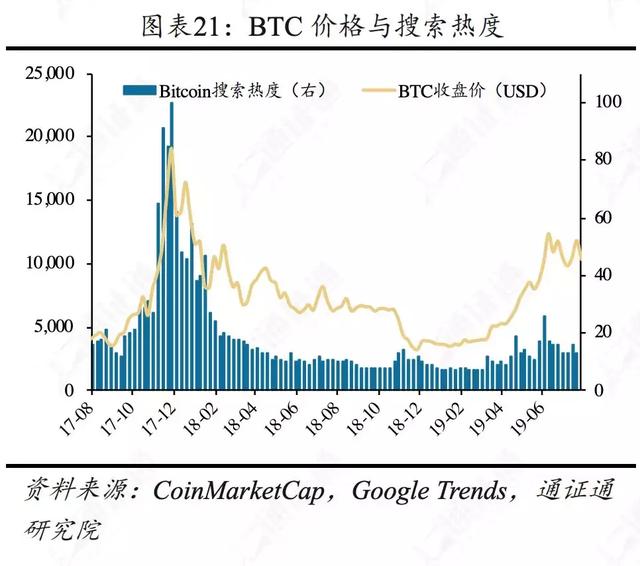

According to historical data, the current trend of shock consolidation is coming to an end. At present, the monthly volatility of BTC has once again fallen below 20%, the volume of transactions has continued to fall, and the price has returned to above the support level of 9,000 US dollars, indicating that the medium-term consolidation may end in the next two weeks. Combined with the official launch of the September Bakkt futures, BTC is likely to be At the beginning of September, the pressure broke through the pressure.

The long-term bull market will continue. In the long run, the quality pass has a large imagination, and it is still in the early stage of the bull market. The callback is a rare opportunity to increase the position. Investors can do a good job of asset allocation based on their own situation.

3 Output and heat: stability and computing power remain stable, public attention is low

The difficulty of BTC mining has not been adjusted, and the average daily computing power has declined slightly. BTC's mining difficulty is 9.985T this week. It has not been adjusted this week. The average daily computing power is 74.45EH/s, down 0.21EH/s from last week. The ETH mining difficulty is 2286 this week, down 3.6 days from last week. The average power is 183.5TH/S, which is 1.6TH/S lower than last week.

This week, Google Trends's Bitcoin entry search heat was 13, and the Ethereum entry search heat was 7, which was slightly lower than last week. Public attention is not high.

4 Industry News: Channels for institutional investment digital certification continue to expand

4.1 Central Bank Mu Changchun: The central bank digital currency is about to launch, will adopt a two-tier operating system

On August 10, Mu Changchun, deputy director of the Payment and Settlement Department of the People's Bank of China, said at the Third China Financial Forty Forum that the central bank's digital currency is about to be launched and will adopt a two-tier operating system, that is, the upper layer is the People's Bank of China. The second floor is a commercial organization. The central bank will not presuppose technical routes. Any advanced technology may be used for central bank digital currency research and development; electronic payment and central bank digital currency boundaries are blurred; it can fully mobilize market forces and achieve system optimization through competition.

4.2 The US Securities and Exchange Commission delayed the decision of three BTC ETF proposals until the fall

The US Securities and Exchange Commission (SEC) postponed a decision on three proposals for BTC exchange-traded funds on Monday. The three proposals were proposed by Bittech Asset Management, VanEck/SolidX and Wilshire Phoenix, and have been filed on the New York Stock Exchange Arca and the Chicago Board Options Exchange BZX. There is a view that the SEC will never approve the BTC ETF, but this does not prevent traditional institutions from investing in digital assets such as BTC.

4.3 Seed CX begins testing BTC margin swap transactions for physical settlement, scheduled to be launched in the next three months

Seed SEF, a subsidiary of Digital Certified Exchange Seed CX, has begun user acceptance testing of BTC margin swap transactions for physical settlement. Seed SEF revealed that the test will continue until August and will publish successful test results and wait for regulatory review. Seed CX co-founder and CEO Edward Woodford told The Block: "We are working closely with CFTC and hope to launch the product publicly in the next three months." This is a derivative contract, usually both off-site. Trade a financial instrument with custom features.

4.4 Bakkt plans to launch a physical settlement of BTC futures contracts on September 23

According to Coindesk, the Intercontinental Exchange (ICE) subsidiary Bakkt announced that it has been approved by the New York State Department of Financial Services (NYDFS) to allow it to provide physical settlement of BTC futures contracts. The company plans to launch its products on September 23. The release of the BTC futures contract has been somewhat bumpy and finally approved by the New York State Department of Financial Services (NYDFS), which is a good thing for the market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After Huawei and Apple, Samsung added Bitcoin to its Keystore.

- Vitalik: Eth2 will increasingly rely on light clients

- Gu Yanxi: Bookstore in the Internet Age, Movie Theater in the Blockchain Age

- Suspected "Zhong Bencong" released "My Confession (Part 1)": Reviewing the Origin of Childhood, Bitcoin Name, and the Origin of Nakamoto

- The market responded positively to the positive, and the downward trend has not changed.

- Bakkt, which is difficult to produce, has finally arrived, but can it really bring a big bull market?

- National Financial and Development Laboratory Yang Tao: Redefining the Micro Foundation of Money under the Digital Trend