Blockchain Weekly | AlipayHK: Chinese version of Libra?

Guide

Hong Kong version of Alipay Alipayay is approved by the national license, AlifayHK is the Chinese version of Libra?

Summary

Special Topic: The same way, AlipayHK is the Chinese version of Libra? AlipayHK, the Alipay Hong Kong e-wallet, was launched in May 2017. At present, AlipayHK has over 2 million users and Hong Kong supports more than 50,000 retailers of AlipayHK. On June 25, 2018, AlipayHK launched a cross-border remittance service and currently supports remittances to the Philippines. It's not hard to find that AlipayHK and Libra's goals are very similar, that is, to make more people enjoy convenient and cheap financial services. But on the specific path, AlipayHK and Libra have some obvious differences. Libra has launched a stable pass as an intermediary medium for circulation. Its value is supported by a variety of legal currencies, and AlipayHK is through electronic wallets with multinational banks and other countries. Cooperation, relying on the alliance chain to achieve cross-border remittance, which does not involve digital pass. From the perspective of landing, Libra is still in the exploration stage and has been repeatedly questioned by all parties. Alipayay's blockchain cross-border remittance solution has already landed in some areas and has been recognized to a certain extent.

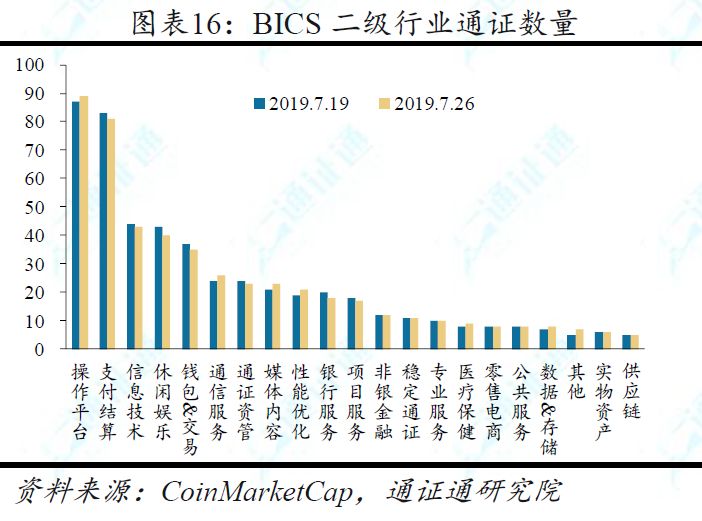

Quotes: The rebound is weak and the shock is down. The total market value of digital certificates this week was 275.29 billion US dollars, down 3.9%; the average daily trading volume was 56.03 billion US dollars, down 25.1%; the average daily turnover rate was 20.0%%, down 6.7%. The current price of BTC is 9.870 US dollars, a decrease of 6.3%; the average daily turnover of BTC this week is 17 billion US dollars, and the average daily turnover rate is 9.4%. The current price of ETH is US$219.6, a decrease of 0.8%. The average daily trading volume of ETH is 6.8 billion US dollars, and the average daily turnover rate is 28.9%. This week, the exchange's BTC balance was 884,300, an increase of 0.4 million; the exchange's ETH balance was 8.71 million, an increase of 390,000. In the secondary industry of BICS, the market value of payment settlement decreased significantly, and the number of leisure and entertainment passes significantly decreased.

Output and heat: Difficulty in mining is reduced, and ETH attention is greatly reduced. The difficulty of mining this week is 9.014T, which is 0.050T lower than last week. The average daily power of this week is 69.43EH/s, up 7.25EH/s from last week. The difficulty of mining this week is 2181, which is 19% lower than last week. The average daily power is 175.1TH/S, which is 3.3TH/S lower than last week.

- I was killed by Algo…

- Analysis of the market: In the early hours of the morning, the main force began to support the disk?

- The price broke 76%, and Algorand was questioned as the Turing Award level.

Industry: Blockchain cross-border payments have made new progress. German encryption companies will need to obtain a license issued by the German Federal Financial Supervisory Authority next year; Hong Kong version of Alipay will be approved by the national license to provide cross-border remittances in blockchain; SWIFT announces cross-border instantaneous payment test results, and payment can be completed in 25 seconds. ; Bakkt has opened a global user test for BTC daily and monthly futures contracts.

Risk warning: regulatory policy risk, market trend risk

On July 21, 2019, the Hong Kong version of Alipay Alipayay was approved by the national general license, and its mobile payment service will be gradually extended from Guangdong, Hong Kong and Macau to the rest of the country.

AlipayHK is operated by a joint venture between Cheung Kong Hutchison Industrial and Ant Financial. AlipayHK, the Alipay Hong Kong e-wallet, was launched in May 2017 and is operated by Alipay Financial Services (HK) Limited (APSHK) and regulated by the Hong Kong Monetary Authority. APSHK is a joint venture between Changjiang Hutchison Industrial Co., Ltd., a large multinational company with operations in more than 50 countries , and the world's top financial technology group and Alipay Financial Services Group .

At present, more than 50,000 retailers in Hong Kong have supported Alipay Bank's payment. At present, more than 50,000 retailers in Hong Kong support Alipay Hong Kong e-wallet payment, covering large chain stores, convenience stores, pharmacies, supermarkets, minibuses, markets, taxis and restaurants.

At present, AlipayHK has more than 2 million users, and an average of one in every three Hong Kong people is using AlipayHK. According to the latest third-party survey, each mobile payment user in Hong Kong has an average of 3 e-wallets, and AlipayHK has a usage rate of over 53%, which is the preferred e-wallet for Hong Kong people.

In addition to payment services, AlipayHK offers a wide range of lifestyle and convenience services to Hong Kong users. Currently, cross-border payments, P2P transfers, Peli (red envelopes), blockchain international remittances, telecommunications or living payments, Taobao and Tmall platform payments, Hong Kong racecourse tickets and food and beverage vouchers, purchases from third parties have been supported. Insurance products, receiving e-vouchers, and enjoying electronic printing.

Cross-border payments are a step by step. Starting from March 1, 2019, AlipayHK launched the “Dawan District Cross-Border Payment Service”. AlipayHK users can directly consume some merchants in the mainland cities of the Guangdong, Hong Kong and Macau Dawan District, without the need to exchange foreign exchange in advance. On July 21, 2019, the Hong Kong version of Alipay Alipayay was approved by the national general license, and its mobile payment service will be gradually extended from Guangdong, Hong Kong and Macau to the rest of the country.

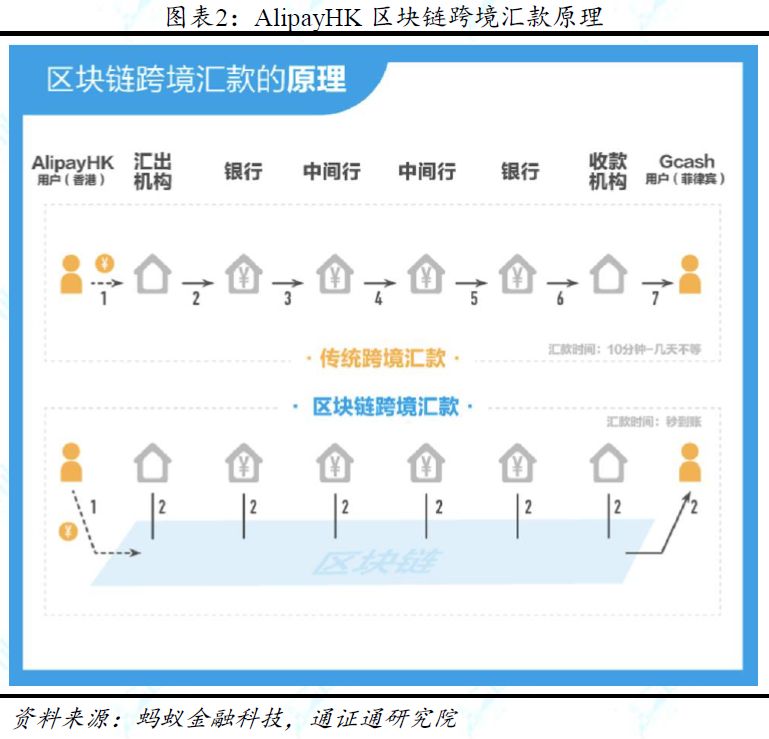

International remittances have taken a solid step. On June 25, 2018, AlipayHK launched a cross-border remittance service, using the distributed ledger technology of the blockchain to achieve inter-agency collaboration between AlipayHK, Standard Chartered Bank (Hong Kong, Singapore) and Philippine Wallet (GCash). At present, AlipayHK's international remittance supports remittance to the Philippines, the currency is the Philippine peso, there is currently no handling fee. The exchange rate is provided in real time by the partner EMQ to ensure continuous updates. In addition, on January 8, 2019, the Governor of the Central Bank of Pakistan announced in Islamabad that the country's first blockchain cross-border remittance project was launched. Ant Financial said that the technical solution was provided by Alipay, and Pakistanis working in Malaysia could remit funds to the Pakistan Alipay Easypaisa through the remittance service provider Valyou.

AlipayHK International Remittance supports three payment methods, which can be instantly received. Remittance to the Philippines, you can collect money in the following three ways: 1. Cash withdrawal: The payee goes to the chain agency Cebuana or Palawan, and receives the cash (15 minutes to the account) with the withdrawal code displayed on the page after the sender's successful remittance; 2 Bank account collection (1 business day to account); 3.Gcash (instant account, Gcash is the Philippine "e-wallet" created by Ant Financial and Philippine digital finance company Mynt in 2017, with the name of the Philippine version of Alipay ).

AlipayHK international remittances have certain restrictions on the amount. The intermediate remittance account has a daily remittance limit of HK$5,000, the annual remittance amount is limited to HK$60,000 (shared with the shopping payment limit); the advanced reimbursement account has a daily remittance limit of 5,000 HKD, and the annual remittance amount is limited to HK$100,000 (shared with the shopping payment limit) ). The minimum remittance amount is at least HK$100.

The same way, AlipayHK is the Chinese version of Libra? It's not hard to find that AlipayHK and Libra's goals are very similar, that is, to make more people enjoy convenient and cheap financial services, including payment, cross-border transfer and so on. But on the specific path, AlipayHK and Libra have some obvious differences. Libra has launched a stable pass as an intermediary medium for circulation. Its value is supported by a variety of legal currencies, and AlipayHK is through electronic wallets with multinational banks and other countries. Cooperation, relying on the alliance chain to achieve cross-border remittance, which does not involve digital pass. From the perspective of landing, Libra is still in the exploration stage and has been repeatedly questioned by all parties. Alipayay's blockchain cross-border remittance solution has already landed in some areas and has been recognized to a certain extent.

At the Libra hearing a week ago, the Libra project leader did not deny the competition with Alipay and WeChat, which caused a hot debate in the market. However, due to user habits and national policies, Libra may not be able to shake the position that Alipay has achieved in the short term; On the other hand, Libra's technology implementation may not be too difficult for Alipay, the leading patent in the blockchain field. With the development of the Libra project and the exploration of its model, Alipay launched with a large user base The next "Chinese version of Libra" is also unknown.

At the Libra hearing a week ago, the Libra project leader did not deny the competition with Alipay and WeChat, which caused a hot debate in the market. However, due to user habits and national policies, Libra may not be able to shake the position that Alipay has achieved in the short term; On the other hand, Libra's technology implementation may not be too difficult for Alipay, the leading patent in the blockchain field. With the development of the Libra project and the exploration of its model, Alipay launched with a large user base The next "Chinese version of Libra" is also unknown.

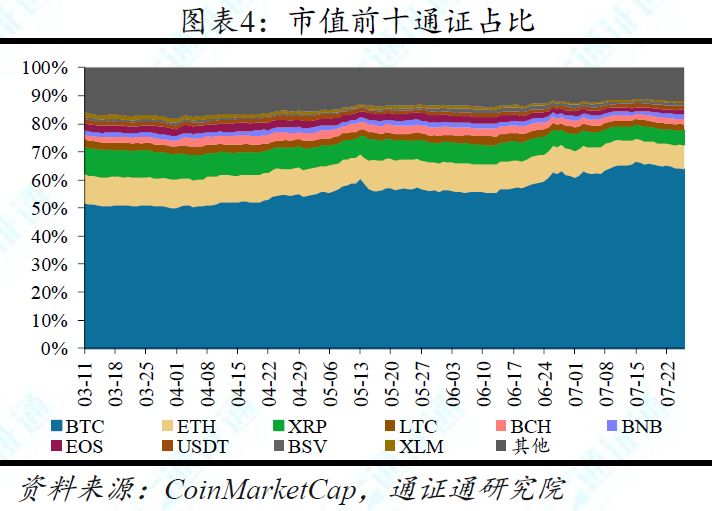

The total market value of digital passes this week was 275.29 billion US dollars, a decrease of about 3.9% compared with last week's decline of 11.2 billion US dollars. Following the sharp correction last week, the market continued to fluctuate downward this week.

This week, the exchange's BTC balance was 884,300, an increase of 0.4 million from last week. The exchange's ETH balance was 8.71 million, an increase of 390,000 from last week. The exchange's BTC and ETH balances increased in different degrees, and the selling pressure on the market increased.

This week, the exchange's BTC balance was 884,300, an increase of 0.4 million from last week. The exchange's ETH balance was 8.71 million, an increase of 390,000 from last week. The exchange's BTC and ETH balances increased in different degrees, and the selling pressure on the market increased.

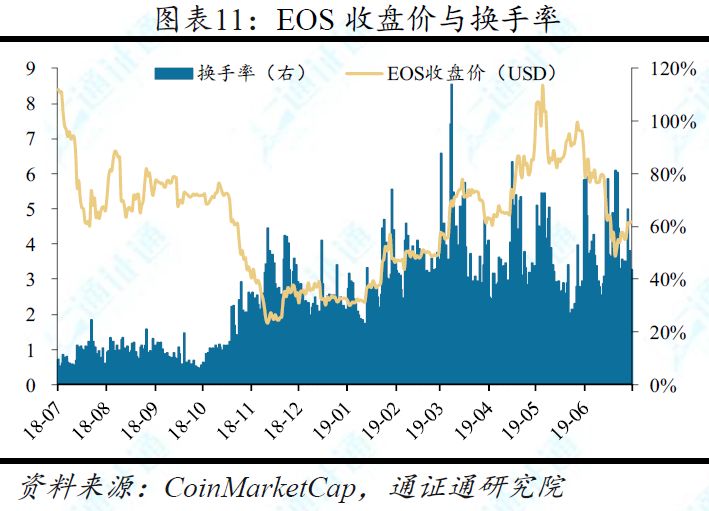

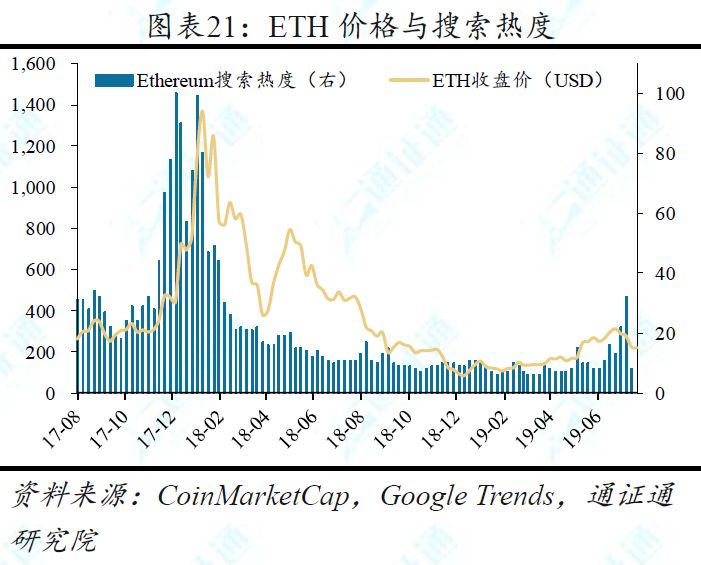

EOS led the main circulation certificate

The current price of ETH is 219.6 US dollars, with a weekly decline of 0.8% and a monthly decline of 34.8%. The average daily trading volume of ETH this week was 6.8 billion US dollars, and the average daily turnover rate was 28.9%. ETH had a large decline in the previous period and closed slightly lower this week.

The current price of XRP is $0.32, a weekly increase of 0.9%, and a monthly decline of 30.8%. The average daily volume of XRP this week was $1.1 billion, with an average daily turnover of 8.1%.

The current price of XRP is $0.32, a weekly increase of 0.9%, and a monthly decline of 30.8%. The average daily volume of XRP this week was $1.1 billion, with an average daily turnover of 8.1%.

The monthly volatility of the main pass continued to fall this week. The monthly volatility of BTC was 35.4%, down 2.9% from last week. The ethical volatility was 33.5%, down 2.1% from last week. The EOS monthly volatility was 37.7%. It rose 1.8% from last week; XRP monthly volatility was 26.2%, down 0.5% from last week. This week, the market EOS volatility rose slightly, and the volatility of other major circulation certificates declined slightly.

In the secondary industry of BICS (Blockchain Industry Classification Standard), the market value of the payment and settlement industry decreased from 74.0% to 72.8%. From the perspective of the rate of change in market capitalization, the market share of retail e-commerce, general securities and media content has a higher growth rate, up 26.1%, 10.7% and 10.5% respectively compared with last week; non-bank financial, payment settlement The decline in the market value of the project services category was more significant, down 1.6%, 1.6% and 2.6% from last week.

The BICS secondary industry with more obvious increase in the number of passes this week is other, data & storage and health care, which increased by 40%, 14.3 and 12.5% respectively compared with last week; BICS level II with more obvious decline in the number of passes this week The industry is banking services and leisure and entertainment, respectively, down 7% and 10% from last week.

The BICS secondary industry with more obvious increase in the number of passes this week is other, data & storage and health care, which increased by 40%, 14.3 and 12.5% respectively compared with last week; BICS level II with more obvious decline in the number of passes this week The industry is banking services and leisure and entertainment, respectively, down 7% and 10% from last week.

In the recent down market, BTC showed obvious anti-falling property. This week, BTC performance was weaker than the main circulation certificate. Some of the main circulation certificates began to rebound first. As the BTC gradually stabilized, the follow-up other main circulation certificates may lead the next round of market.

The bull market is accelerating, breaking through new highs or not far off. Compared with the previous round of bull market, this round of market seems to have signs of acceleration. The market's double bottoming and breakthrough of 70% of the previous high point only used the previous round of 1/3 and 1/2 of the bull market respectively. If the market continues to press This evolution, not far from the new high.

The callback can be gradually added. In the long run, the quality pass has a large imagination, and it is still in the early stage of the bull market. The callback is a rare opportunity to increase the position. Investors can do a good job of asset allocation based on their own situation.

This week, Google Trends's Bitcoin entry search heat was 13, which was slightly lower than last week. The Ethereum entry search heat was 8, which was significantly lower than last week.

4.1 German encryption companies will need to obtain a license issued by the German Federal Financial Supervisory Authority next year.

According to Cointelegraph, starting next year, the new anti-money laundering (AML) regulations will require German cryptographic companies to hold a license issued by the Federal Financial Supervisory Authority (BaFin). The new regulations will require Bain-licensed services such as exchanges and wallet providers to obtain BaFin licenses and comply with the “anti-money laundering” regulations, since from January 1, 2020, encrypted assets will be considered a financial instrument. .

According to Xinhua News Agency, Alipay's Hong Kong version of Alipay Alipay HK has been licensed, and its mobile payment service will be extended from Guangdong, Hong Kong and Macau to the rest of the country. In addition to payment functions, AlipayHK is able to provide local insurance features such as purchase insurance, blockchain cross-border remittances, and stamp printing.

4.3 SWIFT Announces Cross-Border Instant Payment Test Results

According to zdnet, SWIFT announced the global test results of integrating SWIFT gpi Instant (cross-border instantaneous payment service) in Singapore's domestic instant payment service. The test involved 17 banks in 7 countries, including Australia, China, Canada, Luxembourg, the Netherlands, Singapore and Thailand. Payments can be made within 25 seconds between these regions, with Australia taking the shortest time to pay in Singapore, which takes only 13 seconds.

4.4 Bakkt starts futures contract global user test

Bakkt official Twitter said that global user testing has been launched, and the current BTC daily and monthly futures contract tests on Bakkt are on schedule.

Source: Tongxuntong Research Institute

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Gu Yanxi: How to issue stable currency based on Bitcoin?

- Why are you optimistic about RSK (root chain)? This is my point of view

- Data | Traditional investment institutions compete in the blockchain field, nearly half flow to tool application projects

- Who is the most dangerous in the encryption market? Tether!

- July 29th market analysis: the needle market reappears, the market will stop falling?

- Bakkt was confirmed in the third quarter, and the super bitcoin bull market is really coming?

- Lightning Labs Releases Lightning Network Monitoring Tool for User Visualization