The price broke 76%, and Algorand was questioned as the Turing Award level.

On June 19th, Algorand, the star project of the Turing Award winner SilvioMicali, began the first ALGO token Dutch auction. In the end, 25 million ALGO tokens were sold at a price of $2.40, a 48-fold increase over the private placement price ($0.05), and a successful fundraising of $60 million, making it one of the top fundraising projects to date in 2019.

After the auction, the exchanges such as Firecoin, OKEx and Coinan Announced the listing of ALGO. In order to get ahead of ALGO, the fire currency even changed the rules and advanced ALGO's open trading time to 10:30 on the 21st, leading other exchanges. .

After the opening, ALGO continued to rise sharply. After the online currency was secured on the 22nd, it surged to 3.44 US dollars. When most people are looking forward to "ALGO TO THE MOON", ALGO turns direction, straight down, from the Turing Awards project to "TO Zero, from the highest point of June 22, 3.79 US dollars to the lowest point of 0.557 US dollars, the highest drop in a month reached 85%, even if compared with the auction price, it fell 76%.

- Gu Yanxi: How to issue stable currency based on Bitcoin?

- Why are you optimistic about RSK (root chain)? This is my point of view

- Data | Traditional investment institutions compete in the blockchain field, nearly half flow to tool application projects

Algorand, why is a world-class blockchain project leading the blockchain revolution, becoming a “cutting leek” scam in the eyes of retail investors and a “funding game” in the eyes of some professionals?

01 Algorand: Turing Award winners entering the blockchain

Algorand was born in the impossible triangle problem of the blockchain.

Blockchain Impossible Triangles Blockchain projects cannot simultaneously address the three requirements of decentralization, scalability, and security.

For example, Bitcoin has low scalability, but its decentralization and security are very strong; EOS guarantees security and scalability through the super node, but only 21 super nodes control the blockchain out of the block, and the power is too concentrated. Sacrifice decentralization; the impossible triangle seriously restricts the development of the blockchain, making it difficult for the blockchain industry to enter the commercial field on a large scale.

Professor Silvio Micali of the Massachusetts Institute of Technology launched the blockchain project Algorand when the blockchain was caught in a technical dilemma due to the impossible triangle problem.

Compared to the identity of Professor MIT, Micali is more famous as a cryptographer and Turing Award winner. He co-authored the first paper on zero-knowledge proof theory in 1986.

Algorand is a combination of "algorithm" (algorithm) and "random" (random), which basically summarizes its biggest feature: random generation of blocks and verification nodes using algorithms.

Algorand chief cryptographer Gorbunov said, "In order to solve the problem of decentralization, Algorand innovatively introduced a secret self-selection mechanism. Every user can participate in the encryption lottery of the committee fairly, and eventually become a member of the committee. Only the users know for themselves. ."

Through the encryption lottery technology, Algorand randomly selects the consensus nodes among the users, and cannot predict in advance which people will be selected, thus avoiding the tendency of centralization.

At the same time, the members of the verification committee are randomly selected by the VRF encryption lottery. Only the selected person knows it, and the identity of the verifier is exposed only when the block is broadcast. Each round of the block proposer re-uses the VRF for encrypted lottery. .

Introducing VRF (validable random function) into the public chain is Algorand's unique innovation, which increases randomness and unpredictability, thus enhancing security.

Finally, Algorand established an encrypted lottery format to determine the committee members who participated in the broadcast block. Each draw took only about a microsecond, and all the lottery operations were independent and did not interfere with each other. The expected value of the candidate group size is a constant, and the network size is not proportional to the number of users, thus ensuring scalability.

Chen Hao, chief scientist of Algorand, said in an interview with the media that Algorand's TPS performance will be comparable to VISA in the future.

According to the code audit report issued by the code audit team InCodeWeTrust team, Algorand code is well structured, clear in function, and reusable and testable.

Recently, the Algorand Foundation announced that the stable currency company Tether will integrate and develop the stable USDT in the Algorand network, which also indicates that Algorand is technically recognized.

However, the technical innovation public chain that is committed to solving the impossible triangle problem is not too small. Why is it that Algorand is the fire?

Relative to the technology itself, Algorand is best known for his identity as the founder of the Turing Award, as well as the Dutch auction (DutchAuction) and the bearish repo option design, which also makes Algorand known to some industry insiders as Turing. The prize-level "funds".

02 Turing Award "Funds"?

Dutch auctions, also known as reduced-price auctions: In each auction, a fixed number of ALGOs are available for auction at a fixed time. During the auction, the ALGO auction bids are decremented from high to low, until one person's auction is successful, and all ALGOs sold are sold at the settlement price of the auction.

Algorand is preparing to put 3 billion ALGOs into circulation in a Dutch auction in five years, with an auction of 25 million each time, twice a month, for a total of 120 auctions. The token will be circulated after the auction is over and will not be locked. During the auction, the price of ALGO was linearly reduced from $10 in time until the total supply of 25 million units was sold to the clearing price.

The Algorand Foundation said in the announcement that there are two main reasons for choosing this way of selling tokens, aiming at achieving the principle of fairness:

"One of the core principles of a borderless economy is fairness. We believe that the price of ALGO should be determined by the market, not by us. We have found that the Dutch auction mechanism can achieve the principle of fairness. There are two main reasons. First, because in every field. In the auction, the price of each person buying ALGO is the same; second, because the price is determined by the market."

How do investors in the market decide the price? The main considerations are two points, one is the investor's return expectations, and the other is risk appetite.

In order to make a higher price, investors need to generate high-yield expectations for ALGO while increasing their risk appetite.

In order to achieve these two points, Algorand launched a Turing award-winning genius design – the right to withdraw coins.

If ALGO is sold for more than $1, then all investors (ie, those who are more than $1) can get a 7-day refund after one year, during which time 90% of the funds can be returned; If the price is less than $1, the buyer can refund their ALGO token at the settlement price minus 10 cents.

This is equivalent to giving a Put Option at the same time, which greatly increases the investor's risk appetite . In the future, it will save 90% of the future, and use 10% of the loss to go to the greater profit. Why not? For Algorand, it not only promoted the subscription of ALGO, but also created a 10% arbitrage space for itself.

Liu Yi, a partner at Random Capital, believes that the Dutch auction used by Algorand has caused confusion in the industry. The project side has shifted the attention of investors and will enable investors to focus on the research of arbitrage mechanisms and bring the industry A bad head.

Primitive Ventures founding partner Wan Hui referred to Algorand as the "funding disk" at the Turing Award level .

"With the design of a price mechanism, Algorand successfully guided the expectations of both parties involved in the transaction. It is really a very clever game design. For the first time, it can be called cryptography economics. How much repo should be paid in the end? It is limited, as long as the seller knows that " I can always save 90% in one year. " Effective and expected management is the real magic. "

She believes that the most powerful place in Algorand, Put Option, sets a hard bottom for ALGO prices. As long as the price falls by more than 10%, the people who participate in the auction will buy it because they can arbitrage at a higher price.

But in fact, the existence of the right to withdraw the currency did not bring price support to ALGO, but continued to fall. Of course, there are still many people who think that ALGO will rise to a price close to the auction price sooner or later, but as a large number of private equity tokens flow into the market, the share of the currency with the right to withdraw the currency will be lower and lower. As auction participants gradually repurchase tokens from the market, ALGO prices may rise slightly, but their overall purchase demand is not high relative to market liquidity. If retail investors try to buy a large amount of ambush and wait for a period of time before returning the currency, etc. The price rises to the price close to the original auction price, unless the project party takes the initiative to pull the disk , the result may only be more and more secure.

03 Who is sitting in the village? Who is paying?

In February 2018, the Algorand project successfully raised a $4 million seed round financing at the beginning of the project. The investors were Silicon Valley's well-known venture capital Pillar and Union Square Venture Capital (USV); after testing the online line in July, Algorand was In October, it announced the completion of a $62 million equity financing involving a number of international investment groups covering a wide range of global investment groups in venture capital, cryptocurrency and financial services communities.

According to the official website, Algorand has received investment from 32 institutions including CMB International and Xinyi Capital. Their cost is only US$0.05, and they are locked for 2 years and unlocked 730 points per day.

As ALGO's private equity investors, they are motivated to participate in the auction, increase the auction price, and thus earn more profits.

The price of ALGO's first auction ended at $2.40, while its private placement price was $0.05, which means that private equity investors have already achieved a 48-fold return on the opening, earning a lot of money.

Investors who participate in the ALGO auction also receive a put option, even if they sell ALGO, they still have the right to withdraw the currency.

For those who have the right to return coins, ALGO's plunge is the result they are happy to see. The worse they fall, they can reclaim chips at a lower price.

Private investors who participate in the auction can sell the tokens in the hands when the ALGO price is high, and the ALGO price will be smashed down, and then repurchased at a low price. At that time, the Put Option in the hands will be used to sell the low-priced tokens at a low price. The project side realizes serial harvesting.

In addition, Algorand institutional investors not only enjoy ultra-low private equity prices, but they are also super nodes and enjoy permanent income.

According to Algorand investors materials, each super node is worth $2 million and has permanent income and voting rights.

The super node helps Algorand to run, thus gaining the right to revenue, which is issued in two time periods.

In the first phase 0-2 years, the proceeds are the release of 2 million tokens.

After the second phase, after 3 years, the proceeds come from Algorand's entire network, and the amount is based on the actual operation of the Algorand network.

However, the second phase of the benefits has many conditions to meet, including allocating sufficient bandwidth and storage space for the consensus protocol and providing a 99.99% availability guarantee for its nodes.

Super nodes are not losing money, so who are the big players in these institutions, who are the people who carry the sedan chair?

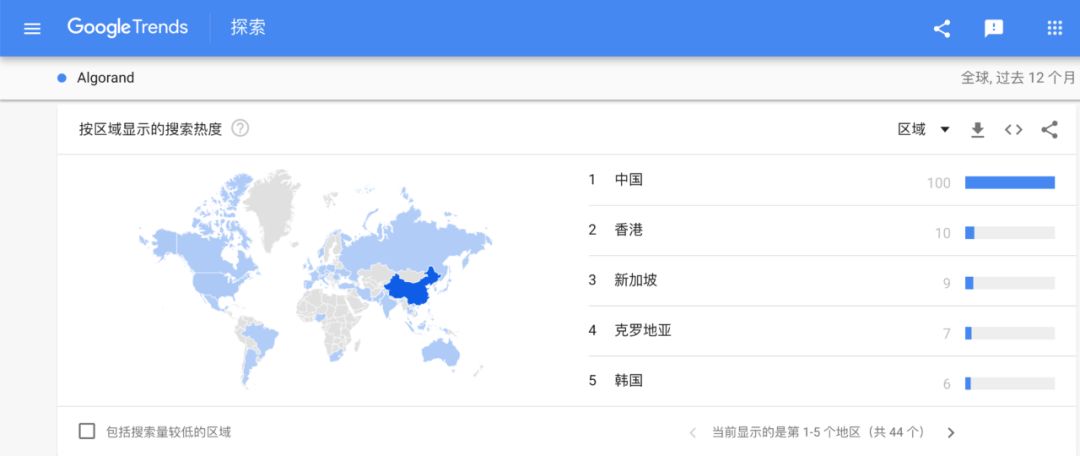

Just refer to Google, the search engine that most people can't use. According to Google Trends, Algorand's search fever is 90% concentrated in China, and other hot spots are mainly in Asia, while the US search is only 3% of China's.

From the transaction data point of view, ALGO's trading volume is also mainly concentrated in exchanges dominated by Chinese users.

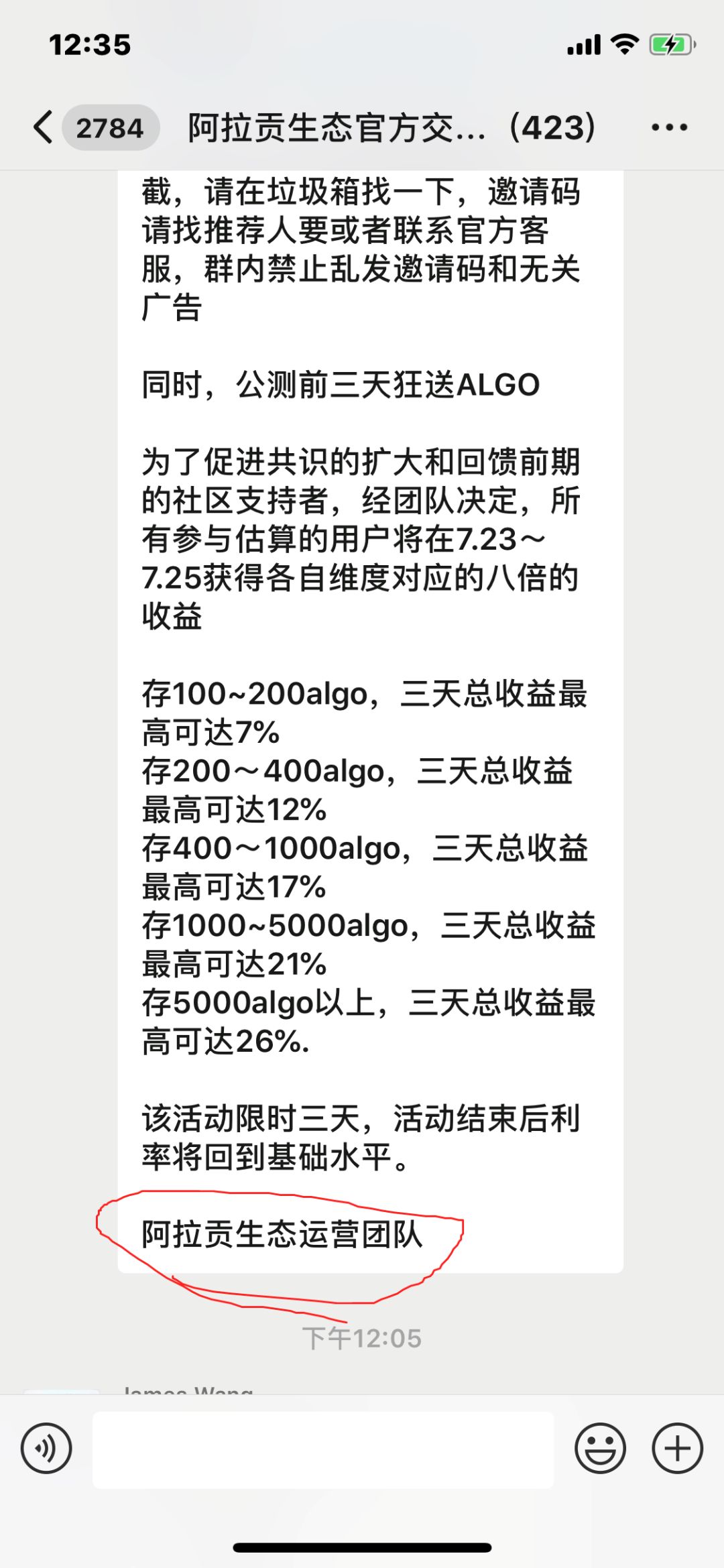

Recently, a fund with the name of “Aragon Eco” began to appear. Its routines and traditional funds are exactly the same, and the deposits are in interest. The paper promises to pledge 5000 ALGOs, and the daily income can reach 1.1%. During the event, the three-day income Up to 26%.

However, Algorand officials said that no ecological plans have been released.

04

Can you really solve the impossible triangle?

Regardless of the mode, at the technical level, whether Algorand can really break the blockchain is still impossible.

After analyzing its specific working mechanism, blockchain research expert Larry pointed out that there are some problems in Algorand itself in "Technical Analysis of the Three Popular Public Chain Projects Algorand, Dfinity and Thunder Consensus System":

First, the signature data is huge, causing storage waste and affecting performance.

Algorand uses VRF to determine the proposal group and the verification group. This approach gives full play to the verifiability of VRF. However, after Algorand enters the verification phase, Algorand's verification group must be large due to the use of the scalable Byzantine fault-tolerant algorithm. 2000 to 4000 people), this will result in an unusually large signature data. Severe waste of storage and capacity not only causes storage waste, but also affects performance.

Secondly, the algorithm has great requirements for network bandwidth, and it is difficult for individual users to participate, which seriously affects the decentralization characteristics.

In the experimental environment, Algorand needs to reach the block size of 10M to achieve the performance of 125 times bitcoin. The 10M block size means that the peak of the network bandwidth of the node needs to be at least 80M to be carried, which is very difficult for the current general users. The efficiency and decentralization of the system.

Finally, Algorand does not have a strong output fairness guarantee.

Bias-resistance ensures that the output of the protocol is not manipulated by adversaries. However, Algorand uses a somewhat biased randomness in selecting the proponents, making applications that need to be truly random and evenly distributed unsuitable for this protocol.

In general, Larry believes that Algorand's VRF and cryptographic lottery posteriority give a design idea that can better solve the "triangular paradox", but its design in the verification process is more purely academic idealized, resulting in It does not think enough about the actual project such as network traffic and effective communication data, which seriously affects the performance of the public chain, the size of the node network, the storage capacity of the books, and the degree of decentralization.

Through Algorand, we can't help but reflect on what kind of project is the real high-quality blockchain project?

In the K-line jungle world where "the blockchain revolution has risen and the blockchain scam has fallen", in the eyes of retail investors, the most important thing in a good blockchain project is not to do things, but to pull. Technology can't pull directly, and “model” innovation has become a straw for all blockchain projects to make a living. Even technical projects like Algorand can't be avoided.

Before the real value creation, the secondary market is just a pure zero-sum game. Private investors are making 48 times more. Someone has to pay for it. When the Turing Award is also questioned, it becomes a "dish knife." Who can we trust?

Reference material:

"Technical Analysis of the Algorand, Dfinity and Thunder Consensus Systems of the Three Popular Public Chain Projects"

"Algorand test network third-party code audit and testing: system maturity is good against attack"

Source: Chain Catcher

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Who is the most dangerous in the encryption market? Tether!

- July 29th market analysis: the needle market reappears, the market will stop falling?

- Bakkt was confirmed in the third quarter, and the super bitcoin bull market is really coming?

- Lightning Labs Releases Lightning Network Monitoring Tool for User Visualization

- [07.28] Waterfall and waterfall, where is the bottom?

- Bitcoin plunged 600 dollars in short-term, it was the main opportunity to flee

- The United States wants to make money in abandoned bitcoin, and the exchange may face litigation?