Break through $6,000! 50% of Facebook enters digital currency payment system during BTC

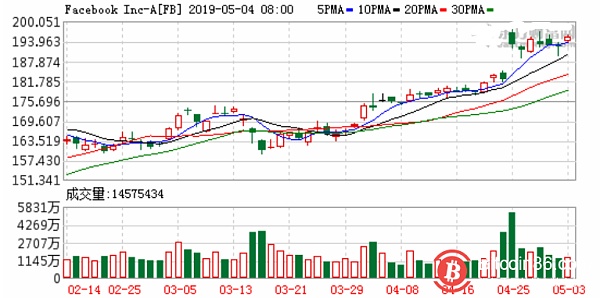

After nearly half a year of consolidation, Bitcoin prices began to force in April. Within a month, the price of two single-day prices rose by more than 5%. On the evening of May 3, the Bitfinex offer showed that the bitcoin broke through the $6,000 mark, hitting a new high in November last year. At this price, bitcoin has skyrocketed by nearly 50% in one month, based on the price of $4,100 in early April.

Analysts' views are more differentiated. Some think it may be short-lived. Others believe that 6000 US dollars is an important barrier. After breaking through this barrier, the upward momentum is strong. However, from the overall trend of digital currency, although the increase in bitcoin price has brought certain confidence to the market, the actual display is still “out of the box” market. Although other currencies have slightly increased, the overall increase is not large. The overall warming is still not expected. It is worth noting that in the digital currency bear market, social giant Facebook has been frequently released to issue its own digital currency, and relevant details have surfaced. The entry of the giants is undoubtedly a strong shot for the digital currency, which may also drive the market's positive.

Bitcoin broke the $6,000 mark, hitting a new high in November last year

- What are the quantitative trading tools in the digital currency market?

- Reuters: Japanese regulators will introduce new regulations on exchange cold wallet

- Nevada legislators abolish defective cryptocurrency bills

After a long-term shock of half a year, Bitcoin once again broke through the $6,000 mark in early May, driving the digital currency market to be red. On May 3, Beijing time, Bitfinex quoted that the bitcoin broke through the $6,000 mark, hitting a new high in November last year and rising more than 5% in the day.

The good performance of the spot market has increased confidence in the futures market. CME bitcoin futures BTC June contract closed up 280 US dollars, an increase of more than 5.19%, reported 5670 US dollars, this week rose more than 11.61%; CME bitcoin futures BTC July contract closed up to 5675 US dollars.

In late May 1st, CBOE bitcoin futures XBT June contract rose 5.60% to $5,690, which rose more than 11.13% this week.

The Diar report from the cryptocurrency research institute shows that, on a quarterly basis, the volume of transactions on the Bitcoin chain (in US dollars) has been declining since the beginning of 2018, setting a new low in the first quarter of this year. However, according to the month, the trading volume in the bitcoin chain has reversed the downward trend, and reached a new high of 10 months in April this year, with a transaction volume of over 130 billion US dollars. Some analysts said that the reason for the increase in trading volume is likely to be due to the price rebound of Bitcoin in recent months, rather than its actual development.

On May 2, Gary Gensler, former chairman of the US Commodity Futures Trading Commission (CFTC), said at the blockchain business event held at the Massachusetts Institute of Technology that the cryptocurrency market needs regulation to grow because consumers must be protected.

He believes that in order to maintain market prosperity and growth, investors should be aware of the risks of market manipulation or loss of private keys, and the law should also protect investors and consumers.

When asked if the Bitcoin ETF is influential if approved, Gensler said the SEC is working to ensure that if an ETF is approved, the ETF itself and the underlying markets such as Bitcoin or Ethereum are not easily manipulated. .

The Diar report from the cryptocurrency research institute shows that, on a quarterly basis, the volume of transactions on the Bitcoin chain (in US dollars) has been declining since the beginning of 2018, setting a new low in the first quarter of this year. However, according to the month, the trading volume in the bitcoin chain has reversed the downward trend, and reached a new high of 10 months in April this year, with a transaction volume of over 130 billion US dollars. The analysis said that the reason for the increase in trading volume is probably due to the price rebound of Bitcoin in recent months, rather than its actual development.

From the actual market, Bitcoin prices began to appear "Xiaoyangchun" in April this year. During the trading hours on the afternoon of April 2, the price of Bitcoin rose from $4,100 to $4,800, and it was basically in a state of rising during the week. For more than a month, although the price has fluctuated, it has steadily increased. As of press time, the gate.io platform quoted 5,871 US dollars, which was more than 45% higher than the price of 4000 US dollars in early April.

For the reason of this round of price increases, the more common view is because of the previous oversold, the current price is in the return stage. From April to the current overall situation, there are mainly two waves. First, the increase from 4,100 dollars to 4,800 dollars in early April, the reason for the rise was originally because there was news that the SEC had made a major decision to approve the bitcoin-based ETF listing on the CBOE on the Chicago Board Options Exchange. But what is surprising is that the price of the currency has not been "sounded down" after the news has been falsified. The second round of the market is from $4,800 to the current price.

Some analysts pointed out that Bitcoin's short-term rebound below 6,000 US dollars is driven by the long-term sideways, but the fundamentals are not fully supported. In the short-term operation, the views of various parties are more dispersed. On the one hand, I am worried that the market will be short-lived; optimists think that the price from 4,000 US dollars to 5,000 US dollars has not stayed for too long, the rise does not seem to have much resistance, 6000 US dollars is a key node, if the bulls can break through 6,000 US dollars, the funds will put The price of the coin is pushed to $8,000 or higher.

In addition, the arrival of the flood season, the bitcoin mine began the practice of the currency may also be one of the reasons for the rise in the price of the currency.

However, from the overall trend of digital currency, although the increase in bitcoin price has brought certain confidence to the market, the actual display is still “out of the box” market. Although other currencies have slightly increased, the overall increase is not large. Most of them are still in a state of sideways volatility or stagnation, and most currencies are underpowered, and the overall recovery is still unsustainable.

Facebook enters the currency circle, or will issue stable cryptocurrency

This round of bitcoin market may be related to a news – Facebook is building a digital currency-based payment system.

On May 2, according to The Wall Street Journal, Facebook is building a digital currency-based payment system. According to people familiar with the matter, the project codenamed "Project Libra" has been in operation for more than a year.

According to reports, the project is intended to be based on Facebook and a number of financial companies and online e-commerce companies, based on Facebook's largest social network launched by the cryptocurrency-based payment system. Incoming people may include Visa and MasterCard, and the addition of the payment giant will help Facebook expand its cryptocurrency to more users, not only on the social network, but also on the entire Internet.

In fact, Facebook has been paying attention to the blockchain for several years. As early as last May, the company announced the establishment of the blockchain technology department. In December last year, it released five blockchain related positions on the recruitment page. The report also said that Zuckerberg also set up a separate office for the encryption team, other Facebook employees can not enter.

Bloomberg previously reported that Facebook will develop a digital currency called "Facebook Coin" and first try it in the Indian market. According to sources in the New York Times who are familiar with the project, more than 50 engineers are currently developing new cryptocurrencies and will run on Facebook's WhatsApp network.

In December last year, a number of sources, including Bloomberg, said that Facebook would launch digital currency anchored with fiat money based on its own blockchain, and use the cryptocurrency in WhatsApp applications, allowing users to send and receive funds between each other. Facebook's cryptocurrency, tentatively called "Facebook Coin" – may not be anchored solely to the dollar, but rather a number of fiat currencies for a "basket" of foreign exchange reserves.

Informed sources also revealed that the company is working hard to integrate applications such as Messenger, WhatsApp and Instagram to expand its cryptocurrency coverage to more than 2.7 billion global users, with the goal of completing by the end of this year or early 2020. According to a previous report by Bloomberg, the cryptocurrency developed by Facebook may be originally issued in Asia and will focus on the Indian market.

Source: brokerage China

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum Alliance and Microsoft, JP Morgan Chase and other initiatives to initiate token classification

- Experts say that China’s official currency, the yuan, will become a cryptocurrency

- The bear market lost more than 272 million US dollars, and well-known encryption investors still purchase Galaxy Digital shares

- Research: Bitcoin appears in 95% of digital currency crimes

- HTC executives said they plan to launch another blockchain phone this year.

- May 1 madman market analysis: Is the real money? The madman uses his own instructions…

- CoinMarketCap is six years old today, how is this website that is always in dispute and inseparable?