Brokers enter the blockchain research and compete with the original investment research institutions for pricing power

Text: Mutual Chain Pulse · Black Pearl

Source: Interchain Pulse

On November 8th, the China Blonde Financial Research Institute "Hong Kong Financial Technology Weekly: Blockchain and Digital Currency Become the Focus of the Conference", indicating that CICC participated in the Hong Kong Financial Technology Week main venue from November 6 to 7, and passed Observe the dynamics of the event venue series and draw conclusions:

“We believe that the blockchain is expected to be the core technology supporting the next generation of infrastructure in the financial industry, and is expected to help the Dawan District achieve interoperability and synergy.”

- Tether said the USDT stable currency has been fully supported by its reserves

- Zhou Xiaochuan's latest speech: The internationalization of the renminbi is a "premature baby", and the central bank's digital currency is mainly focused on domestic

- Wuzhen·I read the concept, promotion and profit model of Web3.0

CICC is an early research blockchain and digital currency among traditional brokers. Mutual chain pulse observation, after the Xinhua News Agency reported on October 25, a number of traditional brokers and investment research institutions have published relevant research reports on blockchain, the number is far more than usual. Traditional brokerages have made intensive blockchain research.

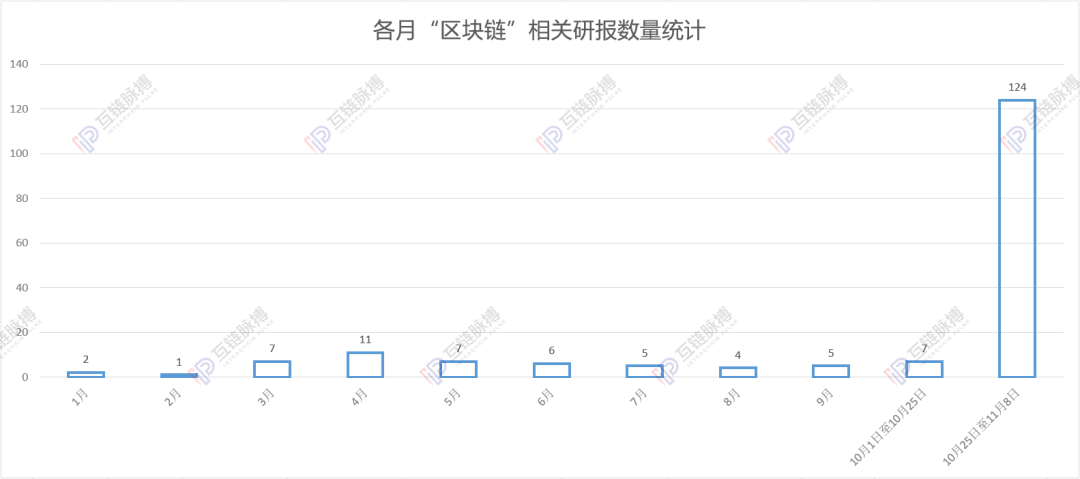

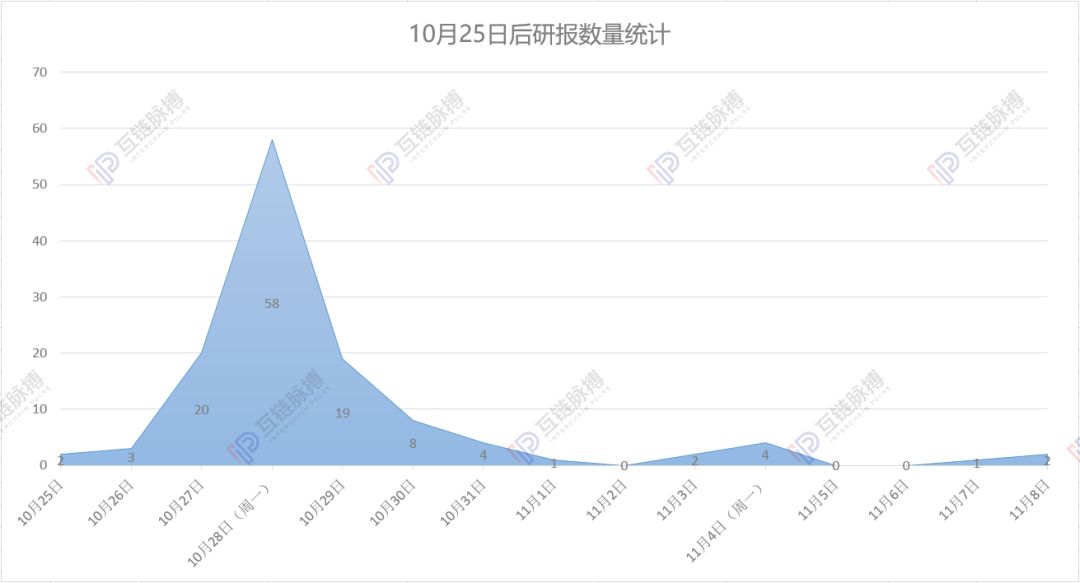

Mutual chain pulse search for radish investment research, the title contains "blockchain" research report, this year has a total of 179 articles, of which a total of 124 published from October 25 to November 8 at noon (here published time refers to The radish investment research website was included in the time. On October 28 (Monday), the most relevant research report was 58 articles.

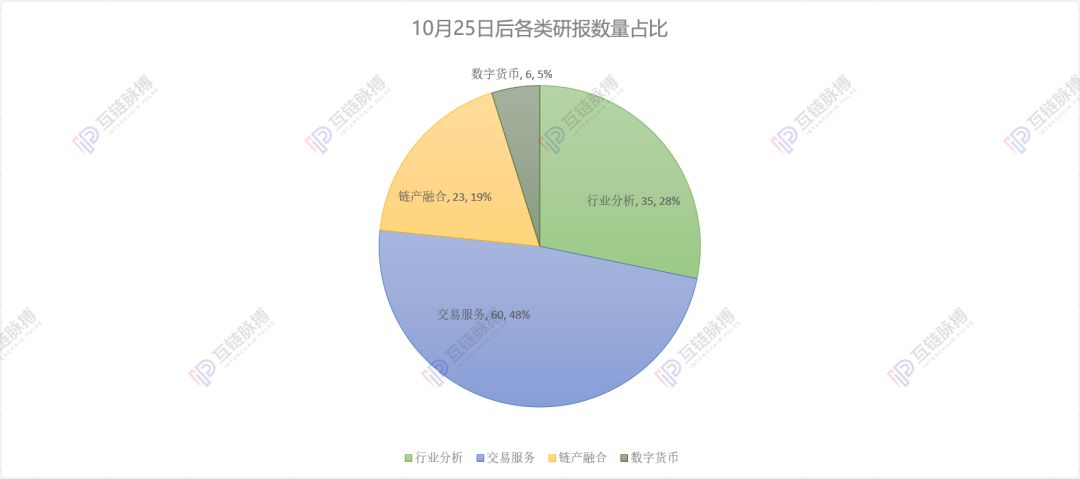

Beginning on October 25th, there were 52 traditional brokerage investment institutions, which carried out research and analysis on “blockchain” from various angles. Mutual chain pulse is divided into four categories according to the main direction of the report: focus on the research analysis or review of the blockchain technology itself (industry analysis); application case analysis of blockchain and other industries, industries or technologies (chain integration) The impact of blockchain on transactions in the secondary market (transaction services); and the application of blockchain and digital currency (digital currency).

Last week, the stock market was affected by a huge blockchain, and blockchain and industry convergence attracted attention.

Since the beginning of this year, traditional brokers and investment research institutions have been concerned about the impact of blockchain technology, especially the blockchain business of various enterprises. For example, Everbright Securities released a research report on the application of blockchain electronic invoices in March. Dongxing Securities commented on the layout of the blockchain business of Thunder and China Netan in May.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

However, before October 25th, the total number of research reports was small, with only 55 articles from January to September. It began to surge after October 25 and reached its peak on October 28. This week's heat has a significant downward trend, with only 7 related research reports.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

According to the content of the research report, there are 60 transactions in the service category, accounting for half of the total; 35 articles in the industry analysis category, accounting for 28%; 23 articles in the chain industry, accounting for 19%; and 6 related to digital currency. Accounted for 5%.

On October 28, the first trading day after the Xinhua News Agency was released, nearly 100 blockchain concept stocks went up, causing various brokerages and investment research institutions to publish research reports, detailing the concept of being included in the blockchain. Individual stocks, give investment advice. The coverage of these batches of research reports is also extensive, with specific analysis of the impact of blockchain on stock index futures, computer sector, bond market, and technology sector. For example, Galaxy Futures published the futures stock index daily for two consecutive days on October 30 and 31, pointing out that the blockchain concept strongly influenced the market; CITIC Jiantou released the policy tracking report for the fourth week of October on October 28, pointing to the blockchain height. To improve, we need to pay attention to financial technology.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

Affected by the favorable news of the industry, the investment research institutions have also increased the research on the blockchain industry itself. The content of the inter-chain pulse observation report is mainly from two aspects. The first is the introduction of the blockchain industry. And conduct a review analysis. For example, on the 4th of November, CITIC Jiantou published a research report on the status quo of the industrial blockchain industry: big waves and sands, technology and model innovations, and the fourth industrial revolution opened. Guosheng Securities issued a political bureau on October 28. Tune, blockchain industry welcomes the golden period of development, interpret blockchain technology development and policy environment, and analyze the application of blockchain in finance, people's livelihood and other fields.

The second is to discuss the development of blockchain and industry integration in a certain industry or a blockchain layout of a certain enterprise. Among them, the financial industry and the energy industry led by state-owned enterprises have received much attention. Guosheng Securities is concerned about the impact of the blockchain new deal on the communication infrastructure; CITIC Securities has published a number of reports on the development and application of the blockchain on the grid and energy side; CICC, Zhongtai Securities, CITIC Securities, etc. all have financial Industry blockchain applications are being researched.

At the enterprise level, large state-owned enterprises such as State Grid and China Netan are mentioned; well-known companies such as Thunder, Tencent, and LG have also been analyzed in blockchain applications; even blockchain-original companies such as China Securities have also received attention.

Traditional investment institutions focus on the stock market, and native rating agencies are vying for digital asset pricing rights.

Of the 124 recent research reports, only 6 directly focused on digital currency, compared with 60 transaction service type research reports, showing that the focus of traditional brokers and investment institutions is still in the stock market, vying for blockchain concept stocks. Pricing power.

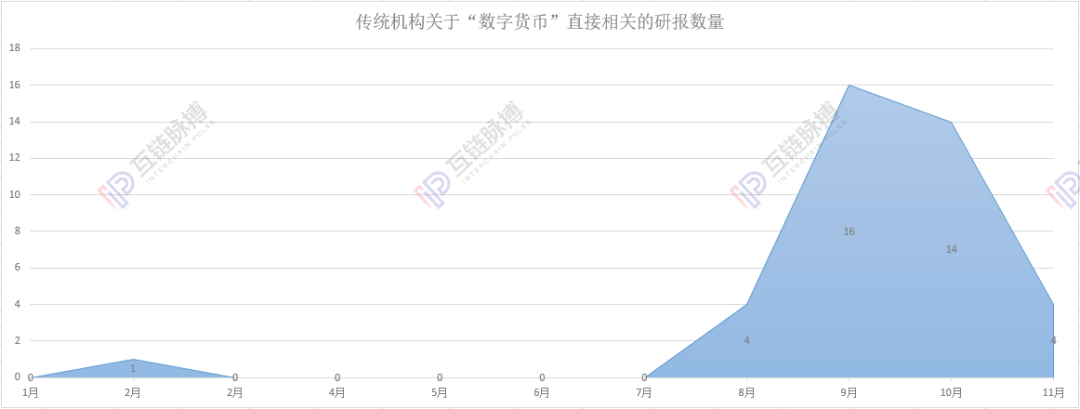

Having said that, traditional brokers and investment institutions have also vaguely entered the trend toward digital assets. Affected by the central bank's digital currency news and the October 25 news, traditional institutions are strengthening their focus on digital currencies. Mutual chain pulse search for the radish investment research, the title contains "digital currency" research report, 16 in September, 14 in October.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

In terms of specific digital assets, traditional brokers and investment research institutions have paid more attention to Bitcoin. In the two China Macro Observation and Research Reports published by BOCOM International on October 15 and October 29, the research topics are all Bitcoin. Guosheng Securities and CITIC Jiantou even paid attention to the bitcoin mining industry and currency price changes. In June this year, CICC released the Global Semiconductor Watch June report to observe Huawei and Bitcoin.

In addition, the inter-chain pulse statistics, this year also appeared some brokers continue to observe the blockchain field, such as Guosheng Securities, CICC and so on. Guosheng Securities published 23 direct research reports on blockchains this year, and 16 articles in China Gold.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

Among them, Tianfeng Securities, CICC, Essence Securities, Chuancai Securities, Guosheng Securities, and Zhongtai Securities were affected by the news on October 25, and the number of research reports published in the past two weeks soared, ranking the forefront of the organization after October 25.

(Cartography: Mutual Chain Pulse Data Source: Radish Investment Research Website Data Collection)

Under the help of the 1025 New Deal and the influence of the central bank's digital currency, traditional brokers and investment institutions have aggressively entered the blockchain industry and deepened their research on digital currencies, or will impact on local brokers and investment institutions. But now, the main business of traditional and original institutions in the blockchain field is still clear, and the future may form a competitive situation.

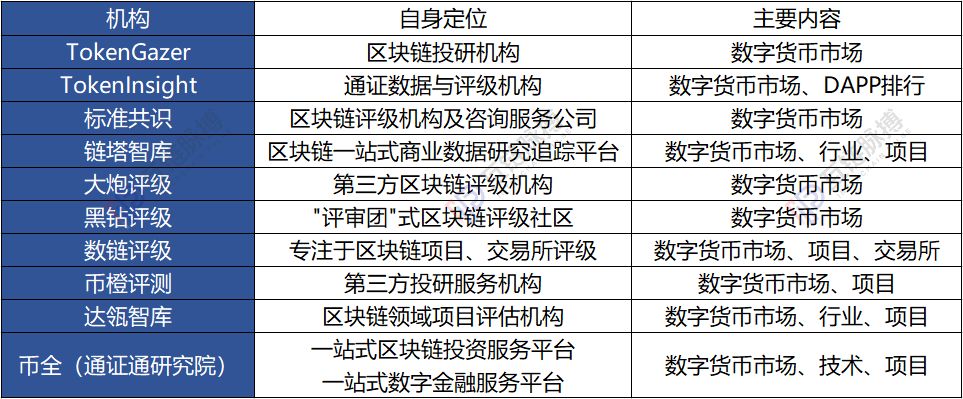

The blockchain industry has emerged a number of ratings and research institutions such as tokenGazer, tokenInsight, standard consensus, chain tower think tank, Daxie think tank, currency total, currency orange evaluation, number chain rating, black diamond rating, and cannon rating. The primary evaluation targets of these native rating agencies are digital assets, including public-chain projects, which are vying for pricing power of digital assets. There are also rating agencies that do some industry-level research and analysis, but the relative number is small.

(Cartography: Interchain Pulse)

In the field of blockchain concept stocks, which are more concerned by traditional brokers and investment research institutions, the attention of the original institutions is less, and there is almost no involvement before October 25. In the blockchain original investment research institutions, such as the Tongxuetong Research Institute is trying to cross the border and benchmarking the digital asset trading market against the traditional trading market. In the latest article of the General Research Institute, the platform certification is described as another form of stock dividends. When comparing BNB valuations, compare it with traditional exchange data.

In addition to the small number of business intersections, traditional brokers and investment institutions do not seem to have the resources to compete with the original institutions. Traditional institutions have historically paid less attention to blockchains. Even Guosheng Securities, which has the largest number of documents issued this year, has even a small number of 23 research reports that are difficult to obtain in a month.

In response to the long-standing lack of attention, traditional institutions lack blockchain talent, so the analysis of the blockchain industry lacks depth and originality. In the research report after October 25th, most of the research reports on blockchain industry analysis and chain product integration have a common idea – explaining blockchain technology, analyzing blockchain application policies, and simply listing blockchains. In which industries play a role, there is a lack of detailed analysis of blockchain technology and applications.

At the same time, the traditional institutions' analysis of the blockchain industry lacks their own original materials and opinions. For example, in the article "Critical Analysis of the Status Quo of Industrial Blockchain Industry: Big Waves, Technology and Model Innovation, and the Fourth Industrial Revolution Opening", many references to Huawei's blockchain white paper and the safe blockchain white paper Tsinghua blockchain white paper, Tencent blockchain white paper, CCID Consulting, FISCO BCOS case editing and other information.

According to the information of the radish research institute website, the number of updates of traditional brokers and investment research institutions has been significantly reduced this week. It is not known how much they will add in the blockchain industry in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Wuzhen·On the next generation of blockchain, the key point is to have these!

- CGTN Tracks and Reports World Blockchain Conference·Wuzhen: China will be the frontier of blockchain technology development

- Ben Fen, co-founder of Wuzhen·Findora: How does Supersonic stand out in the zero-knowledge proof family?

- Wuzhen·Mema Technology CSO Mary Ma: “Blockchain+Game” will create a new market, break the pain points of the industry and reshape the industry

- Wuzhen·Zhu Xi, Da Yu, Zhang Li, Dominic on Wuzhen, who is the future of POW and POS?

- Wuzhen·Daco Network CEO Nico Büchel: Europe is the largest cryptocurrency exchange market

- Wu Dawei, Chairman of Wuzhen•Crystal Holding Group: Compliance is the only way for the future development of the Exchange