BTC premium of $1,000? Here is a detailed explanation of the South African cryptocurrency market.

Foreword: In recent times, news about blockchain and cryptocurrency markets has been frequent, whether it is the G20 summit, Libar issue, or the smashing of cryptocurrencies in countries such as Zimbabwe and India. And have a greater understanding of the market situation. At the end of June, Luno, the largest cryptocurrency exchange in South Africa, reported that Bitcoin had a premium of $1,000. This reminds me of the article I wrote that year, and hopes that this article will help the spectators who need it. (This article was actually written in April 2019)

01. Country Profile of South Africa

Conclusion Preview: South Africa is a country with ample labor, but the unemployment rate (27%) is extremely high. The education level of residents over 25 years old is mostly junior high school or high school. South Africa's GDP growth rate in recent years is less than 2%, which is also lower than its inflation rate (5% to 6%). The economic development trend has a certain gap with China, India and the United States. In addition, as the country with the highest Gini coefficient in the world, South Africa's income distribution and wealth distribution are extremely unequal and will continue to maintain this trend for the next few years.

1.1 Geographic, administrative and demographic profiles

The Republic of South Africa ("South Africa") is located in the southernmost part of Africa with a land area of approximately 1.22 million square kilometers. South Africa is a Parliamentary Republic with no statutory capital. The three main government agencies are located in Cape Town (the legislative body – the seat of the parliament), Pretoria, the executive – the president House and cabinet location), Bloemfontein (judiciary – seat of the Court of Cassation).

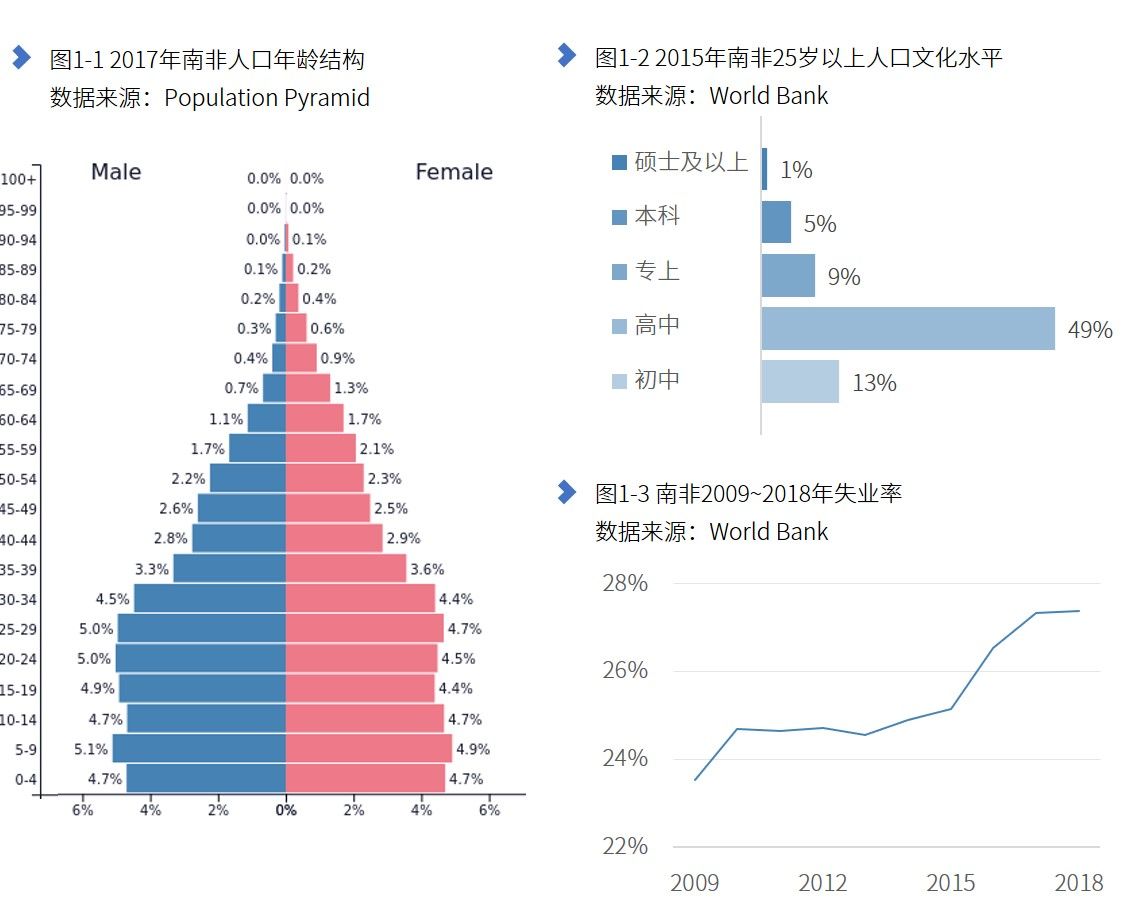

South Africa is a multi-ethnic, multi-religious and multi-lingual country with a population of about 56.7 million. The age structure shows a positive pyramid shape. The population under 40 accounts for more than 70% of the total population, and the labor force is sufficient. As far as education is concerned, as of 2015, among the population aged 25 and over in South Africa, 64% have a high school education or above, and 15% have a tertiary education or above. In terms of unemployment rate, the unemployment rate in South Africa has been above 23% in the past decade and has continued to rise over time.

- Nasdaq, one of the world's largest stock markets, article: "New Challenges, New Solutions – The Rise of Smart Cities"

- July 6 market analysis: the market may reverse? High energy warning ahead!

- Dry Goods | Nick Szabo: The Origin of Money (Part-5): Heritage and Marriage

1.2 Economic development and income distribution

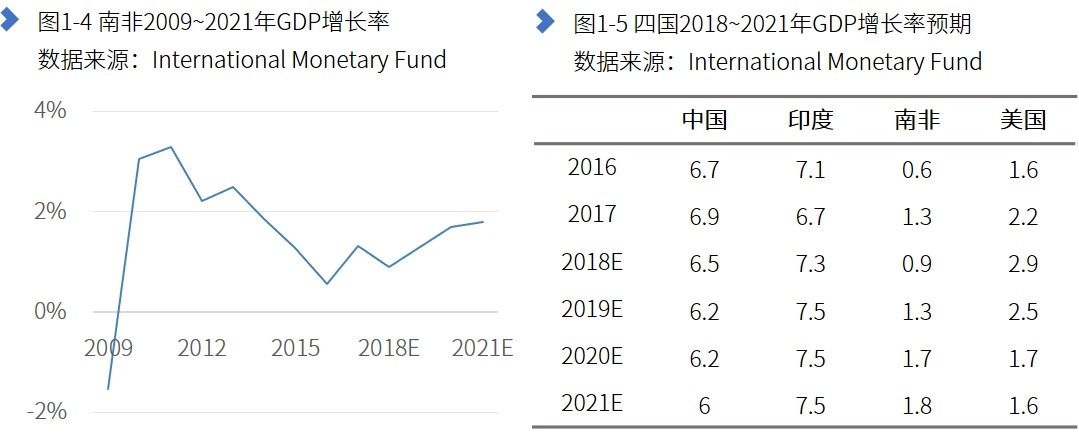

As the second largest economy in Africa, South Africa has maintained a certain growth in GDP since 2010. The National Monetary Fund's IMF (International Monetary Fund) is expected to have a lower growth rate for South Africa in the next few years, while China and India, which are both BRICS countries, are expected to have much higher GDP growth rates than South Africa. The GDP growth rate is expected to be closer to that of South Africa, but the future trends of the two will be different.

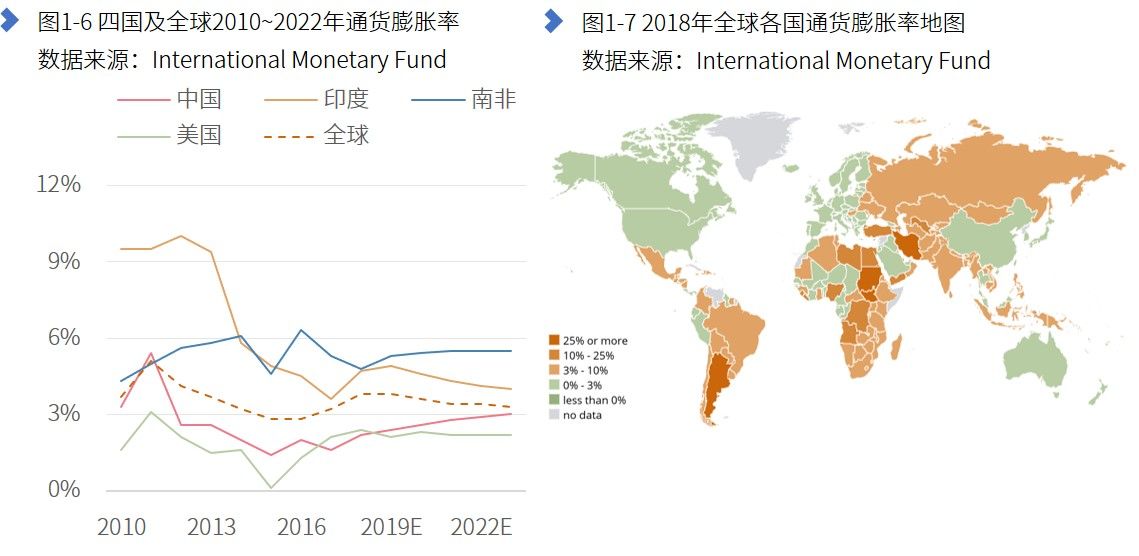

However, while South Africa’s GDP is developing slowly, its domestic inflation rate has remained at 4% to 6%, higher than the global average, and it is “moderate inflation”. Even some years will evolve into “serious inflation". Inflation rates in the United States and China are mostly “crawling inflation”. Although India’s inflation rate was higher before 2014, it has been in a downward channel in recent years and is now lower than South Africa’s inflation rate.

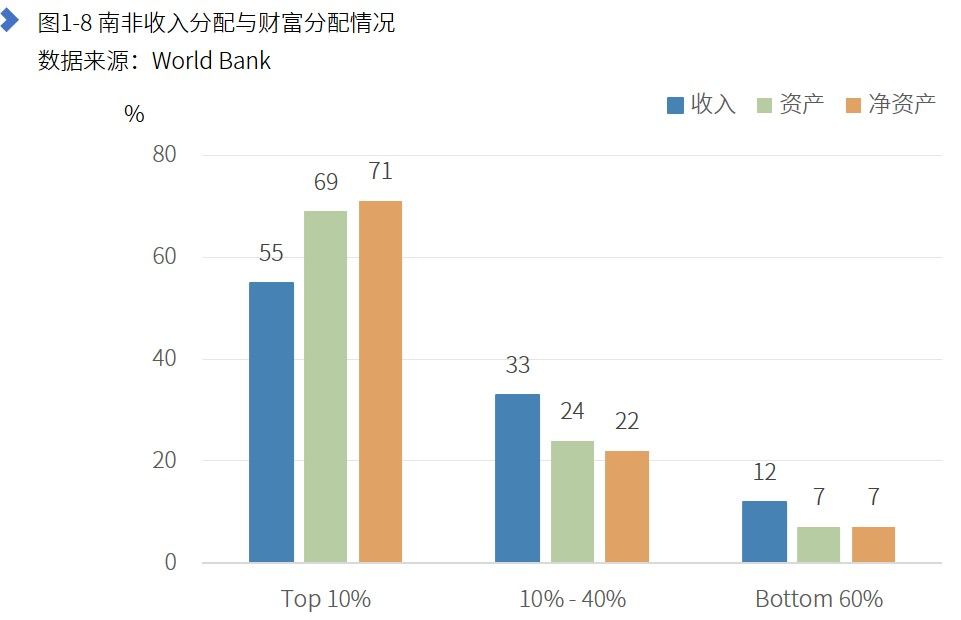

In the distribution of wealth, South Africa is known as the country with the most unequal income distribution in the world. In 2015, the World Bank World Bank released a report with a Gini coefficient of 0.63, the highest among the world's countries. Among them, the top 10% of the residents accounted for 55% of the gross national income, the assets accounted for 69%, the net assets accounted for 71%, and the corresponding 60% of the residents' income, assets, net assets share respectively It is 12%, 7%, and 7%.

At the same time, the World Bank pointed out that the income growth rate of South African residents is also affected by the Matthew effect and there is inequality. Therefore, in the foreseeable future, South Africa’s Gini coefficient will remain high, and income and wealth distribution will remain unequal. Significant.

02. South African encryption market situation

Conclusion preview:

1) Theoretical analysis, although the purpose of South African residents holding cryptocurrencies is diverse, the inequality in the distribution of wealth in South Africa has left most residents without additional private wealth. In other words, most South African residents have fewer household net assets. The higher inflation rate results in the asset shrinkage effect is not obvious in absolute value, and users do not have sufficient assets for exchange or investment. For most South African residents, the use of cryptocurrencies is a meaningful but not necessary matter;

2) For a small number of middle-class and elite groups in South Africa, the use of cryptocurrencies can meet their needs to avoid asset shrinkage, cross-border remittances and exchanges, and investment. Therefore, the above-mentioned “acceptance rate of Internet users in South Africa” is Most of the 10.7%" should belong to the middle class and elite groups. Due to the high cost of mining, the channel for obtaining cryptocurrency is usually a legal currency transaction or a currency transaction. The ecological development of Xiangliang's cryptocurrency is also convenient for its use and circulation. However, in the portfolio of such cryptocurrency holders, the cryptocurrency currently accounts for only a small portion of its total investment, perhaps indicating that it values its investment attributes rather than the hedge attributes and circulation attributes.

2.1 Willingness to hold cryptocurrency

For users, the purpose of holding a pass can be divided into two categories: transaction demand and investment demand. Among them, the transaction demand refers to the user holding a certificate for avoiding high inflation rate or realizing small cross-border exchange. The investment demand refers to the user holding the certificate for the risk reward.

As mentioned in Chapter 1, South Africa is a country with high inflation rate, low GDP growth rate and extremely uneven income distribution. At the same time, the data shows that the growth of South African residents' assets has a certain Matthew effect. Therefore, it is inferred that 60% is For the above-mentioned South African residents, the high probability of their assets has continued to shrink due to inflation. But South Africa’s inflation rate is mostly “moderate inflation”, so South African residents have the need to hold a certificate to circumvent inflation and cause assets to shrink, but demand may not be strong.

From the perspective of small cross-border exchanges, the South African Reserve Bank SAB (South African Reserve Bank) stated in a report released in 2014 that the total value of foreign capital allowed to be transferred annually by residents is 4,000,000 ZAR (about 280,000 USD). Encrypted currency is allowed in the process.

In terms of investment demand, there is no more data to show the demand of South African residents for their investment. In the third quarter of 2018, Old Mutual Limited released a research report on the willingness of cryptocurrencies of South African residents. 38% of respondents said that they “hoped to invest in cryptocurrency before” and 71% of respondents agreed to “cryptocurrency”. Can bring great benefits to the holders." The survey report may prove to some extent that South African residents have a positive view of the investment properties of cryptocurrencies and have certain investment needs.

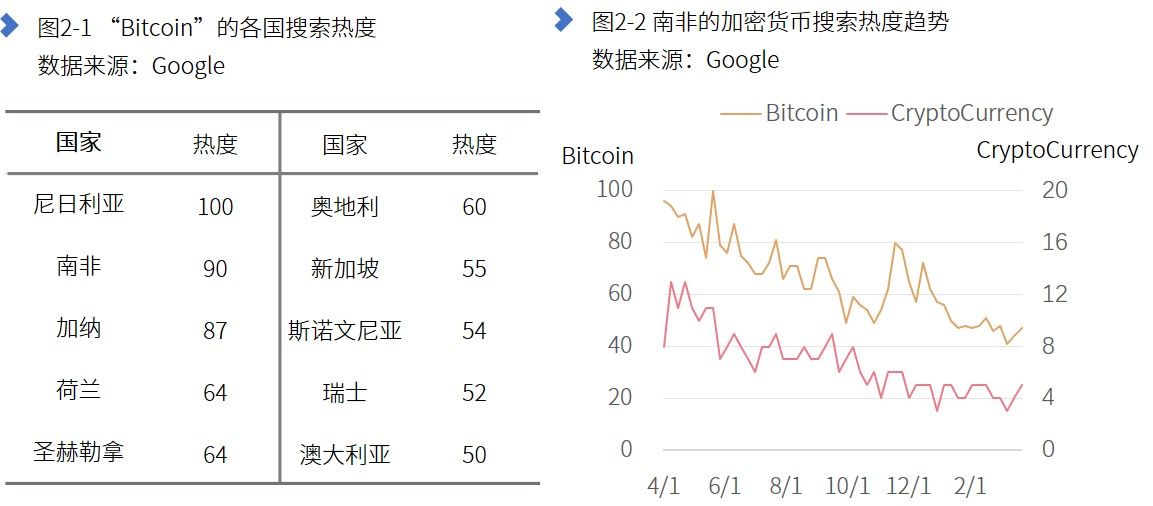

From the Google search heat of cryptocurrency-related vocabulary, South Africa is second only in Nigeria. In South Africa, the search for cryptocurrency-related vocabulary has continued to decline in the past year. Although Bitcoin's search fever has warmed up due to government decision-making, it has not changed the trend of heat decline.

2.2 The size and ecology of holding cryptocurrencies

According to Hootsuite's "Digital 2019", the pass rate of Internet users in South Africa reached 10.7%, much higher than the world average of 5.5%, and is the highest value of nearly 40 countries involved in the report.

According to the MyBroadband Cryptocurrency Survey in 2017, among the 1,598 people surveyed (mostly IT staff or technicians), 53.57% of the respondents hold cryptocurrencies, and among these cryptocurrency investors, they have Bitcoin BTC and Ethernet. The investors of ETH and Bit Cash BCH are 89.94%, 51.05% and 32.59% respectively, and 44.51% of the investors' investment amount does not exceed 380 USD, and 20.68% of the investors' investment amount is between 760 USD and 3,800 USD. 3.04% of investors have invested more than $38,000. In addition, 78.86% of investors indicated that they will further increase their investment in cryptocurrencies such as Bitcoin and Ethereum.

SAB, the South African Reserve Bank, said in a report released in January 2019 that “the South African cryptocurrency transaction is not estimated to reach 1% of the narrow money supply (M1), and the three-year cryptocurrency transaction is estimated to have not reached South Africa’s multiple options. Set 4% of the SAMOS (South African Multiple Option Settlement) system daily settlement amount."

In the cryptocurrency ecology, some of the merchant listings that support bitcoin payments in South Africa are shown in Figure 2-3. As of 2017, according to incomplete statistics, there are more than 200 merchants in South Africa that support bitcoin payments, and the usage scenarios include paying tuition fees, paying traffic fines, and purchasing online retail merchandise.

Julie-Anne Walsh, CMO of South Africa's largest online retailer, Takealot, said that when Bitcoin payments were supported in 2014, the use of Bitcoin accounts was less than 0.1% of the total, but in recent years it has shown an upward trend year by year. Trading in Bitcoin accounts by 2017 has increased by 170% compared to 2016.

In addition, the South African Standard Bank South Africa Standard Bank or the second half of 2019 launched a fabric-based foreign exchange payment and settlement service platform.

2.3 User access to cryptocurrencies

There are three main channels for users to obtain cryptocurrency: mining acquisition, legal currency transactions, and cryptocurrency payment channels.

For the channels in which mining is obtained, BitNodes data shows that there are only dozens of running full nodes in South Africa, accounting for 0.2% of the total. In addition, in February 2018, Elite Fixtures used three different types of mining equipment, AntMiner S7, AntMiner S9, and Avalon 6, to study the electricity costs required to mine bitcoins in various countries and regions. Studies have shown that the price of bitcoin in South Africa (ie, the cost of electricity per bitcoin) is ranked 8th in 60 countries, indicating that South Africa is in a weak position in mining competition worldwide.

For the cryptocurrency payment channel, as mentioned above, there are many merchants and application scenarios that support bitcoin payment in South Africa, at least a certain number of merchants can obtain bitcoin and other cryptocurrencies through currency transactions.

For the legal currency trading channels, Luno, AltcoinTrader, ICE3X and other exchanges offer South African Rand ZAR and Bitcoin transactions, and there are also some Bitcoin ATM machines in South Africa. Therefore, South Africa supports the platform for residents to obtain Bitcoin and other cryptocurrencies through legal currency transactions. And the service provider can meet the relevant needs to a certain extent.

2.4 User's commonly used exchanges

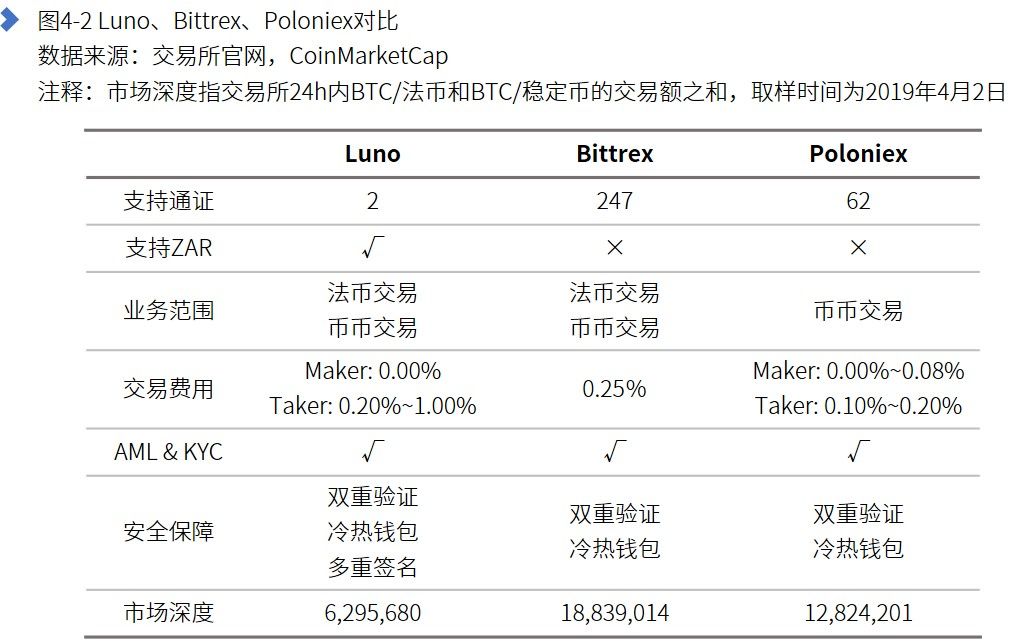

In South Africa, the most popular exchange is Luno, followed by Bittrex, Poloniex and other exchanges.

2.5 Comprehensive analysis

At the demand level, South African residents hold cryptocurrencies for three purposes: avoiding high inflation rates, cross-border remittances and exchanges, and investment needs. Among them, South Africa's inflation rate is higher than GDP growth rate, and is higher than the reasonable value of inflation. South African residents are willing to exchange South African Rand ZAR for Bitcoin BTC, but the willingness may not be strong; cross-border remittance and exchange, The state supports the use of cryptocurrencies in this respect. Considering the efficiency and cost of using cryptocurrency remittances and exchanges, South African residents will also have a certain willingness to use cryptocurrencies. In terms of investment demand, the survey shows that South African residents have a positive attitude towards cryptocurrency. Sideways reflect the recognition of South African residents on the cryptocurrency investment properties.

In terms of market size, in addition to the enthusiasm of cryptocurrencies and the existing market size. The popularity of Google search reflects the high enthusiasm of the South African region on cryptocurrency-related topics; in terms of the size of the existing market, South African Internet users have a pass rate of 10.7%, ranking among the top countries in the world, but the investment of cryptocurrency holders The scale is still dominated by small and medium-sized investments, and the transaction volume of cryptocurrencies is still thin compared to traditional finance in South Africa.

In terms of ecology and mining, hundreds of merchants in South Africa support bitcoin payments, and transactions using Bitcoin accounts for payments have continued to grow in recent years. However, in terms of mining, the cost of electricity for mining in South Africa is extremely high compared to other regions, which may be one of the reasons for the small number of Bitcoin nodes in South Africa.

Considering the economic form of South Africa, the income of US$5.5 or less in 2014 still accounts for 57% of the total population. Combined with the previous wealth and income distribution, the following conclusions are drawn:

1) Theoretical analysis, although the purpose of South African residents holding cryptocurrencies is diverse, the inequality in the distribution of wealth in South Africa has left most residents without additional private wealth. In other words, most South African residents have fewer household net assets. The higher inflation rate results in the asset shrinkage effect is not obvious in absolute value, and users do not have sufficient assets for exchange or investment. For most South African residents, the use of cryptocurrencies is a meaningful but not necessary matter;

2) For a small number of middle-class and elite groups in South Africa, the use of cryptocurrencies can meet their needs to avoid asset shrinkage, cross-border remittances and exchanges, and investment. Therefore, the above-mentioned “acceptance rate of Internet users in South Africa” is Most of the 10.7%" should belong to the middle class and elite groups. Due to the high cost of mining, the channel for obtaining cryptocurrency is usually a legal currency transaction or a currency transaction. The ecological development of Xiangliang's cryptocurrency is also convenient for its use and circulation. However, in the portfolio of such cryptocurrency holders, the cryptocurrency currently accounts for only a small portion of its total investment, perhaps indicating that it values its investment attributes rather than the hedge attributes and circulation attributes.

03. Laws and regulations

04. Afterword

South Africa and China have many similarities in the policy of blockchain and cryptocurrency, both of which support the application of blockchain technology, but are cautious about cryptocurrency. In addition, the market situation of the two is similar, and will the development of South African crypto assets change with the transformation of the Chinese market?

In the past, Mandela wrote the name of freedom on this land in South Africa. I don't know in the future, the blockchain and cryptocurrency symbolizing the more decentralized wealth and power will leave a mark on this land.

—— END ——

This article was written in April 2019, and I am a very lazy person, so the data in this article has not been updated before this issue, only for reference. In addition, if some readers feel that this article is good and look forward to the next one, emmm I think basically do not expect. This article was written for some accidents. It took about 4 days. In fact, I don't like to write such articles. I prefer to look at some blockchain projects, do some investment, and learn some technical and economic models. But what will be written in the next article, I don't know, let's follow.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Babbitt column | 5 big questions of FB, Libra's 3-layer system and FB one stone three birds

- Babbitt column | Another example of STO application under Reg A+, what is the difference this time?

- Will Facebook and Libra fight with each other?

- Market Analysis: Will Wall Street approve ETH futures, will it lead the coin to set sail?

- Viewpoints | Some "malicious" speculations on how Facebook promotes Libra

- The Internet is developing like this, blockchain?

- Where is the paradise of cryptocurrencies? Count the 7 countries that are tax-free for cryptocurrencies!