Xiao Lei: The United States prevents Facebook from issuing coins, and challenging US dollar hegemony will trigger a global currency war.

In order to explain the US House of Representatives requesting Facebook to stop sending money, we still need to start from a farther thing.

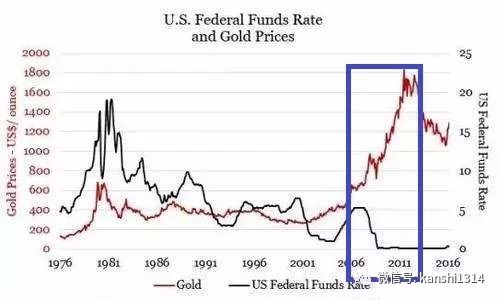

When the paper on the creation of the Bitcoin system was published in 2008, the world was experiencing a serious financial crisis. At that time, the US government injected huge amounts of dollars into Wall Street and manufacturing giants. The Fed lowered the federal funds rate to near zero and introduced unprecedented quantification. Loose; European government and banking industry are also in a credit crisis; other markets around the world are rekindling Keynesianism. In order to save the economy, the government will not hesitate to abandon the maintenance of its currency purchasing power and begin its currency depreciation strategy. Another background is that gold prices have soared, and gold prices have risen 2.5 times in the next two years.

Federal funds rate and gold trend

- In recent years, the "blockchain" has become a hot option for college entrance examinations. Please accept this report guide.

- Research Report | Blockchain Power Energy Application Industry Report

- Bitcoin Twitter user map: the most active in the United States, the most negative in Estonia

By 2009, Bitcoin had already had an impact in Silicon Valley and the global geek market. At that time, one of the inventors of PGP encryption, and the inventor of the important technology "reusable workload proof mechanism" used by Bitcoin, Hal Finney was attracted by Bitcoin.

In the first time of the birth of Bitcoin, Hal Finney accepted the transfer of 10 bitcoins of Nakamoto to become the first transfer in the history of Bitcoin, and then Hal Finney became the technology of Bitcoin. Contributors, until they die. In fact, this is just the beginning of the bitcoin conquering the computer programmer community.

In 2011, there was an entrepreneur in Silicon Valley called Vince Casares. A friend introduced him to use Bitcoin to send money to Argentina. He didn't believe in the security of Bitcoin. So he hired two hackers for $100,000. Trying to crack the bitcoin code.

Since Bitcoin was not worthwhile at the time, a bitcoin was only about $1 (now $10,000), and spending $100,000 to crack the bitcoin program was actually a huge expense, if I bought $100,000 at the time. Bitcoin is now worth $1 billion, but hackers have never succeeded in attacking Bitcoin, and then Vince Casares began to become a bitcoin evangelist. From this point on, Bitcoin can be said to have begun to conquer entrepreneurs in the field of Internet technology, including Zuckerberg, who is now preparing to launch digital currency.

Another person and two things about bitcoin are more important around 2011. Nakamoto's successor, Gavin Andreson, hooked up with the CIA, and Gavin Andreson accepted an invitation from the CIA to introduce Bitcoin and Bitcoin. The community is ready to donate bitcoin to WikiLeaks. Under the influence of these two things, the inventor of Bitcoin, Nakamoto, began to fade out of the Bitcoin circle and disappeared.

It is also at this time that Bitcoin has embarked on a long journey to conquer national policies. So far, the United States has launched legal bitcoin futures, and entered the mainstream investment market like commodities such as crude oil and gold.

The development of Bitcoin may be beyond the expectations of the creator Nakamoto. Before the disappearance of Nakamoto, it seems that he is very worried about the US government’s targeting of Bitcoin. He said that Bitcoin is like a nestling and is still testing. Stage; in addition to exchange, there should be no more use, otherwise it is self-immolation.

Later, some people suspected that Bitcoin was created by the US Central Intelligence Agency, such as the co-founder of Kaspersky Lab and the president of Russian Security Company (InfoWatch) Natalia Kasbeskaya. It is believed that the US intelligence agencies created bitcoin for their own actions in the world. Bitcoin is "US$2.0 (virtual currency)", and the founder of its pseudonym Satoshi Nakamoto is actually a group of American encryption systems. Developer.

When I analyzed the Libra white paper a while ago, I mentioned a conjecture, Libra's white paper, which echoes the bitcoin white paper. I don't think Bitcoin is from the hands of the US Central Intelligence Agency. It is more likely to be a group of young people who want to use technology to change the world.

Because password punks tried to develop dozens of digital currencies before Bitcoin was born, these developments ended in failure until Bitcoin appeared. This is more like the marketization of science and technology, dozens of failures, and finally a success.

It is certain that institutions such as the US Central Intelligence Agency are eyeing Bitcoin, because the United States will never give up control of any technology that leads the world.

In fact, both the original paper of Bitcoin and the white paper of Libra are technical ideals intended to change a certain status quo, rather than a mysterious research and development with aggressiveness and ulterior motives.

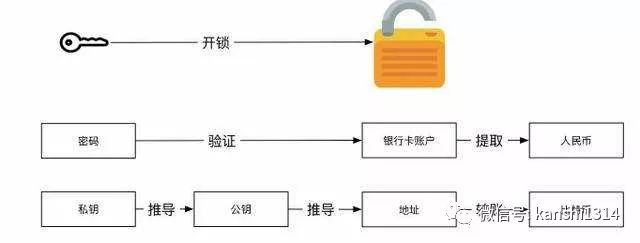

The white paper title of Bitcoin is “a peer-to-peer electronic cash system”. The main thing that stimulates Nakamoto is that e-commerce basically relies on financial institutions as a trusted third party to handle electronic payments . There is a big problem.

In Nakamoto's view, financial institutions as trading intermediaries have greater uncertainty. Therefore, “completely irreversible transactions are basically impossible, because financial institutions cannot avoid coordination of disputes. Coordination will increase transaction costs and limit minimum realities. The volume of transactions does not reduce the possibility of accidental transactions. And because it cannot make irreversible transactions for irreversible services, it will bring more losses."

Looking at the Bitcoin papers throughout, you will feel that it is actually solving the problem of a transaction payment, and it is based on the business in the real market. For example, at the beginning of the article, "What we need is an electronic payment system based on cryptography, which allows both parties to trade directly without the need for a trusted third party. The transaction is computationally irreversible to prevent the seller from being cheated and can be very simple. Realize the daily contractual mechanism to protect buyers ."

I have been thinking about this issue. In the e-commerce and virtual markets, if there is no credit guarantee mechanism, in the process of trading, the buyer and the seller, who is the vulnerable group?

I personally think it is a seller, because the seller has a fixed investment and needs to continue to operate. For many users, the cost of default is very high, but the buyer is often a one-time transaction, the possibility of cash on delivery is much higher than the payment. Not shipped. So the logic of Bitcoin actually means that in a bare market, it is easier to protect the interests of the seller, because the transfer is irreversible, I think this is in line with the evolution of business, only to stimulate and protect people's enthusiasm for supply. This society will have more creativity.

If in 2008, Benedictine invented Bitcoin, it was a test of the global payment system. Libra, which Facebook will send in ten years, can be said to be ready.

Libra’s proposal this time is mainly a concept of inclusive finance. The moral high ground occupied by this concept, I personally feel that the US House of Representatives cannot be erased and overthrown.

The importance of the concept of inclusive finance is probably unimaginable. Since most of the world’s funds need to rely on the financial system, and the financial industry has always been the most profitable and richer industry, it has been criticized, so how to make financial resources become more popular, let Finance serves the ordinary people, which has become a highland that politicians all over the world must fight for.

If there is any way to make financial benefits, this contribution may receive great repercussions and praise. More than 30 years ago, an economist in Bangladesh, in order to realize the ideal of inclusive finance, opened a bank dedicated to poverty-free access to traditional bank loans. This person is called Muhammad Yunus, who uses each The methods and techniques have indeed achieved many goals. In 2006, “In recognition of their efforts to promote economic and social development from the bottom of society, Yunus and the Bangladesh Rural Bank jointly won the Nobel Peace Prize and became a model for inclusive finance in all countries of the world.

However, due to various problems such as cost, Yunus’s “village bank” has been removed from the aura, and its model is also difficult. At this time, the general banner of Inclusive Finance, I am afraid that there is no more suitable than the digital currency. This is not what I said, this is what the International Monetary Fund (IMF) President Lagarde said.

As early as the end of 2018, Lagarde spoke at the Singapore Financial Technology Festival and pointed out that the possibility of issuing digital currency should be considered. Because providing money for the digital economy may be a national task. She said the currency could achieve public policy goals, including inclusive finance, security and consumer protection, as well as providing services that the private sector could not provide, and paying for privacy protection.

Just last week at the Bank of England forum, Lagarde directly hinted that the organization intends to launch a similar bitcoin-based global digital currency, IMFCoin, under the Special Drawing Rights (SDR) mechanism, aimed at replacing the existing reserve currency.

Finally, to enter today's theme, will the US House of Representatives' proposal or appeal for Facebook to stop libra release will work?

I think it may be hindered by tactics, but from a strategic point of view, it will not cause much impact, for four reasons.

First of all, libra is not issued for US users, the main body is established in Switzerland, all procedures are transparent, and there is no absolute interest. The foundation is a non-profit organization. In this context, the part that the United States can directly govern is very less;

Secondly, Libra has occupied the moral high ground of inclusive financial practitioners. Even the International Monetary Fund is imitating the same model to prepare to issue digital currency. If Libra is prevented from coming out, it may be condemned to curb business and innovation.

Third, before the release of Libra, on September 10 last year, the US exchanges Gemini and Paxos were approved by the New York Financial Bureau and issued a digital currency (stabilized currency) that can be anchored by the government. GUSD and PAX, although these two stable currencies are different in mechanism from libra, there are already precedents for issuing such digital currencies, which is very important;

Fourth, Facebook is well prepared to respond to Congressional inquiries. A Facebook spokesperson told US technology media TheVerge on Tuesday, "We look forward to working with legislators in the process of launching Libra, including Answer their questions at the upcoming House Financial Services Committee."

On the digital currency, and the global financial issues that Libra is trying to solve, I am afraid that Facebook's congressional hearings may become an opportunity to elaborate on ideals and gain more supporters.

Well, since the House of Representatives can't stop Libra, isn't the US able to control it, of course not? According to the concerns of the House of Representatives, libra's main risk is to challenge the current US monetary policy and the status of the US dollar , and will bring serious privacy, transactions, national security and monetary policy issues to Facebook's more than 2 billion users, and also to investors, Consumers and the wider global economy pose serious threats.

In fact, to put it bluntly , it is to ask Facebook to solve a problem. How libra can help the hegemony of the US dollar in the future development and design process, rather than subversion; how to safeguard the core interests of the United States, not damage.

So the real purpose of the United States is not to stop the launch of Libra, but to have to go from the legal and design level in the first place, in line with US interests and dollar hegemony logic.

For other countries, although institutions such as the International Monetary Fund have begun to promote global digital currencies, according to current planning, IMFcoin is still a reserve currency, not a consumer and transaction currency.

And IMFcoin is a top-down design that may be contrary to the logic of the future world currency. From the prosperity of Bitcoin, it can be seen that the birth of the world currency in the future must be a bottom-up consensus. After the consensus is formed, the digital currency with global consensus may still flow to powerful economies and authorities. But it is completely different from the nature of the banknotes. Just like gold, although it has always flowed to the hands of imperial power and various powers, no one can abolish and dilute the credit of gold.

Therefore, for countries that cannot grow a globally recognized digital currency from their own markets, they may need to obtain from the secondary trading market, and the competition for future digital currencies may actually be no less than when the major powers in history rise. The battle for gold and silver. But unfortunately, in today's world, there are still many countries that regard digital currency as a beast.

Text / Xiao Lei

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Love to spray bitcoin and quietly hold the currency, this gold lover is a little fan

- Garbage classification – a practice of distributed computing for all people can learn from the blockchain

- Encrypted currency and class crossing (3): After the layout is over, where do you expect the bull market?

- CoinEx Chain's wild vision is born for financial freedom and is reserved for the DEX ecosystem.

- Getting started with blockchain | How is the blockchain anti-counterfeiting traceability application implemented?

- Facebook Interview: Facebook has gradually lost credibility in recent years, will Libra succeed?

- The bull market is coming, do you want to wait and see if you want to buy a mining machine?