BTC prices are artificially pushed up? Tether is also suspected of illegally manipulating the price of the currency.

The Twitter user continues to monitor the cryptocurrency trading platform Bitfinex, especially Tether's funding trends. According to the company, the company started the issuance of the issuance plan on April 8, 2019, resulting in a surge in the total liquidity of the USDT market of 417 million.

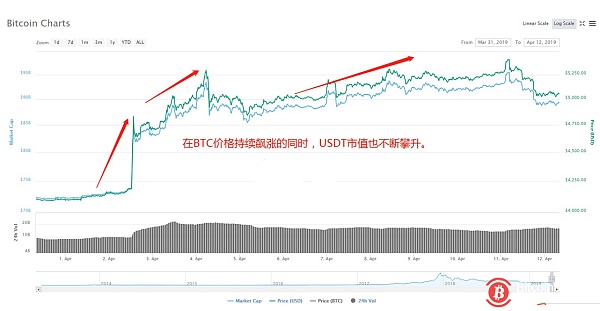

As shown in the chart, on April 1st, the market value of Tether remained at around $2 billion, but it continued to rise in the next few days. It has exceeded $2.4 billion on the 13th and is still rising. During this period, the BTC price jumped several rounds and successively broke several major passes and successfully stood at $5,000. It can be seen that while the price of BTC continues to soar, the USDT is constantly increasing, and the market doubts are not unfounded.

- Report: North Korea steals $700 million worth of cryptocurrencies to fund research and development of nuclear weapons

- April 16 madman market analysis: the return of funds did not bring a decent rebound after the city how to do

- Surface cloud computing server, behind the bitcoin mining machine? A-share company sells mining machine

According to PeckShield monitoring data, the USDT market has surged since April. Tether Treasury officially issued 314 million USDT (the difference between the outflow and the inflow of the Treasury address), and added an additional ESR20 USDT of 170 million to the Ethereum network. At present, the total liquidity of the USDT market is 2.345 billion pieces, accounting for 76.6% of the total stable currency market, an increase of 4.4% from the beginning of the month.

Does the market manipulate BTC prices? Not the first time

Bitfinex'ed often accuses the company of using USDT to manipulate currency prices. Previously, the market has repeatedly questioned Tether and its "nedora relationship" with Bitfinex. Tether and Bitfinex have repeatedly been suspected of jointly manipulating the market, but these allegations were categorically denied by Tether.

In an interview with Bloomberg, John Griffin, a professor of finance at the University of Texas, said that from the link between BTC price movements and the USDT issue, Tether does have the motivation to manipulate the market.

“Tether seems to be used to stabilize and manipulate bitcoin prices at the same time. If there is fraud or manipulative behavior in the market, it will leave traces on historical data. From the BTC price and historical data released by USDT, it does match the market. The assumption of manipulation."

Although from a legal point of view, many people believe that the cryptocurrency market is still gray, market manipulation is illegal in any case.

At the end of 2017, Tether was summoned by the US Commodity Futures Trading Commission (CFTC) for alleged manipulation of bitcoin prices and lack of transparency, but both Tether and Bitfinex firmly determined that the allegations were unfounded.

The Bitfinex CEO said in the mail that the allegations were wrong (so far, no one can prove that Tether is suspected of illegally manipulating behavior).

“Bitfinex and Tether have not been involved in manipulating the market or currency. The additional USDT cannot be used to raise the price of other currencies on BTC or Bitfinex platforms.”

Last month, Tether made adjustments to its transparency and reserve assets, saying that its reserve asset structure now includes cash equivalents and other assets in addition to the US dollar. After the market questioned Tether's never-audited audit, Tether also subtly changed the wording to reserve assets for "professional verification."

Currently, Tether has not responded to the challenge raised by Twitter user Bitfinex'ed. (Scallion block chain)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin broke through $5,100, and the decline in trading volume is worthy of vigilance

- Can the coin be rich?

- Ethereum price analysis on April 15

- How will Bitcoin churn the French $2.5 trillion life insurance market?

- Why is the economic weakness turning into a hotbed of bitcoin's next bull market?

- How many currencies are suspected of false trading volume, how can Bitcoin self-certify?

- Analysis of the madman market on April 15: Different judgments on one thing will create different futures