CB Insights blockchain report: Bitland ranks second in the "most funded company"

Recently, CB Insights, a well-known venture capital research institution, released the report "Blockchain Trends In Review 2019". The Institute of Financial Technology of Renmin University of China (WeChat ID: ruc_fintech) compiled the core content of the article. This report is data-oriented and focuses on risk. Investment trends such as investment and corporate mergers and acquisitions explore how various forces shape the current blockchain landscape and provide insights into the future of the sector.

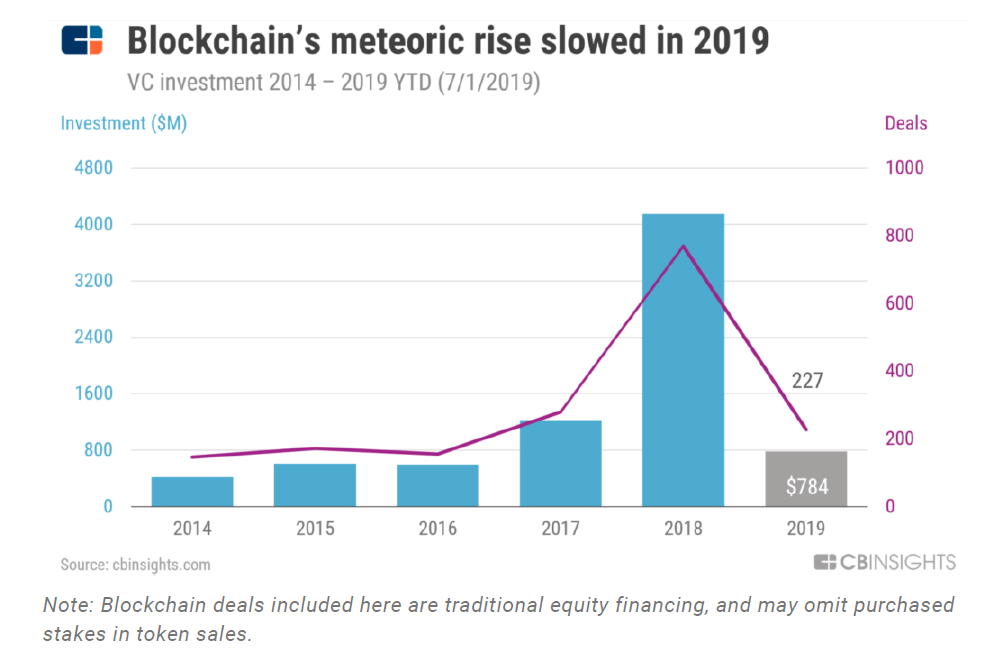

Venture capital and equity investment trends

- 4D dry goods | Why do we need Bitcoin?

- The SEC is about to run bitcoin nodes, just to get the blockchain internal data

- Dragon White: A practical Chinese central bank digital currency and Libra design

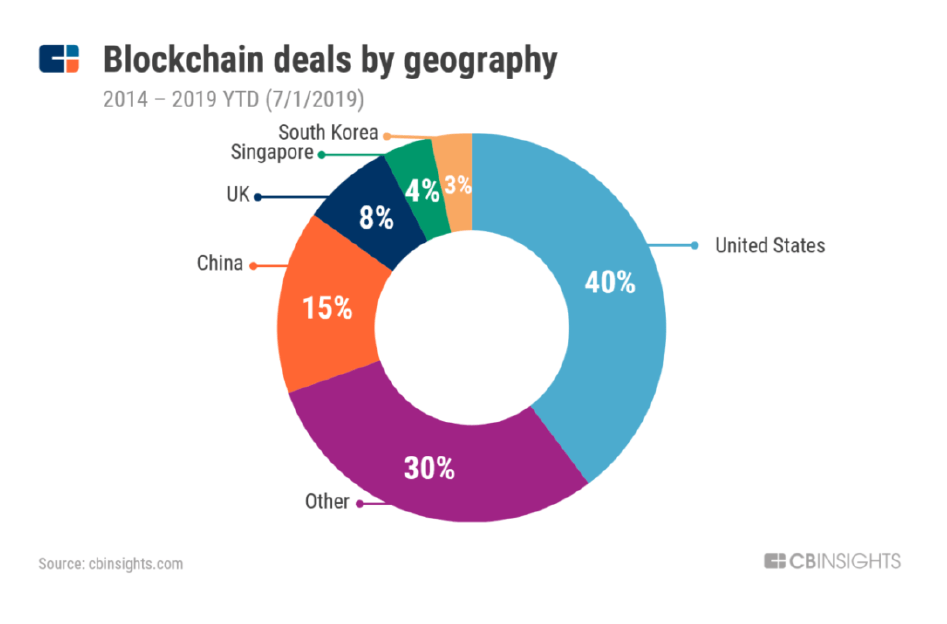

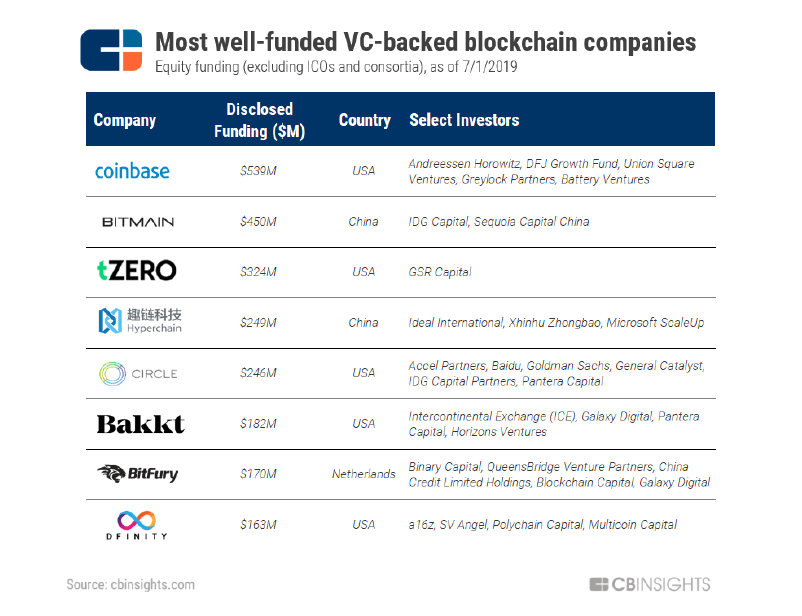

Finally, in terms of geographic location, the US has 40% equity financing. This is followed by China (15%), the United Kingdom (8%), Singapore (4%) and South Korea (3%). It turns out that Asia is a hotbed of start-ups, and China has several of the most well-funded blockchain companies in the world.

Mergers and acquisitions

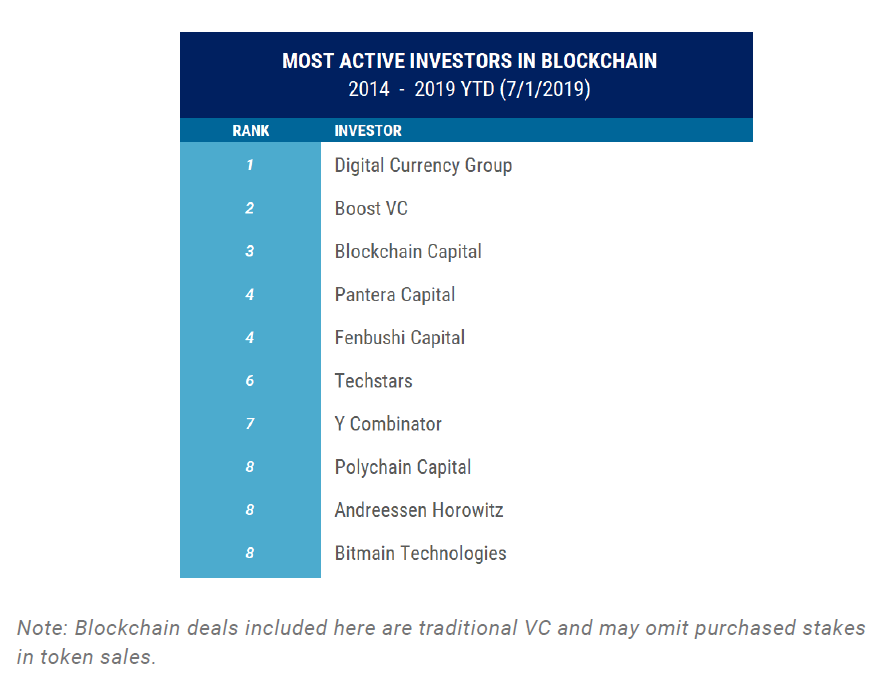

Ranked first is the Digital Currency Group, which invested early in the blockchain sector. So far, the company has supported four companies in 2019, including a $65 million Series B financing for Figure Technologies. The company's other transactions in 2019 included multiple rounds of financing for Livepeer, DeFi provider Staked and the encrypted futures exchange CoinFLEX.

Boost VC, the leading edge technology accelerator led by Adam Draper, has invested in nearly 50 blockchain companies over the past five years. Recently, attention has been paid to the decentralized DNS service Unstoppable Domains, which predicts the market Guesser and the encrypted portal ramp Amun.

Blockchain Capital is also one of the longest-established blockchain venture capital firms, ranking third among the most active venture capital firms.

In addition, many blockchain investors based in China have entered the field in a big way. For example, in the past five years, Febushi Capital has invested more in blockchain companies than the backbone of Pantera and Polychain.

Well-funded company

Future trends

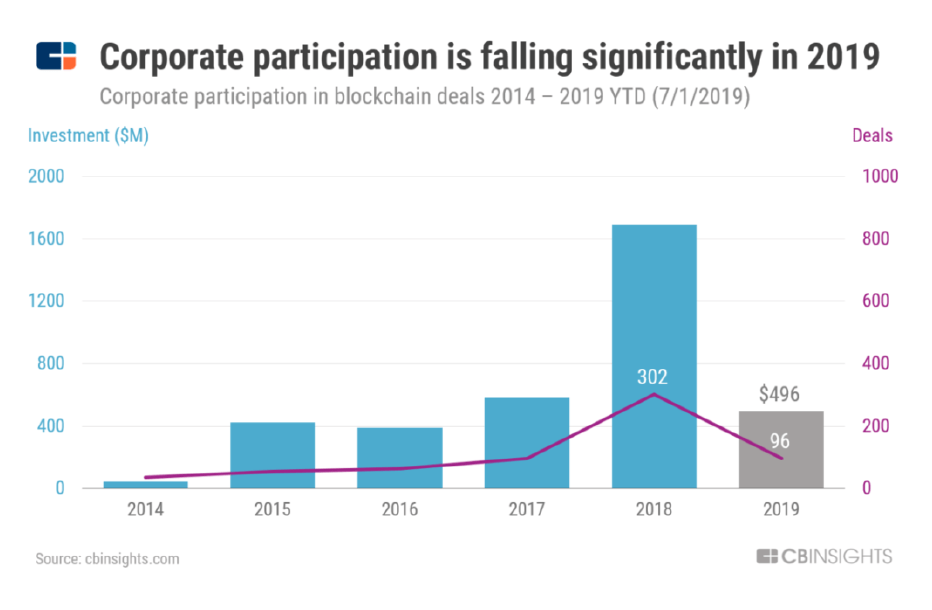

But speculative activity and trading volume in key currencies such as Bitcoin and Ethereum have surged in recent months. With the recent actions of blue chip companies such as Facebook, JP Morgan and Visa, corporate profits in this area have also picked up.

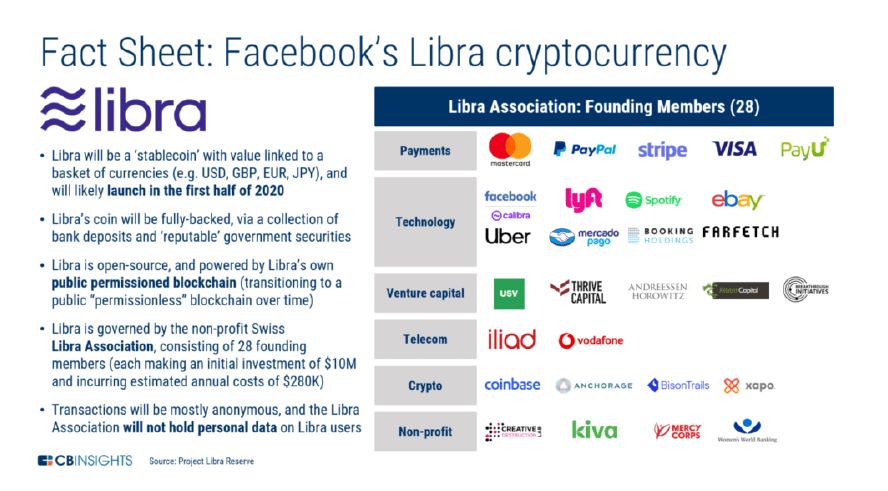

The recent heat may be largely due to the relationship between Facebook and Libra. The goal of the project is closer to Venmo, not a new bitcoin, and is designed to provide a stable currency for customers with no bank accounts worldwide.

Facebook has signed an agreement with partners from payments, online car, e-commerce, venture capital and blockchain startups to launch the Libra project.

Mike Novogratz, founder of crypto hedge fund Galaxy Digital, said Facebook's plan is part of the reason for the recent rise in bitcoin: (investors) are excited about Facebook. Because Uber, Mastercard and Visa said they also want to participate in the cryptocurrency world. He added that the entire project completely legalized the idea of cryptocurrency.

In addition, Bloomberg's Tyler Cowen believes that cryptocurrencies provide a safe haven in political instability, trade turmoil and future wealth taxes.

For all of these and more reasons, the blockchain space seems to be reborn. This may also be good news for start-ups. Due to the high level of technology in this area, startups are well positioned to help large companies and institutions enter the field.

In 2019, it is worth noting whether this newly discovered optimism will translate into a significant rebound in the VC sector.

Source | Institute of Financial Technology, Renmin University of China

Original | CB Insights

Compilation | Qi Qingwu

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Encrypted currency and class traversal (5): The digital printing industry has ushered in a heavy elite organization. Do ordinary people have the opportunity to turn over?

- Stick to the dead sky! Gold predators indicate that the higher the bitcoin rises, the more people prove the wrong

- Fed interest rate meeting, interest rate cuts expected or lay a solid foundation for bitcoin prices

- QKL123 Quote Analysis | The bullet has been uploaded, and then the sucker is raised? (0731)

- [Chainge]Technical Salon Roundtable "Frequent Times of Robbery | How to Build a Solid Line of Defense"

- For ten years, the blockchain is still a toy for the technical house, but this is not a bad thing.

- Technical Perspectives | How do ordinary users earn miners in cross-chain?