Crypto asset management in the second half, the path to the break of the active ETF

Lead:

1. The global ETF management scale has grown rapidly, reaching nearly US $ 6 trillion in 2019, doubling its size in four years; asset management giants BlackRock (iShares), Vanguard, and State Street all use ETFs as their main asset management products;

2. Passive ETFs, as the main force in ETF products, target index tracking, and have the characteristics of diversifying risks and stable returns. Active ETFs add active investment strategies based on passive ETFs to enhance the index and obtain excess returns. The goal is to lower investment costs and increase liquidity of transactions compared to common mutual funds and private equity products;

3. Due to the high correlation between investment targets in the digital currency industry, passive investment methods are difficult to obtain excess returns, while active investment in quantitative products is difficult for small and medium investors. Therefore, we use traditional financial market active ETF management methods and operating models to carry out ETF attempts on quantitative asset management products in the digital currency market, in order to reduce the investment threshold of investors for quantitative products and improve the liquidity of digital currency asset management products.

1. Overview of ETFs in traditional financial markets

1.1 ETF and LOF

- Inventory 201 DeFi systems on Ethereum

- Analysis | Forecasting Bitcoin mining cost price after halving with hashrate trend

- January data shows: cryptocurrency derivatives market still dominated by "unregulated participants"

ETF (Exchanged Traded Fund) is a trading open index fund. It is a fund that tracks changes in the "underlying index" and can be listed and traded on the stock exchange. ETFs can be purchased or redeemed from fund companies, and can be bought and sold from the secondary market. They have the characteristics of closed-end funds and open-end funds.

At present, most of the ETFs issued in China are passively managed and fitted according to specific indexes. The portfolio and position composition are relatively fixed. The exchange adopts the method of publishing IOPV (Indicative Optimized Portfolio Value) every 15 seconds to reflect the changes in the fund's net value caused by the index's rise and fall. This net worth indicator has a temporary discount premium on the secondary market transaction price, but the values are basically the same.

In addition to passive ETF products, there are also actively managed ETF products. This type of product does not perform simple simulation of the index, but adopts quantitative methods for stock selection and timing trading to obtain returns exceeding the benchmark index. The product line of the public offering index / quantitative direction is sorted according to the strength of the investment strategy initiative: index ETF, Smart Beta ETF, ordinary index / LOF / grading, index enhancement, quantitative long and quantitative hedging. From left to right, the initiative has increased in order, the flexibility of the strategy has increased, and its disclosure mechanism and frequency have also changed. Among them, Smart Beta mainly performs style stock selection based on certain specific factors to obtain a certain factor excess return, while the index enhanced type adopts a multi-factor stock selection strategy with tracking error constraints. The main purpose is to outperform the tracking index while obtaining a stable excess. income.

Figure 1 Public Offering Product Line Source: Founder Securities

1.2 Market Overview

Thanks to the recovery of the overall stock market, China's ETFs will burst out in 2019. During the year, 90 ETFs were newly established, a year-on-year increase of 240%, and 254 new applications were filed, a year-on-year increase of 450%. The overall size of the ETF reached 598.1 billion, a year-on-year increase of 59%. Trading activity in the secondary market has gradually increased, and asset allocation using ETFs as an investment tool has increased year by year.

Figure 2 Source of changes in the number of Chinese ETFs: Zhongtai Securities

Figure 3 Proportion of ETF transactions in the market as a percentage of stock market turnover in 2019 Source: Zhongtai Securities

In terms of yield, 97% of domestic ETFs have achieved positive returns in 2019, of which 13 ETFs have increased by more than 50%. Smart betas and industry ETFs have higher yields, and the average increase of the ETF market as a whole is about 32%.

Figure 4 ETF performance in 2019 Source: Zhongtai Securities

As the main market for global ETFs, the management scale of the U.S. ETF accounts for 72% of the world's scale. As of the end of 2019, the total number of U.S. ETFs was 2,343, with a total size of 4.25 trillion U.S. dollars, an increase of nearly 5.5 times over the ten years compared with 2009 data.

Figure 5 US ETF Scale and World Proportion Source: Zhongtai Securities

At the same time, according to the statistics of MorningStar, at the end of 2018, the proportion of investment in passive tracking indexes such as stock index mutual funds and ETFs in the US stock market reached 48.7%, which is expected to exceed 50% by the end of 2019. Passive ETF investments will exceed active Managed investment has become the mainstream of the market.

Figure 6 Proportion of the management scale of the top ten fund managers in China and the United States Source: Wind

At the fund manager level, iShares, Vanguard, and State Sreet accounted for 80% of the US ETF market. BlackRock's iShares ranked first with a 39% market share. The top three domestic companies are Huaxia Fund, E Fund and Southern Fund. The three markets account for a total of 40%, and the overall market concentration is relatively low compared to the US ETF market. For the subdivision of the index target, the types of ETFs in China and the United States are mainly broad-based, followed by industry ETFs, but the types and varieties of ETFs in the United States are more abundant and comprehensive than in China, and investment categories and target markets are more For broad.

1.3 Actively Managed ETFs

Actively managed ETFs were first launched at Bear Stearns in the United States. In March 2008, the company issued a fixed income active ETF. In April, PowerShares also launched four actively managed ETFs, three of which were invested in equity and one in fixed income.

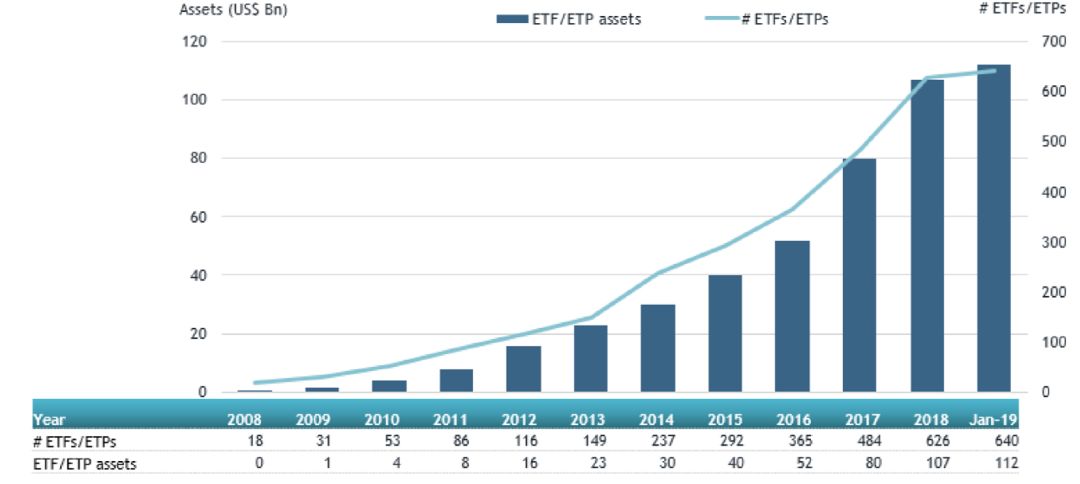

Figure 7 Scale of Actively Managed ETF Source: ETFGI

Active ETFs developed rapidly in the following decade. According to Bloomberg's statistics on October 31, 2019, global active ETFs have reached 657, accounting for about 10% of the total number of ETFs, and the overall scale has reached 138.45 billion US dollars, accounting for the total scale. 2%.

Figure 8 Active ETF Size Distribution Source: Bloomberg

According to the types of assets invested by ETFs, fixed income products accounted for the highest proportion, accounting for 73.6% of the overall scale. The reason why the proportion of equity products is relatively small is because of the characteristics of high-frequency announcement of positions required by the ETF itself, which makes equity strategies easy to be leaked and imitated, and issuers tend to avoid equity-type active ETFs.

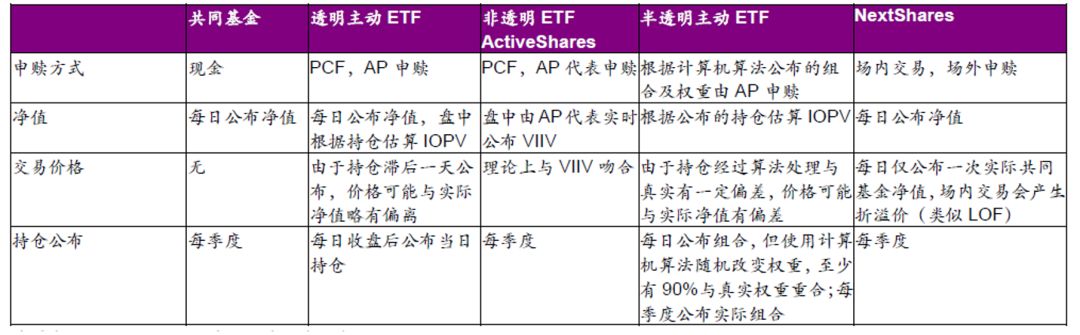

In order to avoid the leakage of fund strategy, active ETFs have formulated different disclosure specifications and operating methods according to different product types. The following is a comparison of the disclosure methods of mutual funds and several active ETF products:

Figure 9 Comparison of US ETF product transparency Source: Everbright Securities

After understanding the definition, overview of ETF and LOF, and the operation mode of active ETFs, the topics we will focus on next are the feasibility of ETFs in the digital currency market and the ETFization of quantitative asset management products in the digital currency industry.

2. ETF application in the digital currency market

2.1 Feasibility Demonstration of Passive ETF and Active ETF in the Digital Currency Market

The main purpose of investing in passive ETF products is twofold. One is as a trading tool, it is convenient and quick to invest in a certain target or a combination of targets. For example, an investor believes that gold is expected to rise in the future and can directly buy a gold ETF without buying a physical gold or opening a commodity futures account to be long on gold. Similarly, investors are short on the Nasdaq but lack financing means. This is achieved by buying an ETF (SQQQ) that is three times short the Nasdaq. In this context, ETFs are a tool designed by fund companies to help investors improve their investment convenience.

Figure 10 FTX platform triples BTC (BULL) tokens Source: FTX

This product also exists in the digital currency market, mainly represented by the leveraged tokens (BULL / BEAR) of the FTX platform. This type of product is in the form of ERC-20 tokens, but is essentially an index tracking ETF. The platform is managed as a market maker and fund issuer, and can be traded through the secondary market and purchased and redeemed. Convert ERC-20 tokens to US dollars. The value anchoring mechanism and positions of the tokens are published on the website, and can be directly applied for redemption through the platform. What needs to be explained here is that volatility products (MOVE) and style tokens (SHIT, DRGN, EXCH) are not ETF-type products but platform-set index contracts, which are outside the scope of this article.

Another purpose of investing in passive ETFs is to avoid non-systemic risks and reduce volatility by building a decentralized portfolio. There is non-systematic risk exposure when investing in individual stocks or a single product. By constructing a "basket" of stocks, multiple investment targets with low correlation coefficients of returns are combined to find an effective frontier to obtain Beta returns. .

Figure 11 Investment portfolio's reduction of non-systemic risk Source: BlockVC study

For the digital currency market, many exchanges and asset management companies have also carried out product design and trials of "digital currency ETFs" or "ETTs" and "ETPs." The main representatives are three digital currency index products: HB10 launched by Huobi, OK06 launched by OKEX, and BVC16 launched by BlockVC. The first two products can be purchased and redeemed through the exchange and traded on the secondary market. The compilation logic of the two is basically the same, and the passive tracking strategy is mainly adopted. Among them, HB10 selects the top 10 currencies as components based on the daily average transaction volume of the currency in the previous quarter, and then calculates the index price based on the volume weight For tracking. OK06 is to select the top five currencies with the current market value plus OKB as the component, and calculate the index price based on the weighted average of the circulating market value. The composition is relatively fixed and can basically reflect the trend of mainstream currencies.

Compared with the previous two, the BVC16 index adopts a more proactive investment model. Three types of indicators are selected, which represent the high market value of the overall market, Value Token accounts for 50%, high-quality public chain Public Chain accounts for 30%, and emerging potential. Growth Token accounts for 20%. Backtesting based on liquidity and correlation criteria, screening a total of 16 currencies, monthly stock adjustments and publicity, and then superimposing weighted ratios based on market value and volatility.

Figure 12 Historical data comparison between BVC16 and OK06 and HB10 Source: BlockVC

From the data in the figure above, it can be found that the absolute return of the BVC16 index with active management factors is significantly higher than that of OK06 and HB10, and it is lower on the volatility Z-Score and the daily volatility ATR.

The main reason is that the mainstream currencies with the highest market capitalization or the highest transaction volume in the digital currency market have extremely high correlation coefficients. The properties of investment portfolios based on major currencies are basically similar, and they cannot achieve index ETFs. The effect of risk sharing, while the index tracking strategy has caused the passiveness of the investment strategy, making it difficult to outperform the so-called Beta value in the minds of most people, that is, the value of BTC. Therefore, the introduction of active management investment model and active management + passive management fund model is more in line with the investment characteristics of the digital currency market.

Figure 13 Correlation analysis of mainstream currencies Source: BlockVC

2.2 ETF of quantitative asset management products in the digital currency market

Through the introduction of the classification of fund products in the first part, we can find that the quantitative asset management products in the digital currency industry are mainly operated as mutual funds. There are both open and closed types, but there are no available ETF-type fund products traded on the secondary market. The investment strategy of quantitative trading is mainly a CTA strategy based on trend following and arbitrage. There are few strategies similar to the quantitative stock selection and index enhancement in traditional financial markets. Therefore, there are certain difficulties in price announcement and position disclosure.

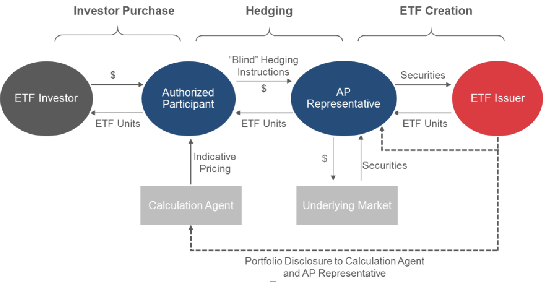

Combining the market characteristics and strategic characteristics of the digital currency market, we can carry out the operation of ETF through the way of LOF + Activeshares:

Figure 14 US ETF operation mode Source: ETF.COM

Figure 15 Opaque Operation of Activeshares Source: ScotiaBank

· First, use a similar LOF method for cash purchases or redemptions in the purchase and redemption process (the currency standard adopts BTC, the USDT standard adopts USDT); the main purpose is because the quantitative strategy is highly time-selective and the position composition changes rapidly. Cannot apply for "redundancy" of currency;

· The participants in the purchase and redemption are authorized participants AP, which mainly refers to institutional investors and act as liquidity providers. They perform purchase operations when the fund is at a premium and redemption operations when the fund is discounted to ensure the ETF price. Stability in the secondary market; ETF investors can conduct primary market transactions by applying for purchases and redemptions from authorized participants, and can also trade through secondary market transactions;

· The disclosure mode is to publish the position composition to authorized participants on a quarterly basis, and the IOPV disclosure mode is changed to VIIV (Verified Intra-day Indicative Value). The exchange (custodian) updates the fund's net value in real time based on the net asset value of the escrow account. The method of only publishing the net value can not only guide the secondary market to stabilize prices in a timely manner, but also ensure the confidentiality of the strategy to a great extent.

Conclusion

Through the analysis of passive investment products in the digital currency market, we can find that the main foothold of index tracking passive ETFs in the digital currency market lies in their tool characteristics, and in terms of obtaining excess returns, passive ETFs are often difficult to surpass BTC and other active Investment strategy. Therefore, we have selected quantitative asset management products to design and transform them in accordance with active ETFs in traditional financial markets, to solve strategic disclosure and discount premium issues. While lowering the investment threshold for asset management products, it also improves product liquidity and provides ideas for the design and development of financial products in the digital currency industry in the future.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- After the epidemic is overcome, it may have a profound impact on the development of the blockchain.

- Stoppages, losses, suffering … Having not halved, but the mine disaster is coming?

- MakerDAO-backed PoolTogether raises $ 1.05 million, with ConsenSys participating

- QKL123 Blockchain List | The market value of the project rebounded sharply, and the trading platform was significantly active (2020.01)

- Blockchain startup Digital Asset completes C + round of financing, with Salesforce and Samsung participating

- Five big mining pools called for "strong donation", 42 million yuan BCH miners decided?

- Multi-currency halving approaching, is the bull market imminent?